July 31, 2020

by Andy Golden / July 31, 2020

by Andy Golden / July 31, 2020

We’re all familiar with the story of Goldilocks, right?

If not, it’s the tale of a girl faced with the choice between three sets of options, and spoiler alert, she ignores the two extremes (too hot, and too cold) in favor of the middle option that is “just right.”

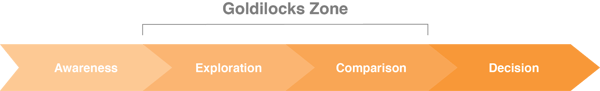

Think of a typical B2B buyer’s journey like the three options facing Goldilocks. At one end, a buyer might not fully understand the problem they are trying to solve, or might not be ready to enter into a sales cycle with any company. At the other end, a buyer who has already made up their mind about which technology or vendor to purchase from is unlikely to be swayed by even the best sales pitches. But a company that falls in the middle, now there’s the sweet spot.

In this article, we’ll discuss what intent data is, how to gather it, and finally how to use buyer intent to see which accounts are just right for your sales and marketing teams to target.

Today’s B2B buyer journey is not a perfectly linear progression, and often includes a multitude of smaller stages and frequently results in the buyer flipping between stages. However, looking at the larger picture, there are still distinct steps every buyer goes through during the process.

Awareness: This is the beginning. A buyer might not even fully understand the problem they are facing just that something is not working like it should. This is where they begin researching their specific problems and start forming a picture of the solution landscape.

Exploration: Once the buyer has recognized their problem and they’ve done a bit of research into possible solutions, they will have a much clearer idea of the criteria they want in a solution and how it would fit into their organization and department’s processes. Maybe there are certain features they need, or a budget they have to work with, whatever their parameters are, they will evaluate any potential vendor against their criteria.

Comparison: In this stage, they have narrowed down their search to only a few possible vendors, and now it’s just a matter of finding the right one. The buyer might be engaged in trials with multiple vendors at once for comparison, and one vendor will be crowned the winner.

Decision: This is the home stretch where the buyer presents their findings to the decision-maker or buying group and, barring some unforeseen catastrophe, will very likely complete their purchase with their chosen vendor. However they might still be doing some last minute shopping around to get a better price from the vendor they’ve already chosen.

However, as priorities change and budgets are reallocated, decision-makers are brought into the conversation, the number of prospects that progress through the stages diminishes. Prospects will be lost to competitors, change their minds, or simply go radio silent.

Here are some stats that can put this into context:

This list of stats could go on, but you get the idea. B2B buyers are doing more research and making more decisions on their own before reaching out to a vendor. So if a sales team is solely reliant on inbound leads reaching out to them on their own, they could be ignoring a huge segment of interested accounts and missing out on potential revenue.

The companies in the “Goldilocks Zone” are ones that you need to be talking to. They understand they have a need or problem and are actively seeking information about ways they can solve it, but at the same time, they have not yet made a purchasing decision.

However, these accounts are also researching your competitors as well, making it much more crucial for you to make the first move and gain an advantage in the sales process. Of course, this is not to say you can’t or shouldn’t sell to companies outside this sweet spot, but these engaged companies should be considered high-value low-hanging fruit in comparison to companies outside this stage.

So, how do we find these companies? And more importantly, how do we tailor our outreach to resonate with these companies at different stages of the buying cycle? By using intent data.

Intent data is information collected about a person’s online behavior that indicates that they are somewhere in a buying process. This information can include anything from content downloads to website pageviews, social media interaction, etc. However, for the sake of simplicity, we will focus on only first-party intent data – meaning data that you yourself collect from your website.

First-party intent data is generally collected by one of two methods:

Once you’ve got your preferred tracking method picked out, setting up an account scoring model is the key to discovering which companies are perfect for a sales or marketing outreach.

Once the implementation process is complete and the first-party intent tracking method is running on your site, you’ll quickly start to see which companies are showing elevated levels of interest. These companies can be added to various sales or marketing campaigns depending on the different scoring models you have set up.

If you really want to get fancy, you can set up different campaigns depending on the specific content they engaged with, which will allow you to hyper-target your messaging and cut out a lot of the preface involved in the first few touches with a potential buyer.

Here’s what it could look like:

Ok, so now you've got the general idea of what account scoring looks like; let's see how it works in practice.

For this example, here’s what our scoring model will look like:

We'll say the green-light threshold for a marketing campaign is 25 points, and the threshold for a sales action is 55 points. This is why a contact form fill or free trial sign up is 55 points – if a visitor has reached out, or is interested enough to start a free trial, they should automatically receive a call or an email from a sales rep.

Now let's compare a few different companies that visit your website:

In this case, Company A has not shown enough interest yet to be placed in a marketing campaign, nor have they hit the threshold to warrant a sales outreach. We can look at this visitor as being “too cold." This visitor might be in the early stages of their search and need more time to reach the point where either action makes sense.

In this example, this account has hit the threshold for adding them into a marketing campaign. We can think of this visitor as being “just right” for a marketing outreach, and we can assume they are reasonably interested in your product offerings. While this account might not necessarily be ready yet for a call with a salesperson, they are at least on some level looking to your company as a thought leader (evidenced by the whitepaper downloads), and could be swayed by more marketing content.

First off, even though this account has not reached out directly, it’s safe to say they are interested in your offerings. Depending on how you’ve set up your scoring model, this account may go directly into a salesperson’s hands for a follow-up or, at a minimum be added to a marketing campaign. Maybe the visitor is looking at a solution that isn’t a good fit for their company and could benefit from a salesperson reaching out and suggesting a different product that would provide more value, or maybe they’re on the right track and just need more marketing content to get them excited. Whatever action you choose, you’ll be able to go into it knowing you’re talking to a receptive audience.

Company D would fall under a special case in this example. Even though they have had less overall action on your site than Company B or Company C, they have reached out directly and thus should bypass the entire marketing process and be passed directly onto the sales team. While this is the exception to the rule, you should have a system in place to handle inbound leads if you don’t already.

Filling out a contact form in order to receive a piece of gated content is NOT the same, and should not be given the same weight. While engaging with gated content might be a good signal of intent, filling out a contact form should warrant a touch from a salesperson directly as they basically stood up and said, "I'm interested, tell me more."

Much like the decisions facing Goldilocks, many potential leads out there are either too hot or too cold, and unfortunately, we can’t simply rely on our target accounts to raise their hands when they are interested.

But by leveraging first-party intent data tracking on your website you can gather valuable information about which companies are in the market and what they’re looking for. With this data at your fingertips, you’ll be empowered to take action on more potential leads and target those accounts that are “just right".

Andy is a Content Marketing Specialist at KickFire, where he brings his passion for creative writing to the ABM space. In his free time you’ll find Andy surfing, hiking, or planning his next trip.

Marketers today rely on data-driven approaches to engage prospects. You yourself may have...

by Bikash Thokchom

by Bikash Thokchom

Millennials are leading companies to look online for goods and services instead of traditional...

by Sarabeth Lewis

by Sarabeth Lewis

B2B buying behaviors are constantly evolving, with review sites – like G2 – playing a more...

by Palmer Houchins

by Palmer Houchins

Marketers today rely on data-driven approaches to engage prospects. You yourself may have...

by Bikash Thokchom

by Bikash Thokchom

Millennials are leading companies to look online for goods and services instead of traditional...

by Sarabeth Lewis

by Sarabeth Lewis