September 30, 2025

by Sean Blanda / September 30, 2025

by Sean Blanda / September 30, 2025

Partnerships are no longer just a growth lever — they’re a core business strategy.

From industry giants like Salesforce and HubSpot to fast-scaling disruptors, companies are increasingly relying on partner ecosystems to accelerate revenue, expand market reach, and maximize customer value.

The market is demanding more integrated, flexible solutions, and collaborative go-to-market strategies have become a competitive necessity. For business leaders, understanding how to build, scale, and optimize a partner program can mean the difference between stagnation and outsized success.

Building a partner ecosystem using partner management software is the work of partnership professionals who spend their working lives building alliances between their organizations – and all of the meetings, strategy, and preparation it takes to align sales and product organizations at two fast-growing tech companies.

A partner program is a strategy that helps a business connect with sales and marketing channel partners who sell the company's products and services. Partners are also known as referral partners, resellers, and marketing partners.

Some of the most successful SaaS companies, such as Salesforce, HubSpot, and Stripe, have built massive businesses leveraging partnerships. And yet advice on how to build your own partner program is hard to come by.

In this guide, we’ll break down what a partner program is, the major types, actionable launch steps, and critical lessons from the world’s most successful software companies — so you can unlock new growth channels and future-proof your business.

TL;DR: Partner programs drive SaaS growth by connecting companies with tech, channel, and strategic partners. This article covers definitions, key types (tech, channel, strategic), and actionable tips to launch your own program. Expect a long-term investment — success depends on ecosystem thinking, executive buy-in, and a clear understanding of your business goals.

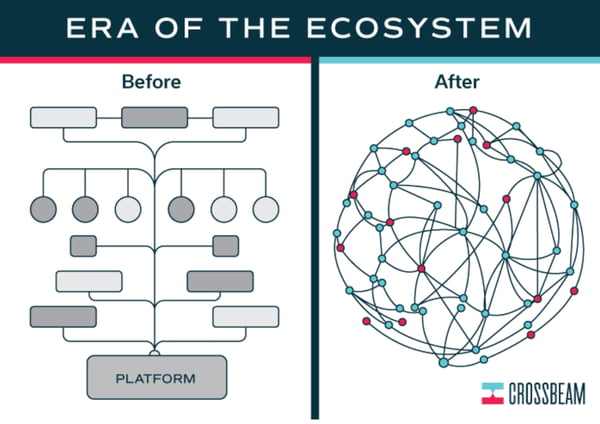

Years ago, software was a monolith. Your email, word processor, and payment solution were all made by the same company that likely charged your company a massive yearly bill.

This was an all-or-nothing approach; choosing your software provider was a massive commitment and changing vendors was an arduous and expensive process.

Today, business customers have a bit more flexibility. You can choose best-in-breed tools that do a handful of things well and connect them with one another. Your technology stack is fully customizable. For example, if a better payment processor tool comes along, you can switch and connect it with your existing tech stack.

In a modern business, you can use one tool to send emails, one to close deals, and another to communicate with your teammates.

What changed?

Consumers have the expectation that all of their tools work with one another. It’s a shift to the “era of the ecosystem". Ecosystems are filled with bidirectional application programming interfaces (APIs).

Data moves freely between the services as opposed to the ”all-in-one platforms” of old where data never leaves. Think of a train terminal (platform) vs the train tracks (ecosystem).

The data above shows that the most successful companies will be the ones that embrace an ecosystem approach.

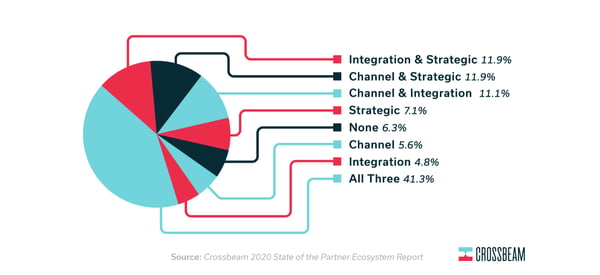

For simplicity’s sake, it’s helpful to think about SaaS partnerships as falling into three buckets:

Most companies have some sort of combination of the above.

Let’s explore them one at a time.

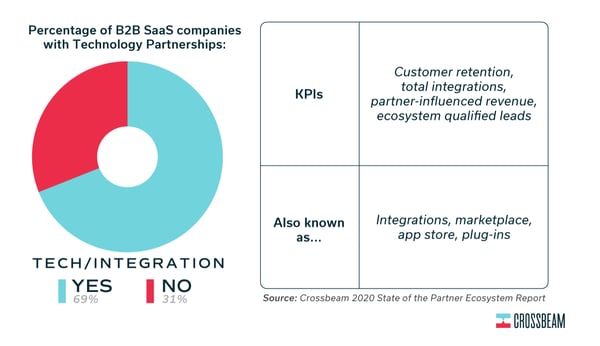

Tech partners work together by exchanging data, creating workflows, triggering events, enriching data, and/or creating go-to-market strategies. They make money by co-marketing and co-selling their integration to mutual leads and customers.

