May 25, 2023

by Chris Perrine / May 25, 2023

by Chris Perrine / May 25, 2023

Cooking a gourmet meal and buying software have a lot in common. Both are more complex than they may seem.

Let’s say you have a thorough and detailed recipe to prepare your own Beef Wellington at home. You might have all the ingredients and a step-by-step recipe to walk you through, but this doesn’t mean you have the equipment or cooking skills required to make a good dish.

Software buying on paper seems straightforward. The reality is that it’s a complex and nuanced process for modern buyers. Consider that buyers must also be more cautious with spending in a market with tighter budgets.

The good news is that companies still need software. Although the buying journey isn’t what it once was, it’s crucial to understand what they expect and what challenges stand in the way.

There’s no doubt that the B2B software landscape is drastically different from what it was. On top of that, it’s constantly evolving and shifting.

But take a moment to consider what it was like to buy software during the 1990s. If you’ve been in this industry for as long as I have, you’ll remember that magazines were one of your best resources for researching vendors. In fact, there were a few other distinct differences in buying software from back then:

Fast forward to today, and it’s obvious that software buying doesn’t look as it once did. The problem has become freedom of choice. When you have so many options, choosing software means shortlisting offerings that best fit your needs becomes necessary.

Let’s say you’re looking to source a new CRM. Did you know that G2 currently lists over 845 different software products and services in this category? Whittling down your options is a challenge in itself.

The challenges of software buying extend beyond choice. The following provides just a few hurdles buyers must overcome to give the green light.

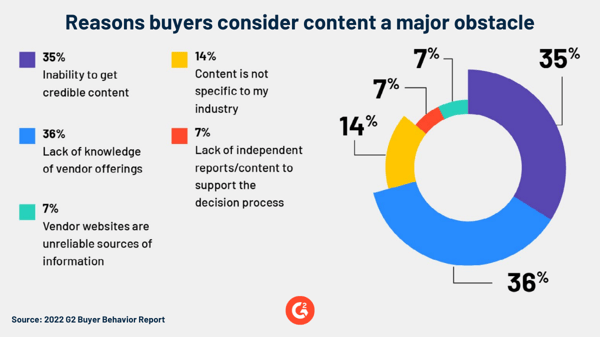

Assuming a buyer has an initial list of vendors to research, many feel that finding the right content can be difficult. Sure, G2 is where many buyers will perform meaningful research, but it’s more likely they also use other content in their exploration.

Everyone claims they are the best. Every website has an interactive demo and stories of their work. But buyers without credible content are left asking themselves how they know who to trust and how to learn more before making a decision.

Buying software encompasses more stakeholders than ever. This can complicate things for both vendors and buyers.

.png?width=600&height=338&name=Whats%20holding%20up%20buyers%20-%20Chris%20Perrine%20thought%20leadership%20(1).png)

On top of the conversations between decision-makers, add in the countless others who will be impacted and how their opinions and needs factor into evaluating software. Adding new stakeholders throughout the buying process increases complexity as each stakeholder joins in with their individual expectations.

Not only are more stakeholders included in the evaluation, decision-makers are also more likely to change throughout the process.

.png?width=600&height=338&name=Whats%20holding%20up%20buyers%20-%20Chris%20Perrine%20thought%20leadership%20(2).png)

Buyers also need to convince the person who makes the final decision about their project. But if there’s a strong likelihood that this person might change in the near future, that can add an extra layer of uncertainty and difficulty.

Software is often a big decision that affects numerous stakeholders. On top of that, cost is another consideration buyers must keep in mind. Many management teams are pushing for shorter contracts to help minimize risk if the project doesn’t work out.

.png?width=600&height=338&name=Whats%20holding%20up%20buyers%20-%20Chris%20Perrine%20thought%20leadership%20(3).png)

More than half of software contracts are six months or shorter. In India alone, that percentage jumps to 69%.

Typically, companies prefer buying directly from vendors but are now exploring buying from third-party marketplaces. However, we are now seeing the rise of third-party marketplaces such as the AWS Marketplace and the Azure Marketplace. These marketplaces provide buyers with more options and a more B2C-like experience in some cases.

