November 3, 2025

by Holly Landis / November 3, 2025

by Holly Landis / November 3, 2025

Keeping track of what your business owes, and when payments are due, is critical to staying financially healthy. Whether you’re financing equipment, taking out a short-term loan, or managing vendor agreements, understanding how those debts are recorded can make a big difference in how clearly you see your company’s financial picture.

That’s where notes payable come in. These formal agreements document borrowed funds, interest terms, and repayment schedules, helping businesses maintain transparency, stay compliant, and plan for future cash flow with confidence.

Notes payable are written promises to repay a specific amount of money at a future date. Businesses use them to borrow funds and record the obligation as a liability on the balance sheet. These formal agreements often include interest and repayment terms negotiated between the borrower and lender.

All notes payable should be entered into a business’s accounting software to keep a record of what’s still left to pay on the loan and the recurring payments that are being made. Accounts payable automation software is one of the best ways to do this, keeping track of large volumes of financial transactions between businesses.

Although most often used by businesses for loans between the business and a bank or a vendor, notes payable can be used for any lending agreement. Other promissory notes can be used for transactions like car loans, student loans, or other non-commercial lending. On the lender’s end, incoming funds from the notes payable agreement are known as notes receivable.

Notes payable are written promises to repay a loan under specific terms. They’re formal agreements between a borrower and a lender, usually involving a bank, supplier, or investor, and detail:

This isn’t just paperwork. Notes payable must be recorded in your accounting system and tracked over time, especially if your business has multiple debts or staggered repayment dates.

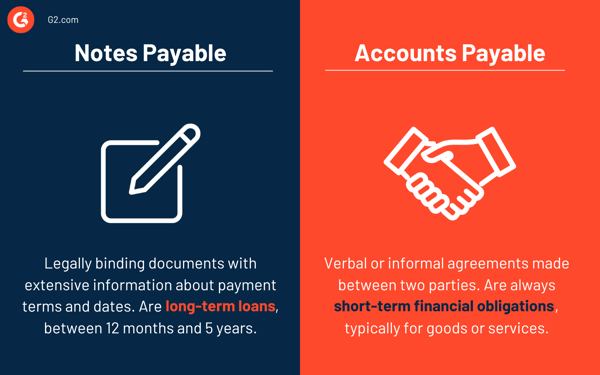

Both notes payable and accounts payable are frequently used interchangeably, but it’s important to understand the difference between them, especially when looking at a business balance sheet.

Notes payable are considered to be long-term loans over 12 months but usually less than 5 years. The borrower, or maker of the note, will create a liability with the lender for the amount they owe. It’s a specific amount that should decrease over time as the borrower pays back the lender for both the principal and interest amounts.

Accounts payable, though, are always short-term financial obligations, usually for goods or services. They don’t need a promissory note as they’re typically paid within a month. Utilities for the business, like electricity, water, heating, or goods provided by a vendor and invoiced to the business, are examples of line items that fall under accounts payable.

As accounts payable are typically for smaller amounts, these are verbal or informal agreements made between the two parties. Notes payable, like other promissory notes, are legally binding documents with extensive information about payment terms and due dates for the repayment of borrowed funds.

As a type of promissory note, notes payable are often used for big ticket items. They are large, long-term loans used in many industries, especially when heavy equipment, real estate, or supplies are being purchased. They may be issued when:

Short-term financial obligations are listed separately on a balance sheet under accounts payable. This could include:

| Feature | Notes payable | Notes receivable |

| Role | Borrower (you owe) | Lender (you're owed) |

| Financial impact | Liability | Asset |

| Balance sheet | Under liabilities | Under current/non-current assets |

| Recorded by | The business borrowing | The business lending |

| Examples | Loan from a bank | Customer owes you via promissory note |

There are several types of notes payable that a business could use, varying by the terms of the note, interest rates, and the amount owed. There are four commonly used types of notes payable.

With these notes, the total amount borrowed is due back to the lender in a single lump sum payment. Both the principal and interest are owed at the same time in one payment on the due date specified on the note.

Amortized notes are generally used for larger sums of money, as they set a sum that must be paid each month until the loan is fully repaid or the term expires. The amount due each month is the same, with some going towards the principal and some towards interest. As the amount on the loan decreases, more will go towards the principal. Real estate loans are the most common use for this type of notes payable.

These are somewhat the opposite of amortized notes, where payments are structured to be lower than they would be under a traditional loan to help the borrower afford the repayments. Any interest not paid each month is added to the principal balance, which means borrowers can end up owing more by the loan maturity date.

The only payments made during the course of the loan under this type of note are for the interest, not the principal amount. At the end of the loan, the total principal amount is then owed as a single lump sum. More interest will be paid on these loans as the interest amount will be calculated against the total principal amount for the lifetime of the loan, not getting smaller as the principal amount decreases.

On a balance sheet, notes payable are classified based on when they’re due:

Example:

If your business owes $80,000 on a 3-year note, and $25,000 is due in the next year, then:

Proper classification affects your financial ratios and how investors view your liquidity.

