Buying a home isn't just a financial decision; it’s a major life milestone.

From navigating legal documents to coordinating with agents, lenders, and sellers, real estate transactions come with high stakes and even higher complexity. It’s not just about exchanging money; it’s about making sure every box is checked and every party is protected.

That’s why most deals rely on an added layer of security: escrow. It’s a process designed to hold funds, verify terms, and keep everything fair and accountable until closing day.

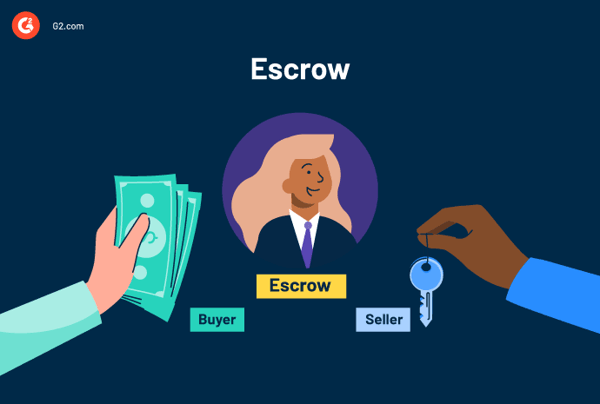

Escrow is a financial arrangement where a neutral third party holds money or assets on behalf of two parties until specific conditions are met. It ensures both parties fulfill their obligations before the funds are released.

This setup creates a safety net against fraud, double payments, or premature fund transfers. In modern real estate workflows, it’s often built into digital mortgage closing software, which helps manage tasks like disbursement, tax payments, and loan finalization.

Now that we’ve defined it, let’s look at what escrow actually does and why it plays such a vital role in real estate, online commerce, and business finance.

Real estate transactions are prone to risky outcomes. Having an escrow company in place assures the buyer and the seller that the process stays safe from forgery. Here’s how a standard process works:

An escrow account is different from the short-term escrow used during the home buying process. It is used to pay property taxes and homeowners' insurance on your behalf.

In many cases, lenders require buyers to set up a mortgage escrow account as part of the loan agreement. Once the home purchase is finalized, the lender creates the account and begins collecting funds as part of your monthly mortgage payment. These funds are then held until tax and insurance bills are due, at which point the lender pays them directly.

Because your mortgage payment now includes these additional costs, it may be slightly higher than a loan without escrow. But the trade-off is fewer surprises, fewer deadlines, and far less risk of missing a payment.

Say you apply for a loan for your new home. Along with principal and interest, escrow agents may ask you to pay homeowners' insurance in advance and keep a certain amount of cash reserves in your escrow account. It doesn’t mean you’re double-paying for insurance or property tax, but simply maintaining an escrow balance.

Whenever your payment is due, the lender will use your balance to disburse the money. Each month, you’ll receive an escrow account statement from the lender.

Did you know? The reserve collected at closing (a lump sum) acts as a safety cushion in case your property tax or insurance rates increase unexpectedly. If a buyer declines escrow and then fails to pay their taxes on time, the government can place a lien on the property.

Escrow accounts operate within strict regulations, minimizing the risk of fraud or mismanagement. When a mediator takes charge of funds, the buyer and seller’s assets are in safe hands.

Before we explore the various types of escrow accounts besides real estate escrow, let's quickly compare them, including who uses each type, how they are released, and the risks involved.

| Escrow type | Who uses it | What it holds | Trigger for release | Common risks |

| Real estate escrow | Home buyers, sellers, real estate agents | Purchase funds, property documents | Completion of sale conditions (e.g., inspections, approvals) | Delays in title clearance, unexpected fees, buyer/seller disputes |

| Mortgage escrow | Homeowners, mortgage lenders | Property taxes, homeowners insurance payments | Lender releases payments as bills become due |

