October 28, 2025

by Soundarya Jayaraman / October 28, 2025

by Soundarya Jayaraman / October 28, 2025

Every time I talk to someone in sales or marketing, I hear the same story: revenue feels like a moving target. One quarter, the pipeline looks solid; the next, conversion rates dip, and no one’s sure whether it’s process, pricing, or people. Reports don’t line up, metrics lose context, and every team has its own version of “the truth.”

I’m not in sales myself, but I research software for a living, and I’ve seen how the right RevOps platform can turn messy data and disconnected systems into a single, reliable source of insight.

That’s why when I dug into the best revenue operations software, I looked for platforms built to connect go-to-market data, workflows, and teams, so everyone finally sees the same picture.

The best tools don’t just centralize information; they automate handoffs, uncover pipeline friction, and make forecasting something you can actually trust.

Whether you’re a RevOps manager trying to unify reporting, a sales leader chasing cleaner forecasts, or a marketing team tired of proving pipeline impact, this list will help you find the right platform to bring alignment, accountability, and predictability to your revenue engine, backed by 10,000+ G2 reviews.

| Best revenue operations software | G2 rating | Best for | Standout feature | Pricing |

| Salesforce Sales Cloud | 4.4/5 | Complex revenue models | Advanced forecasting and end-to-end CRM integration | Starts at $25/user/month |

| Gong | 4.8/5 | Conversation-driven sales insights | AI-powered deal intelligence and call analytics | Custom |

| Clari | 4.6/5 | Revenue operations and forecasting accuracy | AI-driven pipeline visibility and predictive insights | Custom |

| Substrata | 4.9/5 | AI-powered behavioral intelligence in sales | Analyzes verbal + non-verbal cues, plus email and meeting behavior | Starts at $510/per user/year |

| MaxIQ | 4.2/5 | Enterprise RevOps teams | Single pane view of opportunity/customer health across teams | Custom |

*These revenue operations and intelligence software are top-rated in their category, according to G2’s Fall 2025 Grid Report. All offer custom pricing and a demo on request.

I still remember when “RevOps” felt like a buzzword floating around LinkedIn and then suddenly, every SaaS and B2B company I talked to was hiring a Head of RevOps and looking for tools to make sense of their go-to-market chaos. Since then, the category has evolved fast.

At its core, revenue operations (RevOps) software unifies sales, marketing, and customer success data so every team works toward the same goals. It helps organizations forecast accurately, manage pipeline health, enrich CRM data, and analyze performance from one connected platform. You might also hear it called RevOps software or revenue intelligence platforms, different names for the same mission: building a single, trustworthy view of revenue.

The best platforms go beyond data centralization. They bring automation and intelligence into the mix: scoring deal health, surfacing insights, and powering AI-driven forecasting to help teams move faster and make smarter decisions.

According to G2 Data, adoption spans all business sizes: 24% small business, 56% mid-market, and 19% enterprise users. On average, RevOps software delivers a payback period of just nine months with around 70% user adoption. That balance of efficiency, visibility, and scalability is exactly why more teams are making RevOps platforms the backbone of their revenue strategy.

I used G2's Grid Report to create a shortlist of top revenue operations and intelligence based on G2 score, user satisfaction, and market presence.

I used AI to analyze over 1,000 G2 reviews, looking for consistent patterns in what real users value most, like automation capabilities, forecasting accuracy, CRM data enrichment, pipeline visibility, integration quality, and ease of use. This helped me see which platforms actually improve revenue alignment across teams versus those that sound great on paper but underdeliver in practice.

Since I haven’t used these platforms directly, I leaned on interviews with sales and RevOps experts to ground my analysis and cross-validated their feedback with what I saw in verified G2 reviews. The screenshots featured in this article come from G2 vendor listings and publicly available product documentation.

