September 1, 2020

by Darren Heffernan / September 1, 2020

by Darren Heffernan / September 1, 2020

Over the last few decades, the responsibilities of the finance department have changed and grown, especially in terms of organizational importance.

Accountants that were once considered “number-crunchers” are now relied on for actionable, business-critical insights and strategic planning. The voice of the CFO for the strategic direction of the company ranks very highly alongside the voice of the CEO, especially as internal and external stakeholders look to the office of finance for guidance during times of uncertainty and instability.

The tools that finance and accounting teams use have not evolved as steadily as the duties they are required to perform. As organizations develop and grow, certified management accountants often struggle to keep up, mainly because of the outdated software and manual processes they leverage in business-critical duties such as their month-end close.

Because of this, the need for automation implementation in the office of finance has gained momentum in recent years. So why should your team be investing in financial automation tools?

Here are five reasons:

Before finance teams can consider implementing automation to their processes, accountants must identify what problems they are trying to resolve. Many monthly closing complications can be boiled down to three main categories: manual processes and spreadsheets, a lack of visibility and control, and time spent on repetitive tasks.

Though these problems tend to be prevalent in many organizations, finance teams may not have been aware that these problems can be easily solved.

The majority of finance and accounting teams tend to utilize a network of spreadsheets, word processing documents and other inadequate project management tools as their primary financial close tools. Even riskier, some businesses rely on tribal knowledge to get them through the close.

These manual methods cause many issues throughout the month-end close process. A lesser-known fact about spreadsheets specifically is they were originally created to balance on average, a four-person family’s budget. This tool was not designed to support your complex organization’s finances, and certainly is not able to manage the fluidity of working through these complexities.

First, there is a limit on the amount of data that can be placed in a single spreadsheet. Because offices of finance manage large batches of data, a spreadsheet is filled to the brim with information, and becomes a massive data silo. In the month-end close process, numerous spreadsheets exist that are all disparately connected, rendering the accounting workflow bulky and inefficient.

This also paves the way for many data errors. In fact, 90% of all spreadsheets contain errors. Spreadsheets have to be manually edited – a process that sounds simple enough but can yield catastrophic results. For example, copy-and-paste transfers. Some of the most infamous compliance cases can be traced back to copy-and-paste transfer errors.

These start as unnoticed, miniscule mistakes that, when compiled, snowball into large amounts of inaccurate data spread across many spreadsheets. Even with the latest features that track your changes, you can be left with confusing save versions or saves to different locations. When organizations grow at a steady pace, the amount of spreadsheets grows with it, and so does the number of uncaught errors. This is also true of pen-and-paper methods. Errors cannot easily be caught and when an inaccuracy is noticed, it consumes a lot of time to comb through all the documents to find the source of the mistake.

These tools open companies up for huge compliance risks, often unknowingly. Spreadsheets certainly have their place in the process as a supplementary tool, but not as the system of control. Not only are they hotbeds of error, but spreadsheets and manual methods prevent a finance team from easily managing the workload and the team’s focus on high-risk items.

Consequently, high-risk accounts are severely underattended, increasing organizations’ risk profiles. The chance that organizations will have to issue restatements, accompanied by audit expenses and fines in some cases, is high. For those organizations that are not yet public, this is a behavior and discipline that will have to be overcome, as shareholder expectations today include having state-of-the-art compliance practices.

Another risk factor is an inherent lack of security. Other than password safety, spreadsheets offer very little protection. This is also very dependent on user behavior to ensure that files are not placed in locations subject to unauthorized access. Sensitive spreadsheet data – both from the organization and from clients – is much more prone to a successful cyber-attack, leaving organizations and their customers extremely vulnerable to compliance violations. And with paper documents and binders, the only precaution to be taken is access-card protections or worse, none at all.

One of the reasons that an organization’s financial close cycle takes so much time is the lack of visibility into the tasks across the company. Especially now, when a virtual close is becoming much more widespread globally, the ability to see and control all aspects of the month-end closing procedures is crucial.

In a traditional office scenario, when an accountant has a question or comment about a specific task or document, they only need to walk over to a teammate’s desk for clarification. The issue is then cleared up, and the accountant returns to their desk to finish the task. But in a virtual close, the luxury of constant, face-to-face communication is eliminated. Traditional close process tools don’t allow accountants to leave comments or attach supporting documentation to fix these communication gaps.

When the interaction between teams is lacking, bottlenecks occur frequently. One frustrating bottleneck that accountants may recognize is called “rework”. Rework happens when one accountant completes a task, feeling they have all the information required to finish it. However, after completion, the accountant receives information that is vital to the task they’ve just completed. That accountant must then go back and “rework” the entire task.

