November 13, 2020

by Manaswini Rao Kaki / November 13, 2020

by Manaswini Rao Kaki / November 13, 2020

Expense management is a process that is often described as time-consuming, laborious, error-prone, and frustrating. Yet it plays a crucial role in maintaining your company's bottom line.

By definition, expense management is a system of organization deployed for processing expense reports, approvals, and employee reimbursements.

However, further into the read, you will see how the nitty grits of expense management could make or break businesses of any size if left unattended. This article talks about why companies must pay closer heed to expense management and its benefits.

Expense management has different implications for different stakeholders. For finance teams, the main focus is to maintain accurate records and financial planning. For employees, it is to get reimbursed faster and with minimal friction. For owners or management, it is about growth, productivity, risk management, cost-saving, and employee satisfaction.

Here are some perks of paying heed to expense management:

The expense management process involves the following:

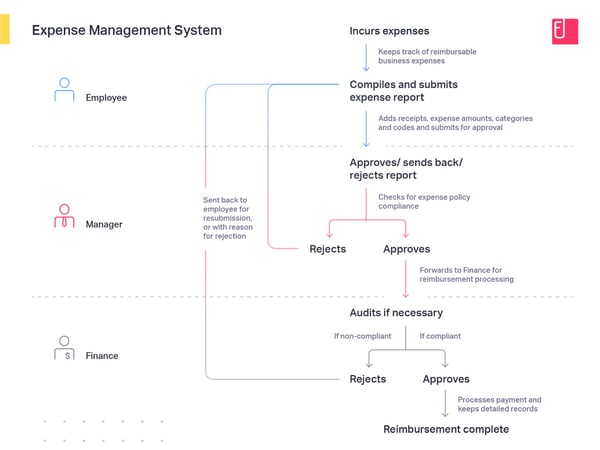

Here’s a flowchart to help you visualize the process:

It looks quite simple, but in reality, there are challenges at each step of the process that pose severe threats to the business’s stability and growth if not done right. Thus, it is essential to understand these challenges to build an efficient expense management system.

Added to being time-consuming and labor-intensive, the expense management process is riddled with challenges right from when you set up policies till reimbursements are processed. And then some more. Here are the three most common challenges in expense management.

The cycle of expense reporting starts from the employees, and with unclear expense policies, the first step is where the trouble begins. Especially because expense reporting is always a last-minute job, and it is dreaded by all.

Problems employees face with unclear travel and expense policies:

As in the case of travel and expense policies, if the approval workflow is not well defined, the expense report might just not reach the right person and in the right time frame. This causes frustration, confusion, and delays in reimbursing employees for the money they spent from their pockets for your business.

Problems employees and finance teams face with inefficient approval workflows:

Expense reimbursements are a lengthy and tiresome process. Be it the multiple back and forths between employees and finance teams or the colossal amount of manual data entry, verification, and processing – nobody likes expense reporting.

Additionally, delayed employee expense reimbursements lead to:

Delays, errors, frauds, and painful audits are characteristic of traditional expense management. This is businesses, small and large, turn to more effective methods of managing expenses.

Traditional expense management processes rely on paper-based receipts and records. To paint a picture, this is what a traditional expense management system looks like:

An upgrade from paper-based accounting was Excel-based accounting. However, both systems are time and labor-intensive, relying solely on manual data entry and verification. Here are some challenges and limitations of traditional expense management:

Automated expense management software use features designed specially to eliminate all mundane tasks involved in financial reporting. This helps remove the frustration behind manual expense reporting.

Besides making expense reporting and tracking a breeze, here are some other benefits automated expense management brings with it:

A switch from paper and Excel-based expense reporting to digital can be a significant transformation for businesses. Here are a few benefits automated expense management offers over traditional expense management.

Switching to automated expense management takes over manual, error-prone, and time-consuming tasks and helps businesses boost financial performance, employee productivity, and optimize their budget management.

Expense management software is designed to automate travel and expense management-related processes, including expense reporting, approvals, reimbursements, and travel bookings. An automated expense management process minimizes risks that are usually characteristic of traditional expense management. Here are a few advantages of using an expense management software organized by stakeholders.

For employees, it offers:

Most expense management software offer easy business receipt tracking options to reduce the time and effort employees invest in expense reporting. The most salient expense reporting feature is the Optical Character Recognition (OCR) scanner found in almost all expense management mobile applications.

This feature allows employees to simply take a picture of the paper receipt using the OCR scanner. The software then auto-populates expenses details from the captured image, all ready to report. This ensures that a truly one-click experience replaces the otherwise tedious manual expense reporting process.

An automated travel and expense management software makes it easy for employees to submit compliant expense reports. It also eliminates the need for constant back and forths between stakeholders to ensure timely expense report submissions, approvals, and employee expense reimbursements.

