September 29, 2025

by Nicholas Shaw / September 29, 2025

by Nicholas Shaw / September 29, 2025

In e-commerce, price isn’t just a number, it’s a signal of value, trust, and positioning.

For online shoppers who can compare dozens of options in seconds, your pricing strategy can make or break a sale. Whether you’re running a fast-growing DTC brand or managing a niche online storefront, choosing the right pricing approach is one of the most important decisions you’ll make.

Do you price based on your costs, your competitors, or your customers’ perceived value? The answer isn’t always obvious, and it’s rarely one-size-fits-all.

E-commerce pricing is a strategy used by online businesses to determine the prices of their products and services. The pricing is based on several key factors, including production costs, revenue goals, and the target market.

Online businesses often use e-commerce platforms to process online transactions, as this software serves as a unified hub for managing all operations related to online sales.

This guide breaks down five of the most effective e-commerce pricing strategies, how to evaluate which one fits your business model, and how to test and iterate over time.

You’ll also learn how to build your ideal customer profile, understand pricing psychology, and connect your unique selling proposition (USP) to your pricing decisions, all while balancing profitability with customer satisfaction.

Before choosing a pricing strategy, it’s crucial to understand the core factors that shape pricing decisions in e-commerce. These variables influence how customers perceive value and decide whether your prices are competitive and sustainable.

Balancing these factors ensures that your pricing strategy aligns with both your business objectives and your customers’ expectations, setting the stage for sustainable profitability and growth.

Based on the information above, we've compiled a list of the five best e-commerce pricing strategies to choose from. Any one of them may greatly benefit your business needs.

Cost-based pricing is one of the simplest strategies, with prices based on the cost of the product or service being sold. Take the basic cost of production and add a profit percentage to it, resulting in the total cost. So, if a product costs $15 to manufacture and ship to you, and you want to turn a 20% profit on it, you would simply add $3, making the final price $18.

It’s appealing because it covers production and overheads, and virtually guarantees a profit. This strategy has the benefit of predictable turnover, while stable prices can win trust, especially if you’re transparent about your pricing.

Cost-based pricing is divided into two types: cost-plus pricing and break-even pricing. The first method is a simple approach where a fixed percentage (or markup) is added to the production cost for one unit.

In break-even pricing (or target-return pricing), you determine how many units you must sell to break even, instead of marking up each individual unit.

Source: WallStreetMojo

Source: WallStreetMojo

The issue with cost-based pricing is that it fails to account for demand or competition. This means your prices may differ hugely from the market rate, so you could end up with products being sold for too much or too little.

The strategy could also lead to supply, manufacturing, and distribution inefficiencies. Since you’re passing those costs on to the customer, you may not concern yourself with streamlining processes and could miss opportunities to reduce costs.

Additionally, a cost-based pricing strategy largely ignores consumer behavior. If you ignore customers and their changing requirements, you won’t be able to tailor your offering to meet their needs.

For example, the state of the economy, online shopping trends, and personal circumstances can lead customers to change their buying habits. A more flexible pricing strategy could help you maintain awareness of fluctuations and respond accordingly.

A market pricing strategy involves companies setting prices based on the cost of similar products on the market, rather than demand or production costs. After analyzing competitor products, the retailer sets a higher, lower, or matching price.

This flexible strategy allows you to amend prices according to market demand. If your products or services closely match those offered by your rivals, a market pricing strategy can be effective and relatively low-risk.

You could decide to make your prices lower than average to attract cost-conscious new customers. This works well if you are able to reduce production and overhead costs to avoid shrinking your profit margin.

If you set a higher price than your competitors, you’ll need to justify the cost, usually by offering extra features or simply better quality. Similarly, if you match the retail price of the competition, you can set yourself apart by using clever marketing techniques that show your USP.

Market-based pricing is often used for cell phones and vehicles, where there’s not too much difference between available products. Another example is Disney+ and Netflix, whose plans are very similarly priced.

Obviously, this strategy means it’s essential to monitor your competition and stay aware of market developments at all times. Amazon, for example, reassesses its prices every 10 minutes to ensure they are always the cheapest.

Pricing intelligence involves gathering as much data as possible about competitor pricing decisions and using it to assess both current and future demand. You need to look at:

This data can be used to inform your own pricing decisions and gain a competitive advantage.

Market-based pricing is not without its downsides. It assumes your competitors have a sure-fire strategy and that you should follow their lead. But if they get it wrong, then you’ll get it wrong too!

