Debt can be scary when you’re paying off college loans or deciding whether to use credit to finance a big purchase.

But for many companies, debt capital is a necessary part of their financial structures.

What is debt capital?

When a company borrows money to increase its capital, it has debt capital. A company can use debt capital as a part of its capital structure to maximize growth, profit, and shareholder value. Debt capital, along with equity capital, helps companies achieve financial goals with funding they would not otherwise have access to.

Afraid of a little bit of debt? Businesses need to leverage debt capital in order to grow, so being frightened is not an option. We’ll break down how they achieve this leverage below.

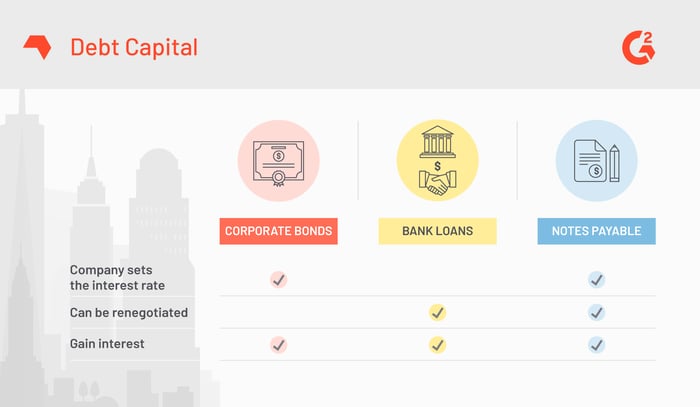

Types of debt capital

- Corporate bonds

- Bank loans

- Notes payable

How do companies use debt capital

There are several forms of debt capital that a company might use, including corporate bonds, bank loans, and notes payable. Each has its pros and cons for businesses as well as lenders, and they’re nothing to be afraid of. Let’s explore them together.

Corporate bonds

Corporate bonds are loans from investors that allow companies to use money they will pay back later at a fixed interest rate that they choose. Bonds can be advantageous to the the company that sells them because their interest rates never go up, meaning their value will not change over time. Corporate bonds can be long or short term, and depending on rates could cost companies less than a loan.

Bank loans

Business loans differ from corporate bonds because the money is usually borrowed from a bank rather than an investor, and they are usually paid back within a shorter period of time. They are similar to loans you might get from your bank to finance a personal purchase, such as a home or car. The loans must be paid back with interest, but the rate can be re-negotiated with the bank, making bank loans a more flexible option than non-negotiable bonds as a source of debt capital.

Notes payable

Notes payable, also known as promissory notes, are essentially IOUs from companies. They are typically kept track of in a company ledger. When referring to notes payable from the perspective of the lender, they are known as notes receivable. Like bonds, notes payable also gain interest at a rate set by the company, but they may be restructured as long as both sides can come to a legal agreement.

Debt capital vs equity capital

Debt capital is often discussed at the same time as equity capital. Instead of borrowing money and paying it back with interest, as with debt capital, companies building equity capital sell stock, or ownership, in the form of common stock or retained earnings. Rather than lending money to a company and earning interest on investments, buyers of company equity typically expect a higher return on their investments as partial owners.

However, any loans and debt capital must be repaid before a company can pay equity holders. This makes equity financing a typically more expensive option, but too much debt can also lead to bankruptcy when companies are unable to pay off their loans.

|

TIP: Check on the financial health of your business using financial predictive analytics software. Now you can predict asset movements and drive investment strategy based on historical data patterns — easy!

|

Debt to equity ratio

When financing for the growth and prosperity of a company, its financial structure will include both debt and equity. The debt to equity ratio varies by industry and company and depends on what kind of service or goods it provides, and whether it intends to go public and sell shares.

Ultimately, the goal of using debt and equity, and finding a balance between the two, is growth. Along with equity capital, debt capital is a necessary part of this process of balancing finances, analyzing capital structure, and making decisions on how to manage money.

Still afraid of accruing debt?

Never fear, with proper planning and balanced finances, debt doesn’t have to be bad. Whether you’re taking it on, or your company is, it can be a healthy and necessary part of personal or corporate finance. Whether it’s in the form of a bond, loan, or note, debt capital could help get your business off the ground.

Planning ahead is a key factor in managing debt capital. Learn how a sinking fund helps corporations improve their creditworthiness and pay off their debts.

by Maddie Rehayem

by Maddie Rehayem

by Harshita Tewari

by Harshita Tewari

by Maddie Rehayem

by Maddie Rehayem