Did you know? G2 Partner Hub features 50+ products, so you can easily integrate with your favorite sales, marketing, customer success, and operations tools.

Additionally, user retention rates tend to be higher among those companies that utilize an integration. After all, you are less likely to stop using a SaaS product if it already works with the rest of your workflow. Why bother?

Tech partners use this API data to help fill gaps in their use cases. If you work at a SaaS company you know your company can’t meet all of your users’ demands.

In some cases, you will choose not to build in the functionality and instead partner with a company that can help. This is often referred to as the “buy vs. build” question. In some cases, a SaaS company will build the functionality themselves. But increasingly, companies are opting to allow partnerships to fill their use case gaps.

For example, HubSpot doesn’t have a robust survey feature, so they partner with Typeform to feed Typeform responses directly into HubSpot CRM functionality.

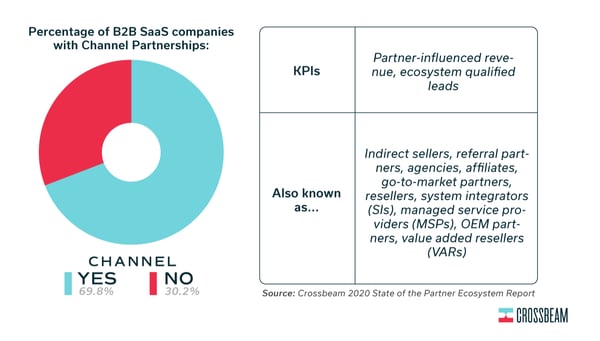

A channel partnership occurs when a vendor – typically a SaaS company (often referred to as an independent software vendor, or ISV) – collaborates with a third party that promotes, sells, and distributes the vendor’s product. Put simply, a channel partner program is a strategic business initiative that leverages outside companies or individuals to extend your indirect sales motion.

Companies use channel partners to quickly grow their reach. SaaS vendors often hit a growth ceiling with a purely direct sales motion. Enter channel partners, who can be in more places and handle the heavy lifting in exchange for a cut of the sale.

What’s in it for the partner? A well-structured program typically offers:

Channel partners can cover geographic areas, market segments, or types of customers your direct sales can’t serve efficiently.

Example: Your U.S.-based company is ready to expand into Japan. Rather than staffing up an office and negotiating distribution deals with Japanese companies, you can find a channel partner there. They handle your rollout in exchange for 30% of the yearly contracts they close. You grow faster with less investment, and they can get a new revenue source. Everyone wins.

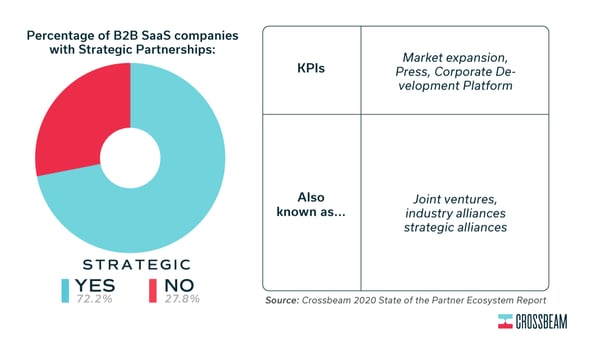

A strategic partnership is a bit more loosely defined than our previous buckets. A strategy partnership is a broad agreement that aligns the strategic efforts of two or more companies with overlapping products or markets towards a common goal.

These are often long-term arrangements that can sometimes result in one company acquiring another.

Strategic partnerships can (and often do) involve elements of tech and channel partnerships, but tend to be recurring, long-term commitments. They can also include co-branding, product roadmap development, and/or public relations.

Here’s the tricky part about building a partner program: there’s no guidebook for partnerships. Good advice is hard to come by – especially when each partnership hinges on the unique offerings, cultures, structures, and maturity of each partner company.

Hear from dozens of partnership professionals every week, and with these learnings and others in the Partner Playbook – free to you. Some universal advice and key learnings we’ve learned in that process:

Business professionals evaluating partner management solutions should assess account mapping capabilities, as this functionality enables cross-referencing customer and prospect lists to identify partnership opportunities and measure potential ROI.

