November 20, 2019

by Patrick Bryden / November 20, 2019

by Patrick Bryden / November 20, 2019

Does trying to get to know your donors feel like stumbling around in the dark?

Does getting an understanding of your donors’ wealth capacity feel like a never-ending uphill battle? Does finding out whether your donors support organizations like yours feel like running a marathon with two left shoes? Do these analogies annoy you? Okay, I’ll stop.

But seriously, if you answered yes to any of the questions above, it’s time to reassess your nonprofit’s wealth screening system.

With any piece of technology, it’s important to continually assess and reassess the benefit it provides your organization. Wealth screening software is no different. With challenges mounting within the nonprofit industry, including the decreasing number of donors and increasing competition for major gifts, a wealth screening tool that fits your nonprofit organization’s needs is imperative.

As it stands now, there are tons of options for a nonprofit organization looking for a wealth screening tool. A quick Google search for the term “wealth screening software” returns over 12 million hits. Nonprofits must analyze and assess their wealth screening tool options to find out how the software would fit with their organization. Like grains of sand and snowflakes, every nonprofit has different needs, and with such an abundance of options, finding the perfect fit is challenging.

To help cut through the noise, I outlined four challenges every nonprofit will face with their wealth screening platform, and explored ways to overcome them.

I know what you’re thinking—time-consuming is a relative term. How can you tell if something is time-consuming? Luckily for wealth screening, there is a rule of thumb. After submitting a list of prospects to screen, if the results take a week or longer to receive, it’s too time-consuming.

In the nonprofit industry, timing is everything. Asking for donations a day late could be the difference between an organization-changing donation and not making your office’s rent. To avoid this potential pitfall, you need a screening tool that’s quick. Regardless if you screen once a day or once a week, the faster you receive the results, the more effective your fundraising will be.

When sourcing new wealth screening tools, look for a platform that provides results and scores in a matter of minutes (rather than days or weeks). Ensuring a quick turnaround with screening results will also provide your fundraising team’s confidence when making major gift asks.

Have you ever looked at a prospect score and thought, “That's not correct, something must be off.” If so, you might need to reevaluate your screening tool.

Prospect scores can act as the foundation of a strong donor prospect research and fundraising plan, but only if they are accurate. To ensure accuracy, it’s imperative to understand what records, data, and intel contribute to this score. Being able to understand what makes a score unique to each individual is critical when formulating accurate and confident major asks. Without this ability, an organization may be asking for a gift that is way too large (embarrassing) or leaving money on the table (unfortunate).

When screening a very common name, it’s good practice to verify the records used to calculate the prospect’s score. Whether it’s professional information, real estate holdings, or stock transactions, it’s easier to trust the results if you can verify the data.

So, what happens when incorrect records continually factor into a prospect score? Your entire organization’s prospect scoring system will be inaccurate. To circumvent this, look for a screening solution that offers confidence of match.

Confidence of match is a wealth screening feature that controls what data, intel, and records are matched to a prospective donor. The higher the confidence of match, the stricter the matching algorithm will be, and fewer records will be returned. Conversely, the lower the confidence of match, the more records will be returned, with the possibility of some not being related to your prospect.

Confidence of match means you control how wide you cast the net when searching for information about donors. For example, if you want to pull in all possible information on your donor and then decide for yourself whether a gift was given by a particular donor, set your confidence of match to a lower number and you’ll bring back more records. From there, you’re able to review the results and easily remove any records that don’t align with your prospect. Boom! Accurate data and a match made in heaven.

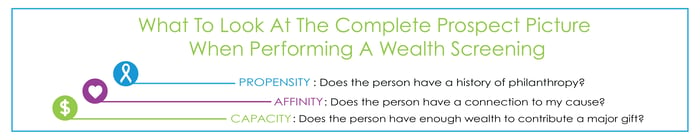

The days of wealth capacity being the only factor used in finding prospective donors are in the past. Instead, a nonprofit’s ideal donor is someone who has the wealth capacity to give as well as a history of giving and a connection to your cause. When leveraging wealth screening, it’s important that your tool of choice factors in more than wealth information. If your screening tool only provides results based on a prospect’s wealth capacity, rough waters are ahead.

