January 18, 2018

by Aaron Walker / January 18, 2018

by Aaron Walker / January 18, 2018

Bitcoin is booming, but blockchain is evolving. Bitcoin is always a point of reference for blockchain technology because it’s one of the earliest (and definitely the most widely known) applications of the technology. But blockchain is so much more than just bitcoin. It has the potential to evolve the finance, real estate, retail and myriad other industries.

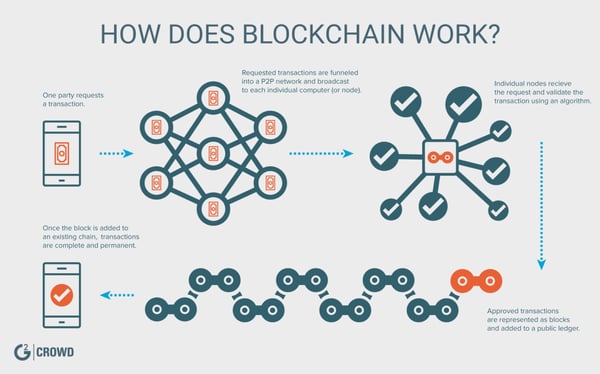

Blockchain as a term is surrounded by a bit of mystique, but it is not actually that hard of a concept to grasp. Blockchain tools use distributed ledger technology (DLT) to keep records of globally distributed, encrypted transactions. Transactions are documented, stored and publicly available to prevent tampering and ensure validity. Its initial use came as a framework for cryptocurrency distribution and trading, but the technology can be utilized in a variety of industries. Its self-sustaining database makes it easy for users to validate their data and prevent fraud while keeping information available to the public.

Health care providers can utilize its encryption features to ensure confidentiality in payments, contracts and communications. It can also help internet of things (IoT)-connected medical devices from being tampered with. Voting is more of a theorized application, but blockchain could provide a public ledger for ballots, displaying the source, time and date of each vote. The real estate and investment industries could use the technology to monitor and document transactions, identify trends and encrypt sensitive data. Applications continue to emerge in industries like supply chain management, contract management, cloud storage and payment processing.

In terms of security, blockchain and its public ledger are seen as a potential solution for big data processing, endpoint protection software, finance tools and supply chain management software. Decentralization adds a level of transparency to transactions and improves historical record-keeping for large networks. The ledger’s reference makes it incredibly difficult to commit fraudulent transactions without being noticed. The ledger can also be seen as a secure, scalable framework for protecting IoT endpoints. A decentralized ledger for all data can eliminate single points of failure in digital infrastructure and improve data integrity for interconnected IoT devices.

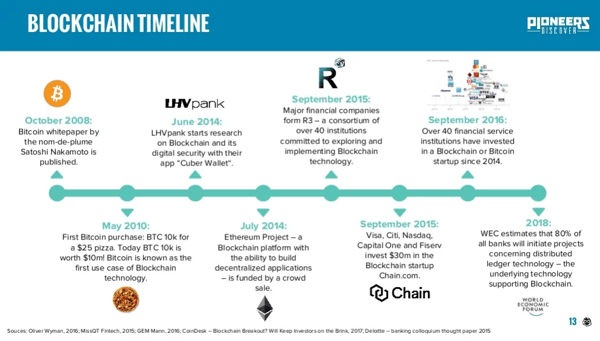

Most experts consider bitcoin’s framework as the first applied blockchain technology. Satoshi Nakamoto mined the first bitcoins in 2009. Interest and investment followed shortly. From nothing, the value of one bitcoin has exploded to more than $20,000. Other cryptocurrencies like ethereum and litecoin have seen significant growth in the wake of bitcoin’s miraculous evolution. But pioneers in the blockchain market are embracing more than cryptocurrencies themselves.

2017 witnessed a plethora of venture capital funding instances for applied blockchain technology. R3 is a financial services technology provider utilizing blockchain technology that raised $106 million in 2017. Its flagship tool, Corda, is a frictionless transactional tool for companies to simplify record keeping and streamline operations. The company asserts its platform can be used to develop company-specific financial management solutions using Corda as a framework.

