The word “trust” can mean a lot of different things to different people.

In finance, setting up a trust is a way to manage and protect your assets so that when the time comes, you can pass them off to your family or other trustworthy individuals.

What is a trust?

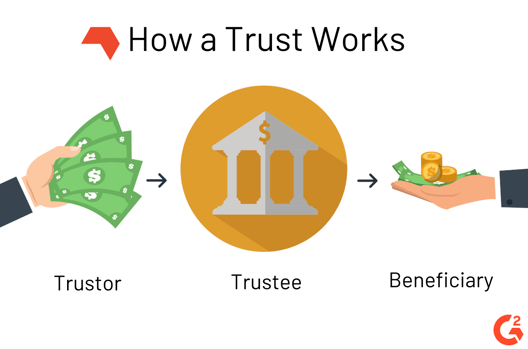

A trust is an agreement that allows a person (trustor) to give legal responsibility of their estate to another person (trustee) for a receiving third party (beneficiary).

Many people believe that trusts are only for the ultra-wealthy - but that’s not actually the case. Creating a trust is a smart financial move for anyone looking to protect their assets. This article outlines the basics of a trust, the different types of trusts, and differences between a trust and a will.

The basics of a trust

In short, a trust is a way to manage your assets and make sure they are distributed according to your wishes. Depending on how the trust is set up, assets can be distributed during your lifetime or after your death. Aside from the obvious benefit of helping you manage your estate, a trust is a legal way to avoid probate court and paying estate taxes.

| TIP: Probate is the legal process of distributing assets to living beneficiaries after someone has died. It is supervised by a court and can be both long and costly. |

Parties of a trust

A trust is a three-part agreement that involves the trustor, the trustee, and the beneficiary. Let’s break down exactly what these terms mean:

- The trustor or grantor is the individual whose assets are being handled. This person initiates the trust agreement.

- The trustee is the individual or organization that holds control over the assets for a set period of time. They are responsible for managing the assets that have been granted to them by the trustor.

- The beneficiary is the individual that is set to eventually receive the assets, thereby benefiting from the trust.

Types of trusts

There are several different types of trusts that are intended to fit different situations and needs. Although they are different, every type of trust follows the three-part trustor-trustee-beneficiary pattern.

There are four main categories of trusts:

Living vs. testamentary trusts

These categories determine when the trust goes into effect.

In a living trust, the trustor’s assets are set aside to be distributed to the beneficiary during their lifetime. This type of trust is beneficial because it helps avoid the court-supervised probate process because the trustee technically owns the assets, not the trustor. It is fully in effect during the trustor's lifetime, although the assets themselves will only be passed to the beneficiary after death.

A testamentary trust outlines how the trustor's estate will be distributed after their death. This type of trust is written in accordance with the individual’s last will and testament. It goes into effect immediately after the trustor has passed away. This type of trust cannot avoid probate since it is still under the trustor’s name at the time of their death. Probate is necessary in order to delegate ownership to the trustee and outline the terms that are required to move the assets into the names of the living beneficiaries.

Revocable vs. irrevocable trusts

These categories are related to the ownership of the trust. All trusts are either revocable or irrevocable.

A revocable trust can be changed or revoked during the trustor’s lifetime. If a major life event happens, such as a divorce, the individual may need to go back and change the terms of the trust. Since a revocable trust doesn’t become permanent until the trustor passes away, there is a lot more flexibility with this option. The grantor can move assets around and remove/add beneficiaries.

An irrevocable trust cannot be changed or revoked after it has been finalized. Once placed in the trusts, the assets are no longer the trustor's and cannot be modified without the beneficiary’s consent.

Trust vs. will

Although both a will and a trust are used in the estate planning process to name beneficiaries, there are a few noteworthy differences between the two.

A will is a legal document that outlines how an individual wants their estate handled after their death. Wills must be signed in the presence of a witness, and often include information about guardianship if the individual has children. Having a written will ensures that the probate process runs much smoother.

On the other hand, a trust is a three-party agreement that outlines the distribution of your assets. It required that funds and/or assets be placed in it and therefore is more difficult and expensive to manage over time. If it’s a living trust, probate can be avoided altogether.

Deciding whether you need a trust, will, or both depends mainly on your financial circumstances. Consult with an attorney or financial advisor to decide the best course of action for estate planning.

Who do you trust?

The notion that trusts are only for wealthy individuals is a common misconception. Regardless of your financial situation, there are many benefits to setting up a trust that shouldn’t be overlooked during the estate planning process. You work hard during your life for the things you have, so it’s smart to make a plan for them. At the very least, your beneficiaries will thank you.

Finalizing a trust requires going through all of the information with a fine-toothed comb since your life’s work and assets are being evaluated. Discover the best legal software on the market to help automate this process and ensure no detail is missed.

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev