March 14, 2023

by Meredith Wood / March 14, 2023

by Meredith Wood / March 14, 2023

.jpg?width=600&height=400&name=iStock-1268445718%20(2).jpg)

Cash flow is akin to your company’s heartbeat- it helps keep your company’s lifeblood circulating. It should also be maintained for a financially healthy body.

In theory, cash flow is the amount of money going into and out of your business in real time. Businesses often use cash flow management software to track their revenue and expenses.

A sustained negative cash flow can hamper financial relationships with investors, suppliers, employees, and consumers. Read on to learn more about negative cash flow and how to manage it.

Negative cash flow is when a business has more cash outflow than cash inflow. In other words, when a business spends more than it is earning in a set time frame.

Negative cash flow doesn't always mean the business isn't doing well. In fact, it is quite common for new companies. It could also mean that the organization is expanding and investing in more growth solutions. However, it is a constant negative cash flow that is a cause of concern.

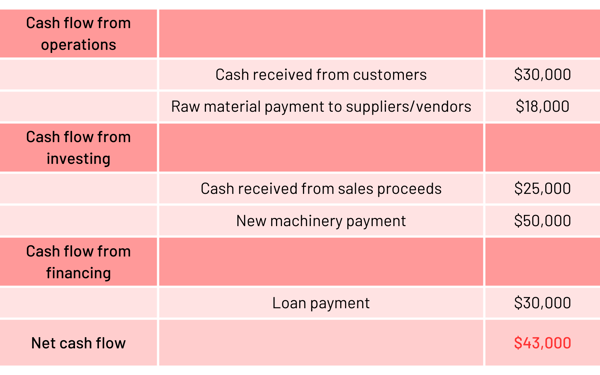

Suppose company ABC is a health supplement manufacturer that recently started doing business. Let's take a look at its cash flow statement to understand negative cash flow better. According to the example, the company has spent more than it earned in a given timeline. Due to the negative cash flow ($ - 43,000), the business looks at a loss.

According to the example, the company has spent more than it earned in a given timeline. Due to the negative cash flow ($ - 43,000), the business looks at a loss.

Cash flow = cash inflow - cash outflow

The hit to the cash flow statement comes from negative investing cash flow and negative financing cash flow. The investing activities show the selling and buying of assets, and financing activities represent debt payment, business liabilities, and equity.

However, upon deep diving, we see that the company is doing well in core profit-generating operations, with a positive cash flow from operating activities (receivables - payables). Another thing to note is that ABC has spent quite a lot on new machinery, implying that they plan to scale production and expand in the near future.

Several factors, such as miscalculations, unnecessary investments, and mismanagement of resources, lead to a disrupted cash flow. Some common reasons for negative cash flow are:

As mentioned earlier, if your company has cash flow problems, you might have too much overhead, not enough products, or are wasting money somewhere within your operations.

You can forestall larger financial problems by paying attention to cash flow on a frequent basis and trying out some of these tips to prevent your cash flow statements from turning red.

Tip: Over 1,600 companies manage software spend, usage, contracts, compliance, and more through G2 Track. Fight the SaaS sprawl and get deeper financial insights today.

Maintaining a healthy cash flow isn't the easiest. Customers don’t always pay invoices on time, surprise expenses pop up frequently, and seasonal cycles make it tough to always have money ready to pay your staff.

Nevertheless, it’s up to you to figure out how to pay your staff on time.

Thankfully there are business loans out there to help you cover payroll when cash flow is low. Many lenders offer a variety of products that make it easy to cover cash shortfalls, so you can guarantee that your team gets paid.

Some loans focus directly on helping you make payroll, while others help you stabilize your cash flow. But no matter which loan is right for you, each can help you cover payroll during lean times and keep your business humming.

Best for: Those who only need a one-off solution.

A short-term loan is the fastest way to provide you with the cash you need. Lenders typically approve applicants within a few hours, and you can usually have the cash in hand within the same day. The expediency of short-term loans makes them uniquely suited to help in emergency situations or to cover big-time expenses when nothing else can.

Short-term loans are particularly helpful if you’re in a one-off cash flow crunch rather than a recurring situation.

A word of warning, though: Short-term loans are expensive, and you’ll have to pay them back quickly. Most require repayment in less than a year. More often than not, the terms are even shorter. You might even have to make daily repayments, depending on what your lender offers you. And if you do, that means you might find yourself right back where you started regarding cash flow problems.

Best for: Established businesses.

Even the best accounting can’t always prepare you for down months or unexpected expenses. Short-term loans are often expensive and come with stringent repayment schedules. If your cash flow isn’t too hot, you’re not likely in a position to make these loans work to your benefit, either.

This is where a business line of credit comes in handy. A business line of credit provides companies with a pool of funds from which they can withdraw as needed. You only pay interest on the money you’ve withdrawn, which means that you don’t have to pay interest on funds you don’t need. You’re not restricted to certain uses for the money you borrow, either. This means you could dip into your line of credit to cover payroll just as easily as you could buy inventory.

A business line of credit is great for well-established companies with good credit. Newer companies, or those without good credit, may have a hard time getting approved due to the nature of how these products work. The lender takes on significant risk when assuming that you’ll be able to pay back the money you’ve borrowed on a repeat basis, which can make a business line of credit harder to get.

Best for: Companies with an irregular cash flow.

Invoice financing can be an easier option for most small business owners than getting approved for a business line of credit. You don’t need to have exemplary credit, nor do you need a long credit history, to get one. All you need are existing unpaid invoices.

This option doesn’t have the same requirements as a typical loan. Lenders will give you an advance on a percentage of the total amount of your invoice, which is usually around 85%. Your lender then holds onto the remaining 15% and will charge you a fee based on the percentage of the funds you’ve received until the invoices are paid. At that point, you’ll get the remaining 15% back.

Invoice financing provides a great, quick way to put your outstanding invoices to work for you. This can help you normalize your cash flow if clients pay irregularly or if you’re in an unexpected bind. Note that invoice financing won’t be cheap: you can expect to pay a factor fee of 8-30%, which makes them less cost-effective than a business line of credit (but more available and expedient).

Running into payroll and cash flow issues is never pretty and is always a stressful spot to be in as a small business owner. Regardless of why and how you came up against the challenge of getting enough money in the coffers to pay your employees, there are ways to get by. Best of all, some of these options can even set you up for steadier cash management in the future as well.

Ready to learn more about managing payroll? Learn how payroll software can help finances teams stay on top of their invoicing needs.

This article was originally published in 2018. The content has been updated with new information.

Meredith Wood is the Editor-in-Chief at Fundera, an online marketplace for small-business loans that matches business owners with the best funding providers for their business. Specializing in financial advice for small-business owners, Meredith is a current and past contributor to Yahoo!, Amex OPEN Forum, Fox Business, SCORE, AllBusiness, and more.

The products and services your company provides are your lifeblood.

by Rob Browne

by Rob Browne

The software we buy, the vacations we take, the food we eat - there is a digital platform...

by Mara Calvello

by Mara Calvello

Money isn’t everything, but it is a significant factor for just about anything you can imagine...

by Kayleigh Alexandra

by Kayleigh Alexandra

The products and services your company provides are your lifeblood.

by Rob Browne

by Rob Browne

The software we buy, the vacations we take, the food we eat - there is a digital platform...

by Mara Calvello

by Mara Calvello