Investing in real estate is a gamble, and not always the fun Las Vegas-type of gamble either.

Buying investment properties can be very lucrative but there’s also a major amount of risk involved. The real estate market is constantly fluctuating and it’s difficult to forecast whether or not you’ll see a return. That being said, there are ways to evaluate a property to help make an educated buying decision before fully committing to the investment.

One of these ways is through formulas – and there a lot of them. In this article, we’ll take an in-depth look at one of the main formulas investors use to predict if a property is a worthy investment: net operating income.

What is net operating income?

Net operating income (NOI) is a value that determines how much profit a commercial real estate property generates. By calculating NOI through a specific formula, investors gain insight into the overall financial health of the property.

Looking at net operating income alone isn’t going to determine whether or not a property is a good investment. However, when paired with other variables such as cap rate, NOI can be a useful tool for forecasting income potential.

Now that we’ve defined the term, let’s get to the formula itself.

How to calculate net operating income

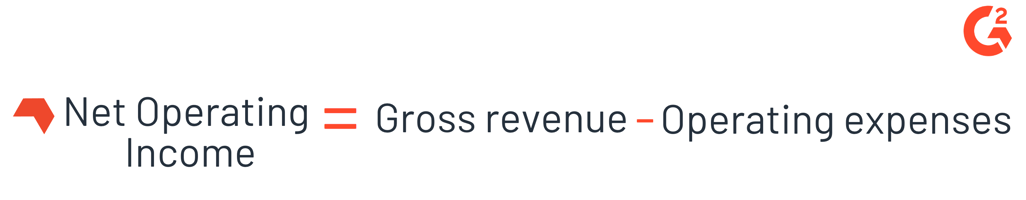

To calculate net operating income, subtract the total operating expenses from the gross revenue of a property.

For example, let’s say the gross revenue of a building is $150,000 and the operating expenses total out to $45,000. In this case, the net operating income (150,000 - 45,000) will come out to $105,000. Seems simple enough, right?

Since you can’t calculate NOI without first knowing the figures for gross income and operating expenses, let’s break these two elements down further.

Gross revenue

In real estate, gross revenue refers to how much income a property generates. The main way in which a property makes money is through rental units. Other possible ways are by selling parking spots or charging maintenance fees for services like laundry or vending machines. To get this figure, simply add up the rental income with the additional totals from other revenue-generating activities.

Operating expenses

In order for a property to run properly, there are going to be various operating expenses. This figure includes any costs associated with keeping the property running on a daily basis, including:

- Maintenance and repairs

- Legal fees

- Insurance

- Utilities not covered by the tenants

- Property taxes

It’s important to note that debt payments, such as a mortgage, or income taxes are not accounted for in net operating income equation. This is because these costs vary greatly from one investor to the next. They are specific to the investor, not the property, and for this reason are not considered to be operating expenses.

|

TIP: Investors use real estate asset management software to maximize returns and analyze property performance using data like NOI. For more information, head to G2 to explore asset management tools and read reviews from real users.

|

Why is net operating income important?

The main goal of an investor is to make money. If you’re considering investing your money in a real estate property, you want to know that you’re going to eventually make a profit. By calculating NOI, investors can forecast the future cash flow of a property just by crunching some numbers.

Additionally, NOI can be used by lenders when determining loan eligibility of the buyer. Rather than looking at the investor’s credit history, the loan provider will use the NOI figure to predict the property’s income potential. If it’s profitable, the lender has legitimate reason to believe the investor can pay the mortgage.

Since this formula doesn’t account for outlying factors like debt and income taxes, it’s not going to be one hundred percent accurate. That being said, it’s still a powerful tool all real estate professionals and investors should have in their back pocket.

| Note: Net operating income is a measure used specifically in real estate and is not to be confused with net income. Learning how to calculate net income is specific to standalone businesses. |

Bottom line

Net operating income isn’t the sole indicator of whether or not a property is worth the investment. However, any investor that does their due diligence should consider NOI before moving forward with a big financial decision. Buying an investment property might be a gamble, but if you’re equipped with the right tools, the decision could lead to a big payoff.

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev

by Izabelle Hundrev