February 6, 2020

by Mary Clare Novak / February 6, 2020

by Mary Clare Novak / February 6, 2020

We can all agree that payday is the best day.

There’s a universal love and anticipation for getting paid, but payday for sales reps can look different depending on their business’ sales compensation plan.

A sales compensation plan is the strategy that businesses use to pay sales reps and drive their performance in a way that will help the business become more profitable. Aspects of a sales compensation plan include details like base salaries, commissions, and incentives.

The purpose of having a sales compensation plan is to set the standard of performance for sales reps that will result in them being well compensated. When expectations are set, it encourages reps to work accordingly so they maximize their personal reward in a way that also benefits the business.

The framework of a sales compensation plan will vary from business to business.

The organization of your company, resources at hand, and overarching goals will affect the method, requirements for, and frequency of compensation. To break it down even further, team members require different compensation based on experience, deals they are involved in, and whether or not their sales metrics indicate success.

Needless to say, creating a sales compensation plan is complex. Let’s walk through it.

There are certain words and phrases that are used in the mini world of creating sales compensation plans. Make sure you, the sales team, and anyone else involved in this process has a firm grasp on the following ideas to avoid confusion around money conversations.

A sales quota is a time-bound target for a sales rep, team, or territory. These targets can be measured in a couple of ways, including by volume, revenue, or sales activities. A salesperson’s quota is typically correlated to their compensation plan.

A salary is a fixed, regular payment, also known as base pay. The amount is typically presented as a large sum, but distributed in smaller amounts throughout the year.

A form of variable pay, commission is the amount of money a salesperson earns based on the amount they’ve sold. The amount of commission a person earns depends on the business, but it’s usually a percentage of the revenue from a particular sale. Typically, commission is given in addition to a salary.

Another type of variable pay, a bonus is additional compensation given to sales reps for good performance. Managers will sometimes use bonuses as an incentive for sales reps. Also, they can be mentioned during interviews to convince promising candidates to join the team.

On-target earnings is a forecast of the total potential compensation for a specific position, including base pay (salary) and variable pay (commission and bonuses). This number is usually shown to promising candidates in hopes they’ll accept the position.

There are nine main types of sales compensations plans that businesses use. They all have their own benefits and drawbacks, and because of that, certain companies will find that one plan is best suited for their team, business plan, and goals.

A salary-only compensation plan is just like any other salary-based job — the money a sales rep earns is decided ahead of time. Their performance and the amount they sell doesn’t matter. Either way, they’ll make the same amount.

Businesses that use a salary-only sales compensation plan for reps typically use it because it simplifies expense calculations and gives an idea of how much team growth is reasonable in terms of budget. Also, it takes a lot of stress off sales reps because no matter what, they see consistent pay.

A salary-only sales compensation plan is not very common for sales teams. Commission acts as an incentive to never stop selling, and if that extra benefit isn’t there, sales reps might kick their feet up and call it a month once they hit their quota. A lot of people go into sales because there is that added layer of monetary satisfaction when closing a big deal, and the salary only compensation plan doesn’t provide that.

| PRO | CON |

| Simplifies expenses and offers sales reps consistent pay. | Sales reps don’t have an incentive to sell once they reach their quota. |

A commission-only compensation plan pays reps solely based on their performance and the amount they sell. When a rep makes a sale, they will make commission, which is a percentage of the profits from that sale. There is no base pay involved.

With a commission-only plan, the stakes are high. If a sales rep doesn’t make a sale during a specific time frame, their earnings will be zero. This motivates reps and gives them compensation freedom — they have control over how much they make, depending on how much they can sell. Being compensated on commission alone also motivates reps to create lasting relationships with customers, which is good for business.

The thought that a sales rep can technically make an unlimited amount of money might initially be a scary thought to companies. It makes projecting expenses and sticking to a budget difficult, however, they aren’t taking all of the profits home. Commission is only a percentage. So when they make a sale, reps get paid and the company’s revenue increases. If a customer is lost, you lose nothing at the moment (monetarily) because you aren’t paying the rep a salary.