For approvers, it offers:

With an expense management software, there’s no need for managers or approvers to respond to “could you please point me to the right person” emails. Once the workflow is fed into the system and policies set, you could even set automatic report submission reminders and auto-approve reports and eliminate bottlenecks in the expense approval process altogether.

As managers, department heads, or the finance department, there are better and more important things you have to do than verifying expense claims against policies. An expense management software automates policy checks and alerts you about any violations. This enables you to take appropriate action and without wasting productive hours on verification.

For finance teams, it offers:

A while ago, when corporate cards were all the rage, they felt like the ultimate solution to managing business expenses. Only finance teams know the pain of matching credit card statements to bills and then auditing them for compliance.

An expense management software can be a real boon when it comes to credit card reconciliation. The software automatically matches expenses, receipts, and transactions, erasing manual intervention from the equation. It also integrates with credit card providers to get direct feeds on the expense management dashboard. This helps finance teams get real-time insight into where exactly the spend is happening instead of just the information that spend is happening.

Expense management software maintains detailed digital audit trails for each expense and all stakeholders’ corresponding actions. This makes it easy for Finance teams to audit expense reports before processing reimbursements. This also eliminates the need for storing stacks of paper receipts and worrying about their safekeeping.

An expense management software integrates your existing ERP, accounting, HRMS system, and bank portals. This allows you to bring all employee and expense data to a single platform and initiate payments right from your expense management dashboard. Further, it will enable you to track payment progress, ensuring you are always in-the-know of things.

All expense receipts attached to expense claims are stored in a secure and searchable cloud. This makes it easy for finance teams to search for any expense, receipt, or report using filters. The next time you sit for an audit, there won’t be an hour of awkward silence between you and the auditor while you sort through heaps of reports to find the one the auditor asked for.

An expense management software offers real-time visibility and insight into employee spending across the organization or multiple organizations. These insights are made available on your expense management dashboard, where you can view spend by departments, projects, categories, and more.

Real-time expense data insights will help you optimize spends whenever and wherever necessary. It also ensures you’re sticking to the predicted/allocated budgets. Additionally, insight into historical data enables you to analyze your organization’s financial needs better to make data-driven decisions.

Data security is a massive concern with anything that involves software. A good business expense management software adheres to industry-standard security measures to ensure your data is always safe. They also offer features like role-based access, IP based access, and auditor-access to ensure different stakeholders with different roles only have access to data you decide to let them see.

An expense management software helps you automate the entire expense management system, save time and costs. It also helps reduce risks and frauds while boosting employee morale and overall profitability. If you’d like to check, strictly in terms of money, the RoI of an expense management software, here’s a free ROI calculator you can use.

If you used the ROI calculator we were just talking about, you’re probably convinced that an expense management software is worth the investment.

But automating your expense reporting is more than just ROI. You must pick an expense report software that suits your business needs. To help you through the process, we've compiled a handy checklist to help you select the best expense software options for your business:

Your chosen expense management software vendor should offer the following capabilities to ensure that you can automate every single step of the expense management process:

You must understand your organization's customer support requirements before you shortlist vendors. If you have frequent traveling employees, you might need a highly rated vendor with quick responses, active live chats, and timely customer support.

If you prefer having detailed how-to videos, documents, and other resources, ensure that your vendor can make such resources easily accessible for your team. This ensures quicker and easier adoption of newer technology.

Reviews from customers who use a software provide insight into their experiences post-implementation. These reviews play a crucial role in understanding whether a particular software is a viable product or not for your business.

Software review platforms like G2 simplify and fasten the process by rating software based on real user reviews across various platforms. They rate software based on different criteria such as ease of use, quality of support, ease of implementation, and more. This provides a trusted shortcut to getting your hands on the best expense report software to achieve your desired business goals.

The main ingredients for an organization's success are a seamless collaboration between teams with a constant rise in financial and employee productivity. This can be achieved by streamlining your expense management process to save time, effort, ensure accuracy and security, and provide valuable expense data insights.

Manaswini Rao Kaki is a Content Marketer at Fyle, a B2B expense management software company. When she’s not building brands, she’s off exploring pretty places and vibrant cultures or brewing a perfect cup of coffee. Reach her at manaswini.kaki@fylehq.com

Keeping track of expenses is a headache.

by Sudipto Paul

by Sudipto Paul

I know how delayed reimbursements can affect employee travel experiences and overall morale....

.png) by Shreya Mattoo

by Shreya Mattoo

It’s no secret that running a business is expensive.

by Rob Browne

by Rob Browne

Keeping track of expenses is a headache.

by Sudipto Paul

by Sudipto Paul

I know how delayed reimbursements can affect employee travel experiences and overall morale....

.png) by Shreya Mattoo

by Shreya Mattoo