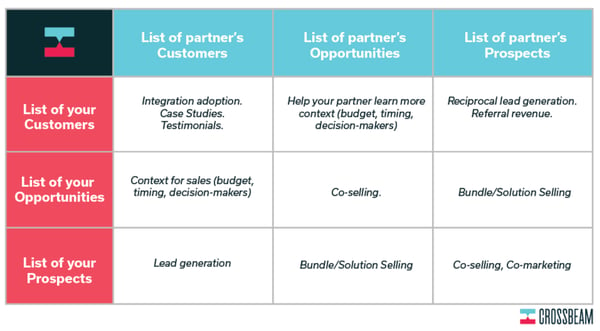

In short, account mapping is taking a list of your pipeline and cross-referencing or “mapping” it with a partner’s list of current or potential customers.

For example, I can take a list of my opportunities and “map” them to your customers to see what accounts you can introduce me to. You can use this "account map" to learn more about the contacts in your CRM software, accelerate deals in motion, or start to co-sell. A simple benefit matrix may look like:

For example, if you are considering an integration with a partner, compare customer lists. The more overlapping customers you have, the more likely your integration will be successful as more shared customers = more possible users.

Because of the nebulous nature of partnerships, if you are starting from scratch it’s going to take a while. At minimum you’ll see to decide:

Whew. That’s a lot of hard work that involved research and candid conversations with internal and external stakeholders. And even when you do have alignment on goals, you still need to find the right partners.

Veteran partnership professionals will tell you that they spend a lot of time going to events and taking calls that don’t result in a partnership.

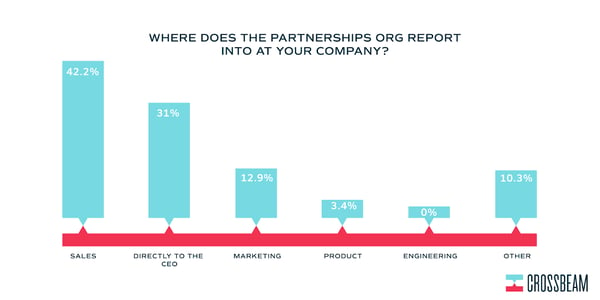

Starting a partner program is a commitment of one to three years and you should expect not to see any revenue until around the ninth month at minimum. If your executive team can’t give you this runway, you won’t be successful. This is why so many partnership professionals demand that they report to the C-suite.

It’s best if your C-suite understands the commitment and that the partner program may take some time to bear some fruit.

Plan on a 9–12 month runway. You’ll spend the first few months defining goals, recruiting partners, and setting up workflows. After onboarding and joint selling start, closed-won deals typically appear toward the end of year one.

Partnerships require long-term thinking and alignment with business goals. Shifting priorities and strategy could render your partnership efforts moot, which is especially frustrating if your sales cycles are long.

If you can’t report to the C-suite, you should have regular meetings with your C-suite. And if you can’t do that you need to ensure your manager is advocating for partnerships at the executive level.

No matter your partnership strategy, you will be exchanging data with your partner. Channel partners exchange leads, contact lists, and opportunities. Integration partners also exchange product data via bidirectional APIs.

You will need a handful of tools to help facilitate these exchanges, such as:

A modern partnership professional uses all three of these tools in concert to scale a partner program. And in true “meta” fashion, these tools often integrate with one another ensuring your sales team can get the partnership data when they need it to help close deals and avoid conflicts. Even if you can't use all the tools, it's important to at least employ the best PRM software to make the most of your partner program.

Partner management systems, also known as partner relationship management (PRM) tools, provide business partners with tools for tracking sales and affiliates. These software solutions enable businesses to train, onboard, and certify partners as well.

To be included in this category, the software product must:

*Below are the top five leading partner management solutions from G2’s Fall 2025 Grid® Report. Some reviews may be edited for clarity.

Salesforce Partner Cloud makes partner relationship management feel seamless by combining collaboration, lead distribution, and performance tracking in one place. It helps businesses onboard and empower partners with AI-driven insights, automated workflows, and shared dashboards for real-time visibility. Ideal for scaling partner ecosystems without losing control or consistency.

"I love how it pulls everything partner-related into one spot, from getting new folks on board to seeing how they're performing – it just makes working with partners so much smoother. Plus, it really greases the wheels for sales, making things like deal registration and co-selling way easier, which means more revenue for us."

- Salesforce Partner Cloud Review, Lindsey J.

"The main downside is definitely the setup complexity and licensing cost structure. Getting the sharing rules and data visibility just right for external partner users is a massive administrative headache, and the price jumps when you scale up can be tough to manage"

Also, I wish they integrated with SFDC CPQ. I was also hoping their default translation tool would be better, as our team in Asia agrees some of the wording is not optimal. Lastly, I wish they had better tools to support the two-tier business."