Between G2 Data, expert interviews, and hundreds of user reviews, I found consistent signals about what separates good RevOps tools from great ones. These are the factors that shaped my evaluation:

After researching deep into the category, I’ve rounded up the best revenue operations software that stood out for impact, innovation, and usability. No single platform does it all, but each solves a critical piece of the RevOps puzzle. So think about where your team needs the most support, whether it’s forecasting accuracy, workflow automation, or unified reporting, and select the one that's most suitable for your needs.

The list below contains genuine user reviews from the Revenue Operations and Intelligence Software category. To be included in this category, a solution must:

*This data was pulled from G2 in 2025. Some reviews may have been edited for clarity.

I don’t think there’s a RevOps conversation where Salesforce Sales Cloud doesn’t come up. It’s one of those platforms nearly every revenue team has either used, evaluated, or built their strategy around, and after reviewing G2 Data and user feedback, it’s easy to see why.

With a 4.4 out of 5 rating on G2, Salesforce continues to lead the pack in the revenue operations and intelligence category.

What stood out most to me is how well it balances forecasting precision with flexibility. Salesforce’s predictive forecasting tools use historical data, AI modeling, and real-time pipeline signals to estimate revenue with surprising accuracy.

Users mention being able to run “what-if” scenarios, see how quota changes ripple through future revenue, and monitor sales velocity or pipeline coverage from customizable dashboards. This is reflected in its highest-rated features on G2: dashboard analytics (rated 90%) and multi-device visualization (89%). It’s clear that forecasting here isn’t a spreadsheet exercise; it’s a living, data-driven process.

Sales teams also love the contact capture (89%) capabilities and CRM enrichment features, which pull in data from interactions, emails, and connected systems to keep deal records up to date. That kind of automation means fewer manual updates and cleaner data flowing across the RevOps stack. Combined with AI-led deal insights, the platform shows what’s happening and why deals move or stall and what actions to take next.

And when it comes to usability, users consistently rate ease of use at 85% and ease of doing business with Salesforce at 88%, which is impressive for an enterprise-grade system.

Where Salesforce really shines, though, is in scalability and ecosystem depth. Mid-market and enterprise teams, which make up over 80% of its user base according to G2 Data, benefit from its tight integration with the broader Salesforce suite. For organizations already using Sales Cloud, Service Cloud, or Marketing Cloud, the ability to connect all go-to-market data into one system is a major advantage.

While Salesforce Sales Cloud offers impressive depth and flexibility, according to G2 reviews, teams looking for a simple, plug-and-play setup might find Salesforce more involved than they need. Its flexibility and depth are designed for organizations that can invest time in configuration and ongoing management. The payoff is huge once it’s tailored, but it’s not the kind of tool you switch on and master overnight.

Also, users note that between licensing costs and implementation resources, Salesforce makes the most sense for companies planning to scale or already operating across multiple regions, products, or revenue models. For leaner teams, it may simply offer more horsepower than necessary right now.

Still, for businesses ready to invest in a unified, data-driven revenue engine, the return speaks for itself. On the whole, Salesforce Sales Cloud earns its spot among the best revenue operations software for teams that want predictable forecasting, clean CRM data, and deep analytics under one roof. If your organization is scaling fast or managing multi-product revenue streams, this is a platform that can grow with you.

"The best part about it is how it acts as a center point for all of the RevOps functions."

- Salesforce Sales Cloud review, Surya V.

"What I dislike about Salesforce Sales Cloud is that while it’s a powerful platform, it can feel overly complex and sometimes overwhelming to navigate, especially for new users. The level of customization available is a strength, but it also means setup and ongoing configuration often require dedicated admin support or technical expertise, which can be costly. The user interface, though improved over time, isn’t always intuitive, and simple tasks can take multiple clicks. Additionally, the platform can become expensive as more features, add-ons, and integrations are needed, which may not be ideal for smaller businesses. Lastly, reporting, while robust, can have a steep learning curve, and running advanced reports isn’t always straightforward without proper training."

- Salesforce Sales Cloud review, Bhavna C.