Essentially, they perform the same close task twice – not only inconveniencing that accountant, but also reviewers and approvers who have to review an excess amount of tasks. Multiply that frustration when auditors require clarification on all the different versions.

While problems such as rework are the result of poor communication, these bottlenecks also occur due to a lack of ability to manage the steps of the close. Finance leadership cannot see into the huge of accumulation of documents to monitor the progress of all close tasks and the entire close cycle across all entities of the organization.

This is also partly due to limited data analytics capabilities in spreadsheets, binders and manual processes. Without the proper analytics tools, management cannot see where bottlenecks occur or how these bottlenecks impact the financial process. The shortage of visibility also limits the amount of control that leadership has over the month-end.

This lack of control occurs because traditional processes don’t support an effective compliance framework, increasing risk. Company policies and procedures can’t be standardized and enforced within a spreadsheet or binder system. For example, with spreadsheets, each accountant will follow a document setup most familiar to them – creating a widespread inconsistency of formats.

With this method, many problems arise when an accountant is absent, as their team members then have to decipher that accountant’s personal layout. Not only does this waste time, but leaves organizations open to audit expenses and non-compliance risks with governmental laws and regulatory bodies. To repeat an earlier point, companies looking to acquire capital need to have a reliable compliance framework that is consistently showcasing when risk exists.

Offices of finance that leverage manual tools are constantly performing tedious, time-consuming tasks. Processes such as transaction-matching and account reconciliation represent the bulk of the close cycle. When accountants are forced to sort and complete these tasks manually, these assignments take weeks. Not only that, but due to the lack of visibility, accountants are constantly stuck in lengthy update meetings to inform management of the progress of these essential close tasks.

This takes valuable time away from the actual completion of these processes, further extending the duration of the monthly closing. In a virtual close, this is especially true, and causes accountants to work late hours and over weekends. Over time, this fosters burnout and a significant decrease in employee morale, as employees spend more time working than engaging in quality of life.

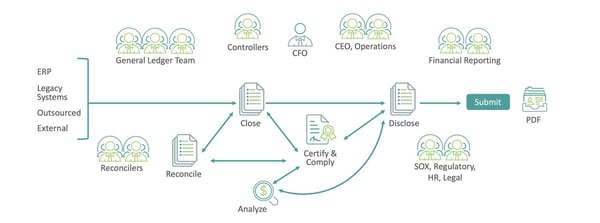

This setup also promotes an extremely unorganized workflow that also eats away at time. Consider what your organization’s month-end close process looks like. Many finance and accounting teams might diagram their financial close resembling something like this:

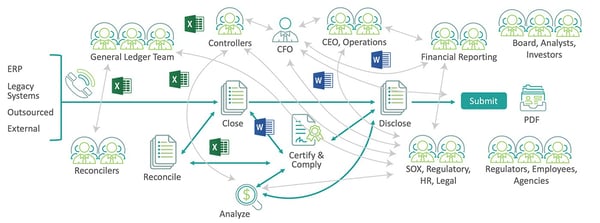

However, this diagram doesn’t factor in the constant updates, approval requests, data corrections and other aspects that finance and accounting teams ask for through emails, conferences and other communication platforms. After those are considered, the average monthly close actually plays out more like this:

Imagine how much time finance and accounting teams consume with this as their standard process. Even so, this diagram is not able to represent the number of bottlenecks that occur because of this cluttered workflow.

Your month-end close process does not have to look like this. There is a way for your finance and accounting teams to have visibility, control and a timely close cycle.

In the last decade, many organizations have made the switch from outdated technologies such as pen-and-paper and spreadsheet approaches to more modern, automated solutions. There are several advantages to implementing automation to your organization’s financial processes, including integration with data sources such as your ERP. Another benefit is that automated solutions can be tailored to your specific organizational requirements to maximize your investment.

Across the entire organization, finance and accounting is the only department that touches everything and has the first view on all organizational matters. Because the office of finance is so important to an organization in both the short and long-term, it would make sense that these team members are properly equipped with both the right tools and the appropriate amount of time to accomplish their responsibilities.

Financial automation gives accountants their time back by speeding up time-consuming tasks in order to focus on more value-adding, strategic tasks that guide the entire organization. By reducing binders and spreadsheets, tasks like transaction matching that normally might have taken weeks to complete can be cut down to only days.

Additionally, an automated solution can allow accountants to communicate within the platform and attach notes and documentation. Whether finance teams are performing a traditional, in-office or a dispersed, virtual month end close process, the close cycle is being completed accurately and on-time.