If a large portion of the market uses the same strategy, the market will eventually lose touch with consumer demand as prices stagnate. Businesses risk becoming complacent, which leads to missed opportunities for expanding their customer base.

Although low prices can drive sales, too much focus on cost-conscious customers can have the opposite effect. And getting into a pricing battle can lead you to set prices way too low. Customers will then always expect the best price, but it may be unsustainable for your business.

Market pricing also focuses on competitor data, rather than customer value. We’ve already explored the importance of understanding your ideal customer and ensuring you add value to their lives, so it makes sense to market your products as valuable and desirable, rather than merely as inexpensive.

This will give you better long-term growth, instead of the short-term thinking involved in trying to undercut rivals. If you think you’re justified in offering a lower price, tell your customers exactly why your prices are fair.

Dynamic pricing is a proactive strategy in which businesses adjust their prices in response to changes in market demand. It aims to find the optimum price point at any time and is particularly suitable for a fast-paced environment like e-commerce.

Source: Prisync

Source: Prisync

Prices are based on variables such as competitor pricing and the customer's willingness to pay at a specific time. This strategy is also known as surge pricing, demand pricing, or time-based pricing.

Dynamic pricing is common in the hospitality and tourism industries, such as “happy hour” at a bar or seasonal fluctuations in airline prices. You will usually require some level of automation to ensure a fast response to market changes.

For instance, if your supplier gives you a discount, you could quickly pass this saving on to your customers by offering the item at a lower price for a limited time only. Alternatively, you could run a promotion aimed at shifting unsold stock and target specific customers through an e-newsletter.

With a wide range of products, you can sometimes employ a loss-leader strategy, where you offer lower prices on one item and sell others at a higher price. Selling items below market value can encourage customers to buy more overall, and give opportunities for upselling and cross-selling.

Dynamic pricing can be combined with market pricing to increase your competitive power. In addition to aligning prices broadly with your competitors, you can also remain agile enough to capitalize on market fluctuations.

Dynamic pricing does come with risks, such as alienating customers with ever-changing prices, being drawn into a price war, or failing to respond quickly enough to market changes.

Source: Businesswire

Source: Businesswire

If customers see a different price every time they visit your online store, they won’t know whether you’re a discount retailer or a high-end brand. They may start to distrust you, and visit competitors’ sites to compare prices.

You might find that savvy customers delay making a purchase because they know a price drop is imminent. Those who did buy from you might be annoyed to discover that if they’d waited a little longer, they could have gotten the item cheaper.

Dynamic pricing also requires time and effort to achieve the right results. You’ll need to constantly monitor market conditions and ensure your website is quickly updated to reflect the latest prices.

Larger retailers will benefit from automating the process, although that comes with a cost too. For the long-term sustainability of this strategy, consider repricing software that detects competitor price changes and market changes, and adjusts your prices instantly.

Bundle pricing is a common strategy in which retailers sell several complementary products as a single package. The bundled price is usually lower than the sum of the individual prices of the separate products.

The method is commonly used to sell techware, such as bundling a laptop with accessories, or beauty products, such as a complete skincare set. These are things the customer would buy anyway, but selling them in a bundle offers convenience and the pleasure of getting a bargain.

Other common uses of bundle pricing include mobile devices with integrated data plans, fast food meal deals, and batteries sold with children’s toys. As well as set packages, some retailers offer choose-your-own bundles, perhaps pointing out that it’s cheaper to buy all three books in a trilogy than to purchase them one at a time.

Although each item is technically sold at a discount, bundle pricing can actually increase revenue by simplifying the buying experience and leading to larger-volume purchases. Customers typically perceive the value of a bundle as greater than the sum of its individual products.

If you’re going to offer bundle pricing, be careful to create the right bundles. You could actually end up decreasing the value of certain products if you don’t package them in a way that’s useful to the customer.

Some customers prefer to make their own decisions. If an accessory is only available as part of a bundle they don’t want, those customers won’t buy it from you. And those who need the main product but not the add-ons might resist buying the whole package.

Bundle pricing can also lead to product cannibalization, resulting in a decline in sales. When you sell two items together, but also offer them separately, more of them will be sold at a discount via the bundle, meaning lower profits for the individual product.

Finally, when you bundle products and sell them at low cost, you might find it harder to sell them individually or at their original prices in the future. Make sure you’ve factored this in when choosing what items to bundle together.

