July 23, 2019

by Lauren Pope / July 23, 2019

by Lauren Pope / July 23, 2019

You’ve found your calling to serve the greater good. But, how exactly will you pull it off?

If you’re thinking about starting your own nonprofit, you’re not alone. Nonprofit statistics show that the nonprofit sector is growing faster than ever before. But starting a nonprofit takes a lot more than just collecting donations and dropping canned goods off at the local food bank. It’s a business that takes time, effort, and careful consideration to execute.

|

Looking for specific information about how to start your own nonprofit? Click the links below to jump ahead: |

Starting your own nonprofit is not easy. Although the industry is different from your traditional for-profit model, it takes just as much hard work and attention to detail to pull-off. Before you dive head-first into creating your own nonprofit, there are some things you should consider first.

|

What questions should you ask yourself before starting a nonprofit?

|

While the idea of starting a nonprofit is exciting, you need to consider the practicality of your business venture. You wouldn’t open a cupcake shop in a town that already has 30 bakeries, and you shouldn’t launch a new nonprofit if the needs of your community are already being met by other organizations.

If you’ve reviewed the questions above and are still convinced your nonprofit will offer a unique benefit to your community, keep reading!

The number one reason new businesses fail is because not enough time was spent on the planning process. If you want your nonprofit to succeed, you’ll need to create a solid foundation to begin with.

|

What do you need to start a new nonprofit?

|

The IRS is less likely to approve 501(c)(3) tax-exemption to a business that doesn’t have it together. Doing all of this work before you proceed with the process will show potential donors, investors, and volunteers that you have a plan and that they can trust you.

It’s important to remember that your nonprofit is a business, and you need to treat it like one. One simple way to achieve your goals of starting your own nonprofit is to create a business plan.

A business plan is a formal document that outlines the goals of your business, a timeline for when they need to be achieved, and includes other elements such as the background of your business, financial projections, and your organizational structure.

Your business plan is your ultimate marketing tool. You can use your business plan to attract investors, donors, and potential board members. It shows you’ve done your research and have built a solid foundation for your business.

|

There are eight key things your business plan needs to include:

|

There’s no required length that a business plan needs to be. It could be a single page or it could be twenty! The important thing is including all the necessary details for your nonprofit. Once you have all of that mapped out, you can move onto securing the funding for your nonprofit.

You know the old saying: you’ve got to spend money to make money.

The same is true for starting your own nonprofit. Before you can start helping other people you need to make sure you have the funds to keep your business afloat. Understanding where you can find and recruit investors is the key to a good business funding strategy.

|

What are some common ways nonprofits fund their business?

|

Just how much money should you have upfront? According to the U.S. Small Business Administration, most micro-businesses cost around $3,000, while most home-based franchises cost $2,000 to $5,000 to start. For someone looking to start a nonprofit, saving at least double what you expect to need is a sure-fire way to cover your bases.

The Alzheimer’s Association. Boys and Girls Club of America. Habitat for Humanity.

What do all of these nonprofits have in common? Names that pack a punch. When you hear any of these nonprofit mentions, you know exactly what nonprofit we’re talking about, what they do, and who they serve. That’s because they’ve cleverly chosen a name that makes an impact.

Your nonprofit needs to pack the same punch in order to stand out from the crowd. There are more than 1.5 million nonprofits in the United States alone and many are competing for the same donors and grants. Something as simple as name-recognition could help you more than you know.

| Tip: Struggling to craft the perfect name for your nonprofit? Check out this article on how to create your own business name. |

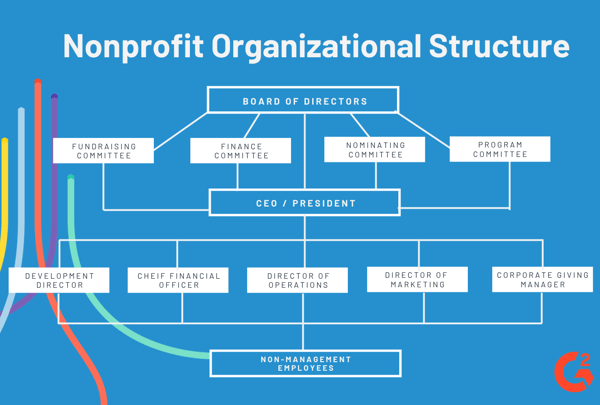

At any company, your board of directors is a key piece of corporate governance.