Turn sales data into decisions. Discover the 6 top-rated sales analytics platforms for 2025, from streamlining your pipeline to predicting revenue with confidence.

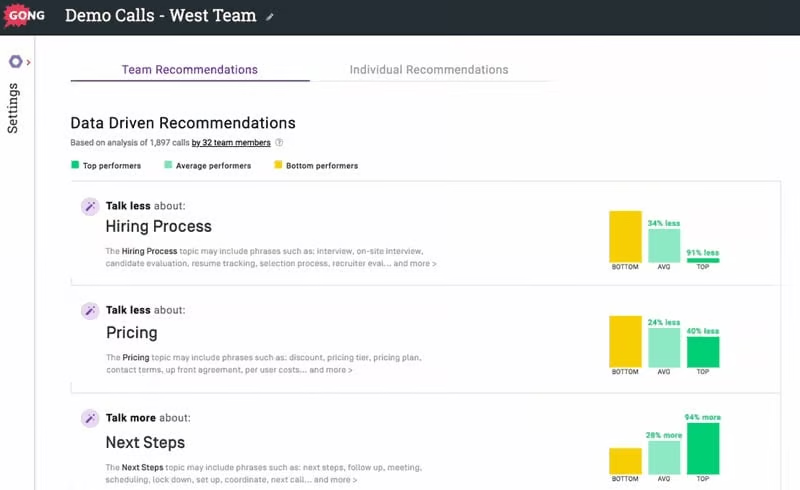

The first time I heard about Gong was from a sales leader who said, “It’s like having a second set of ears in every deal.” That stuck with me. With a 4.8 out of 5 rating on G2, Gong has built a loyal following among sales and revenue teams seeking clarity on what actually drives revenue.

Instead of relying solely on CRM data, Gong acts as a revenue intelligence platform, capturing calls, emails, and meetings to analyze real interactions. That context provides RevOps, enablement, and sales leaders with a more comprehensive picture of deal health, rep performance, and customer sentiment. It helps teams see not only what’s happening in the funnel but why.

Its higest-rated features on G2, conversation intelligence (93%), calendar sync (91%), and email activity capture (90%), show how well it automates the capture of sales interactions. Every call, meeting, and follow-up gets logged automatically, eliminating manual data entry and improving CRM accuracy. From there, Gong applies AI to detect buying signals, measure talk-to-listen ratios, and identify risk patterns that could affect conversion rates or deal velocity.

For RevOps leaders, that translates to better forecasting and coaching visibility. You can see which deals are likely to close based on real interaction data rather than rep-reported notes, and spot early warning signs when engagement drops. Its dashboards are highly visual, giving teams real-time views into pipeline trends, deal stage progress, and even how rep performance compares across segments.

Users also rate ease of use and quality of support at 94%, which says a lot for a platform packed with AI and automation. Even the setup process earns praise, with ease of setup at 91%.

It’s especially popular with mid-market RevOps teams, which make up about 66% of its G2 user base, though plenty of enterprise (18%) and small business (16%) teams rely on it too.

For teams that need data the moment a meeting ends, though, Gong’s recordings and analytics may take a little time to appear, based on G2 reviews. However, most users love how accurate and detailed Gong’s insights are once conversations are processed.

Also, teams that rely heavily on historical data or manage large call libraries might find Gong’s search experience for older recordings takes a little more getting used to. Still, for most users, these trade-offs feel minor compared to the clarity, precision, and time savings Gong delivers.

Overall, Gong strikes a rare balance. It’s technical enough for RevOps leaders who need data you can trust, yet intuitive enough for sales managers who just want visibility into what’s working. For teams that want to connect conversation data with forecasting, performance, and deal execution, Gong easily earns its place among the best revenue operations software on the market today.

"It reduces the heavy lift of notetaking, accurate follow-ups, and allows for quick hit insights for relevant information. Provides the ability to transfer knowledge internally and get relevant teams up to speed in a matter of minutes. The briefs and AI prompts are great for finding what you need, and the ability to click into those takes you directly to the time the information was shared. It drives efficiency and minimizes mistakes."