One thing to keep in mind when using the commission-only pay structure is a person’s involvement in the sale. If someone on a commission-only plan is solely qualifying leads, they shouldn’t make as much as someone who is taking a customer all the way down the sales pipeline and closing the deal.

| PRO | CON |

| Motivates sales reps to sell as much as possible. | Sales expenses can be unpredictable. |

The base salary plus commission compensation plan gives sales reps a fixed salary as well as commission from their sales. It’s the most common pay structure for sales teams.

The base salary plus commission compensation plan is a sweet spot for sales reps. They have a steady income they can rely on in addition to the incentive to sell more to boost their earnings. For businesses, it offers a little more structure to their expense projections because there isn’t as much flexibility as to how much people can earn.

With this pay structure, the salary and percentage of commission received will not be as high as the compensation plans that focus on one of those two things alone. A lot of businesses will use a tiered commission rate, where reps enter a different commission range if they make a certain number of sales/generate a certain amount of profit.

Others will base commission on the following parameters:

If you have a simple sales process that doesn’t include the rep having a big impact on the buying decision, their commission will be smaller. However, if the rep is incredibly involved and has experienced complications to get the customer to say yes, they deserve a heftier commission.

There are typical industry standards for commission, so depending on what your company specializes in, do some research to see what is normal and expected.

| PRO | CON |

| Sales reps have an incentive to sell more even after they reach their quota, and sales expenses are relatively predictable. | Keeping track of the balance between base and variable pay can be complex for administrators, especially when using a tiered system. |

The base salary plus bonus compensation plan includes a salary and a bonus. The bonus is only given when a sales rep hits their quota.

For example, a sales rep might make a $40,000 base salary and then receive a $12,000 bonus if they sell a predetermined amount. After a certain amount of time on the team, you will notice which reps tend to hit quota and which ones fall short. This will help you plan how much money to set aside for bonuses.

Over time, this compensation plan offers predictability in terms of expenses for the business and extra incentive for your reps to close a certain amount of deals within a certain time period.

However, it’s not enough incentive for sales reps to go above and beyond. There is still a cap on how much they can make, so once they hit that quota and get their bonus, they might lose motivation to sell.

| PRO | CON |

| Offers more predictability into sales expenses. | Sales reps still have a limit on how much they can make, which doesn’t give them any reason to keep selling once they get their bonus. |

An absolute-commission plan lays out specific milestones that’ll result in a sales rep being paid a certain amount of money. When presenting this to your team, it might sound like this: “You will be paid $___ for every ___.”

Examples might include $500 for every new customer or a percentage of the annual contract value for new accounts. With different monetary values attached to different tasks, this plan is easy for reps to grasp and be motivated by. What they give is what they get.

This pay structure allows companies to manipulate the focus of sales reps. They might switch the milestones to focus on a certain product, territory, or market, motivating the reps to reprioritize a primary company objective.

With the absolute-commission plan, managers don’t need to set quota for sales reps. And although this plan might seem like it evens out the playing field, this “equal” pay structure might benefit some reps more than others.

Depending on the selling opportunities available in a certain territory, some reps will hit these benchmarks and milestones easier and more often. Also, the goals that sales reps are working towards aren’t directly related to those of the company overall, making it possible for them to lose sight of your overarching mission.

| PRO | CON |

| Sales managers can alter milestones to switch the focus of sales reps to prioritize certain goals. | It’s difficult to be fair, and depending on the milestones set, reps might lose sight of the company’s overall mission. |

A relative-commission plan pays reps based on their performance against their quota, in addition to their salary. This means that, more often than not, if a sales rep hits the exact quota, they’ll earn the exact commission amount associated with it (plus their base salary).

Consider the meaning of the word relative. It means to be related, or to be in proportion to something else. So with relative-commission, the more someone sells, the amount of commission they receive will be proportionate to that amount.

Absolute commission and relative commission are often mixed up. Relative commission is more focused on money, while absolute commission can shift a rep’s focus to other overarching sales goals, like acquiring new customers.

So if your business is shifting their thinking to high value products to boost earnings, the relative-commission plan is your best bet. On the other hand, if you want to bring in new customers, absolute commission will help you get there.

