April 21, 2023

by Soundarya Jayaraman / April 21, 2023

by Soundarya Jayaraman / April 21, 2023

"Buyers reign supreme." This would be the shortest summary of what we found out about B2B software buyer behavior in 2022 from our survey of 1,002 B2B decision-makers.

Thanks to the endless options in the software marketplace and the power of the internet, B2B software buyers hold all the cards. It’s not just the C-suite anymore deciding on software.

Nowadays, everyone has the power to purchase the tools they want for their business. And they want to shop for software just like they shop for their homes.

Like master chefs carefully handpicking their ingredients to create delectable menus, buyers look for products on the web, research on their own, check reviews, and zero in on their favorite options before even considering getting in touch with the vendors. Very different from how businesses shopped for software a few years ago, right?

For software sellers, the new reality is daunting. However, understanding the changing B2B software as a service (SaaS) buyer behavior is crucial for success in this competitive industry.

In this article, you’ll learn about the four most important B2B software buyer behavior trends with 50+ statistics based on our 2022 G2’s Software Buyer Behavior Report. We'll study how B2B SaaS purchasing decisions are made and explore key factors, influencers, and challenges.

Software is meant to solve a company’s pain points. But recently, purchasing that software has become complicated. Look at what we gleaned from our study that shows how the buyer’s journey is getting complex.

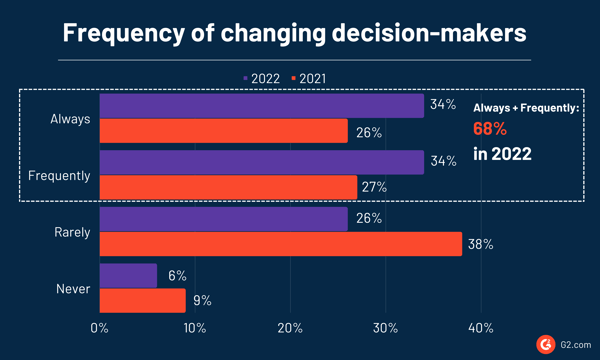

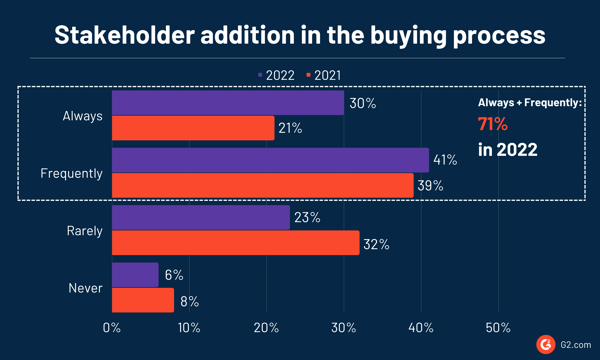

Today, most businesses have a buying committee and process in place for software purchases. But the number of steps and people involved in the buyers' decision process is expanding. New stakeholders also keep joining the process, and the decision-maker changes frequently.

As a result of the ever-expanding cast of characters, each step in the buying process – from initial research and vendor evaluation to product demos and negotiations – requires careful consideration and input from multiple parties.

This makes reaching a consensus difficult. Conflicts and disagreements arise as various people bring their unique perspectives and agendas to the table.

For example, consider a company buying a marketing automation tool. Sellers must deal with C-suite executives, department leads, internal influencers, IT, legal team members, and the all-important end user as part of a company’s buying decision process.

In this case, the IT department prioritizes security features and privacy concerns, while the marketing department focuses on simple functionalities and operational efficiency. The finance department wants to know about the total cost of ownership and the tool's ROI. The difference in priorities results in opposing opinions that create tension between the teams and impede decision-making.

All this makes the process overwhelming, leaving buyers frozen.

Statistics reflect these changes and complexities.

Another trend we see is a gradual shift in final decision-making authority from technical IT teams to C-suite executives. Traditionally, IT departments have played a central role in purchasing and implementing new technology. But now, C-suite executives increasingly influence software purchases as they focus on accelerating their digital transformation.

of buyers consider C-suite executives to be the final decision-makers on software purchases, a rise of 7% from 2021.

Furthermore, we have many cloud-based SaaS solutions and no-code or low-code technologies that require no expertise for set-up and maintenance. Since they’re easy to find and use, buyers are gradually moving away from involving the IT department in their software purchases.

Usually, software purchases take time, from researching different options to talking with vendors to testing the features to signing a contract. However, buyers are speeding up the process.

Monthly subscriptions are no longer just for Netflix and Spotify. SaaS buyers are also moving toward short-term contracts, avoiding multi-year deals. The trend reflects a broader shift in the B2B industry toward greater flexibility and cost-effectiveness in software purchasing.

By avoiding multi-year deals, B2B businesses benefit from reduced upfront costs and better service from SaaS vendors. They can test the technology before making a significant financial investment and enjoy the agility of switching vendors in response to changing needs or market conditions.

