All small businesses and startups began with a great idea. For many, the next step was to borrow some money to fund that idea.

When starting a company, the easiest way to borrow money is through taking out a loan.

Loans are common in personal finance; student loans, car loans, and mortgages are seen as a regular part of life. Business loans are the same, but instead of being used to finance personal items, they are used to finance a business.

What are business loans?

Business loans are lending agreements made between business owners and banks or private lenders. Businesses need capital, either to fund operations or simply to start themselves up and begin turning a profit. Banks and lenders are willing to give them the money in advance, so long as they pay it back on an agreed-upon schedule, with interest.

Business loan definition

noun

A lending agreement between a lender and a business in which the lender gives money to the business, and the business pays it back in an agreed-upon amount of time with an agreed-upon amount of interest

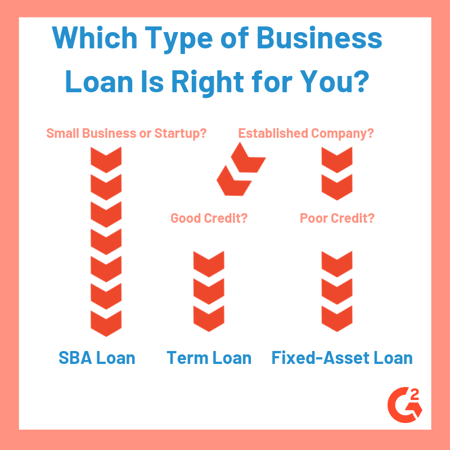

There are several factors that determine whether businesses and startup entrepreneurs will be able to use loans as debt capital. The company’s credit quality is the most important, but other characteristics like the amount of time a business has been around, any collateral it can offer, and current financial health can all make a difference.

|

TIP: Make the most of your loan by tracking & saving software spend with G2 Track.

|

Different types of business loans

Depending on where the money comes from and the time in which it must be paid back, there are plenty of funding options for all kinds of great business ideas. Read on to learn about some of the most popular business loan options out there.

Term loans

Term loans are the most common type of loan. They are what is typically thought of as a loan. The word “term” refers to the length of time between when the loan is issued and when it is paid off.

The term length can vary—some term loans can have term lengths anywhere from one to 25 years or more. The lender takes the status of the borrower’s business and credit quality when determining how long the term is. A new business with poor credit may only be able to secure a short-term loan with a high interest rate, whereas a business that has been around for years and has good credit may be able to secure a long-term loan with a low interest rate, or APR.

| Tip: APR stands for annual percentage rate. A loan’s APR is the percentage of the loan’s principal (the amount of money borrowed) that must be paid back in interest every year. The lower the APR, the lower the interest rate. |

SBA loans

In a world of global corporations, small businesses have it rough. It can be hard to start a company from scratch, even if it’s a small one. The government’s way of solving this issue is to subsidize small businesses in the form of an SBA 504 Loan.

The SBA, or Small Business Administration, does not issue loans to small businesses, but through this type of loan, it guarantees to pay back a portion of a bank loan taken out by small business owners.

Fixed-asset loans

Some loans are secured, meaning the borrower has promised to put down an asset as collateral. Whether it’s stock, equipment, or other property, the asset acts as reassurance for the lender. The lender will get to claim the asset in the event that the borrower does not pay back the loan and interest.

Oftentimes lenders will even overlook poor company credit if there is a guarantee that an asset will be used to secure a loan. This practice is called asset-based financing.

Bank line of credit

While it is not a typical loan, a business line of credit is a similar form of debt financing. Rather than receiving a lump sum of money and paying it back in monthly installments, a bank line of credit operates more like a credit card for a business—just without the card. Money is used by the business as-needed, so there’s no risk of borrowing too much and not being able to pay the excess interest.

Other

There are all sorts of loans out there for all sorts of businesses. Many lenders are able to offer lower rates to non-profits out of goodwill. Sometimes businesses choose equipment loans, or loans used to fund a specific piece of equipment. Small business and startup owners and advisors can use loan origination software to assist in finding loans that work for their needs.

What happens when loans don’t get paid off?

If a business defaults on a loan — meaning it cannot pay the money back to the lender — there are a few things that may happen. The business could use more debt financing to generate the capital it needs to pay off the loan. If there was an asset being held by the lender as collateral for the loan, the lender could claim that asset as payment.

If the company cannot pay off any of its debts or generate any more capital, it may face bankruptcy and be forced to liquidate all of its assets, in which case lenders would be paid back before any company equity holders.

Follow your dreams

By definition, anyone who is an entrepreneur is ready to take risks to make their dream a reality. While it can seem risky to take out a loan to start a business from scratch, there are options and resources out there to help reassure and motivate small business owners and potential entrepreneurs to take the leap.

by Grace Pinegar

by Grace Pinegar

by Mary Clare Novak

by Mary Clare Novak

by Nupura Ughade

by Nupura Ughade