Escrow shortages due to underestimated costs, lender mismanagement |

| Online transaction escrow | Buyers and sellers on marketplaces or freelance platforms | Funds for goods/services exchanged online | Buyer receives goods/services and confirms satisfaction | Fraud, disputes over delivery or service quality |

| M&A escrow | Acquiring and target companies | Portion of purchase price | Survival of reps and warranties, regulatory clearance | Disputes over terms, failure to meet conditions, legal challenges |

| Stock-based escrow | Employers and employees in equity compensation plans | Employee stock grants or options | Vesting schedule, performance milestones, time-based triggers | Employee turnover, stock devaluation, failure to meet performance goals |

In the stock market, the shareholders don’t have direct ownership of the shareholder equity. For example, multinational companies retain their top-line of workforce through additional shares. However, the employees cannot monetize these shares. They’re held in an escrow account that liquidates only after the employee spends a bond duration with the company.

Companies also set some restrictions on how employees can use these shares. The shares will only be credited to them if they satisfy the escrow agent’s pre-verification checks.

During a company or an asset merger, escrows record the assets involved, patents and trademarks, and other important documents in a repository. Escrow is a safe option to protect fixed assets, current assets, and various marketable securities of the dissolving company. Signing up for escrow with a good-faith deposit showcases your willingness to take responsibility for assets.

The buyer and seller in a mergers and acquisitions process need a multitude of government approvals, staff adjustments, and cross-border transactions to merge entities successfully. Escrow does all the legwork and reduces the financial burden on finance and accounting teams.

Although escrows can be used for any business transaction, it’s wisest to set them up for big-pocket transactions. If you’re buying a luxury watch, a car, or a heavy piece of machinery, protect your funds with an escrow.

Escrow conducts a five-step run-through before releasing your deposit to the seller

Did you know? The global software as a service (SaaS) escrow services market was valued at $6.7 billion in 2023 and is expected to reach $26.4 billion by 2033, growing at a CAGR of 14.3%!

Source: Allied Market Research

If something goes wrong with the transaction, the property can fall out of escrow. This means that the deal is unable to work in its current state because one or both parties cannot meet a condition in the agreement.

Although this situation isn’t ideal for either party, it doesn’t necessarily mean the deal is dead—it may take longer to close. The buyer and the seller can renegotiate the terms and agree to make the necessary changes to move forward. What this looks like for each party varies depending on why the deal fell out of escrow in the first place.

The best way to avoid falling out of escrow is to prevent it from happening altogether. Prior to making an offer, the buyer should have a reasonable budget in mind and be confident they will qualify for the loan.

On the other hand, the seller should be transparent about any damage to the property. This way, the inspection will not uncover any new problems that could jeopardize the contract.

An escrow shortage happens when there’s not enough money in your escrow account to cover upcoming property taxes or insurance premiums. This often results from underestimating costs or unexpected increases in tax assessments or insurance rates.

If the shortage remains unaddressed, the lender may apply late fees or initiate additional escrow draws, which can lead to further financial pressure. In extreme cases, consistent shortages may even risk your tax or insurance payments being missed, exposing you to legal or coverage-related consequences.

An escrow shortage means your account doesn’t have enough money to cover future projected costs like taxes or insurance.

An escrow deficiency, on the other hand, means your account has a negative balance, funds have already been disbursed, and your lender had to advance the payment on your behalf.

Both can raise your monthly mortgage payment, but a deficiency typically requires more immediate repayment.

Upon identifying an escrow shortage, lenders usually offer several options to address the deficit, allowing homeowners to choose the most suitable repayment method. Here’s how most handle it:

To avoid an escrow shortage, consider these proactive steps:

Depositing your funds in escrow reduces the probability of future fraud. If a buyer opens an escrow account, the agent looks into every nook and cranny of that purchase transaction before depositing funds to the seller.

That’s not the only advantage of opening an escrow account.

