August 11, 2023

by Ashley Knierim / August 11, 2023

by Ashley Knierim / August 11, 2023

An SBA loan is financial support offered to small businesses by banks and online lenders who are partly guaranteed by the government (US Small Business Administration).

When seeking an SBA loan, you can apply through a trusted lending institution such as a reputable bank or credit union. The lender then submits the application to the SBA for a loan guarantee.

The SBA typically requires an unconditional personal guarantee from all individuals who own at least 20% or more of the business. The personal guarantee means that these individuals, often business owners or stakeholders, become personally liable for the loan repayment In the unfortunate event that the company cannot make the loan payments.

This personal guarantee, along with the SBA's loan guarantee to the lender, significantly reduces the risk for the lending institution. With these safeguards in place, lenders are more inclined to work with small businesses and provide them with financing opportunities that might not be accessible through conventional channels. However, you must understand the potential risks of giving a personal guarantee before taking on an SBA loan.

Once your SBA loan application is approved, your lender is responsible for disbursing the loan proceeds. From that point forward, you'll repay the lender directly, typically monthly.

There's a variety of SBA loans available for consideration. Taking the time to evaluate your business needs, repayment strategy, and loan rates will help you identify the most suitable choice for your requirements.

Let's take a look at the 6 main types of SBA loans available:

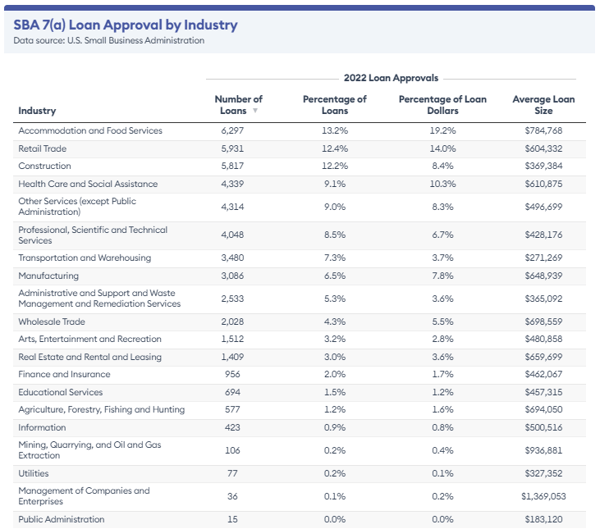

The 7(a) loan program is small businesses' most popular SBA loan type. It’s the right move for a company with basic financial needs—like business acquisitions or broadening working capital.

With this, you get up to $5,000,000 in a loan amount for general business financing needs and can expect a repayment plan of between 5 to 25 years with an interest rate from Prime +2.25% to Prime +4.75%.

Finally, the CDC/504 loan program is a good choice for a business that wants to purchase land, buildings, or equipment. With this option, you’ll get up to $5.5 million in loan amount and a repayment plan of 10 to 20 years, with an average interest rate of around 5%.

The SBA CAPLines program provides businesses with up to $5 million at interest rates similar to the SBA 7(a) loan program, making it suitable for those seeking a revolving line of credit to manage recurring business expenses and unexpected costs.

The four available CAPLines options:

Most CAPLines come with a capped servicing fee of 2%, although working capital CAPLines may have slightly higher costs. The program offers a maximum maturity of 10 years for all lines except the Builders CAPLine. Applicants must have at least 20% business ownership and guarantee the loan to qualify.

SBA Export Loans provide financial assistance of up to $5 million at a reasonable interest rate of 11%. This helps small businesses engage in international transactions and explore new foreign markets.

The microloan program is for businesses with small capital needs. They cap out at $50,000 with a repayment plan of up to 6 to 7 years and an interest rate of 6.5% to 13%. This loan can be used for almost any business need except for purchasing real estate or refinancing debt.

SBA community advantage loans are vital in supporting businesses operating in underserved markets. They provide essential financial support for various business needs, such as working capital for operational expenses, purchasing equipment, funding growth initiatives, or investing in property. These loans offer flexibility to address the diverse requirements of businesses in marginalized communities.

To increase your chances of securing an SBA loan, providing thorough and accurate financial documentation for both the bank and the SBA is essential. The loan approval process requires a meticulous analysis of your application, and the final decision will be based on this evaluation.

