July 29, 2019

by Bryce Welker / July 29, 2019

by Bryce Welker / July 29, 2019

When most people hear the word “blockchain,” the first and only thing that usually comes to mind is Bitcoin.

While it’s true that this cryptocurrency is the most popular project associated with blockchain, it only represents a fraction of the technology’s versatility. In actuality, the complex decentralized network of cryptographically secured data that forms the bedrock of Bitcoin offers much more impressive potential: particularly where professional auditing is concerned.

My experiences in the accounting industry, cryptocurrency speculation, and independent entrepreneurship have given me a unique perspective on this subject. From what I can gather, continued development and adoption of blockchain technology will inevitably lead to an intersection with the professional auditing industry. And when it does, the results will be nothing less than a complete paradigm shift.

Before I get into the specifics, here’s some necessary background information:

The term “blockchain” refers to a method of record-keeping and data storage. A number of “blocks” containing raw data are connected to each other to form a “chain.” They’re connected in the sense that every block is both encrypted and able to decrypt data from other blocks.

Image courtesy of Investopedia

Image courtesy of Investopedia

There are many benefits to this method of recordkeeping using distributed database. For example, the decentralized nature of blockchain makes it highly resistant to hijacking or fraud. This is what makes cryptocurrencies like Bitcoin and Ethereum so valuable and popular. Additionally, blockchain technology is very lightweight and accessible from a structural standpoint. Hence, information stored on a blockchain can be instantaneously accessed and updated.

This is where auditing comes in.

From an accounting standpoint, auditing is the act of evaluating financial statements from an individual or organization. The goal of an audit is to determine whether or not these statements are accurate, with professional auditors trained to detect inaccuracies that are both intentional and unintentional.

Auditing is a core aspect of professional accountancy and is one of the main subjects tested on the Certified Public Accountant (CPA) exam. Additionally, there are several professional certifications based entirely around auditing, such as Enrolled Agents (EA) and Certified Internal Auditors (CIA). Essentially, the act of properly regulating financial transactions for accuracy and honesty is a gigantic industry responsible for millions of jobs and billions of dollars in revenue.

In order to understand the effect blockchain technology is poised to have on professional auditing, we also need to look at some numbers:

Determining the value of the blockchain based on the value of cryptocurrencies is difficult and largely inaccurate due to their highly volatile nature. Instead, an easier way to evaluate the current value of this technology is by analyzing its investor appeal and general adoption rates.

|

TIP: Learn more about 2019 cybersecurity trends, including what the future holds for blockchain technology. |

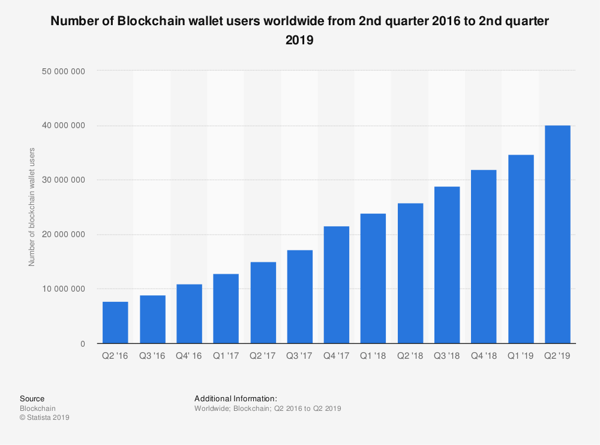

According to Statista, the amount of money invested in blockchain-based projects has increased exponentially over the past few years: from roughly $1 million in 2012 to over $1 billion in 2017. Furthermore, the amount of blockchain “wallet” users has increased from just under 8 million in 2017 to over 40 million in June of 2019.

Image courtesy of Statista

Image courtesy of Statista

According to these metrics, it’s clear to see that blockchain technology is becoming more and more popular. In fact, these increases in spending and adoption have been consistent despite the highly volatile price of Bitcoin: from $700 to $17,000 all the way back down to $4,000 in the year 2017 alone.

Image courtesy of Yahoo Finance

Image courtesy of Yahoo Finance

Based on the fact that interest has increased despite these drastic price shifts, it can be stated that blockchain technology has more to offer investors and users than Bitcoin alone.