Enormous financial services and banking corporations, such as Citigroup, JP Morgan, Visa and Capital One, have jumped on the blockchain bandwagon. In October, JP Morgan announced a blockchain payment network called Quorum — despite its CEO denouncing the bitcoin boom as a bubble. In November, Visa announced a B2B payment system powered by blockchain. Last year, Capital One partnered with blockchain firms to develop and test a number of claims and analytics capabilities for the healthcare industry. In May, Citigroup partnered with NASDAQ, announcing an integrated payment solution powered by blockchain technology.

“I don’t think governments are going to take lightly other people coming in and potentially disrupting their abilities around data, around tax collection, around money laundering, around know-your-customer,” Citigroup Inc. CEO Michael Corbat told Bloomberg in November 2017. “It’s likely that we’re going to see governments introduce, not cryptocurrencies — I think cryptocurrency is a bad moniker for that — but a digital currency.”

Companies that provide wallet tools for cryptocurrency storage, management and trading have received significant funding. A company simply called Blockchain, the most widely used cryptocurrency wallet today, received $40 million in funding in 2017. Similar companies, such as Abra and Coldlar, received $16 million in October 2017 and $10 million in December 2017, respectively. As cryptocurrency transactions become more popular, individuals and businesses need locations to store their digital assets.

Blockchain technology has impacted the cybersecurity industry in a few ways. HYPR uses blockchain technology to decentralize credential and biometric data to facilitate risk-based authentication. It raised $10 million this year for the platform, likely since it’s unlike most RBA solutions on the market. NuCypher is another blockchain security company breaking ground, raising $4.3 million in 2017. Its tech utilizes distributed blockchain systems for proxy re-encryption. It’s also an access control platform and uses public-key encryption to securely transfer data and enforce access requirements.

Guardtime has been around since 2007, but it differs a bit from the identity-focused blockchain security solutions. The Estonian company provides a blockchain platform focused on secure data exchanges. It provides a keyless signature infrastructure, unlike common public-key products. But this allows data in transfer to be encrypted asymmetrically for improved security and centralized management. It’s already used to secure Estonia’s 1 million health records.

Cryptocurrency transaction and investment are the most obvious practices in the future. Bitcoin, ethereum and litecoin will likely increase in value. But other companies such as Ripple have developed cryptocurrencies specifically for global financial sectors. Ripple (RPX) itself is much more centralized than Bitcoin (BTC, XBT) but can theoretically be more easily implemented into the current structure of most financial industries. It’s faster and linked to banks and payment providers, which increases the access, security and accuracy of blockchain-based transactions.

In terms of applied blockchain, database management and information storage systems will see a big influx of blockchain-secured systems. Tools such as BigChainDB are providing developers with scalable blockchain-based databases for applications and big data processing. The NoSQL database could be used as any other non-blockchain distributed database tool, but would provide increased asset storage, decentralized access and immutability.

Cloud applications will see new identity and access solutions. Storj is an interesting product that could see some growth in the near future. It’s a distributed cloud storage platform based on blockchain technology. It offers end-to-end encryption, speed boosted by peer-to-peer technology and high availability. The company raised a hefty $30 million last year and could become a big player in the cloud storage and cloud security markets.

Blockchain-based fintech offerings will continue to pop up because of their increased security. Corporations will continue producing secure transaction technology. Mastercard already has a distributed ledger offering, and Deloitte’s Rubix has already been on the market for a few years. Information security and corporate integrity have both taken a blow after events like the Equifax catastrophe, and companies are investing in blockchain as a precaution.

Companies such as Riot Blockchain, the first NASDAQ-listed, pure-play blockchain company, will continue to arise. The company invests in applied blockchain technology and cryptocurrency. Its portfolio includes a cryptocurrency accounting tool called Verady, a cryptocurrency exchange called Coinsquare and a blockchain-based escrow service called Tesspay. The company had its initial public offering in October. Shares were listed at $8.74 and have risen as high as $38.50, leveling out at $23.69 as of Jan. 8, 2018. With Riot Blockchain earning a market cap of more than $260 million, investors may find similar companies to be lucrative investments.