- Gong review, Marc M.

"One area that could be improved is how long it takes for call analysis to complete. In some cases, waiting up to an hour for a call to fully process can disrupt the flow for reps who want to follow up quickly. Faster processing, or even partial summaries available sooner, would go a long way.

We’ve also seen occasional hiccups with the HubSpot integration. For example, not all call summaries are logged consistently, which can cause some confusion. While Gong's support has been excellent at troubleshooting, more consistency would help ensure smoother day-to-day use."

- Gong review, Kelly L.

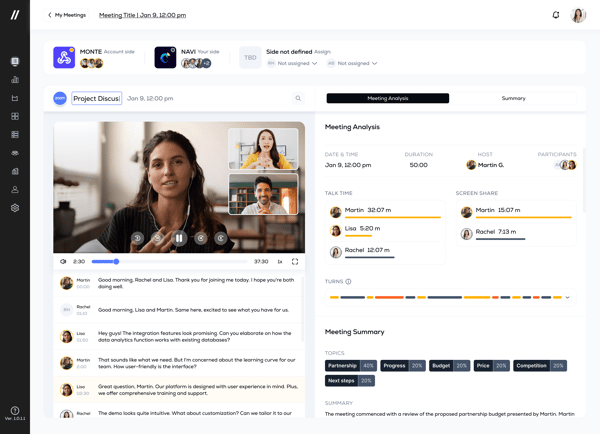

With a 4.6 out of 5 rating,Clari continues to be one of the most trusted names in the revenue operations category. It’s especially popular among enterprise teams (48%) and mid-market companies (45%), with smaller businesses (7%) adopting it as they scale.

What makes Clari stand out is its ability to unify forecasting, pipeline management, and analytics into one intelligent system. Like Gong, it automatically captures data from CRMs and connected tools, then applies its proprietary RevAI engine to surface insights and predict outcomes with remarkable accuracy.

Users frequently highlight its pipeline management (92%), dashboard analytics (87%), and rep performance (85%) as game-changers, helping leaders visualize deal health, identify risks early, and forecast with confidence.

From what I’ve seen, Clari turns revenue management into a proactive process. Reps and RevOps teams can track pipeline changes in real time, see which deals are trending upward or slipping, and use AI-guided recommendations to focus on high-impact actions. Its Revenue Cadences make a big difference for larger teams, guiding weekly execution with tailored playbooks and task suggestions.

Usability is another strength. G2 users rate Clari’s ease of use at 92%, ease of admin at 85%, and ease of setup at 84%, showing its approachability despite its enterprise depth. Integrations with Salesforce, HubSpot, and communication tools make onboarding smoother, while visual dashboards make insights easier to digest across departments, from sales and marketing to finance and operations.

Clari’s depth and precision make it a great fit for organizations that want full control over their revenue process, though that same sophistication means setup takes time, according to G2 reviews I read. The platform is designed for RevOps and sales teams managing complex pipelines, so configuring forecasts, cadences, and permissions requires some upfront effort. Once in place, though, that structure scales beautifully. making it ideal for teams that value accuracy over instant setup.

Also, because Clari gives such a comprehensive view of pipeline data, some teams also wish for even more flexibility in customizing dashboards to reflect their unique forecasting models or sales frameworks. It’s already one of the most configurable platforms in this space, but those who live deep in data often want to push that flexibility further. For most teams, though, the built-in modules already provide the right balance of control and clarity.

Overall, Clari delivers on its promise of accuracy and visibility. For teams managing global pipelines, recurring revenue models, or multi-product portfolios, Clari is one of the best revenue operations software options out there, combining AI precision, actionable insights, and a user experience built for growth.

"Clari has brilliant forecasting capabilities that use AI to help us predict revenue flows. The program creates a real-time visibility, where all opportunities, risks, and activities concerning our business are fully realized. The software provides efficient deal intelligence, giving us key health signals about our company. Clari offers collaboration with structured customer success, and this aligns sales and ensures marketing is effective."