A tricky aspect of relative-commission plans for managers is setting quotas for sales reps. You need to take experience, role, territory, and available opportunities into account when setting quotas, and doing so isn’t easy.

| PRO | CON |

| Compensation is directly related to performance, lowering the risk for businesses. | There’s a lot of pressure on sales managers to set the right quota for each rep. |

The territory volume commission plan estimates commission based on the sales volume within a certain territory. The sales from that territory are added up, and all the commissions are split equally among all of the sales professionals working within it.

This compensation plan will only work for sales reps who work in a very team-based manner and culture, where everyone is striving towards a common goal. It removes a lot of the individual pressures of selling and focuses on team building.

A common concern and problem of using the territory volume commission plan is when some people aren’t carrying their own weight. Problems can arise when certain reps are contributing more than others and see their hard earned money be split with people that aren’t bringing anything to the table.

| PRO | CON |

| Creates a culture of collaboration and relieves some of the pressures of individual selling. | Sales reps can see splitting the commission as unfair, depending on how equally the commission is being generated. |

A straight line commission plan pays reps based on how much of their quota they hit or how much they surpass it.

For example, if a sales rep hits 75% of their quota, they will get 75% of their commission. If they surpass their quota and hit 115%, they will receive 115% of their commission.

This compensation plan incentivizes reps to surpass their quota, meaning it can get expensive for businesses. However, the only way reps can earn a big commission is to sell a lot and surpass their quota, which also translates to more revenue streams for the business.

| PRO | CON |

| Incentivizes reps to surpass their quota. | Sales expenses can be unpredictable. |

The gross margin commission plan shifts the focus from revenue to actual profit.

Gross margin is the actual amount of money a business obtains from a sale after the cost of goods sold is taken into account. Revenue is an important sales metric to pay attention to, but gross margin reveals true profitability.

The best way to explain gross margin commission is with an example.

Say Matt makes a sale where the revenue total was $5,000 and Beth makes a sale where revenue was $4,500. One would assume that Matt would make more commission here because his sale was bigger. However, the gross margin commission plan would analyze cost before doling out rewards.

It cost the business $1500 to cover Matt’s selling expenses, and only $500 for Beth. At the end of the day, Beth’s sale ($4,000 in profit) is valued higher than Matt’s ($3,500 in profit). Because Beth’s gross margin is higher than Matt’s, she will make a bigger commission.

Businesses use the gross margin commission plan if their reps are offering discounts to customers to hit their quota. Reps can tend to rely on this when they struggle to hit quota, but it isn’t good for your business. It can hurt your profit margin, and create a reputation that your reps are always offering discounts. Soon enough, people will expect to be given a discount and won’t buy if they aren’t given the same reduced cost.

| PRO | CON |

| Shifts focus from revenue to profit, which is better for the business in the end. | Sometimes, avoiding selling expenses is difficult. |

With those types in mind, you can now craft a sales compensation plan for your business. In the process of creating it, make sure you remember the key purposes of a sales compensation plan: to fairly pay employees, set a standard of behaviors, and help the business reach goals and become as profitable as possible.

Here are the steps in creating a sales compensation plan.

Getting into the nitty gritty details of making a sales compensation plan can make it easy to lose your way. As you go about putting the plan together, make sure you have a list of basic requirements and main ideas you want the plan to include. Here are some common ones:

After each step you complete when making the plan, make sure all actions point right back to these main ideas.

With those values in mind, it’s time to set goals for the sales compensation plan.

Like any other plan within a business, the goals and objectives need to align with those of the organization as a whole. Identify your key objectives for the sales compensation plan, and ensure they work towards the bigger picture. If they don’t, you might have to rethink your own goals.

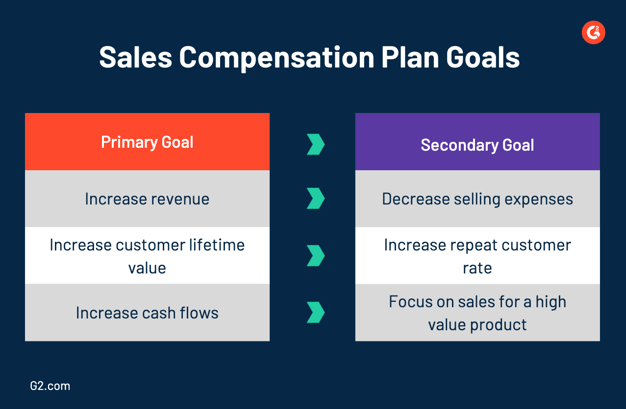

When setting goals, it’s always best to have primary objectives, with secondary ones attached. Secondary objectives are related to the primary ones, but they are a lower priority.

