October 21, 2024

by Grace Pinegar / October 21, 2024

by Grace Pinegar / October 21, 2024

As interest rates fluctuate and inflation affects everyday costs, understanding how to take out a loan is more critical than ever.

Whether you're seeking funds for education, a home, or a new business venture, knowing your options can save you thousands in the long run. Unfortunately, lending institutions can prey on the vulnerable, which is why I’m here to explain the process to you beforehand.

Generally, you should begin by checking your credit score, as a higher score can improve your eligibility and the terms offered. Then, shop around and get pre-approved by comparing options from various lenders, such as banks, credit unions, and online platforms. If you face problems in getting loan approval, it's best to work on improving your credit score.

Tools like loan origination software can simplify the application process, making it faster and more transparent. But with multiple types of loans available, from personal and auto loans to mortgages and business loans, it's crucial to know how to choose the right one for your specific needs and circumstances.

This guide will equip you with the knowledge to make informed borrowing decisions that align with your financial goals.

The type of loan you need will directly influence the paperwork you fill out, your repayment plan, and the repercussions of missed payments.

Let’s go over the types of loans from which you can choose, as well as how to apply for or “take out” each.

Did you know that, as a public servant, you may qualify for public service loan forgiveness?

Personal loans are for individuals who would like help paying off an item or items of relatively low value—low when compared to, say, a home. You might get a personal loan if you wish to pay for a nice new gadget or, in the case of those living in the US, pay off a hospital bill.

Those wanting to apply for a personal loan should first assess their credit to determine if they qualify. If their credit score is low, they may want to take steps to build it up before they seek out a personal loan.

Once you know your credit score, you can check a loan calculator to pre-determine what you might qualify for. Pick out a lender and see if they’ll pre-qualify you for a loan. This helps you determine which lenders are likely to say yes before you go through with the entire loan application process.

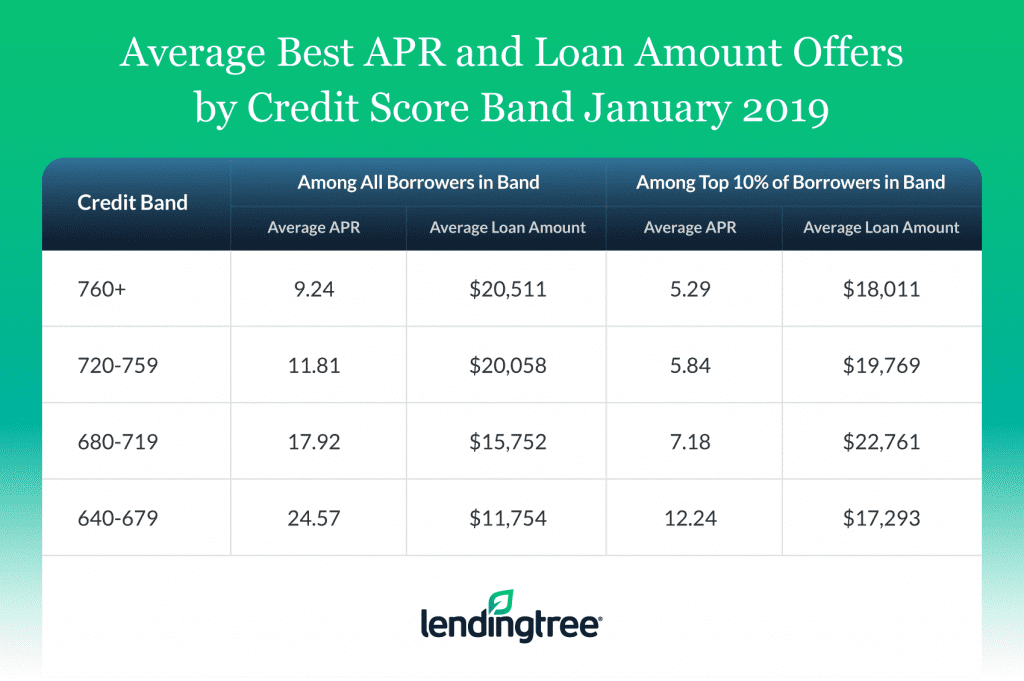

Image courtesy of LendingTree

Once you’ve pre-qualified for a personal loan with a few different lenders, compare the offers they’ve given you. Be sure to research the loan options at your local credit unions and banks as well, as their offers might be even more attractive.