Here's a quick side-by-side look at the key benefits and drawbacks to help you make an informed decision.

| Escrow pros | Escrow cons |

| Protects funds until all contract terms are met | Requires upfront reserves and higher monthly contributions |

| Prevents fraud, payment disputes, and premature fund transfers | Monthly payments may rise if taxes or insurance premiums increase |

| Automatically manages property tax and insurance deadlines | Escrow fees may apply, depending on the provider and loan type |

| Helps enforce legal obligations and reduces administrative friction | Errors in estimates can lead to escrow shortages or overpayments |

| Increases trust between buyers, sellers, and lenders in high-value deals | Not always optional, often mandated for certain loans or down payments |

Not everyone can afford to invest their money in escrow because it charges a commission from buyers and sellers. Sometimes, having an escrow for real estate transactions only delays the loan disbursement and documentation.

Some common challenges associated with escrows are here for you to consider.

Got more questions? We have the answers.

An escrow agreement is a legal contract between the buyer, seller, and escrow agent. It defines what funds or assets will be held, under what conditions they’ll be released, and each party’s responsibilities. It’s essential for protecting all sides in high-value transactions.

To open an escrow account for a home loan or property purchase, follow these steps.

Escrow is not always mandatory, but is often required if your down payment is less than 20% or if you have a government-backed loan (like FHA). Some conventional loans allow borrowers to waive escrow if they meet certain criteria.

Escrow advances are reserves collected by escrow companies in advance to pay off property taxes and insurance when they’re due. The reserve is collected to ensure that your funds don’t run out and you don’t land in an escrow shortfall.

A lack of funds in your escrow account might result in an escrow shortage. Escrow shortage is reflected in your monthly loan statement, which is a cue for the loanee to submit required checks to the escrow agency.

Escrow increases due to a rise in tax amount, insurance interest, and mortgage interest. Also, escrow collects six months or a year's worth of payments in advance, which leads to higher costs.

Escrow payments can be lowered by negotiating your property's mortgage tax. If you think the tax amount is too high, you can call your local assessor and reassess it. As your mortgage company also deducts its commission from your escrow balance, you can opt for cancellation of your mortgage insurance.

You can cancel your mortgage escrow account in cases where:

Keep in mind that without escrow, you’ll be responsible for paying taxes and insurance directly.

Yes. If there's a surplus in your escrow account after closing or refinancing, your lender may refund the excess within 20 days. The refund depends on your loan terms and account balance at the time of settlement.

Escrow adds structure, transparency, and security to real estate transactions. By ensuring that funds and paperwork are only exchanged when every condition is satisfied, it protects all parties and helps deals close smoothly.

If you're planning a property transaction or investment, understanding how escrow works isn't just helpful, it's essential for reducing risk and gaining peace of mind.

Looking to take control of your property finances? Explore real estate investment management tools to track assets, manage deals, and optimize returns with confidence.

This article was originally published in 2023. It has been updated with new information.

Shreya Mattoo is a former Content Marketing Specialist at G2. She completed her Bachelor's in Computer Applications and is now pursuing Master's in Strategy and Leadership from Deakin University. She also holds an Advance Diploma in Business Analytics from NSDC. Her expertise lies in developing content around Augmented Reality, Virtual Reality, Artificial intelligence, Machine Learning, Peer Review Code, and Development Software. She wants to spread awareness for self-assist technologies in the tech community. When not working, she is either jamming out to rock music, reading crime fiction, or channeling her inner chef in the kitchen.

Nobody enjoys standing in line at the bank with a paper check in hand, just to access their...

by Mara Calvello

by Mara Calvello

Million Dollar Listing, Property Brothers, Flip or Flop – what do all these reality shows have...

by Izabelle Hundrev

by Izabelle Hundrev

What if you could create a booking website that saves time, reduces manual work, enhances...

by Sujay Pawar

by Sujay Pawar

Nobody enjoys standing in line at the bank with a paper check in hand, just to access their...

by Mara Calvello

by Mara Calvello

Million Dollar Listing, Property Brothers, Flip or Flop – what do all these reality shows have...

by Izabelle Hundrev

by Izabelle Hundrev