June 23, 2025

by Mara Calvello / June 23, 2025

by Mara Calvello / June 23, 2025

Nobody enjoys standing in line at the bank with a paper check in hand, just to access their hard-earned money. And yet, that’s still the reality for some people, even in 2025! The good news? There’s a better way.

Direct deposit is a fast, secure way to receive your paycheck (or any recurring payment) directly in your bank account (no paper, no postage, and no pit stops at the ATM required).

It’s also one of the most widely used payment methods in the U.S. In fact, nearly 96% of American workers are paid using direct deposit, making it one of the most trusted and widespread payment methods around.

Direct deposit is an electronic payment method in which funds are transferred directly into a recipient's bank account. Employers, government agencies, and institutions use direct deposit to pay salaries, issue tax refunds, and distribute benefits.

In this guide, we’ll break down how direct deposit works, how long it takes to get started, how it stacks up against paper checks, and why so many people (and businesses) rely on it. And if you're already using payroll services or HR software, direct deposit is likely just a few clicks away.

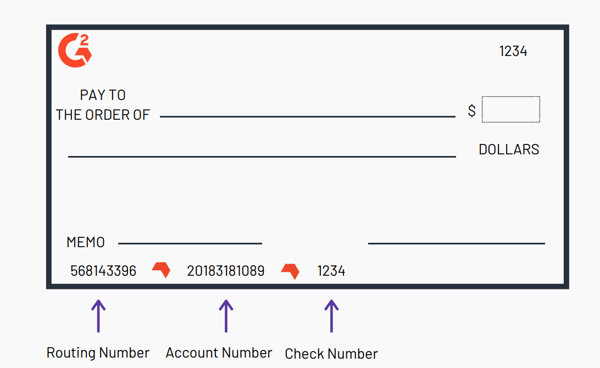

To set up direct deposit, you need to gather your bank information, complete a direct deposit authorization form, and submit it through your employer’s or payroll provider’s secure process. Here’s a step-by-step breakdown.

Once set up, your future paychecks will be automatically deposited: no bank visits, no envelopes, no problem.

Direct deposit works by electronically transferring your payment through the Automated Clearing House (ACH) network, moving funds from your employer’s bank to your account securely and automatically. We’ve already covered how to set up your account. What happens next is covered below:

1. Electronic transfer:

2. Receiving the funds:

Now that you know how direct deposit works, here’s how it stacks up against traditional paper checks in terms of speed, security, and convenience:

| Feature | Direct deposit | Paper check |

| Speed | Funds on payday morning | 1–5 days to clear + bank holds |

| Security | Encrypted, traceable ACH | Prone to loss, theft, forgery |

| Convenience | Auto-deposited, no action needed | Must manually deposit/check mail |

| Employer cost | Minimal, no supplies or postage | Costly over time (paper, ink, envelopes) |

| Recordkeeping | Automated digital records | Manual tracking required |

| Environmental impact | Paperless | Paper, ink, and mailing waste |

Curious when your first direct deposit will hit your account? While setting up direct deposit is a breeze, it might take one to two pay cycles before you see the money reflected in your balance.

This is because, in some cases, your employer might issue a physical check during the initial transition period to ensure everything is set up correctly.

Once direct deposit is fully active, the exact timing of your funds appearing depends on your company's payroll schedule and software. Some businesses pay bi-weekly, while others opt for weekly pay or a fixed schedule on the 15th and 30th.

To avoid any surprises, it's best to check with your employer about their payroll management schedule and when you can expect your first direct deposit.

Direct deposit offers a win-win situation for both employers and employees. It eliminates the hassle of paper checks and provides a secure, convenient way to manage your finances. Here's how:

For employees:

For employers:

Got more questions? We have the answer.

Yes, direct deposit is among the most secure ways to get paid. It uses encrypted ACH transfers regulated by federal authorities, reducing the risks of lost, stolen, or altered checks. Plus, every transaction is traceable through your employer and your bank.

If you switch banks after setting up direct deposit, you must submit a new authorization form with updated account details. It is best to do this at least one pay cycle in advance to avoid delays or receiving a physical check during the transition.

Yes, most employers and payroll platforms allow you to split your direct deposit between different accounts. For example, you can direct part of it to checking and part to savings. You can usually specify exact amounts or percentages during setup.

To find out if your direct deposit went through, check your bank's notifications or your balance online. If you don’t see it by payday, contact your payroll department to verify the transfer.

For the first direct deposit to hit your account, it usually takes one to two pay cycles after setup. Employers often test the setup by issuing one check before entirely switching to digital transfers.

You can use direct deposit for things other than your paycheck. Direct deposit is widely used for government payments (like tax refunds and Social Security), insurance claims, and even investment disbursements. If a payer supports ACH, you can likely use it.

Whether you're receiving or issuing payments, switching to direct deposit can save you time, money, and peace of mind. Setting up a direct deposit is easy, and in no time, you’ll see your payment come through to your bank account. Don’t spend it all in one place!

Make direct deposit effortless. Explore the best payroll software to automate paydays and simplify your workflow.

Whether you're an employer or an employee who needs a direct deposit form, download one here, brought to you by G2!

This article was originally published in 2019. It has been updated with new information.

Mara Calvello is a Content and Communications Manager at G2. She received her Bachelor of Arts degree from Elmhurst College (now Elmhurst University). Mara writes content highlighting G2 newsroom events and customer marketing case studies, while also focusing on social media and communications for G2. She previously wrote content to support our G2 Tea newsletter, as well as categories on artificial intelligence, natural language understanding (NLU), AI code generation, synthetic data, and more. In her spare time, she's out exploring with her rescue dog Zeke or enjoying a good book.

Day in and day out, the leaders within your human resources department have a lot on their...

by Mara Calvello

by Mara Calvello

How do you express gratitude to your employees?Does it take the form of a year-end holiday...

by Mara Calvello

by Mara Calvello

No one likes being snooped on.

by Mara Calvello

by Mara Calvello

Day in and day out, the leaders within your human resources department have a lot on their...

by Mara Calvello

by Mara Calvello

How do you express gratitude to your employees?Does it take the form of a year-end holiday...

by Mara Calvello

by Mara Calvello