Now here are some quick statistics regarding the current state of the professional auditing industry:

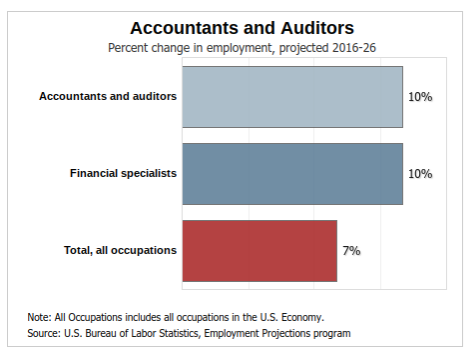

According to data provided by the Bureau of Labor Statistics, accountants and auditors made around $70,000 a year on average in 2018. In 2016, the number of people working in these careers was roughly 1,397,700 – this is predicted to increase by 10% by 2026. When compared to the estimated change in employment among all occupations, this industry is predicted to outpace others by roughly 3%.

Image courtesy of Bureau of Labor Statistics

Image courtesy of Bureau of Labor Statistics

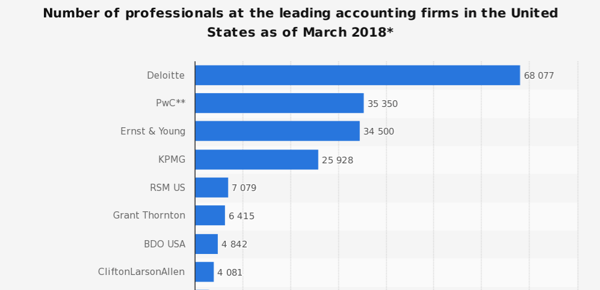

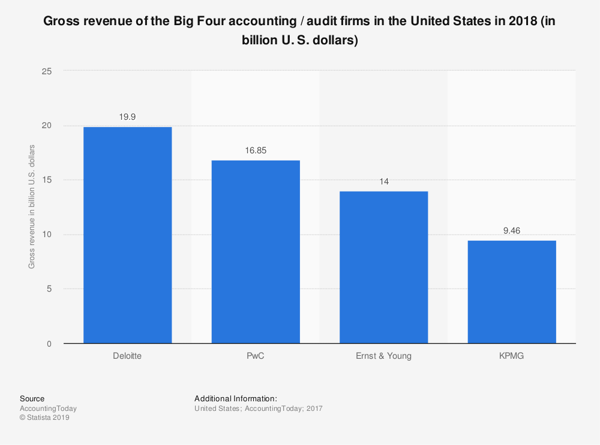

The primary employers of accountants and auditors are the Big 4: an unofficial group of established and highly profitable accounting firms. Roughly 12% of all professional accountants and auditors work at Deloitte, PwC, Ernst & Young, and KPMG.

Image courtesy of Statista

Image courtesy of Statista

With such a high average salary, it’s a substantial monetary investment to hire tens of thousands of these professionals. Based on the BLS’s numbers, KPMG paid around $1.8 billion in annual salaries for 2018, while Deloitte paid $4.8 billion. However, considering the fact that these two firms made estimated gross revenues that same year of $9.5 billion and $20 billion respectively, it appears that their investments were very fruitful.

Image courtesy of Statista

Image courtesy of Statista

In short, what this data tells us is that auditing professionals are highly paid, highly profitable, and highly valued. As a result of these facts, as well as the increasingly globalized economy, this industry is poised to expand even further.

Firstly, here are two key takeaways from the information outlined above that illustrate the upcoming intersection of these two industries:

When considering these facts side by side, it appears that auditing is largely redundant when it comes to blockchain-based projects, at least in its current form. Indeed, this exact point was made in 2017 by an internal auditor at PwC. In a blog post, he writes that the traditional methods of conducting a financial statement audit, known as point-in-time forensic analysis, will be wildly inaccurate in the context of blockchain technology.

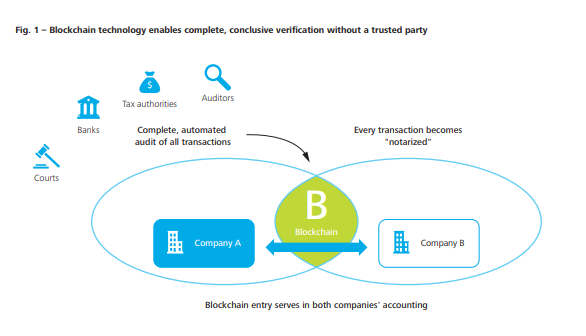

In addition to PwC, individuals working for top accounting firm Deloitte have explored the potential benefits of blockchain adoption to their industry. In a journal published by Deloitte Deutschland in 2016, innovation leader Nicolai Andersen discusses the potential for automating part of an auditor’s work duties through blockchain technology.