However, for vendors, the absence of multi-year deals means the buyer journey is never complete, even after signing the contract and onboarding the customers. Vendors must constantly deliver value and provide excellent customer experience to secure renewals and reduce churn rate.

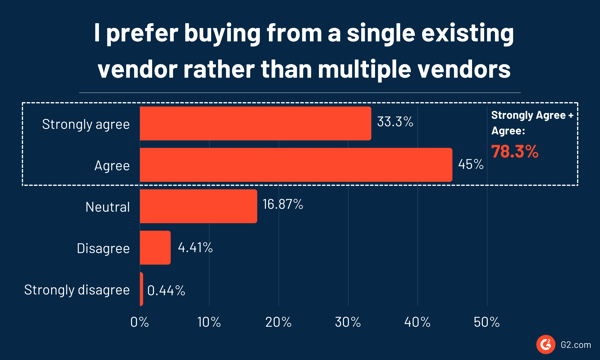

B2B buyers don’t want to stitch together different apps and hope they’ll work. They’re more inclined toward buying an all-in-one solution or an additional product from an existing vendor than dealing with new ones. This gives sales teams many opportunities to upsell and cross-sell additional features and product rollouts to their customers.

Customers are changing where they buy their software, purchasing from vendors less and moving toward third-party marketplaces and resellers to look for value-adds like consultations, support, or deals.

Today’s B2B buyers consume a wide range of information before making a purchase. In the earlier stages of their buying journey, aka the awareness and exploration stage, they want to know more about their problem and which software can solve it.

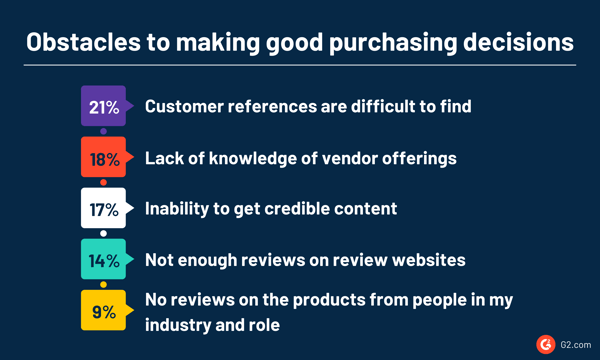

As they move forward in the buying journey to the consideration and decision-making stage, they want materials that support and validate their conclusions, like customer testimonials or reviews. The biggest hindrance buyers have is finding this information.

This may come as a surprise to sellers because software vendors have been working to provide as much information as possible via their websites, sales, and marketing channels. However, it also coincides with the increasing distrust of vendor-provided resources.

From a buyer’s perspective, this search for elusive, high-quality information from other buyers simply highlights that they have higher expectations about the quality of information they get from vendors. They don’t want promotional material but rather credible content that helps them progress along the software purchase path.

Software buyers are now increasingly wary of vendors' resources and are looking for other credible, independent sources of information. They gather data from their peers, professional networks, and market reports. They also look at user-generated content via review sites, online communities, and social media platforms. Here’s what we found about this trend from our survey.

Despite the best efforts of software vendors to be customer-centric, buyers are looking for ways to bypass the relationship in an ironic twist. Take a look at the statistics that prove this.

Buyers are also moving away from the sales team because they desire greater control and independence in the purchase process. By the time they reach out, the buyers are already halfway there.

of software buyers wait to engage the sales team until the last stage of purchase.

The findings highlight that sales can no longer dictate how the customer’s buying journey progresses. Instead, buyers are taking responsibility by independently researching.

As the trust gap between buyers and vendors widens, buyers are increasingly asking trusted sources, aka peers and industry experts, for advice on software purchases. Buyers consider these sources more reliable as they tend to have firsthand experience with the software and provide impartial opinions on it.

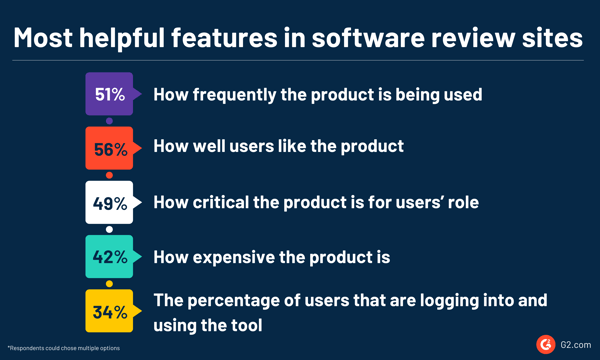

Review sites and online communities are also gaining prominence among buyers as they try to increase their confidence and reduce risk when making high-stakes software purchase decisions.

Think about it. You’re part of a buying committee that needs an email marketing solution. You find two products that meet your requirements. One has 12,000+ reviews and a 4.7-star rating, while the other has 100+ reviews and a 3-star rating.

What would you choose? Reviews and discussions on online communities serve as valuable social proof for buyers here.

of software buyers use review sites like G2 for gathering information, recommendations, and referrals for software products or services they are interested in.