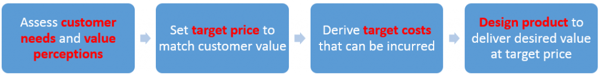

A consumer-based pricing strategy is when a company sets prices according to customers’ perceived value of its products and services. It aims to ensure that customers are willing to pay those prices based on the value they receive.

This is a customer-centric strategy that relies on ongoing research and customer communication. It’s also a great way to build brand awareness and loyalty by giving people what they actually want.

The two components of a consumer-based strategy are good-value pricing and value-added pricing. The first involves a combination of quality and service at a fair price. An example is budget airlines offering no-frills flights; customers expect less value but are happy to pay a price that reflects this.

Source: Marketing-Insider

Source: Marketing-Insider

Value-added pricing involves adding extra features to differentiate your product. You add value and charge more for it in return. For example, flying with a premium airline costs more, but customers are willing to pay for the enhanced experience.

Consumer-based pricing also gives you the flexibility to offer different pricing for different customers. Using segmentation data, you can discern who’s likely to buy what and when, and set prices accordingly. You’ll need to pay close attention to aspects such as shopping habits and social media use.

Personalized communication is an important part of knowing your customer and showing that you care about their individual needs. Offer targeted discounts and promotions; message them when a favorite item is back in stock; and keep an eye on who’s clicking your ads and emails.

Measuring customers’ perceptions of value is a challenging task. These perceptions are subjective and will vary for different customers and circumstances. Rapid changes in the market and in customer behavior will also affect the data, so you can’t take your eye off the ball.

You’ll also have to justify your prices against those of your competitors, which means ensuring your USP pulls its weight. It’s best to tell customers just why your products are the best in terms of value.

Because there is so much research and analysis involved, a consumer-based pricing strategy takes a while to get going. You could also lose money if you focus solely on what customers want without factoring in manufacturing, shipping costs, and marketing expenses.

| Strategy | When to use | Pros | Cons |

| Cost-based | For stable, predictable costs | Easy to implement, ensures profit margin | Ignores market demand, inflexible |

| Market-based | In competitive markets | Responsive to competitors, market-aligned | Risk of pricing wars, lacks customer insight |

| Dynamic | For high-volume or fast-moving inventory | Optimizes revenue in real-time | Can confuse or alienate customers |

| Bundle | For complementary product sets | Boosts AOV, perceived value | Risk of cannibalization or forced purchases |

| Value-based | For premium or niche products | Aligns price with perceived value | Time-intensive, hard to scale initially |

Not many shoppers start their research moments before a purchase. Most spend much longer visiting different sites and comparing prices. The right e-commerce pricing strategy can influence search engine optimization (SEO) and comparison engines, driving savvy shoppers to your site.

There are several popular strategies, as we’ll see shortly. But in e-commerce, there’s no such thing as one-size-fits-all. You need to figure out what appeals to your target market and pick a pricing strategy that fits your business.

Choosing a pricing strategy isn’t only about profit. It’s also about how you want to be perceived by customers: as a discount retailer, a high-end brand, or something in-between. There are e-commerce pricing strategies to suit all business models, and you can even combine a couple of them to maximize your appeal.

To start with, you need to pay close attention to customer behaviors and online shopping habits and gather data on how people prefer to browse and buy. Analytics software will help you identify key customer traits and pick a pricing strategy to match, while a digital operations platform can measure its success.

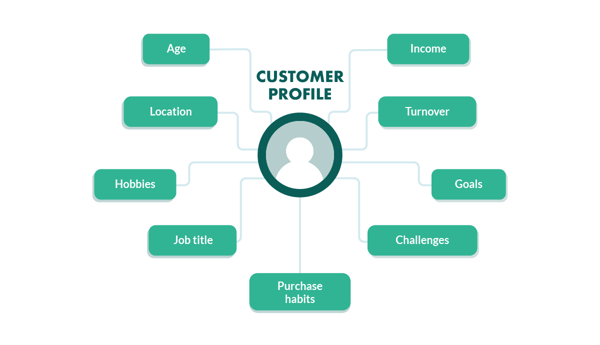

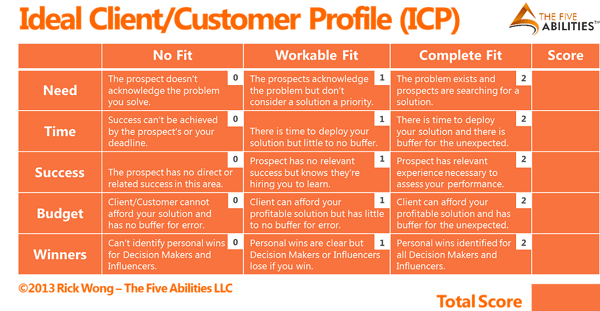

An ideal customer profile (ICP) is a hypothetical description of the type of company you want to sell to. You’re describing a business that’s highly likely to buy your products, stay loyal, and recommend you to others.