Image courtesy of Deloitte Deutschland

Image courtesy of Deloitte Deutschland

Nowadays, the term ‘automation’ in the context of any industry is cause for concern; it’s almost always associated with the loss of jobs. However, in the context of this journal, the implication of automating part of an auditor’s work is positive and still justifies their value as a company asset. In it, Andersen goes on to propose that “Auditors could spend freed up time on areas they can add more value,” such as “very complex transactions or… internal control mechanisms.”

What does all this information mean for both established auditors and candidates attempting to becoming auditors? Here’s what I predict, based on my personal experience as a test-prep thought leader and entrepreneur:

Most, if not all, of the current accounting and auditing certifications will be updated over time to reflect these changes. Currently, part of the Generally Accepted Auditing Standards practiced by professional auditors includes the stipulation that they must stay up-to-date on relevant technological developments. Hence, both new and old auditors will need to learn about blockchain and how it can render key aspects of their job redundant and obsolete.

As per the comments on freeing up time for more valuable tasks, that’s also going to require increased education. Continuing Professional Education (CPE) is already a core requirement of most accounting and finance certification governing bodies. However, the fact that the intersection of blockchain and auditing will inevitably lead to a greater need for specialization can drastically increase these educational requirements.

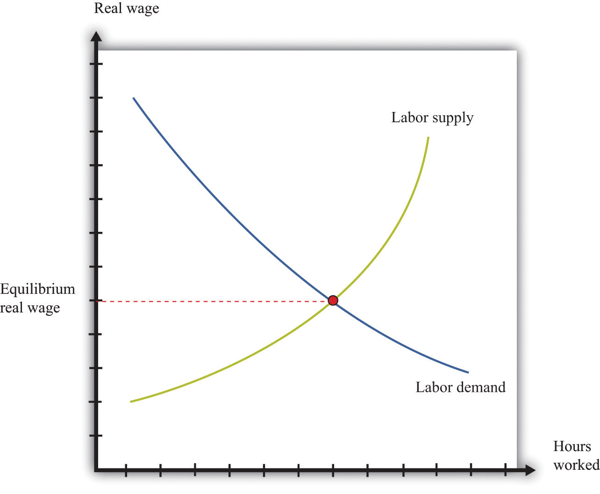

For aspiring auditors, certifications that once required only a Bachelor’s degree may now require a Master’s degree. For established auditors, the amount of CPE required to maintain their status can increase from a handful of development units to hundreds of classroom hours. In either situation, the increased time and money cost from an increased educational burden will require the average salary of an auditor to increase. However, the law of supply and demand in labor markets means that there are some other factors that will ultimately decide their salaries.

Image courtesy of Theory and Applications of Macroeconomics

Image courtesy of Theory and Applications of Macroeconomics

To briefly summarize, the real wages for an industry come from a compromise between the labor supply and the demand of the market. In the case of auditing, increased education requirements due to blockchain technology would result in a lower supply of available auditors, raising their real wages. However, consider the possibility that increased adoption of blockchain technology will also lower the demand for auditors (despite the BLS’s predictions), causing their salaries to level out.

Simply put, you shouldn’t expect the rewards of being a professional auditor to improve just because the requirements become more strict.

To conclude, here’s what I advice I have to offer to anyone interested in an accounting or auditing career:

Interested in more about the impact of this technology on other industries? Learn about the possible effects of blockchain in the insurance industry.

Bryce Welker is a CPA, accounting thought leader, and CEO of multiple companies including BeatTheCPA.com.

Like any other industry, the tech sector isn’t immune to falling victim to hype from...

by Tim Keary

by Tim Keary

While today’s world feels very online with the rise of remote work and an overwhelming amount...

by Dan Roberge

by Dan Roberge

In today’s remote-first world, businesses face challenges like securing desktop access,...

by Sagar Joshi

by Sagar Joshi

Like any other industry, the tech sector isn’t immune to falling victim to hype from...

by Tim Keary

by Tim Keary

While today’s world feels very online with the rise of remote work and an overwhelming amount...

by Dan Roberge

by Dan Roberge