- Clari review, Audrey C.

"I find the setup process challenging, especially when migrating fields from Salesforce, as it can't handle formula fields directly. This requires creating and maintaining duplicate fields, which adds complexity and workload. Additionally, I am disappointed with the limited configurability of dashboards, which feel too basic and lack customization options. Also, Clari's integration capabilities are inadequate, particularly in pulling in call transcripts, which requires working with other tools. Furthermore, the flexibility in setting up hierarchies is lacking, as it relies on CRM's static hierarchy that doesn't accommodate midyear team changes efficiently.."

- Clari review, Josiah R.

Substrata was a new find for me, and honestly, one of the most intriguing platforms I’ve come across while researching the best revenue operations software. With a 4.9 out of 5 rating on G2, it’s earned a reputation as a rising favorite among sales and RevOps teams looking for a competitive edge.

It’s especially popular with small businesses (59%), followed by mid-market teams (29%) and enterprise organizations (21%).

What makes Substrata stand out is how it blends AI-driven emotional intelligence with classic revenue analytics. Instead of focusing solely on numbers and pipeline data, it reads between the lines of every sales interaction, like calls, emails, and meetings, to uncover the signals behind buyer behavior.

Its SoundWave feature analyzes tone, pauses, and conversational flow during virtual meetings to detect confidence, hesitation, or resistance. Meanwhile, Temper instantly profiles buyer personalities, helping reps tailor their communication style to match how each prospect prefers to make decisions. This approach goes beyond forecasting. It’s about reading the room digitally.

The platform also offers sentiment analysis for emails to reveal sentiment shifts, intent cues, and power dynamics within ongoing deal conversations. Reps can even simulate emails before hitting send to understand the emotional and persuasive impact of their message, get feedback, and edit it to ensure it lands just right. Together, these capabilities make Substrata feel less like a CRM add-on and more like an AI sales coach built for modern hybrid selling.

On G2, users rave about its ease of use (99%), ease of setup (98%), and quality of support (97%), along with high marks for revenue history, dashboard analytics, and account optimization (all 97%). It’s the kind of tool that makes advanced behavioral analysis accessible, even for smaller teams without a dedicated RevOps function.

Users love how intuitive Substrata feels once they’ve explored its features and seen the insights in action. For first-time users, though, it takes a few sessions to get comfortable interpreting behavioral cues. Teams that invest time in onboarding quickly unlock deeper value and stronger deal intelligence.

Also, Substrata has a standardized workflow that's suitable for most sales and RevOps teams. That breadth means it already serves the needs of a wide range of users, though some teams in niche or highly specialized sectors mention wanting more industry-specific customization. Even so, its flexibility makes it easy for most organizations to adapt insights to their unique workflows without much extra effort.

Overall, Substrata feels refreshingly different. It’s not trying to replace your CRM or BI tool; it’s augmenting them with behavioral and conversational intelligence that most revenue platforms overlook. For teams that sell through trust, relationships, and nuanced communication, Substrata delivers insights that feel almost human.

If your revenue process relies on high-touch sales, long deal cycles, or strategic client relationships, Substrata is one of the best revenue operations software options to help you read signals that data alone can’t.

"Substrata's ability to read nuanced behavioral signals in client interactions is impressive. As a Sales Deputy Manager at Garmin, I appreciate that it reviews my email and call patterns to help me read client intent so I can adjust my strategy to improve closing ratios."

- Substrata review, David S.

"Some of the deeper analytics take practice to really absorb. I would love for there to be more quick tips or tutorials to help the onboarding process for busy executives who are trying to manage multiple deals."

- Substrata review, Getro J.