- Salesforce Partner Cloud Review, Adriano K.

ZINFI offers a unified partner management solution to help companies align channel policies, programs, and people. It also offers end-to-end automation capabilities for affiliate marketing management, partner marketing management, partner incentives management, and partner relationship management processes.

"The ZINFI portal is very user friendly and has all the required options and details at the fingertips.

I found it quite easy to navigate and am able to find the tools that I needed very easily and to be fair there are quite a lot of tools and resources available in this website. Also this website is smooth and I'm yet to face any lags or bugs in this portal. The customer support is very good and dedicated. The main highlight would be the ease of implementation and integration of this platform."

- ZINFI Review, Sarath Kumar N.

"ZINFI can improve by offering some solutions for a free trial so that we get to know more about their products and then decide which one is best for us. This will also help us to understand how ZINFI can be used efficiaently and productively to achieve our desired goals."

- ZINFI Review, Manoj P.

impact.com is a global partnership management platform that enables brands, publishers, and agencies to manage different types of partnerships. The platform has a large database of over 120k verified global partners that businesses can work with to scale growth.

"The best things about the impact is one the best and large market where we can sell out product and any one create as a affiliate marketer promote the product and earn money."

- impact.com Review, Raj G.

"They will lock you in for a year, with few opportunities for SMB as most profitable opportunities need additional flat fees. Their reps are robotic and don't really care about you as a business. Integration also requires developers and is not so friendly."

- impact.com Review, Eliran L.

Impartner PRM is an award-winning channel partner management technology provider offering PRM and through-channel marketing automation solutions. Businesses use this platform to manage partner relationships, generate demand through partners, and boost profitability.

"Working with Shad and Benjamin saved our implementation with Impartner PRM. We initially implemented the Impartner PRM without sufficient consideration of our desired use cases and what goals we were aiming to accomplish.

After Shad (success) took over management of our account, he quickly understood our actual end goals, got the resources on the Impartner PRM side to support a rebuild of our PRM instance, and worked closely with us to meet our goals."

- Impartner PRM Review, Joseph C.

"Some features take sometimes a little longer to develop and deploy than we would like. We are in a business where we need speed (however not at the expense of quality)! We would like enhanced portal usage reporting metrics."

- Impartner PRM Review, Geneviève B.

PartnerStack helps brands manage partner relationships as well as expand their ecosystem. The platform makes it easy for businesses to recruit partners, track traffic and leads, and reward partners.

"I love the clean user interface. It makes it easy and fast to access all the important information that I need. As a YouTuber who is part of many different affiliate programs, I would say PartnerStack is probably my favorite as I have quick access to the multiple companies I'm an affiliate with and can see the statistics I want to analyze. For any company looking for an affiliate program, I would suggest looking at PartnerStack. Your affiliates will thank you later."

- PartnerStack Review, Paul D.

"The only downside that I've experienced is that the length of time from requesting payout, to actually receiving the payment has grown over the past year. It's not a dealbreaker, but having to wait 10+ business days to receive a payout once you request your funds seems a bit excessive to me. Yes, you can shorten that time to 5 business days by connecting your bank account, but even that seems like a bit long to wait."

- PartnerStack Review, Trevor A.

The new giants of B2B SaaS have all embraced the partner ecosystem: Snowflake, Slack, HubSpot, and Zoom, to name a few.

Your place in your market will be defined by how well you integrate with the other solutions used by your customers. While it may seem daunting, see it for what it is: a career opportunity.

Advocating for and building your company's partnerships strategy is one of the best ways to positively affect its future. Who knows what kinds of doors will open for you?

Partnering with channel marketers to execute scalable marketing programs? Explore the best through-channel marketing software today!

This article was originally published in 2020. It has been updated with new information.

Look, I’ll be honest: channel partnerships aren’t really my day-to-day jam. I’m a marketer...

by Soundarya Jayaraman

by Soundarya Jayaraman

In today's competitive landscape, word-of-mouth remains one of the most powerful marketing...

by Kirsty Sharman

by Kirsty Sharman

Potential customers always ask their friends and family for recommendations before buying a...

by Megan Mosley

by Megan Mosley

Look, I’ll be honest: channel partnerships aren’t really my day-to-day jam. I’m a marketer...

by Soundarya Jayaraman

by Soundarya Jayaraman

In today's competitive landscape, word-of-mouth remains one of the most powerful marketing...

by Kirsty Sharman

by Kirsty Sharman