Source: SuperOffice

Source: SuperOffice

To build this profile, you need to identify specific characteristics of your ideal customer. An ICP typically contains “firmographics” such as:

An ICP should not be confused with a buyer persona, which describes the individuals within the company you’re targeting, defined by demographics such as role, function, seniority, and income.

In addition to increasing revenue by targeting the right customers, ICPs also help align your pricing strategy with the current and future needs of your customers. All departments or teams should have a shared understanding of who the ideal customer is.

Here are some steps toward creating an ideal customer profile:

Your ideal customer should already be in a position to buy your product, both in terms of desire and financial resources. Ideally, you want them to be a profitable, growing business and hot on networking so that they can extol your virtues to others.

New e-commerce companies can use market data to inform their profiles, while mature businesses will already have lists of customers who rank highly in terms of value and loyalty.

Harness data from existing customers with whom you’ve had successful interactions, and figure out what makes them a good customer and a good fit for your business.

Source: The Five Abilities

Source: The Five Abilities

Invite them to chat about why they value your services. Be honest about your reasons for asking; let them know that you intend to improve and that their opinions are invaluable. You could also offer an incentive for taking part.

Don’t forget to look at negative feedback, too! Think about times when the interaction didn’t go so well, and analyze customer data to find common themes.

Using this data, it’s time to identify patterns. You want to look for information about the type of high-value customers you want to attract.

Build a profile of their needs, responsiveness, and emotional connection with the brand. It’s also useful to add in their preferences, such as which communication channels they prefer, and which social media they use.

You should now have a clear picture of your ideal customer’s environment, pain points, and requirements. Use your ICP to assess new prospects by running them through a checklist to find similarities with happy customers.

In a crowded marketplace, it’s difficult for any e-commerce business to be truly unique. However, the key is to make at least one aspect of your service sufficiently different from that of your competitors. This is your unique selling proposition (USP).

A USP is the thing that makes your brand or product stand out, and gives customers a reason to choose you over someone else. It’s a way of communicating your values, and showing customers how you (and only you) can offer this particular benefit.

For example, you could sell handcrafted goods, limited-edition items, or offer a broader selection of products than your competitors. Other ideas include supporting a charity with your profits or committing to an ethical supply chain.

When all departments have a clear understanding of the USP, it becomes easier to determine a pricing strategy. If your particular service cannot be obtained anywhere else, you can charge a premium price. But in most cases, you’ll have to take competitor pricing into account.

Source: Shopify

Source: Shopify

Customer behavior refers to both their buying habits and the factors that influence the decision to buy. Analyzing these habits and beliefs will help you align your business with the customer’s mindset.

The digital world means that customer behaviors are changing at an increasingly rapid pace. There’s a demand for more speed, from efficient websites to next-day delivery options, bringing challenges for retail inventory management.

People have embraced online shopping for its convenience, as well as for lower prices. Customers are increasingly savvy about finding deals and are likely to abandon a purchase before checkout if they spot the same item for a lower price elsewhere.

That said, there are some behaviors that never change. For example, setting prices at $9.99 instead of $10 is still an effective concept in enticing customers, and having an attractive e-commerce website will give a high-quality, trustworthy impression.

Psychological pricing has several applications in e-commerce. For instance, if you offer two similar T-shirts at identical prices, consumers will find it difficult to choose. However, if one is slightly cheaper than the other, they are more likely to pick the cheaper item, as it seems like a comparative bargain. Similarly, placing premium products near cheaper options helps create a clearer sense of value for customers.

Even the smartest pricing model won’t work forever. Markets shift, customer preferences evolve, and competitors get more aggressive. That’s why testing and iteration are essential parts of your e-commerce pricing strategy. Instead of setting prices once and hoping for the best, you need to validate, refine, and optimize using data-driven experiments.

