Put on your best suit and browse those financial statements.

We are applying for a small business loan today.

But before we make our way downtown to the bank, there are some other things we need to do to show up completely prepared.

Getting a small business loan is a lot more than just asking for money. Let’s take a look at each step in getting a small business loan to make sure you get the fuel you need to start, build, or grow your business.

The first step in getting a small business loan is determining why you need it in the first place. This will be the main concern of any lender. Also, determining why you are applying for a loan will potentially impact the type of loan you apply for.

Small business owners have a wide range of reasons for wanting to take out a loan. Some are looking to take a big step and buy an entire business, and others just need some extra cash to buy equipment.

Yes, there are some definite reasons why a small business owner should need a loan. However, it is possible that these reasons might intersect. As long as you are honest with lenders about all of the ventures this loan will fund, there is nothing wrong with this.

The amount you need isn’t always the amount you can afford.

Gauge a realistic loan amount for your small business. If you take out too much, you can end up in a lot of debt. If you take out too little, you will miss the boat with the venture the loan was meant to fund.

There are two ways you can calculate an appropriate loan amount for your small business: a loan calculator or a debt service coverage ratio.

|

TIP: Manage your budget and forecast your spend by activating your free G2 Track account. You'll get unlimited spend tracking, monthly reports, and discover where you can save on business software. |

A business loan calculator will help you determine the monthly payment of the loan you are applying for. You’ll need to know your credit score, the amount of the loan, the loan term, and the annual percentage rate.

A debt service coverage ratio (DSCR) is the ratio of cash available to loan payment obligations. You can calculate this by dividing your annual net operating income by your annual debt payments. If you get a number above one, you have enough cash to cover loan payments. If it is below one, you either need more income or a lower payment amount.

| Note: You can also calculate this ratio by month. Just divide your monthly net operating income by your monthly loan payment. |

Now that you’re aware of the amount of wiggle room you have for a loan, it’s time to take a look at the different types of loans you can apply for. When selecting a loan, you need to keep the reason for the loan and your budget in mind.

Here’s a quick synopsis of the types of small business loans, and the situations where they work best.

Term loanWhat is it: cash given upfront How to pay it off: in set payments, plus interest, over a prearranged period of time When to use it: if you are looking to expand an existing business and you have good credit |

SBA loanWhat is it: a loan guaranteed by the Small Business Administration (SBA) that is offered by banks and lenders How to pay it off: repayment periods depend on how the money will be used When to use it: if you are a business hoping to expand or looking to refinance debt |

Business lines of creditWhat is it: a type of loan that provides you with funds that stop at your credit limit How to pay it off: in set payments, but you only pay interest on the money you’ve taken out When to use it: if your business needs are short term |

Equipment loansWhat is it: a loan meant to help owners buy equipment for their business How to pay it off: repayment rates depend on the equipment’s value When to use it: if you are looking to own equipment, as opposed to leasing it |

Invoice factoringWhat is it: a loan used to account for unpaid customer invoices, but you sell the invoices to a factoring company for cash How to pay it off: when the customer pays the invoice When to use it: if you have unpaid invoices and need the money now |

Invoice financingWhat is it: similar to invoice factoring, invoice financing is when invoices are used as collateral to get cash in advance How to pay it off: when the customer pays the invoice When to use it: if you are looking to turn unpaid invoices into cash for your business or if you feel as if you are losing control over your invoices |

Merchant cash advancesWhat is it: cash given upfront How to pay it off: make payments on a merchant cash advance, which is done by withholding a portion of your credit and debit sales or by simply withdrawing an amount from a bank account When to use it: if your business can handle frequent payments |

Personal loansWhat it is: a term loan but on your own personal dollar How to pay it off: in set payments, plus interest, over a prearranged period of time When to use it: if you are a startup and your business has no credit but you have a good personal credit score |

Once you have made a decision on the type of loan you want to apply for, it’s time to take a closer look at the lender.