47.6% of buyers typically shortlist 3-5 products during a software purchase process. So what factors do buyers consider when selecting the product from the shortlist? We asked buyers, and this is what they told us.

They care more about the ease of use, implementation, quality of customer support, and ROI than the number of features it has or its pricing. Their buying considerations indicate buyers want to see value early on.

Similarly, today's software buyers do not disregard security.

of tech buyers say the level of security software provides is either important or very important.

Imagine a buying committee with a shortlist of products. They compare the products based on needs, weigh their functionalities, get peer reviews, talk with vendors, try free trials, and finally decide on one software solution. If you think their journey ends here, you’re wrong.

With shorter contracts becoming the norm in the software world, B2B tech buyers are no longer tied to a vendor for a prolonged period. And with numerous alternatives and lower-than-ever switching costs, tech buyers are more open to exploring other options when their software contract is up for renewal. Check out how B2B businesses approach their software contract renewals.

Buyers have a solid process when it comes to the factors they consider before making a renewal decision. During the renewal process, they evaluate whether they got adequate support from the vendor and gauge whether users are satisfied with how the tool is used.

of B2B customers indicate that the quality of the software implementation process is important or very important when deciding to renew a product.

However, a considerable number of buyers – 45% – are inclined to renew their contracts without even thinking about other choices. This suggests that these buyers may be loyal to their current software provider and are happy with the value they deliver.

Related: Don’t know how to manage your SaaS contracts and renewals? Get G2 Track now to handle your SaaS with ease.

First, software vendors must recognize this new reality and recognize how difficult buying has become. They need to understand customers as people and offer them the resources that help complete this arduous task. A few steps are sure to ease the buyer’s journey and win them over to your side.

To deal with multiple stakeholders in the buying process, sellers need to identify the key decision-makers involved right away. Personalize any communication between you and individual decision-makers or influencers for specific accounts. After all, selling software to C-suite execs, the marketing team, and an IT member are very different tasks, even if they’re from the same company.

Sellers should spread information about their products transparently and ensure it’s consistent over platforms, targeted to a particular buyer’s persona, and shareable across multiple channels. For instance, add details about pricing, features, implementation timelines, and integrations on product-specific web pages. Include case studies about how the product helped the customers and highlight ROI data.

At the same time, improve your content marketing efforts. Dive into your buyer content preferences. Interview or survey your current customers or use analytics to identify the materials helping your customers the most. Tap into the findings to enhance your content strategy.

Buyers don’t want to hear a sales pitch. At the same time, they aren’t entirely averse to talking to the sales team. Sales have to balance the limited time they get with buyers to show product and service value. For this, sales reps should know precisely where buyers are on their journey, spot problems they might encounter, and provide interventions to ease the buyer decision process. And they gotta do it without being pushy.

Buyers’ issues range from information challenges to conflicts with key decision-makers or disagreements on the implementation plan. Sales reps should act more as consultants and provide targeted actions supported by industry-specific data. They should also share similar case studies of customers who have overcome similar difficulties to inspire confidence. Showing buyers how to buy rather than telling them what they should buy simplifies the purchase and drives sales.

Once you win a customer, always give them top-notch customer service and call attention to their return on investment sooner rather than later to keep them satisfied. Help them adopt the software and make sure they use it effectively.

When you ask them for feedback, you make your customers feel heard. Use that info and that trust to enhance your product. It can be as simple as adding a feature that automatically downloads reports or as involved as overhauling the user interface to make it easier for a client.

Securing renewals and building customer loyalty only happens when you satisfy your current base. Your happy customers are more likely to recommend your product to others, effectively becoming your brand advocates and helping you expand your audience.

B2B buyers control the software purchase process today more than ever. They want things that are easy to buy and easy to use. As a software vendor, adapt your sales and marketing strategies to suit this reality. Ease their pain during the buying journey, and you’ll win many happy customers who will elevate your brand for you.

Want to reach more than 2 million software buyers? Get on G2 today by claiming your profile!

Soundarya Jayaraman is a Senior SEO Content Specialist at G2, bringing 4 years of B2B SaaS expertise to help buyers make informed software decisions. Specializing in AI technologies and enterprise software solutions, her work includes comprehensive product reviews, competitive analyses, and industry trends. Outside of work, you'll find her painting or reading.

B2B buying behaviors are constantly evolving, with review sites – like G2 – playing a more...

by Palmer Houchins

by Palmer Houchins

We live in a world where software purchases are no longer driven by human intuition. AI...

by Washija Kazim

by Washija Kazim

Most B2B marketers think buyers are rational first and emotional later. They are wrong.

by Sidharth Yadav

by Sidharth Yadav

B2B buying behaviors are constantly evolving, with review sites – like G2 – playing a more...

by Palmer Houchins

by Palmer Houchins

We live in a world where software purchases are no longer driven by human intuition. AI...

by Washija Kazim

by Washija Kazim