Value-added resellers (VARs) are also growing, but they look different from the VARs of the past. Rather than just implementing software, many VARs are now focused on delivering services in conjunction with SaaS applications to better serve their customers.

As the market expands, buyer behavior continues to change with it. From longer sales cycles to the prevalence of buying committees, vendors have to constantly assess the buying journey and understand how to win more deals.

Every buyer is unique in what they want, but it’s essential to realize which factors are becoming more critical in their decision-making. According to data from the 2022 G2 Buyer Behavior Report, let’s explore the three most common things software buyers seek.

Buyers still need software, so it’s vital to process what we understand about their journey and take the right steps to mitigate these challenges. Your goal is to provide assistance and help make their decision much more straightforward.

Great content helps you stand out, communicates your value, and conveys why you are unique. The challenges buyers face almost always come back to content. It's either difficult to find, doesn't answer their questions, or doesn't dive deep enough into their needs.

It's important to note that a significant portion of this content won't be found on your website but can be just as critical in helping buyers make informed decisions. This can include expert content from analysts and thought leaders, and customer content from review platforms and social media.

To overcome these challenges, you must deeply understand customer pain points and have a content strategy that addresses them. Consider leveraging a combination of content for every stage of the funnel and take the time to gain insights into how your buyers consume content on their buying journey.

As mentioned earlier, ease of implementation and use are crucial. However, there is a rising trend in the significance of ROI, and buyers are increasingly looking to achieve ROI within six months or less. Unfortunately, this step is often neglected. To ensure success, measuring ROI and communicating its value effectively to prospects is crucial.

As businesses look for ways to stay competitive, your finance team can play a key role in driving growth by exploring new ways to increase customer acquisition. One area where finance can make a significant impact is by offering flexible contracts that meet the needs of today's buyers.

Another way finance can help drive growth is by simplifying the buying process. By streamlining the contracting process and offering more payment options, vendors can make it easier for customers to do business with them.

Today's buyers demand more flexibility in their purchasing decisions, but it's important to balance this with your financial goals. To maximize your success, consider taking a long-term approach. Utilize the benefits of flexibility to increase acquisition, build customer trust, and eventually convert them to longer-term contracts.

We're seeing a growing trend of buyers making SaaS purchases through global marketplaces. While most vendors have primarily focused on direct sales, it's becoming increasingly clear that partnering to access new customers can help vendors grow faster. Exploring alternative channels allows SaaS providers to tap into previously untapped markets and unlock new revenue streams.

As you consider your SaaS distribution strategy, evaluating whether these third-party marketplaces are the right fit for your products is important. Additionally, it's worth noting that VARs are making a comeback, offering value-added services alongside your solution.

While there’s no shot of us ever going back to physical demo CDs or trade magazines to research, software buyers face an uphill challenge in sourcing the right software. The good news is that you can take the proper steps to aid their buying journey.

Understand the challenges your buyers must overcome to your advantage to build trust, provide valuable insights, and win more deals.

Want to show off your G2 Badges with pride? Learn more about how the G2 Content Marketing Subscription can help you leverage the voice of the customer to build trust and win more deals.

Chris Perrine is a seasoned leader and entrepreneur with over 20 years of experience in the Asia Pacific region. Having co-founded Springboard Research and successfully exited to Forrester, he's also helped build IDC, ProductReview.com.au, as well as now leading G2's efforts in the region.

"Buyers reign supreme." This would be the shortest summary of what we found out about B2B...

by Soundarya Jayaraman

by Soundarya Jayaraman

In October, I had an incredible week visiting Bangalore, where we hosted two inaugural APAC...

by Godard Abel

by Godard Abel

The B2B software world is changing fast, and AI is at the center of it all. It’s reshaping how...

by Godard Abel

by Godard Abel

"Buyers reign supreme." This would be the shortest summary of what we found out about B2B...

by Soundarya Jayaraman

by Soundarya Jayaraman

In October, I had an incredible week visiting Bangalore, where we hosted two inaugural APAC...

by Godard Abel

by Godard Abel