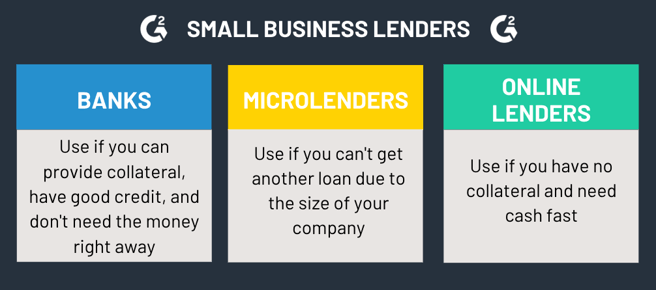

Banks are the most commonly used lenders, probably because they usually offer the lowest interest rates. Typical small business loans from banks include term loans and lines of credit. You can also get an SBA loan through a bank.

Small business owners will borrow from banks if they can provide collateral, have good credit, and aren’t in a huge rush to get the cash. Getting a small business loan from the bank can take anywhere from two to six months.

Bank loans range from $5,000-$5 million.

If your business lacks numbers, financially or in terms of employees, borrowing from a micro-lender might be your best option. These nonprofits lend short term loans to small businesses that can’t get loans because their business is too small, lacks collateral, or has bad credit.

This doesn’t make the process any less formal. You may need to present financial statements, business plans, and the purpose of the loan to receive the amount you need.

Micro-lender loans can vary in amount but rarely surpass $35,000.

Online lenders offer loans and credit to small businesses. This is a good option if you lack collateral and need cash fast - you can get an online loan as quickly as 24 hours. However, be wary. The APR for loans from online lenders can be as high as 108%.

Online lender loans can range from $500-$500,000.

Compare the lenders you think are best and weigh the pros and cons. The biggest aspect of a small business loan to notice is the annual percentage rate (APR), which is the amount of interest you will accumulate in a year.

After you’ve decided on a loan and lender, you need to make sure you are qualified. If you aren’t, there is no use in taking the time to prepare and apply.

There are a couple of things you need to look at, other than whether or not you can afford the loan. (Go back to Step 2 if you need a refresher)

Do you have a good credit score?

You better hope so. Banks offer the lowest APR, but only to businesses with a good credit score. If you don’t, you will have to borrow from a micro-lender or online lender, which will have a much higher APR.

How long has your business existed?

Lenders will be more willing to accommodate experienced businesses. Some banks won’t even lend to businesses that are younger than two years old.

How is that income looking?

You can’t hide your income or lack of it from lenders. Presenting your financial statements, which includes income, is all a part of the process. Some lenders require a minimum income, so figure out what that is to see if you are qualified.

If you have successfully found a loan option that works for you, congratulations! That is a victory in itself.

Now all you have to do is prepare the appropriate documents and apply. Different lenders will require different documents, but they usually include the following:

| Tax returns | Bank statements | Financial statements |

| Legal documents | Business license | Business plan |

Once you have the loan and lender selected, the next thing you need to pick out is a loan software that works best for your business. Loan software will manage the entire loan lifecycle, while also eliminating the mess of loads of paperwork.

Preparing and applying for a small business loan can be intimidating. You are essentially asking someone to support your dream. That’s a loaded request. However, if you take the time to understand the process of how to get a small business loan, you can build the confidence to make your case, get the cash, and grow your business.

Are you set on an SBA loan? Check out our in-depth guide on SBA loan preparation to score the cash you need.

Mary Clare Novak is a former Content Marketing Specialist at G2 based in Burlington, Vermont, where she is explored topics related to sales and customer relationship management. In her free time, you can find her doing a crossword puzzle, listening to cover bands, or eating fish tacos. (she/her/hers)

All small businesses and startups began with a great idea. For many, the next step was to...

by Maddie Rehayem

by Maddie Rehayem

Alright. You started your small business and everything seems to be going pretty well.

by Mary Clare Novak

by Mary Clare Novak

In today's world, many students are understandably concerned about their student loan debts.

by Lauren Pope

by Lauren Pope

All small businesses and startups began with a great idea. For many, the next step was to...

by Maddie Rehayem

by Maddie Rehayem

Alright. You started your small business and everything seems to be going pretty well.

by Mary Clare Novak

by Mary Clare Novak