Here are some examples of what your primary and secondary goals might look like:

By using professional services revenue recognition, you can establish sales goals and objectives will help you create incentives and rewards for reps. Remember, all of your goals for the sales compensation plan need to align with those of the sales team overall, and ultimately back to the business.

With the goals and strategy in mind, hone in on your team.

Clearly define the sales roles within your organization. Based on experience, responsibilities, and current level of customer interaction, each role will most likely be compensated differently.

There are two different rounds of breaking down your sales team for the compensation plan.

First, you take a look at the different positions your sales team is comprised of. Here are some typical ones:

Within each of those roles, you can create a tiered system of positions to fairly compensate employees based on their responsibilities and workloads.

With those roles broken down and different levels designated, choose a type of compensation plan. They are listed in the section above, but as a refresher, let’s list the options and what goals that plan speaks to specifically.

Based on budget, amount of reps, and the team’s expectations, identify the type of compensation plan that works best for your business. If you need more clarification, just refer back to the types of sales compensation plans for more detail.

With that compensation plan structure in mind, you need to set on-target earnings for each position.

The on-target earnings for the positions on your team should be decided after doing market research. Find out what other companies in your area compensate their employees with similar positions. Take cost of living in your geographic location, their experience and education, and the industry into account. Also, don’t forget it needs to fit in your budget.

You can also determine a position’s on-target earnings based on the quota designated to it. When using this approach, a business will typically set a rep’s on-target earnings at one-fifth of their quota.

Create a breakdown of the tiered positions and designate on-target earnings for each.

The value you have chosen for on-target earnings will most likely reflect the amount you have in your budget for sales reps’ salaries. Remember that on-target earnings accounts for both base salary and any additional compensation, like commission or bonuses.

After you have the on-target earnings decided and approved, you can further divide it into base and variable pay. Your salary would be your base pay, and potential bonuses and commission make up variable pay.

The ratio between base and variable pay is often referred to as leverage. If a business’ compensation plan has high variable pay and low base pay, it’s considered highly leveraged. The amount they earn is the same, but businesses typically have a lower leveraged sales compensation plan, meaning the base pay exceeds variable pay within the on-target earnings.

Why have variable pay when you can just lump it all together, you ask? Including the idea of variable pay when presenting your sales compensation plan to the team adds incentive to succeed. It promotes a company culture driven by performance and accountability for your own results.

As great as it sounds, payday can’t be every day. The next step in creating a sales compensation plan is deciding when to provide the compensation to your sales reps.

Businesses usually take one of three routes when deciding on a payday:

Whichever method you choose, make sure you are consistent when paying your sales reps. Once they get used to this structure, they will start to expect payments at a certain time, and might plan personal payments around their payday.

With your goals and structure in place, you need to gather the right tools that will help you compensate employees in a consistent, accurate, and timely manner.

The best way to do this is with payroll software. With this tool, businesses can save time on general administrative HR tasks by automating processes, ensuring accurate bookkeeping, and integrating with other software that handles accounting, benefits, and time tracking.

It’s finally time to take action. At this point, you are ready to set expectations for your team and individual reps. Depending on the type of sales compensation plan you found was best for your business, these expectations might include quotas or other benchmarks.

Make sure each team member knows what is expected of them once you implement the plan. Obviously, people are going to rightfully assume they will be paid for their work, but it is your job to make it clear what’s required and what that’ll entail. A lot of times, this will include setting quotas.

If your plan includes setting a quota, you need to do so in an informed and realistic manner. There are two ways businesses typically set quotas for their sales compensation plans, either with the bottom up or top down approach.

With this approach to setting quota, you gather data about the team’s capabilities, market opportunity, and past performance of reps to determine what their quota should be. The more data you can gather, the more informed your quota is, and the better it will be.