IoT is one other realm breaking into blockchain. Both of these trending and emerging technologies can benefit from each other. The decentralized model is perfect for facilitating communications between multiple endpoints. And modern blockchain tools are scalable enough to handle enterprise-sized loads. IBM Watson’s IoT platform already has tools for integrating blockchain technology into IoT applications. SAP Leonardo includes some early stage blockchain capabilities. Big companies investing in IoT will start investing in blockchain integration — if they haven’t already.

SAP has a distributed ledger that will be launched soon. Komodo’s blockchain platform is in the works. Rumors are floating around about a partnership between Western Union and Ripple. Even Hooters’ parent company, Chanticleer, has announced its intentions to create a blockchain-based customer rewards system. These trends are no fluke, and tech giants will continue offering more blockchain tools to the public.

Along with HYPR, NuCypher and Guardtime, blockchain-based identity management solutions will continue to emerge. There are dozens of products available already, but somehow blockchain gets pigeonholed as a fintech-focused resource. In actuality, anything pertaining to transactions or data integration could adopt blockchain capabilities, and identity management companies are the first to jump in.

The big ones have already done it, and the Western Union/Ripple partnership is interesting. But there’s a lot more to this trend than what’s already happened. Wall Street barons who haven’t joined in will do so soon. Industry leaders like Goldman Sachs, Santander and BNY Mellon will lead the way while firms push trillions of dollars into blockchain technology.

From IBM to SAP, decentralized data transfers are growing in popularity. Microsoft is jumping in with its Azure Blockchain as a Service platform, and AT&T plans to spend $200 million on IoT startups. The telecom giant already put money into blockchain tools, so the crossover is pretty obvious. An IoT chain is building, and it will make endpoints and the data they transfer safer.

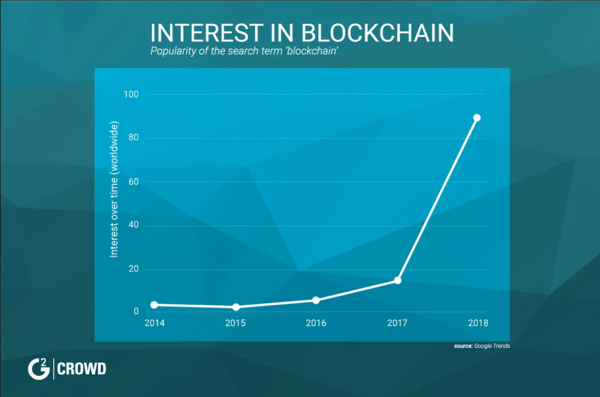

Blockchain’s growth in popularity and the rise of bitcoin have been obvious indicators that the market is trending upward. It has the potential to evolve dozens of industries. The blockchain market was worth more than $400 million in 2017 and is expected to grow to more than $7.6 billion by 2022. There’s no end in sight for blockchain implementation in finance, security, supply chain management and a list of industries that continues to grow. Ambitious companies will continue to gain funding and early adopters will reap the benefits of this emerging technology.

Aaron has been researching security, cloud, and emerging technologies with G2 for more than half a decade. Over that time he's outlined, defined, and maintained a large portion of G2's taxonomy related to cybersecurity, infrastructure, development, and IT management markets. Aaron utilizes his relationships with vendors, subject-matter expertise, and familiarity with G2 data to help buyers and businesses better understand emerging challenges, solutions, and technologies. In his free time, Aaron enjoys photography, design, Chicago sports and lizards.

When you hear “blockchain,” you might instantly think of Bitcoin or other cryptocurrencies....

by Washija Kazim

by Washija Kazim

When most people hear the word “blockchain,” the first and only thing that usually comes to...

by Bryce Welker

by Bryce Welker

Like any other industry, the tech sector isn’t immune to falling victim to hype from...

by Tim Keary

by Tim Keary

When you hear “blockchain,” you might instantly think of Bitcoin or other cryptocurrencies....

by Washija Kazim

by Washija Kazim

When most people hear the word “blockchain,” the first and only thing that usually comes to...

by Bryce Welker

by Bryce Welker