Long before comprehensive wealth screening tools, nonprofit organizations would focus solely on a prospective donor’s’ wealth capacity when gauging their propensity to give. This information predominantly came from real estate data because it was the easiest to obtain and provided fairly accurate insight into a prospect’s wealth. Fast forward to 2019—nonprofits now have access to comprehensive wealth screening tools that look at a donor’s history of giving (propensity) and connection to a cause (affinity), as well as their wealth—we've come a long way.

Let’s compare the power of an old screening platform to one from 2019.

Using a dated screening platform, an organization may identify a prospect who owns a $500,000 property. Traditional methods would indicate that this is a great prospective donor and worth pursuing. All seems fine until your fundraising team makes a gift ask and learns the prospect has never made a donation in their life (and never plans to).

Looking at the same prospect on a modern platform, you would see their $500,000 property as well as the fact they have no history of giving. Rather than making a gift ask, you would quickly bypass them and continue the search, saving yourself time and the potential embarrassment. From here, you may find additional prospects who may offer less in terms of financial assets, a history of giving, and ultimately better suited for a major gift ask. These may have been prospects previously overlooked because they lacked significant capacity even though their past charitable giving may indicate they are a great fit for your organization.

Today's screening platforms aggregate

multiple layers of data to provide a full picture of prospective donors. Using a prospect’s affinity, propensity, and capacity will ensure you’re looking at the full picture of a prospective donor. This will help uncover hidden gems and overlooked names hiding within your donor management database.

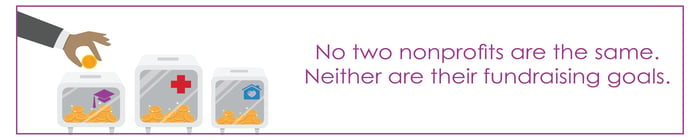

No two nonprofits are the same, and neither are their fundraising strategies or goals. This means a wealth screening tool isn’t a one-size-fits-all solution. A major gift of $1.000 dollars to your organization might seem like a lot, but it may not even crack the top gift of the week for another nonprofit, for example. Not to mention, while you may be searching for donors passionate about healthcare, another nonprofit may be looking for individuals devoted to the environment. This is where customization comes into play.

Depending on your organization, you may place a different level of importance on the propensity, affinity, or capacity of a donor. Universities and colleges might focus more heavily on a donor’s capacity. Meanwhile, a local animal shelter might prefer donor prospects with a high affinity to their cause.

Likewise, whereas a university may feel that a major gift is any gift over $50,000, a local animal shelter may categorize a major gift as over $1,000. Regardless of how you define a major gift, your prospect research tool should be able to find individuals who match that definition. If it doesn’t, you may be missing out on major gifts.

Has your wealth screening tool been limiting your fundraising and research success? Have you decided that your screening methods could be more comprehensive and tailored to your nonprofit organization?

Before you begin looking for a new option, remember the following requirements:

Are you ready to go? Your prospective donors are out there just waiting to be found.

Patrick is the Marketing Manager at iWave, where he helps drives new customer acquisition, client retention and target market awareness. With a strong interest in strategy, creative problem solving and finding efficiencies in everyday processes, Patrick enjoys helping iWave provide nonprofits with the tools to fundraise with confidence.

Life is a boomerang. What you give, you get.

by Lauren Pope

by Lauren Pope

Nonprofit web design isn’t something your organization should overlook.

by Murad Bushnaq

by Murad Bushnaq

Nonprofits? Charities? What’s the difference?

by Lauren Pope

by Lauren Pope

Life is a boomerang. What you give, you get.

by Lauren Pope

by Lauren Pope

Nonprofit web design isn’t something your organization should overlook.

by Murad Bushnaq

by Murad Bushnaq