Every company wants to make payments as efficient and secure as possible.

With all the payments that go into the day-to-day operations of a business, it can be tedious to manually fill out and mail every check. Not only does it take time to write the check, but it also takes several days before the check clears and the funds are deposited into your bank account.

What is an eCheck?

So what is an eCheck, exactly?

eCheck definition

An eCheck, or electronic check, is the online transferring of funds from one person’s checking account into another’s. They eliminate the need to manually fill out paper checks, and streamline the process of making online payments.

Businesses looking to make their payment process more efficient and cost effective can research solutions within our accounting software category to find a platform that offers eChecks.

Essentially, an eCheck is an electronic form of a physical check. That being said, the process of paying someone with an eCheck is very similar to that of a physical check.

The biggest difference between paying with an eCheck versus a physical check is an eCheck must pass through the automated clearing house (ACH) network to confirm the payment is secure. Created in the 1970s to eliminate the need for physical money payments, the ACH facilitates online payments such as direct deposits and eChecks. The ACH network provides an extra layer of security to ensure that your eCheck is not subject to fraud.

Since eChecks can be processed electronically, there are many benefits associated with them:

| TIP: To learn more about mobile payment trends that are happening in finance check out an article on 2019 Fintech trends. |

Benefits of using eChecks

Lower cost — A major benefit of using eChecks is smaller processing fees for merchants. If you are making or receiving a large payment such as rent, mortgages or insurance payments, then it will be way more cost effective to process the payment via an eCheck rather than using a credit card which will often have processing fees associated with payment.

Quicker payments — While an eCheck may take just as many days as a paper check to clear, the online process saves users time by eliminating the task of manually filling out a paper check and sending it to a recipient through the mail.

Fewer bounced checks — Electronic check services confirm there is enough money in an account before confirming the payment. Because of this, the likelihood for your check to bounce is almost impossible. Fewer bounced checks means more consistent payments and fewer fees.

Security — Paper checks can always be tampered with, thus causing security problems and checks to be bounced. Since eChecks are done through the security of the ACH network, it is unlikely that someone can commit fraud by sending a fake check to you.

Automated payments —One of the best features of eChecks is that the process can be automated. If there are monthly payments you are making such as rent or insurance payments, then eChecks can be automated to be sent out at the same time every month. This eliminates the need to always remember to have to fill out a check.

How to send an eCheck

Now that you understand the benefits of using eChecks, you can follow the steps below to start sending eChecks on your own:

-

Identify a service that allows you to send eChecks — The first step in the process is to find an eCheck service or bank that allows you to send eChecks. Businesses that allow eCheck transfers include most national banks, internet banks and eCheck vendors. If your bank has an online service, it will be easy to log in and locate where eCheck processing is by finding keywords such as “online check” or “eCheck."

-

Request authorization — To start the process of sending an eCheck, you must be authorized by the recipient. This means that they have validated the request for the payment in the form of an eCheck. This can be done in an online payment form or even an email or phone conversation.

-

Make sure you have sufficient funds — One of the most useful features of the eCheck is that automatically identifies if you have sufficient funds to complete a payment; this way, the check cannot bounce. Before completing your payment make sure that you have the necessary funds.

-

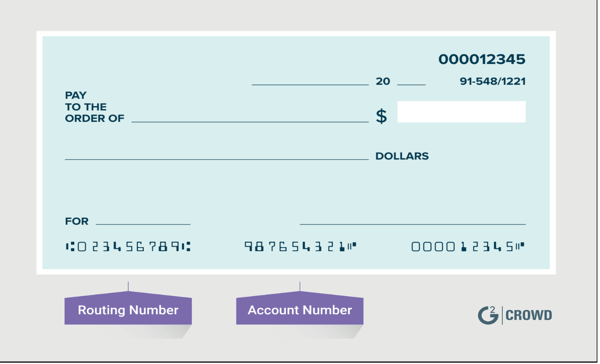

Enter banking information — Once you have been authorized to send an eCheck, you can start filling out your banking information. Similar to when you set up a direct deposit account, sending an eCheck will require you to enter your routing number and account number.

- Complete payment — Once you have entered all of your banking information correctly, you can then submit your eCheck for payment. This will then trigger the eCheck to be passed through the ACH network, which will make sure the eCheck is processed securely. You will then receive a receipt and notification that your eCheck is being processed. You can then monitor the eCheck and make sure that the payment is running smoothly. While the eCheck may clear within one day, the average time it takes for the funds to be deposited into someone else's account is between 3–5 days.

Takeaways

eChecks are an important way to keep your business operating at an efficient level. Eliminating the time and money that is spent obtaining and manually filling out physical checks will save your company plenty of headaches.

Businesses can further accelerate their payment processes by utilizing the best accounting and finance software, small business accounting software and ERP software.

|

TIP: Over 1,600 companies are managing software spend, usage, contracts, compliance, and more through G2 Track. Fight the SaaS sprawl and get deeper financial insights today.

|

Ready to learn more? Discover how free accounting software can help your financial department become more efficient in 2019.

by Derek Doeing

by Derek Doeing

by Michael Gigante

by Michael Gigante

by Lauren Pope

by Lauren Pope