May 13, 2022

by Jessica Heald / May 13, 2022

by Jessica Heald / May 13, 2022

Do you sell physical products to other businesses? Recency, frequency, and monetary value (RFM) analysis is a technique used by businesses worldwide, and it is an incredibly useful strategy for growing B2B wholesalers and distributors.

Knowing how to calculate it across your entire customer base and how to action RFM insights can be tricky, particularly for smaller businesses. Yet, for product sellers, repeat orders are essential to profitable success.

In this article, we explain what RFM is and why you should care, how to calculate it, and how you can use RFM insights to create predictable, repeatable, and scalable success in your product business.

Before we jump into the specifics, let’s take a moment to understand what RFM is. Then, we’ll return to the most important question: How can you use this data to speed up your funnel and flywheel and drive growth in a B2B wholesale and distribution business?

RFM is an industry strategy for segmenting customers using data you already have. This analysis technique assesses customer spend patterns across three areas: recency, frequency, and monetary value.

It’s well-used by big companies but often ignored by SMEs. Smaller companies typically have the necessary data, but understanding and calculating RFM seems complex and daunting. It doesn't need to be! The principles are logical and easy to understand, and modern technology makes the calculation significantly more approachable for SMEs on tighter budgets because hiring expensive consultants or data analysts is no longer required.

Simply put, RFM is the number one strategy for wholesalers and distributors. But what do we mean by that?

Everyone wants a repeatable and predictable way to grow their business, and to do that, you’d need to be a mind reader and know exactly what each customer wants from you at every stage. Well, that's kind of what RFM is.

But, before we get into that, let’s tackle a bit of modern sales and marketing theory first.

There’s a seemingly endless debate between the funnel and flywheel. In truth, both models are right to an extent.

Source: Hubspot

Sure, you need to bring in new customers; lead generation is, of course, a primary focus for sales and marketing (the funnel). But, for wholesale and distribution businesses especially, repeat orders and returning customers are key to profitability and predictable growth (the flywheel). Customer success is key. Put bluntly, when repeat orders are your bread and butter, you can’t afford to have a leaky bucket!

So, successful wholesale and distribution businesses adopt a growth playbook that combines the funnel and the flywheel to maximize sales and customer engagement.

Source: ProspectSoft

In any business, you want to encourage the flow of new customers coming in, which means attracting the right kind of quality leads that fit your ideal customer profile (ICP). Then, you need to nurture your leads through the sale and increase your close rate.

Doing these three things well will generate more new customers for your business - which is great! But, in wholesale and distribution, even more than other types of B2B sales, it’s critical to successfully onboard customers, increase their average order value and average order frequency, and retain them for longer to maximize customer lifetime value ( CLTV). In other words, shift your focus to existing customers to boost your profits.

Let’s take a few simple examples that we can all recognize. Distributing coffee beans to coffee shops, bikes to bike shops, packaging to takeaways, or food to delicatessens and restaurants. Whatever you’re selling, the first sale to a customer is rarely profitable on its own. The profit is in the long-term relationship and the repeated supply of goods over time.

So, to create predictable and repeatable growth, we need to get the first three or four orders from the customer so they see you as their go-to supplier. In other words, onboard this customer. Then ensure that we retain them for the long term, upsell them, and reactivate them if they start declining or churning as customers. But what’s all this got to do with RFM analysis?

If you want to successfully grow and be profitable, you need to know precisely which customers are where in your funnel and your flywheel, how to target each customer appropriately, and what to say to them at each stage in the process - fast and at scale. So whether you’re talking about mass marketing or account management, RFM analysis will allow you to successfully target the right customer, at the right time, with the right message.