Here are some steps to improve your chances of obtaining an SBA-backed loan:

Lenders generally look for businesses that have been operational for at least two years, boast solid annual revenue, and maintain a good credit score. However, it's important to note that each lender may have specific eligibility requirements.

Securing approval for an SBA loan can be challenging, especially if your business is facing difficulties. If your business falls into ineligible categories, like those associated with gambling or political lobbying, pursuing an SBA loan would be unproductive as it won't be approved. If you are a new company operating at a loss, exploring alternative financing options, such as applying for a microloan or a business credit card, is more practical.

When seeking an SBA loan, your credit plays a crucial role unless your business has an impeccable credit history built over many years.

Tip: While an exceptional Fair Isaac Corporation (FICO) score of around 800 is beneficial, having a credit score above 620 is considered favorable. If you're trending lower, consider spending some time on credit score maintenance. You can improve your credit score by building a new line of credit, paying bills on time, staying well under your credit limit, and regularly monitoring it.

Apart from your personal and business credit scores, lenders also rely on a score known as the Small Business Scoring Service (SBSS) score. The exact formula used to calculate the SBSS score remains undisclosed.

It incorporates your personal and business credit history, industry experience, assets, liabilities, financial data, revenue, and cash flow. By analyzing these aspects, lenders can evaluate your business's overall financial health and potential risk, which helps them make informed lending decisions.

The duration a company has been established plays a significant role in its loan approval chances. For example, businesses with a track record of at least four years tend to have a better chance of receiving an SBA loan. Additionally, many lenders view companies operational for two years or more as more eligible for securing a loan.

This consideration of establishment time is essential because it gives lenders a clear history of the company's financial performance, revenue, and borrowing habits. It helps build trust and confidence with lenders regarding the borrower's ability to manage future financial obligations successfully.

Two types of lenders manage SBA loans:

It's important to note that while banks must follow SBA guidelines, they may use their underwriting criteria to evaluate loan applications. If you are applying through a traditional bank, working with one with a proven track record of processing SBA loans is beneficial. Generally, a bank with multiple years of SBA experience will be better equipped to guide you and assess your approval chances.

Tip: The SBA offers a convenient Lender Match tool to find a suitable lender that matches borrowers with lenders within two days.

SBA loan applications vary based on the loan type. Nevertheless, depending on the type of loan you require, your lender should be able to help you prepare your paperwork.

Here are some of the documents you will need:

There’s a reason so many small business owners clammer for SBA loans; a ton of perks will benefit your company immediately and in the long run. The trade-off is that it’s often a slow process requiring a lot of legwork throughout the application. If you need access to funds quickly, you’ll want to look at other options.

Source: Forbes Advisor

The time it takes to get approved for an SBA loan will depend on your chosen lender. With a bank, the entire process — from funding approval — can take anywhere from 30 days to a few months.

If you’re short on time, you might opt for the SBA Express loan, which aims to respond to loan applications within 36 hours. The maximum amount for this type of financing is $500,000, and the maximum amount the SBA guarantees is 50%.

SBA loans are backed by the government (US Small Business Administration), which means that they provide certain benefits not typically found in traditional bank loans:

SBA loans can be a helpful source of financing for small businesses, but they also come with specific challenges:

The SBA should be one of your top choices for a loan. And yes, SBA loans are difficult to get—and a ton of work goes into getting them. But their low cost makes it a worthwhile endeavor. And luckily, with these tips—you’ll increase your chances of getting approved.

Learn more about how fintech is revolutionizing the financial industry, mainly in the payment, lending, wealth management, financial planning, and insurance sectors.

This article was originally published in 2019. It has been updated with new information and examples.

Ashley is the Senior Editing on the Content team at Fundera.

All small businesses and startups began with a great idea. For many, the next step was to...

by Maddie Rehayem

by Maddie Rehayem

As interest rates fluctuate and inflation affects everyday costs, understanding how to take...

by Grace Pinegar

by Grace Pinegar

Put on your best suit and browse those financial statements.

by Mary Clare Novak

by Mary Clare Novak

All small businesses and startups began with a great idea. For many, the next step was to...

by Maddie Rehayem

by Maddie Rehayem

As interest rates fluctuate and inflation affects everyday costs, understanding how to take...

by Grace Pinegar

by Grace Pinegar