Registration. What a headache.

We’ve all done it. Whether it be for school or a recreational sport, there aren’t many activities you can partake in without registering first.

This especially goes for starting a business. In a lot of cases, you can’t conduct business activities without registering first. Even if it isn’t required, registering your business can offer certain benefits that you will want in the long run.

Why you need to register your business:

Registering your business establishes it as a legal entity, which offers the following benefits: you have limited personal liability, you may receive certain tax benefits, it is easier to receive loans and capital, and you create a brand that can build a professional relationship with customers.

Now that you know why you should register your business, let’s take a look at the necessary steps for making it official.

Registering a business

Starting a business is an exciting venture, however, registering it is more on the boring side. Thrilling, no, but still very important.

Before you register your business, you will need to decide on a business structure. Take a look at the types of business ownership to make sure your business is structured exactly the way you want. This is important as your ownership style can alter the way you register your business.

Find out if you need to register your business

First, you will want to find out if you need to register at all.

If you are not creating a separate business entity and will be conducting business using your legal name, you do not have to register your business. Yes, this saves you a step in the process of starting a business, but if you do not register your business you can miss out on liability protection and certain tax benefits.

This will also depend on your business size. If you qualify as a small business, it is possible that you might only need to register your business name with your local and state government. Lucky you.

However, all businesses should take a look at each section below to determine the necessary steps they need to take to officially be considered a business.

Register with federal agencies

Legally, a lot of businesses don’t need to register with the federal government, but there are some situations where it is necessary.

Here are a couple of instances where you need to register with the federal government:

| 1. Businesses getting a federal tax ID (Is this you? Click here to get that tax ID) |

| 2. Businesses seeking trademark protection for a business, brand, or product (Get protection here) |

| 3. Small businesses and non-profits seeking tax-exempt status (Here is some more information on that) |

| 4. Businesses wanting to be an S corp (Find those forms here) |

Register with the appropriate state agencies

If you own a limited liability corporation (LLC), partnership, non-profit, or corporation, you will most likely need to register with the state you are conducting business in.

Here’s how you can tell if you’ve been conducting business activities in a certain state:

| 1. Your business has a physical presence in that state |

| 2. You have in-person meetings with clients in that state |

| 3. A good chunk of your revenue comes from that state |

| 4. Any of your employees work in that state |

It is possible (and likely) that your company will conduct business outside of your state, but you will only need to register with the state you primarily work in.

Most of the time, the state you are conducting business in will require you to register with the Secretary of State’s office, a Business Bureau, or a Business Agency.

The process of registering with the state has a little more to it.

1. Obtain a registered agent

A registered agent is a third-party responsible for receiving process notices, corresponding with the Secretary of State and any other government entities involved in the process of starting a business.

If your business is classified as an LLC, partnership, non-profit, or corporation, you will need to get a registered agent, located in the same state as your business before you file.

2. File for foreign qualification

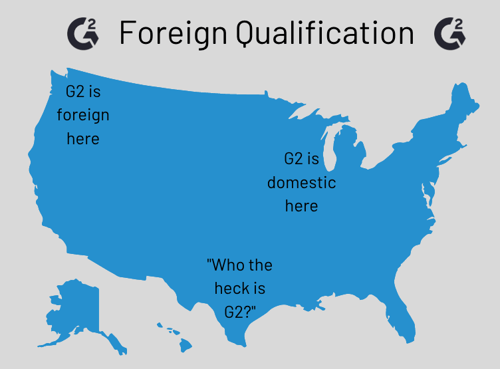

For LLCs, corporations, partnerships, and non-profits conducting business outside of the state, filing for foreign qualification in the other states where your business is active might be required. A foreign qualification alerts the state that a foreign business is active there.

When you do this, the state your business is formed in will see your business as domestic, and all other states you might do business in will consider your business to be foreign.

For example, G2 is established in Chicago, Illinois. The state of Illinois sees G2 as domestic. If we do some business in Washington, that state will consider G2 to be a foreign business. If we have never done business in Texas, they don’t care about us until action is taken to change that.

Businesses with foreign qualifications usually pay taxes in their domestic state of formation and states where they are foreign qualified.

To find out more on qualifications and fees, check with state offices.

3. File state document fees

Once you have determined if you need to file for foreign qualification with the state(s) you are doing business in, you need to file the appropriate documents and pay the associated fees. It isn’t too pricey.

Typically, the information you need to include is as follows:

| The name of your business |

| The location of your business |

| Your business structure |

| The information of your registered agent |

| If your business is a corporation, the number of shares and their value |

However, the actual documents and their contents will depend on your business structure.

Register with the appropriate local agencies

After you register with federal and state governments, you will need to take a look at what your local government requires of you.

Certain business structures call for licenses and permits from the county or city in which your business is located.

Stay updated

Your last responsibility is to stay updated on the rules and regulations associated with business registration. Even after registration, some states require that businesses with certain structures provide additional reports.

For example, you may need to file Initial Reports or Tax Board registration. Ask your local tax office or franchise tax board to see if these apply to you.

Boring but necessary

Registering your business isn’t necessarily the most exciting thing you’ll do today. However, the more forms you fill and the more steps you complete, the closer you are to officially becoming a business owner.

While it is good to get business registration out of the way, there are still a lot of other things you need to do to start a business. Check out our resources on the elements of a business plan and how to conduct market research to take the process to the next level.

by Lauren Pope

by Lauren Pope

by Deirdre O'Donoghue

by Deirdre O'Donoghue

by Mary Clare Novak

by Mary Clare Novak