Think of pricing as a living system: it should evolve with your business goals, customer behavior, and market conditions. Here’s how to do that effectively.

Before you make any change, define what you expect to happen. A strong pricing test begins with a clear question: “If we raise the price of our premium plan by 10%, will overall revenue increase without reducing conversions by more than 5%?”

This approach turns experimentation into a science. Your hypothesis should be:

Clarity up front ensures you're not guessing whether a test “worked”, you’re measuring it against an expected outcome.

A/B testing (also called split testing) is a proven way to understand how price changes affect customer behavior, without committing to a full rollout.

Here’s how it works:

Track key metrics such as:

Avoid testing multiple pricing variables simultaneously; change only one element (e.g., base price, bundle offer, or discount amount) to obtain cleaner, more actionable data.

Price elasticity helps you understand how sensitive your customers are to changes in price. The formula is simple:

Elasticity = (% change in quantity demanded) ÷ (% change in price)

If a small price change has a dramatic effect on demand, your product is highly elastic (like consumer electronics). If demand barely shifts, it’s inelastic (like niche, collectible, or luxury items).

Use elasticity testing to categorize your products based on their sensitivity and establish dynamic pricing rules accordingly.

Don’t just watch conversions, evaluate deeper indicators of pricing health. For example:

By monitoring these signals, you can prevent short-term wins from turning into long-term losses.

After every test, record what you changed, what you observed, and what you’ll try next. Over time, these insights become your in-house pricing playbook. Review your pricing strategy on a monthly or quarterly basis to ensure it remains effective. Consider seasonal trends, competitive shifts, and customer feedback to inform your decisions. Don’t assume what worked once will work forever. Retesting is how pricing stays relevant and profitable.

Run controlled A/B price tests on a small % of traffic (e.g., 10–20%). Plot demand vs. price to estimate elasticity. Watch contribution margin, not just conversion. Repeat by category/segment, elasticity isn’t universal.

Adopt a Minimum Advertised Price (MAP) policy if you have resellers. Monitor marketplaces and enforce consistent policies (warnings → penalties → supply suspension). Use MSRP as an anchor, but price to your positioning and costs.

Anchor around planned moments (seasonal, new-customer, clearance). Keep sitewide promos rare; favor targeted offers (email/SMS, loyalty tiers). Track “promo dependency” by watching lift decay after each sale.

Set threshold just above your current AOV (e.g., AOV ₹2,000 → threshold ₹2,500). Model the trade-off: higher AOV vs. shipping cost hit. Consider category-specific thresholds or product-level exclusions.

Local currency with market-appropriate rounding (e.g., .99 or nearest ₹10). Factor duties, VAT/GST, and lane-specific shipping. Don’t straight convert, price to local willingness to pay, and competitive set.

Every e-commerce pricing strategy has its risks and rewards, so it’s worth looking through each carefully to see which is the best fit for you. In some cases, it’s possible to combine elements of different strategies, such as market-based and dynamic pricing.

Before you implement any e-commerce pricing strategy, you should carry out testing to gain insights into consumer behavior and get an idea of the price points people are comfortable with. However, be cautious not to alienate customers by displaying different prices for the same product, as this can lead to mistrust. It’s better to test your methods across different product categories.

The correlation between pricing strategies and customer experience is undeniable. Get it wrong, and customers may never use you again. Get it right, and you’ll inspire customer satisfaction and brand loyalty both before and after conversion.

Check out these top e-commerce marketing tips to attract and retain more customers to your brand.

This article was originally published in 2023. It has been updated with new information.

Nick Shaw is the Chief Revenue Officer (CRO) of Brightpearl, a retail-focused digital operations platform for sales and inventory management software, accounting, logistics, CRM and more. He is responsible for EMEA Sales, Global Marketing, and Alliances.

Concerns about inflation have greatly affected competition in e-commerce.

by Melike Ulaman

by Melike Ulaman

Businesses that offer customizable solutions allow customers to ideate a product that fits...

by Mary Clare Novak

by Mary Clare Novak

Few things will influence a business' revenue as much as getting the pricing right.

by Kristina Žiaukė

by Kristina Žiaukė

Concerns about inflation have greatly affected competition in e-commerce.

by Melike Ulaman

by Melike Ulaman

Businesses that offer customizable solutions allow customers to ideate a product that fits...

by Mary Clare Novak

by Mary Clare Novak