July 15, 2019

by Mary Clare Novak / July 15, 2019

by Mary Clare Novak / July 15, 2019

Not many people find taxes fun.

If you do, I envy you. (I am looking at you accountants and tax preparers).

No, we cannot all be math wizards for a living. However, with the right information, filing taxes doesn’t have to be such a headache.

If you are new to completing taxes for your small business, this guide is for you.

In this ultimate guide to small business taxes, we will go over the tax requirements for each of the types of business ownership, tax preparation, how to deposit small business taxes, and the most common tax deductions for small businesses.

Want to jump ahead to one of those sections? Feel free!

|

Or, if you don’t even feel like dealing with small business taxes at all, check out the best tax services on G2’s website. |

While business structures may share some similarities, the tax requirements for each one can differ.

A sole proprietorship is a business structure that makes you, as the owner, personally responsible for any debt the company might have. This also means that your personal assets are no different than your business assets in the eyes of the IRS.

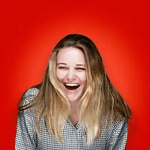

Because your personal and professional assets are lumped together as a sole proprietor, you must report your business’ income and losses on your personal income tax return. Those profits and losses will be taxed at the same rate as your personal income tax rate. Sole proprietors must also pay self-employment taxes, which account for Medicare and social security.

On top of that, you must file a Schedule C or a Schedule C-EZ with your 1040 and pay quarterly estimated taxes.

Whoa. That was a lot. Here are some descriptions.

| Schedule C: where you list income and expenses to get your net income |

| Schedule C-EZ: a simpler version of the Schedule C (it’s EZ-er, get it?) |

| 1040: the form you fill out for your income tax return |

| Quarterly estimated taxes: the typical method of paying taxes for the self-employed |

Alright. Let’s go over everything you need to know again.

A partnership is a business run by two or more people. It is basically a sole proprietorship but with more than one person.

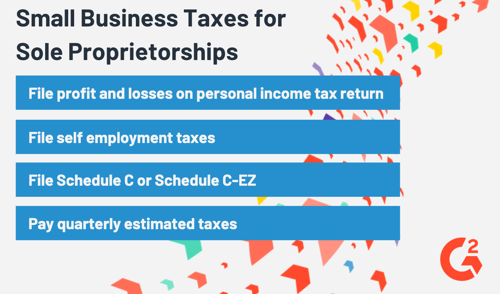

Members of a partnership must pay income taxes, self-employment taxes, and quarterly estimated taxes. You must also file Form 1065, which is where you list income, deductions, gains, and losses.

Similar to a sole proprietorship, the business is not paying taxes. The owners are. With pass-through taxation, the income is taxed on the owners’ personal income statements, avoiding corporate tax rates.

Because ownership is split in a partnership, owners only file for their share of the income on the Schedule K-1, which is the form partnerships file to report income, deductions, and credit.

Nice. Let’s recap.

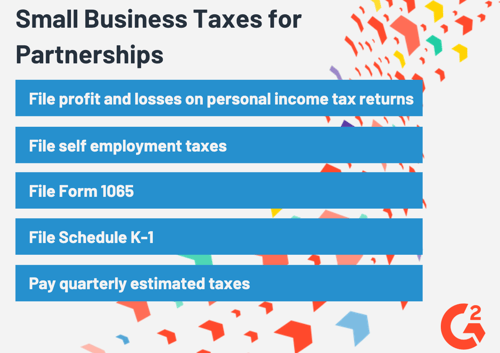

There are two types of corporations that have special tax requirements: C corporations and S corporations.

C corporations are, legally, a separate entity from the business owner(s). As a C corporation, owners are subject to double taxation. Income is taxed once at a rate of 21%. Before part of that income is distributed as dividends, it is taxed again.

If a shareholder is an active member of the corporation, they are considered an employee and must pay self-employment taxes. Dividends are not subject to this same tax.

The income tax form for C corporations is Form 1120.

S corporations are pass-through entities, just like sole proprietorships and partnerships, meaning they avoid that double taxation of other corporations. Owners of S corporations file income and losses on their personal income tax return, and profits are taxed at the same rate as their personal income.

The less formal document to file as an S corporation is called Form 1120S.

Both C and S corporations pay quarterly estimated taxes.

Review time!

A limited liability company (LLC) is a business structure meant to keep the assets and liabilities of a business separate from those of the owner. If you own an LLC, you are protected from personally taking on your business’ debts, and you are also considered a pass-through entity, meaning you avoid double taxation. Hurray!

Owners of LLCs make quarterly tax payments on their personal income tax forms. You also will have to file Form 1065 every year.

One more time for the people in the back.

The best way to handle any tax day is to come prepared. Otherwise, you’d have a mess of paperwork on your hands, and possible fines if you can’t get everything in on time.