As with most formal loans, notes payable amounts will include the actual amount of money borrowed and the interest owed on the loan. This means that more money will be paid by the end of the loan than simply the borrowed amount.

To calculate notes payable, add the principal amount borrowed to the interest accrued over the loan term. Use the formula: Total notes payable = principal amount + (principal amount × interest rate × time), where time is expressed in years or fractions of a year.

To calculate the total amount owed to the lender, borrowers can use the following calculation:

Notes payable = Amount of the loan x ( 1 + interest rate x number of payments)

For example, a $20,000 loan at an interest rate of 10%, with 60 total monthly payments, would be:

$20,000 x (1 + 0.1 x 60) = $140,000

This information should all be recorded on a business’s balance sheet to determine how much of the loan amount still needs to be repaid and to ensure that payments are being completed according to the schedule outlined in the notes payable documents.

Notes payable play a critical role in how external stakeholders assess a company’s financial health, stability, and decision-making discipline. These liabilities offer insight into how and how well a business manages its debt obligations.

Investors review notes payable to understand a company’s capital structure and risk exposure:

They may also examine the interest rates and terms to determine the company’s borrowing power and whether management secured favorable terms.

Lenders scrutinize notes payable to assess a company’s creditworthiness and determine whether to extend additional financing:

Lenders often want assurance that the business has consistent cash flow and sound debt management practices in place.

Why it matters: A surge in notes payable could signal strategic investment or potential financial stress. Stakeholders rely on transparent reporting to distinguish between the two — which makes accurate classification, disclosures, and audit trails essential.

Auditors assess the accuracy and completeness of notes payable disclosures, including:

They also evaluate whether notes payable are fairly stated in accordance with accounting standards (e.g., GAAP or IFRS).

Managing your notes effectively means more than just paying on time. Here’s how smart businesses stay on top of it:

Centralize all note terms in your accounting system

Automate reminders for interest and principal payments

Track short-term vs long-term balances monthly

Model refinancing opportunities if rates drop

Avoid negative amortization unless necessary

Use software to integrate notes with overall cash flow forecasting

Have more questions? Find the answers below.

In accounting, notes payable is a liability that represents a written agreement to repay borrowed money with interest by a specified date. It appears on the balance sheet under liabilities and includes details like the principal amount, interest rate, and maturity date of the obligation.

Record notes payable in a journal entry by debiting the cash or asset account received and crediting notes payable. If interest is involved, record interest expense periodically and credit interest payable. At maturity, debit notes payable and interest payable, and credit cash to reflect repayment.

Notes payable can be a current or non-current liability depending on the repayment term. If due within one year, it is classified as a current liability. If repayment extends beyond one year, it is recorded as a non-current liability on the balance sheet.

Common examples of notes payable include bank loans, promissory notes, equipment financing agreements, and mortgages. These obligations involve a written promise to repay a specific amount with interest by a set date and are recorded as liabilities on the balance sheet.

Calculate interest on notes payable using the formula: Interest = Principal × Rate × Time. The principal is the amount borrowed, the rate is the annual interest rate, and time is the loan period in years. For partial years, adjust time as a fraction (e.g., 3 months = 0.25).

The main difference between notes payable and notes receivable is that notes payable represent a liability where the business owes money, while notes receivable represent an asset where the business expects to receive money. Both are formal agreements with specific terms for repayment.

Notes payable impact a company’s balance sheet by increasing liabilities. If short-term, they appear under current liabilities; if long-term, they appear under non-current liabilities. Notes payable also increase cash or assets when the loan is received, reflecting both the obligation and the benefit.

Yes, notes payable can be refinanced by replacing the original note with a new loan under different terms, or converted to equity through agreements where debt holders exchange debt for ownership shares. These actions often require lender approval and formal documentation.

Keeping business books organized with notes payable information is essential for maintaining good financial records, especially if your company has multiple notes with different lenders.

Whether you have one large loan or several smaller ones, notes payable hold each party accountable for their accounts!

Understand the comings and goings of your business finances with cash flow management services that help you stay on top of loans and forecast future revenue.

This article was originally published in 2024 and has been refreshed with content.

Holly Landis is a freelance writer for G2. She also specializes in being a digital marketing consultant, focusing in on-page SEO, copy, and content writing. She works with SMEs and creative businesses that want to be more intentional with their digital strategies and grow organically on channels they own. As a Brit now living in the USA, you'll usually find her drinking copious amounts of tea in her cherished Anne Boleyn mug while watching endless reruns of Parks and Rec.

Borrowing and lending money are something most of us do at some point in our lives. Whether...

by Holly Landis

by Holly Landis

Debt can be scary when you’re paying off college loans or deciding whether to use credit to...

by Maddie Rehayem

by Maddie Rehayem

Ever wish you could know whether a stock will actually pay off?

.png) by Tanuja Bahirat

by Tanuja Bahirat

Borrowing and lending money are something most of us do at some point in our lives. Whether...

by Holly Landis

by Holly Landis

Debt can be scary when you’re paying off college loans or deciding whether to use credit to...

by Maddie Rehayem

by Maddie Rehayem