Financial automation also greatly reduces organizations’ risk profiles. With an automated solution, company procedures and policies can be developed and standardized across separate entities and the entire organization. Accountants will not spend any more time trying to decipher another team member’s personal layout or risk errors in converting file formats or data transfers.

Another advantage of financial automation is its compatibility with the Cloud so teams can access all required data in one centralized location, as well as the capability to back-up documentation. An automated audit trail saved in the Cloud allows management to track all tasks, supporting documents and commentary across the entire organization, saving time and expenses during an audit.

Transitioning from spreadsheets to financial automation allows for better close management of all entities across the overall organization in one centralized location. Track month-end close progress, as well as the progress of each task with the close. Automation also enables leadership to drill down into the details of the close such as where bottlenecks hinder the process, how many tasks are assigned to each team member and more.

Sixty-one percent of organizations across the U.S. already make extensive use of automation in several departments, especially finance and IT. These companies expect that automation will make them more competitive in their markets for many reasons.

First, the Cloud provides a more secure environment than many on-premise data centers. Second, financial automation has the ability to scale with your organization. With manual processes, as the company grows, the number of spreadsheets and binders continue to accumulate, creating more risk for error and compliance violations. Automation grows with your organization and creates cleaner, more standardized processes to reduce your compliance risk.

Lastly, companies that utilize financial automation have the advantage of the built-in analytics capabilities that accompany the software. As an organization grows, leadership looks to finance for real-time, actionable insights to drive critical business decisions. Companies that use financial automation worry less that their decisions are based on inaccurate data than those that have to worry that 90% of their spreadsheets contain errors, and might influence a bad business decision.

By 2030, the last of the Baby Boomers will have reached retirement age, making Millennials the largest generation in the U.S. workforce, with Gen Z following behind quickly.

While older generations might have been hesitant to implement newer technologies, studies have found that both Millennial and Gen Z employees expect a shift in the way their employees equip them to perform tasks. There is also an expectation in the use of technology consistent with this new generation’s personal life, a lower tolerance of the mundane, and a preference to make a meaningful impact early on in their contributions to an organization.

Additionally, factors such as job flexibility in location and hours influenced their decisions to join and stay loyal to organizations. Younger generations don’t want to work late into the night to finish reconciling an account or forgo a holiday to make headway on transaction-matching – privileges that accountants using spreadsheets constantly find themselves having to sacrifice.

For the office of finance, business insights are a critical part of how finance functions to enhance the overall value of the organization. In order to accomplish this, finance and accounting teams must invest in a tool that reports reliable analytics. Not only can leadership utilize these insights to drive the business forward, but the finance department requires the ability to pinpoint difficulties and opportunities within their month end close process, so it can be fixed or improved.

Though it stands to reason that the office of finance should be one of the first departments to adopt automation, data shows that accountants are among the slowest to implement. Finance and accounting teams’ risk-averse nature works against them in this case, as the benefits to shorten their month end close is typically overlooked. The same can also be said when it comes to cost: analysis continues to show that the cost of finance per revenue dollar is lower when the team is using technology to support the financial close.

Finance and accounting are integral components of every organization’s health, growth and future. Because their priorities over the last decade have shifted from budget monitors and number crunchers to a strategic partner, the financial tools they use should better equip them to fulfill those roles. Traditional close approaches are not capable of providing a solid foundation for finance teams to support the entire organization.

Finance teams that transform their financial processes by implementing automation experience:

Switching from spreadsheets and binders to financial automation is a crucial decision for the future of your organization. Equipping your finance and accounting teams with the proper tools ensures that not only will your accountants be able to perform their responsibilities with excellence, but will set your organization up for success.

Darren Heffernan joined Trintech in 2001 and is President of the Mid-Market. He has been in finance/operational roles for over 25 years, is a fellow of the Association of Chartered Certified Accountants, and sat on the Financial Executives International’s (FEI) Committee on Finance and IT (CFIT).

The disruption brought on by COVID-19 thrust marketers into a new reality and environment...

by Kaitlyn Carpenter

by Kaitlyn Carpenter

Most sales teams think they’re giving buyers everything they need: the right decks, demos, and...

.png) by Devyani Mehta

by Devyani Mehta

Content marketing continues to evolve into new forms of media every year.

by Holly Landis

by Holly Landis

The disruption brought on by COVID-19 thrust marketers into a new reality and environment...

by Kaitlyn Carpenter

by Kaitlyn Carpenter

Most sales teams think they’re giving buyers everything they need: the right decks, demos, and...

.png) by Devyani Mehta

by Devyani Mehta