Before choosing a lender/loan, make sure all the details are to your liking. Questions to ask yourself are: does this lender require automatic withdrawals? How flexible are their payment options? Are there any penalties for paying off a loan early?

Once you’ve approved all the fine print, it’s time to continue with the application process. You’ll typically have to provide identification, proof of address, and proof of income. The lender will check your credit score, and you should have your funds within a week after that.

Credit card loans, which are just the act of owning a credit card in your name, are for anyone who wishes to open a line of credit. People often do this to improve their credit scores, reap the rewards a certain credit card offers, or as a riskier strategy to pay for expensive purchases they don’t have all the money for at that time.

You get a credit card loan simply by applying for a credit card and getting approved. You can apply at banks, online, over the mail, and at stores that offer their own credit card, to name a few places.

In order to get approved for a credit card, you need to have a good credit score. This seems counterintuitive since you may be applying for a credit card in order to improve your credit score. Hopefully, you’ve been able to build up credit in other ways, such as by paying bills and loans on time.

If you’re rejected, you have a couple of options. You can call the card issuer and ask for them to reconsider your application. If they say no, your other option is to wait six months and apply again after you’ve taken steps to increase your credit score.

Home loans are for people who are ready to purchase a home. This type of loan is commonly referred to as a mortgage. Mortgages are long-term loans of great value.

In order to apply for a home loan, you have to really have your ducks in a row. A good place to start is with a mortgage calculator. This will help you take the first steps to determine the price range of homes you can afford.

Among other details, anyone hoping for a loan this big will need to inform their bank of their:

Much like other loans, prospective homeowners can get pre-approved by lenders, which gives them the opportunity to shop around for the best loan offer. The standard mortgage is a 30-year loan with a fixed rate.

Image courtesy of RefiGuide

Once you’ve been pre-approved, you can choose the lender you want to use and continue with the application process through them.

The thing with mortgages is that many institutions simply won’t lend to you if you don’t have a sizable down payment and money for the closing costs. It is nearly impossible to purchase a home completely through borrowed money.

If you get denied at first, set up a savings plan and try again once you have enough money to pay for at least 20 percent of the home out of pocket.

Unsurprisingly, small business loans are available to anyone trying to begin a small business. They are either awarded by the Small Business Administration (SBA) or a local bank.

Banks and lenders only want to grant loans to people they know will pay them back. For this reason, it is rather difficult to get a small business loan, especially if you or your business has no history of success.

In order to get a small business loan, you’ll have to ensure you have good credit. If you don’t, you should spend time working to improve your credit. You should also research local lenders. As a small business, you may have better luck seeking approval at a smaller, local bank.

Before seeking out a small business loan, make sure you have written up a business plan. Lenders will want to see this to help decide if you’re worth their investment. It is also wise to make a presentation of your business plan so you can physically show lenders how well-thought-out your plans are.

Once you’re ready, make an appointment with a loan officer to whom you can make your case. Be sure to include an executive summary with your business plan so they can skim over your work to understand better what you want to do.

From here, it’s really up to you to make the best argument for your business and for the loan officer to believe in you.

Related: Learn more about UCC filings and how they affect your business.

Auto loans are for any person looking to purchase a motor vehicle.

In most instances, you get an auto loan approved through your bank or bank of choice. As with all other loans, the first step is to check your credit score to make sure you’re up to snuff.

Following that, you should look to get pre-approved for auto loans from online lenders. This will help you figure out what a bank would be willing to give you. After you’ve been pre-approved, determine a monthly payment that should be less than ten percent of what you take home each month.