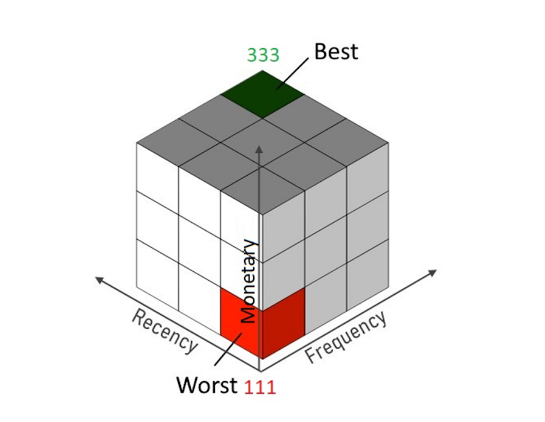

Your entire customer base is effectively assessed across three dimensions like this:

But what do we mean by ranked 1-3 or 1-5? How do you calculate that ranking?

First, you analyze the customers you’ve got and work out sensible ranges for recency, frequency, and monetary value. Then, you split that into three or five equal buckets - either equal in size or range of values, but it often works better if the buckets are an equal distribution of customers. You can then put each customer into one of those buckets and give them a score.

Source: ProspectSoft

Here, you can see a range of values for recency, frequency, and monetary value. As an example, using the chart above we could allocate our customers’ recency score. A customer who ordered 18 months ago gets a score of “1”, but a customer who ordered two weeks ago a score of “5”. Obviously, you could label these “buckets” to be more relevant to your average number of orders, how often customers would buy over time, and how much they’d typically spend.

Example

Example Company Ltd’s scores are:

For this business, Example Company Ltd is in the top 20% of highest spenders in the last two years and the top 40% of most frequent spenders. Even though their last purchase was nine months ago, they've ordered more recently than 40% of the rest of the dataset they’re compared against, making them a "Loyal Customer".

If you have very different and diverse sets of customers, you’d want to split these “cohorts” out. An example of the need for cohorts would be if 50% of your customers place really big orders infrequently, and the other 50% place smaller orders often. This is particularly important when it comes to monetary value.

For example, if you have some direct customers who are independent retailers and a supermarket as a customer, there’s no point in comparing all those retailers against the supermarket in terms of monetary spend if there’s a huge disparity there. Or, say you sell to pubs directly, but you also sell to a distributor who distributes in bulk to hotels. The profile of sales to that distributor may be very different from the independent pubs who you’re supplying on a weekly basis.

Here are a few typical anomaly customer examples you might want to exclude from your overall analysis:

As a rule of thumb, we’d suggest sticking to two or three cohorts maximum. Remember RFM analysis is about measuring different customers against each other, so you only want to use cohorts if you have very different types of customers.

So once we have these comparative scores, what do we do now? First, apply those scores to each of your customers, and then effectively build a 3D model of your customer’s behavior, similar to a Rubik's cube.

Unsurprisingly, your best customers end up with a 333 score and your worst customers end up with a 111 score. Effectively, you’re building this out of those three dimensions to put your top customers in the top far corner and your worst customers in the bottom near corner.

Source: Samba.ai

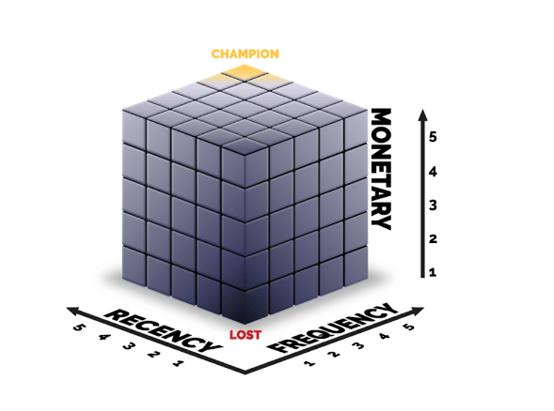

If you’re scoring 1-5, you get a more complex model (like a 5x5x5 Rubik's cube). Although this is a more compounded illustration, a representation like this using 1-5 scoring is the classic way to do this calculation, and it allows you to build important profiles of customers.

Source: Samba.ai

The problem is that it’s quite hard to work with 3D models and even harder to illustrate and visualize them, especially if you want to see all the sides of a 3D diagram at once. So, RFM analysis is usually visualized in a flatter, 2-dimensional pictogram, making it much easier to understand.

