When it comes to finance, there’s a common mentality of “no risk, no reward.”

Risk and reward play a crucial role in the financial success of all sorts of organizations. There are several businesses that desperately need help managing and measuring the financial risks to their organization. This is where actuaries come in.

What is an actuary?

An actuary is a business professional who is responsible for managing financial risk to help protect an organization’s plan for the future and defend against losses.

Becoming an actuary can be a lucrative career for those with an understanding of business and mathematics. If this seems like something you could be interested in, read on or jump ahead to get the information you need:

What does an actuary do?

An actuary is responsible for analyzing and managing the financial risks of a business. Working in actuarial science is a deeply sought-after profession that plays an important role in the success of a company. Actuaries help organizational leaders make strategic decisions and communicate solutions for deeply complex financial issues.

Many types of companies find value in hiring actuaries. Some of the most common employers of actuaries are insurance companies, consulting firms, government, hospitals, banks, and investment firms.

The major divide between actuaries is typically between what are called life and non-life disciplines. This is especially the case for actuaries in the insurance industry. Many actuaries work in the life and health insurance industry while others may focus their career in car insurance, home insurance, or even general property insurance.

The day-to-day role of an actuary involves quite a bit of mathematical work and analysis. It’s a fairly competitive field, meaning that commitment and strong collegiate performance can give you a leg up when searching for a job.

Actuarial education

Becoming an actuary requires you to receive a Bachelor’s degree to start. Many institutions offer actuarial science programs, but you could also study curriculum in business, math, or economics. There are also a number of required actuarial exams that cover important skills like mathematics, probability, economics, and business.

If you want to succeed at these tough exams, consider checking out study tools here on G2, reviewed and rated by verified users.

Actuarial salary:

An important question for anyone considering a career is how much money they could stand to earn in the role. Because the position of an actuary requires thorough schooling and certification, these competitive roles can prove extremely lucrative.

While entry-level actuarial analysts may start at roughly $60,000-$75,000 a year, this compensation may quickly rise to the reported median annual salary of $102,000. The increments of salary increases for actuaries are very high and rise with every exam level passed throughout one’s career.

| Did you know: It can take 7-10 years to become a fully qualified actuary. |

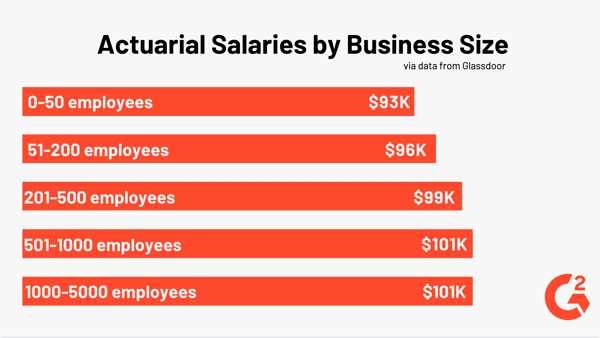

At G2, we highly value validated reviews and ratings. We looked at the popular job site, Glassdoor for data on actuarial salaries and found that based on 1,565 reported salaries, the average base pay is around $105,000. Below you can see how these averages may change based upon the size of the business an actuary works for.

Due to these high salary markers, many actuaries can live comfortable lives with a high income and relatively low-stress work environments.

Due to these high salary markers, many actuaries can live comfortable lives with a high income and relatively low-stress work environments.

Not everyone is cut out for the life of an actuary however, keep reading to discover the skill set you’ll need to develop to have a career in this in-demand industry.

Skills an actuary needs

It takes a very special set of skills to become an actuary. Thankfully, many of these skills are not inherent and can be developed through determination and hard work.

- Specialized math knowledge in calculus, statistics, and probability

- Analytical, project management, and problem-solving skills

- Finance, accounting, and economics

- Interpersonal communication

- Computer skills such as formulating spreadsheets, running statistical analysis programs, database manipulation, and programming languages

An actuary must be self-motivated, creative, both independent and collaborative at times, and have a strong sense of ambition. Having an understanding of the common industries that actuaries are employed in such as insurance, banking, and government can also set you ahead as a candidate in the field.

Risk and reward

Actuaries are in the business of analyzing and managing risk. Familiarize yourself with some of the best accounting software that you could be using in your role or even the financial consulting firms that may employ you.

There are a lot of rewards in life for a successful actuary, you just have to be willing to take the risk.

by Derek Doeing

by Derek Doeing

by Derek Doeing

by Derek Doeing

by Mary Clare Novak

by Mary Clare Novak