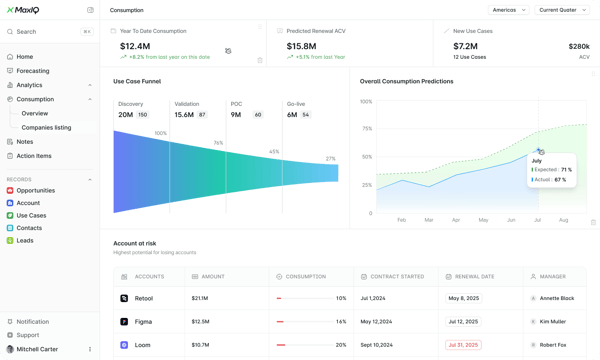

MaxIQ might be one of the newest names in the RevOps space, but it’s already making a strong impression. It’s quickly earned a perfect 5 rating on G2.

It’s especially popular with enterprise teams (75%), with mid-market users (25%) also finding value, showing that it’s built to handle complex revenue environments from the start.

What stood out to me is how MaxIQ combines AI-powered forecasting with collaboration and visibility. Its MaxIQ Workspaces unify data from multiple systems into one central dashboard, even from other RevoOps tools, while Max360° delivers real-time visibility into account activity, user engagement, and performance trends. Together, they give RevOps teams a holistic view of what’s happening across the pipeline, helping them forecast with confidence and act faster on insights.

The platform’s strength lies in automation and integration. It captures and syncs data across sales and marketing systems, helping teams eliminate reporting silos. I also like how it supports collaborative notes, task management, and performance analytics in one place, making it easier for teams to align and execute.

On G2, users rate its ease of use (98%), ease of setup (98%), and ease of doing business with (100%) among the highest in its category. Its predictive forecasting (97%), calendar sync (97%), and historical win/loss pattern analysis (96%) are especially praised for driving data accuracy and helping teams learn from past performance.

Most users praise how comprehensive MaxIQ is once everything’s up and running. A few users on G2 mention that it can take a few weeks to fully ramp and tailor workflows to their process, which seems to be pretty common among most of these revenue intelligence platforms. The good news is that users also note that MaxIQ’s onboarding and enablement support consistently earn high marks for being hands-on and responsive, helping teams get value quickly.

Some users also shared that while integrations with major CRMs and analytics tools work seamlessly, they’d love to see deeper connectivity with niche platforms in their tech stack. For most organizations, MaxIQ’s current integrations cover the core systems that drive forecasting, collaboration, and reporting effectively.

On the whole, MaxIQ is best for revenue teams that want a single, intelligent workspace for forecasting, collaboration, and pipeline visibility without the clutter of disconnected tools.

"My favorite thing about MaxIQ is it actually tracks the whole customer journey instead of just stopping at "congrats, deal closed!" It kills the nightmare of switching between 14 different tools by putting everything in one place so you, CS, and RevOps can actually see what's happening with your accounts. My employer picked it over a bunch of other vendors, and we're running way tighter forecast calls with less BS data hunting. Honestly, if you're sick of forecasting tools that pretend 80% of your revenue doesn't exist after the handoff, this one actually gets it."

- MaxIQ review, Brendan M M.

"It’s a robust platform, so it took a few weeks for our team to fully ramp. But their team did hands-on enablement sessions that really helped."

- MaxIQ review, Amiteshwar M.

Curious how analytics fits into the bigger picture? G2’s guide to the 9 best sales performance management software dives into tools that combine forecasting, coaching, and performance, and many of the platforms I’ve reviewed appear there, too.

Got more questions? G2 has the answers!

Core features include revenue forecasting, pipeline management, workflow automation, data integration, analytics dashboards, and CRM connectivity. Many RevOps tools also use AI-driven insights to identify bottlenecks, predict deal outcomes, and optimize sales efficiency.

Revenue operations software is primarily used by operations leaders, sales and marketing teams, customer success managers, and finance departments. It’s especially valuable for B2B SaaS companies that want to eliminate data silos, improve handoffs, and align every department around a single source of revenue truth.