Source: ProspectSoft

In a 2D visualization like the one above, new customers arrive at the bottom right as "New Customers", and if they begin to spend frequently with a decent value they rise quickly up to "Potential Loyalist", "Loyalist", and eventually become "Champions". But on the other hand, a "Loyal Customer" can drift into "Needs Attention" then "At Risk’"if they begin to spend less often or haven’t ordered in a while.

Ultimately, a customer that doesn't re-engage fully or cannot be re-engaged then becomes a "Hibernating" customer, and eventually drops out of the diagram as lost or churned in the bottom left.

The aim is to identify this trend early and act to reverse it long before you get to that stage. To do this, you should be calculating, recalculating, and resharing your values with your team at least once a month, but ideally weekly or even daily, so it's fluid. Recalculating those “buckets” is also important to do monthly, in case some customers start purchasing more frequently.

All that math is a bit complex and can be daunting, but it is possible to do it manually on a spreadsheet. However, you ideally want a tool, like sales and ops planning software, to automate this and do the heavy lifting for you. Ultimately, for RFM analysis to be effective and accurate, it needs to be calculated every day as your customer and sales data changes.

Once you’ve got your calculations up and running, it becomes immediately obvious to most managers and business owners that RFM analysis helps you identify the best and most promising customers.

But in a small product business, you often already know who your best customers are. If you spoke to your sales, account management, or customer service teams, you could probably find out who your top-scoring customers are and are likely already building a good relationship with them. So it’s the middle and low scorers that are key to focus on.

The lower scores help you identify areas for improvement. For example, it can reveal things like:

All of these are opportunities to upsell, retain or reactivate a specific RFM segment which contributes to increasing your CLTV.

So, how do you now use this analysis to make your business grow successfully? Let’s take some simple examples.

Looking in more detail at each of the segments, there’s a clear description of each and what makes a customer fit into that segment, as well as actionable insights that you can use for every segment in the RFM analysis.

Source: ProspectSoft

For a B2B product seller, the benefits of RFM analysis are clear. Not only can RFM analysis help you monitor your customers spending behavior in real-time, but it will make marketing and sales efforts more strategic and timely.

Overall, RFM analysis helps you maximize the lifetime value of your customers, which is essential for profitable B2B success.

To experience the true benefits of RFM analysis, it’s really important to calculate it across your entire customer base on a daily basis. If you have hundreds or even thousands of customers, this will be manual, time-consuming, and monotonous. Look out for systems that have RFM analysis built in so the legwork is done for you.

Even if you are using software or some kind of automation with RFM analysis built in, ideally it shouldn’t have hard-coded thresholds and limits. Otherwise, segmentation won’t be dynamic or scale as your sales and data changes. Make sure you can exclude those anomaly customers too; you don’t want any B2C data or those few larger customers skewing your stats!

Let’s talk about a few things you can do to take action with RFM analysis to achieve predictable and repeatable growth.

In summary, RFM is the only analysis for product sellers that creates predictable and repeatable growth every single time!

Now that you've completed your RFM analysis and segmented your customers, learn how you can align your sales and marketing teams to hit goals.

Jessica is Head of Marketing at ProspectSoft, a UK-based CRM & eCommerce company. Her experience spans everything from app partnerships, digital marketing and copywriting, and in her spare time she loves cooking Italian food!

When searching for new prospects, it’s easy to overlook the potential of customers already in...

by Yash Chawlani

by Yash Chawlani

Traditionally, a company’s marketing team is separate from its sales team.

by Anu Ramani

by Anu Ramani

Selling is hard. Selling to B2B customers is a Herculean task.

by Kashyap Trivedi

by Kashyap Trivedi

When searching for new prospects, it’s easy to overlook the potential of customers already in...

by Yash Chawlani

by Yash Chawlani

Traditionally, a company’s marketing team is separate from its sales team.

by Anu Ramani

by Anu Ramani