Next, you should go car shopping and compare dealership offers with what the bank can give you.

Student loans are reserved for anyone seeking education from an accredited institution after high school.

Typically, students apply for student loans through FAFSA.ed.gov. FAFSA loans students a sum of money based on their need.

If the federal government does not award you enough student aid to make school affordable, you can try to go through a private lender. Check out some of the best private student loan lenders.

You will likely need someone to co-sign on these loans, as anyone entering into undergrad probably does not have a lot of credit built up. It is worth saying that student loans are a huge scam industry, and there are a lot of fake loan sites out there eager to steal your personal information.

For this reason, it’s best to go through the federal government or a trusted lending institution.

A secured loan is an alternative option for obtaining a loan, as it typically offers lower interest rates in exchange for providing collateral as repayment assurance.

The most commonly used option is a loan with a car as collateral. If you're a car owner, you can use your vehicle's title as a pledge and get the needed amount to cover your education-related needs. Just make sure to choose a trusted loan provider.

Before applying for any loan, asking the right questions can help you avoid financial pitfalls and make informed decisions. Here are five essential questions to ask:

The total cost goes beyond the loan amount. You need to factor in the Annual Percentage Rate (APR), which includes interest and any associated fees. For example, a loan with a low interest rate but high fees may cost more than a loan with a higher rate and no fees.

Be sure to ask for a breakdown of all costs and compare the APR rather than just the interest rate, as it provides a clearer picture of what you’ll pay over the life of the loan.

Some loans come with prepayment penalties—fees for paying off your loan early. While it might sound strange, lenders sometimes impose these penalties because they miss out on interest payments when you repay a loan early.

If you plan to pay off your loan ahead of schedule, confirm whether this will trigger any additional charges. Avoid loans with prepayment penalties if possible, as these could increase your total costs.

Consider your monthly income, current expenses, and how much room you have in your budget for additional payments. Just because you qualify for a loan doesn’t mean you can comfortably afford the payments.

Review the loan’s monthly repayment terms and ensure you have a budget buffer. Ask yourself: "If my financial situation changes, will I still be able to make these payments?"

Missing a payment can have serious consequences, including late fees, interest rate hikes, or damage to your credit score. Understanding the penalties beforehand helps you avoid surprises.

Ask your lender about their grace period policy, how they report missed payments, and whether they offer any deferment or forbearance options for unexpected financial difficulties.

A loan may not always be your best option. Consider alternatives like lines of credit, credit unions, or buy now, pay later (BNPL) services, which may offer better terms for specific needs.

Evaluate all available options and ask about flexibility in loan terms, like repayment plans or refinancing opportunities. Don’t settle for the first loan you’re offered.

Debt is scary, but the truth is, it’s a necessity in the society we’ve invented. You need to be able to go places, but few people have all the cash for a car sitting in their savings account.

Be smart about any type of loan. Talk to friends or family about their experiences borrowing money and see if they have any suggestions. Don’t take out loans unless you have to, but stay informed if you do.

Check out some other ways to secure business funding for your dream project.

This article was originally published in 2019. It has been updated with new information.

Grace Pinegar is a lifelong storyteller with an extensive background in various forms such as acting, journalism, improv, research, and content marketing. She was raised in Texas, educated in Missouri, worked in Chicago, and is now a proud New Yorker. (she/her/hers)

Running a small business is no easy feat. Just when you think you've got everything under...

by Ashley Knierim

by Ashley Knierim

All small businesses and startups began with a great idea. For many, the next step was to...

by Maddie Rehayem

by Maddie Rehayem

Put on your best suit and browse those financial statements.

by Mary Clare Novak

by Mary Clare Novak

Running a small business is no easy feat. Just when you think you've got everything under...

by Ashley Knierim

by Ashley Knierim

All small businesses and startups began with a great idea. For many, the next step was to...

by Maddie Rehayem

by Maddie Rehayem