While CRMs manage customer interactions and deal tracking, RevOps platforms take a broader view of the entire revenue engine. They integrate multiple systems—such as CRM, marketing automation, and billing tools—to deliver end-to-end visibility into revenue performance, forecasting, and growth metrics.

Start by identifying your team’s biggest pain points. Look for platforms that integrate with your existing CRM and marketing tools, support custom reporting, provide real-time dashboards, and can scale as your business grows. You can also compare leading RevOps tools on G2 to see how real users rate usability, ROI, and support.

According to G2 Data, top-rated platforms like Gong, Clari, Salesforce Sales Cloud, Substrata, and MaxIQ consistently earn the highest user satisfaction scores. MaxIQ, in particular, holds a perfect 5/5 rating for its AI-powered forecasting and collaboration capabilities.

For services-based organizations, reliability means accurate forecasting and client visibility. Clari and Gong stand out for helping services teams predict revenue and manage accounts with confidence.

Mid-sized tech companies often rely on tools like Clari, MaxIQ, and HubSpot Operations Hub for scalable forecasting, automation, and strong CRM integration that support rapid growth.

Salesforce Sales Cloud and MaxIQ are popular among growth-focused RevOps teams for their real-time forecasting, AI-driven insights, and collaborative workspaces that streamline revenue execution.

Clari and Substrata lead this category. Clari delivers AI forecasting accuracy for subscription-based models, while Substrata helps SaaS teams understand buyer sentiment and improve deal communication.

Top picks for SaaS companies include Gong for revenue intelligence, Clari for pipeline management, and MaxIQ for unified forecasting across global teams.

Based on G2 reviews, Gong, Clari, Salesforce Sales Cloud, Substrata, and MaxIQ are the most recommended tools for their accuracy, AI capabilities, and enterprise scalability.

Small businesses and startups often choose HubSpot Operations Hub and Substrata for their easy setup, automation, and affordability and is ideal for teams building their RevOps function from the ground up.

Clari’s AI forecasting and MaxIQ’s Max360 analytics both help tech companies make smarter, data-driven decisions based on real-time pipeline insights.

Startups looking for fast deployment and easy adoption often go for Substrata for behavioral intelligence or HubSpot Operations Hub for integrated RevOps across marketing, sales, and service.

If there’s one thing I’ve learned while researching the best revenue operations software, it’s that the strongest RevOps teams are built on anticipation and alignment. They don’t wait for the quarter to end to figure out what went wrong; they build systems that surface risks early and close performance gaps before they turn into lost revenue.

The tools I’ve covered in this list, whether they focus on forecasting accuracy, behavioral intelligence, or deal execution, reflect how RevOps is evolving from reactive reporting to proactive orchestration. Each platform solves a different piece of the puzzle, but they all share one goal: helping teams see, plan, and act faster.

If you are curious how RevOps fits into your company’s growth strategy, explore top-rated RevOps service providers on G2 and find the right partner to bring your systems and strategy together.

Soundarya Jayaraman is a Content Marketing Specialist at G2, focusing on cybersecurity. Formerly a reporter, Soundarya now covers the evolving cybersecurity landscape, how it affects businesses and individuals, and how technology can help. You can find her extensive writings on cloud security and zero-day attacks. When not writing, you can find her painting or reading.

If there’s one thing I’ve learned working closely with sales teams, it’s this: gut instinct...

by Soundarya Jayaraman

by Soundarya Jayaraman

Sales performance doesn’t fall apart all at once. It slips through the cracks of scattered...

by Harshita Tewari

by Harshita Tewari

You can have the perfect pitch deck, a bulletproof CRM, and reps who know your product inside...

by Harshita Tewari

by Harshita Tewari

If there’s one thing I’ve learned working closely with sales teams, it’s this: gut instinct...

by Soundarya Jayaraman

by Soundarya Jayaraman

Sales performance doesn’t fall apart all at once. It slips through the cracks of scattered...

by Harshita Tewari

by Harshita Tewari