And for nonprofits specifically, the board of directors is one of the most important aspects of your business. Above any director-level employee or even the CEO themselves, the board of directors governs a nonprofit. Individuals who sit on the board are responsible for overseeing the organization’s activities, fundraising, strategic direction, and more.

You cannot incorporate your organization or file for tax-exempt status without an established board of directors. Not only that, but your board of directors can make or break the success of your nonprofit.

It’s in your best interest to stack your board of directors with other nonprofit professionals. They have experience, connections, and advice that can help you avoid the growing pains of being a small nonprofit. In the business world, connections are everything. Having the right board behind your nonprofit can help your organization soar.

This is the first big step your organization will take to becoming recognized as a legitimate nonprofit. Incorporation is required if you’re hoping to eventually file for tax-exempt status. Just in case you’re unfamiliar with the concept of incorporation, let’s break it down simply.

Incorporation is the legal process used to separate an organization or business from the owner. When you incorporate your business, you are putting legal distance between yourself and the business. It protects both the owner and the business itself should something happen to either one down the line.

|

Here are the steps you need to take before incorporating your nonprofit:

|

Remember how we said doing the work up front will pay off in the end? If you’ve followed the steps listed above correctly, you should already have everything you need to file for incorporation. Once you’ve successfully incorporated your business, it’s time to file for tax-exempt status!

It’s important to note this next step is not required of all nonprofits. Only nonprofits that qualify as 501(c)(3) can file with the IRS for tax-exempt status. If you’re curious whether your organization qualifies, you can check the IRS website for more information.

Once you’ve determined your organization qualifies as a 501(c)(3) nonprofit, you can file File Form 1023 for tax-exempt status. You will need to send this form via the post-office, and there is a waiting period before approval.

According to CharityNet USA, the IRS receives about 80,000 applications for nonprofits annually. With that volume of applications annually, it could take anywhere from a couple of months to a full year before you hear back about your application.

|

There’s a lot we didn’t cover about filing for tax-exemption status in this section. You can find the answers you’re looking for in our FREE FAQ. |

No, you can’t start a nonprofit without money.

Remember, a nonprofit is still a business, and it takes start-up money to get a business off the ground. Even if you plan on running your nonprofit solely on grants and donations, there’s still a lot of up-front costs associated with getting your nonprofit started.

You need money to start a nonprofit, but how much? We mentioned earlier in the article that it’s always smart to have more money than you think you’ll need. There are a couple of reasons for that but the main one being it’s always smart to have savings in the event of unexpected fees and costs.

|

As for the expected costs, here are some of the things you can expect to pay when starting your nonprofit:

|

As you can see, there’s a cost associated with starting your own nonprofit. Be sure you have the necessary funds saved before you begin the process. Nothing would be more discouraging than getting halfway through starting your own nonprofit and then running out of money.

|

You need more than money to start a nonprofit, you'll need the right software. Check out the best nonprofit software on the market. |

It takes more than an altruistic desire to help people to start your own nonprofit. You’ll need the perfect mix of funding, support, and business savvy. Don’t worry, though. Every big dream starts with a small first step.

Ready to put what you’ve learned into action? Read our piece on how to register a business and check out these small business tips from people who have been there before!

Lauren Pope is a former content marketer at G2. You can find her work featured on CNBC, Yahoo! Finance, the G2 Learning Hub, and other sites. In her free time, Lauren enjoys watching true crime shows and singing karaoke. (she/her/hers)

The world of nonprofits can be a confusing place for anyone not familiar with the terminology.

by Lauren Pope

by Lauren Pope

Ok Google, show me the best ways to market my nonprofit.

by Lauren Pope

by Lauren Pope

Nonprofits? Charities? What’s the difference?

by Lauren Pope

by Lauren Pope

The world of nonprofits can be a confusing place for anyone not familiar with the terminology.

by Lauren Pope

by Lauren Pope

Ok Google, show me the best ways to market my nonprofit.

by Lauren Pope

by Lauren Pope