Here’s a step by step breakdown of setting goals with the bottom down approach:

Quotas set using the bottom up approach are often a lot more reasonable and balanced compared to the top down approach.

The top down approach involves a business setting a goal based on market research and revenue expectations, and then assigning sales quotas that will support it. Essentially, the organization will set goals and then work backwards to designate how they will be reached.

Here’s an example of how this would work step by step:

When assigning duties, you can break it down by number of deals (in the example above) or by revenue.

Creating a sales compensation plan is a lot of work and it plays a big part in motivating your sales team to perform well. Unfortunately, the work doesn’t stop once you’ve implemented your first version of the sales compensation plan. What works today might be wrong for your business in a year.

Over time, your business’ structure, the ability of reps, and competitors in the industry are going to change. As these adjustments happen, your sales compensation plan will need to develop to reflect them.

Remember to evaluate, review, and modify your plan when necessary. Make sure your reps are pleased with their earnings and that the plan contributes to the business’ overarching goals.

In an ideal world, sales compensation plans motivate teams to work together towards common goals while simultaneously creating a friendly, competitive, and collaborative atmosphere. Here are some tips for making that happen.

Because sales compensation plans often involve some variable pay that’ll be under the control of the rep, incentives will only motivate them further.

If you do end up offering a sales incentive plan in addition to a standard compensation plan, make sure it applies to the entire team. The purpose of a sales incentive plan is to motivate and reward reps based on performance, and if you’re only doing so with high performers, it can’t serve that purpose. Find parameters for the incentive plan that will make your entire sales team more productive. These incentives should apply to people of all skill levels, roles, and experience.

This happy medium might look different for each business and role. Too much commission can cause unpredictability in salary expenses, but on-target earnings mostly made up of base pay won’t motivate reps to go above and beyond a certain point. There are three common base to variable ratios:

Certain businesses will place a cap on commissions, meaning when a rep hits a designated dollar amount in commission, they can’t earn any more. If you were a sales rep and you made as much as you possibly could, would you still be motivated to sell? Personally, I would take it easy.

Because reps can only make commission when they make a sale, that means whenever they get commission, the business also brings in revenue (which is good). Every department can feel the positive effects of more revenue. If you start to cap commissions, it can come off as greedy and as a signal for sales reps to kick their feet up and relax.

For reps to be satisfied with a sales compensation plan, they need to understand it first. Lay out the sales compensation plan in a way that highlights the parts that reps care about. Often, a simple table with the breakdown will do.

| Title | Sales development representative |

| Seniority | Senior |

| Reports to | VP of Sales |

| Quota | 30 leads/month |

| On-target earnings | $100,000 |

| Compensation mix | 60 base / 40 variable |

| Base salary | $60,000 |

| Sales incentive | $40,000 |

| Cap | No cap |

Whichever approach you use for paying employees, make sure you do it on time. Never assume anyone is well-off enough to be late in paying them. Your reps spend nine to five trying to make your business more profitable, and they deserve to receive the accurate amount as promised.

Your reps work hard for their money, and they rightfully expect to be compensated accordingly. Establishing a sales compensation plan for your business will not only keep reps happy, well compensated, and motivated, but it’ll also reflect on the profitability of your business.

Discussing salaries with reps can be a stressful conversation to have, and you don’t want miscommunication to make it even worse. Freshen up on these 81 sales terms for a seamless compensation chat.

Mary Clare Novak is a former Content Marketing Specialist at G2 based in Burlington, Vermont, where she is explored topics related to sales and customer relationship management. In her free time, you can find her doing a crossword puzzle, listening to cover bands, or eating fish tacos. (she/her/hers)

The lifestyle of the committed salesperson can be hectic and stressful. Luckily, there’s...

by Piper Thomson

by Piper Thomson

Selling SaaS is not a sprint; it’s a marathon.

by Sameer Sinha

by Sameer Sinha

Messy commission processes frustrate your reps and put revenue at risk. When payouts feel...

.png) by Devyani Mehta

by Devyani Mehta

The lifestyle of the committed salesperson can be hectic and stressful. Luckily, there’s...

by Piper Thomson

by Piper Thomson

Selling SaaS is not a sprint; it’s a marathon.

by Sameer Sinha

by Sameer Sinha