Here is everything you need to be fully equipped for tax day:

| Your business tax return from the previous year (if applicable) |

| Payroll documents |

| Credit card statements |

| Bank statements |

| Partnership agreements |

| Depreciation schedules |

| Accounting documents (income statement, cash flow statement, balance sheet) |

Do you need a little refresher on some of those terms? Check out our resource on some basic accounting terms.

You can even come more prepared by saving records of your checking account, sales transactions, and unclassified income. Anything that proves you spent or received money, keep it. It will only help make your income and expense statements more accurate.

To avoid having a filing cabinet full of receipts and invoices, you can use small business accounting software to keep track of everything you will need on tax day.

For most people, tax day only comes once a year. For small business owners, it actually comes four times.

We can all agree that tax day isn’t as fun as Halloween or St. Patrick’s Day. But paying quarterly estimated taxes has its benefits: it reduces the shock of paying taxes for the entire year, helps you avoid penalties, and gives you a better understanding of your business’ cash flow.

To calculate your quarterly small business tax, estimate your gross income, taxable income, deductions, and credit. A good method for tackling this estimation is by looking at your taxes from the previous year. If this is your first year in business, the IRS has an estimated tax worksheet than can help you out.

Here are the general guidelines for calculating your estimated quarterly taxes. The keyword here is estimated.

| 1. Estimate your taxable income for the year |

| 2. Calculate the appropriate income tax for that estimated income |

| 3. Take other possible taxes into account (e.g. self-employment) |

| 4. Add that all together and divide it by four |

Once you have that figured out, there are a couple of different ways you can pay those taxes. You can fill out Form 1040 ES and mail a check or pay online using the IRS payment site. If you are a corporation, you will need to use the Electronic Federal Tax Payment System.

There are quite a few deposits and forms that go along with small business taxes, and a lot of them apply to owners with employees.

If your business has employees, you need to fill out Form 940. You also must withhold some of their wages to account for payroll tax. In addition, you are required to hang on to each employee’s share of Medicare and Social Security taxes, along with filing Form 941 and matching each of their contributions.

| Tip: Check out the requirements in your state here. |

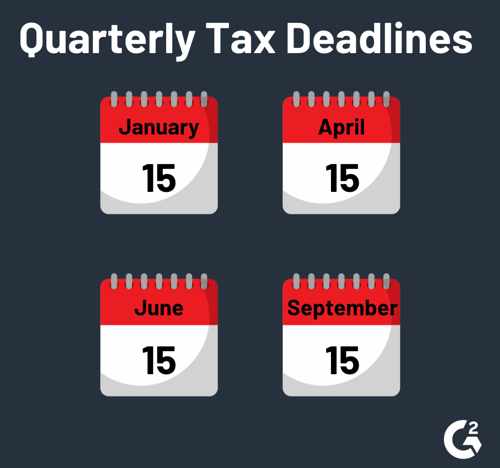

There are four dates important for small business owners to remember when preparing taxes.

The dates shown above are typical, but if one of those dates lands on a holiday or weekend, the tax deadline moves to the next workday.

Owning, operating, and funding a business can really break that piggy bank, especially when taxes are applied. However, there are certain expenditures that can be written off.

Below are the most common tax deductions for small businesses.

A lot of companies use some form of transportation when doing business. If you can prove that the vehicle has been used for business purposes, you can get that cost deducted. You can either keep records of cost, like receipts for pumping gas or getting an oil change, or you can use the standards made by the IRS. In 2019, it was 58 cents for every mile driven.

Certain businesses will decide to use freelancers to complete their necessary labor. The cost of contracting this work to them is deductible. If you are paying a contractor more than $600, file Form 1099 MISC.

Depreciation is a deductible expense. It is basically the IRS thanking you for buying property for your business.

Paying salaries, wages, bonuses, and commissions are all tax-deductible expenses. However, payments for sole proprietors, partners, or LLC members are not. You need to have actual employees for this to apply to your business.

The cost of some items used to conduct business activities, from notebooks to computers, is a deductible expense.

Small businesses are entitled to deduct capital and operational expenses from their taxable income. This includes both your physical and virtual assets. For instance, the costs involved in building your website, hosting, and the subscription paid to third party applications qualify for deductions.

Taxes aren’t exactly fun. However, being prepared for tax deadlines and understanding the forms you need to fill out is a pretty good place to start. Let this guide be your, well, guide. Soon enough, you will become a small business taxes master.

Staying organized is key when preparing for tax day. Learn how to master bookkeeping to make it a breeze.

Mary Clare Novak is a former Content Marketing Specialist at G2 based in Burlington, Vermont, where she is explored topics related to sales and customer relationship management. In her free time, you can find her doing a crossword puzzle, listening to cover bands, or eating fish tacos. (she/her/hers)

You can’t run a business without knowing what makes you money and what drains it. Every...

by Rob Browne

by Rob Browne

Alright. You started your small business and everything seems to be going pretty well.

by Mary Clare Novak

by Mary Clare Novak

You can’t run a business without knowing what makes you money and what drains it. Every...

by Rob Browne

by Rob Browne