As technology evolves, so do customer expectations, creating a dynamic interplay that drives innovation in the financial sector.

Modern customers demand faster, more flexible banking options. Digital banking platforms are leading this transformation, enabling banks to offer a wide range of services with greater convenience.

Top digital banking statistics for 2025

- The global digital banking market is projected to reach a volume of $53.5 billion by 2030.

- Digital banking users in the United States are expected to grow year-over-year, reaching nearly 216.8 million by 2025.

- The digital banking market size is estimated to register a CAGR of over 3% between 2024 and 2032.

- The AI-driven banking market is projected to grow at an annual rate of 28.58% till 2026.

- 59% of people want digital banking to offer simple tools and resources for learning how to manage money.

But how are people responding to these advancements? The following statistics provide a deeper look into digital banking's growth, adoption, and role in shaping the future of finance.

Traditional banking vs. digital banking

The way we bank has changed significantly in recent years. Traditional banking relies on physical branches and face-to-face interactions, while digital banking offers convenient online services. This section compares the two, highlighting their features, benefits, and challenges to give a clear picture of how they differ.

Let’s look at competing statistics to unpack traditional and digital banking facts.

| Traditional banking |

Digital banking |

| 77% of consumers rely on traditional banks as their primary or secondary providers. |

Out of 43% of consumer funds, 35% of consumer funds kept in non-traditional accounts remain in digital-only banks and stand-alone digital accounts. |

| Among the 65% of consumers using traditional banks as their primary provider, only 66% express satisfaction. |

User satisfaction increases to 79% and 81% for users of digital-only banks (21%) and stand-alone digital accounts (7%). |

Digital banking usage statistics

Digital banking has become an integral part of how people manage their finances. This section provides key statistics on its usage, shedding light on adoption rates, user demographics, and the growing impact of digital banking in the financial industry.

73%

percent of the world’s interactions with banks now take place through digital channels

Source: McKinsey & Company

- The United States, Canada, Japan, China, and Europe will drive an estimated 13% CAGR in the global investment banking sector.

- Bank of America leads with over 30 million active mobile app users and over 40 million online banking customers.

- China, the world's second-largest economy, is projected to attain a market size of $4.6 billion by 2026, with a compound annual growth rate (CAGR) of 19.9% during the analysis period.

- China is expected to remain among the fastest-growing in this cluster of regional digital banking markets. The Asia-Pacific market, including India, Australia, and South Korea, is forecasted to reach $615.6 million by 2026.

- Japan and Canada are among the other noteworthy geographic markets; each is forecasted to grow at 11% and 13.1%, respectively, from 2021 to 2026.

- Germany is projected to grow at approximately 14.5% CAGR in Europe. At the same time, the rest of the European market will reach $5.2 billion by 2026.

- Approximately 295.5 million digital banking users are in India, surpassing the U.S. by over 70 million.

- The net interest income from digital banks is expected to grow at an average annual rate of 6.86% from 2024 to 2029, reaching a total of $2.09 trillion by 2029.

- By 2029, the total value of customer deposits at digital banks is estimated to exceed 5.4 trillion U.S. dollars

- It is estimated that digital banking channels will account for over 90% of banking interactions globally by 2025.

- The average digital spending per $1 billion in assets has risen dramatically, from about $200,000 in 2022 to nearly $780,000 in 2024, a 310% increase over two years.

The table below discusses consumers' preferences for digital-only banks according to age.

| Age group |

Percentage of consumers who prefer digital-only banks |

| All age groups |

21% |

| 18-24 years |

24% |

| 25-35 years |

26% |

| 35-44 years |

29% |

| 45-54 years |

18% |

| 55-64 years |

8% |

Traditional banking usage statistics

Despite the rise of digital banking, traditional banking continues to play a significant role in financial services. This section explores key statistics on its usage, offering insights into customer preferences, demographics, and the ongoing relevance of in-person banking

- In 2024, global net interest income for traditional banks reached an impressive $7.03 trillion.

- As of 2024, around 4.5% of people in the U.S. do not have bank accounts.

- 65% of consumers use traditional banks for their primary bank accounts.

- 46% of customers without online bank accounts prefer in-person branch access.

- 82% of people in the U.S. consider having a nearby bank branch important.

- 24% of consumers expect to visit bank branches less frequently in 2025.

- In a shift toward online banking, HSBC Bank in the UK closed over 10% of its branches in 2022, reducing its network by 69 out of 510 locations.

- 61% of consumers indicate their likelihood of switching to a digital-only bank.

- $2.05 trillion is the predicted global market size of digital-only banks by the year 2030.

- 74% of millennials and 68% of Gen Z are most likely to prefer digital banking

Online banking statistics

Online banking has grown rapidly as more people turn to digital solutions for managing their finances. This section highlights key statistics on online banking usage, including adoption trends, user demographics, and its role in shaping modern financial habits.

- 77% of Canadians, 71% of US inhabitants, and 69% of Spanish customers use their online banking services at least monthly.

- 79% of internet users who did not trust artificial intelligence (AI) technology were less likely to bank online, compared to 88% of those who trusted AI.

- Online chat technology, which connects customers to a human customer service representative, has a satisfaction rate of 66%.

- 54% of financial service providers view chatbots as a way to transform the customer experience.

- In 2023, over 66 percent of the population in the US used online banking.

- The proportion of older adults using online banking increased from 62% in 2018 to 70% in 2022

Mobile banking statistics

Mobile banking has become a key player in the way people access and manage their finances on the go. This section presents important statistics on mobile banking usage, including growth trends, user behavior, and the impact of mobile banking on the financial industry.

- In the first quarter of 2023, 63% of bank account holders processed banking matters on their smartphone or tablet.

- 63% of bank account holders processed banking-related tasks on their smartphone or tablet in 1Q 2024

- Experts foresee mobile payments will grow at a CAGR of 29% from 2020 to 2027, reaching an estimated $8.94 trillion.

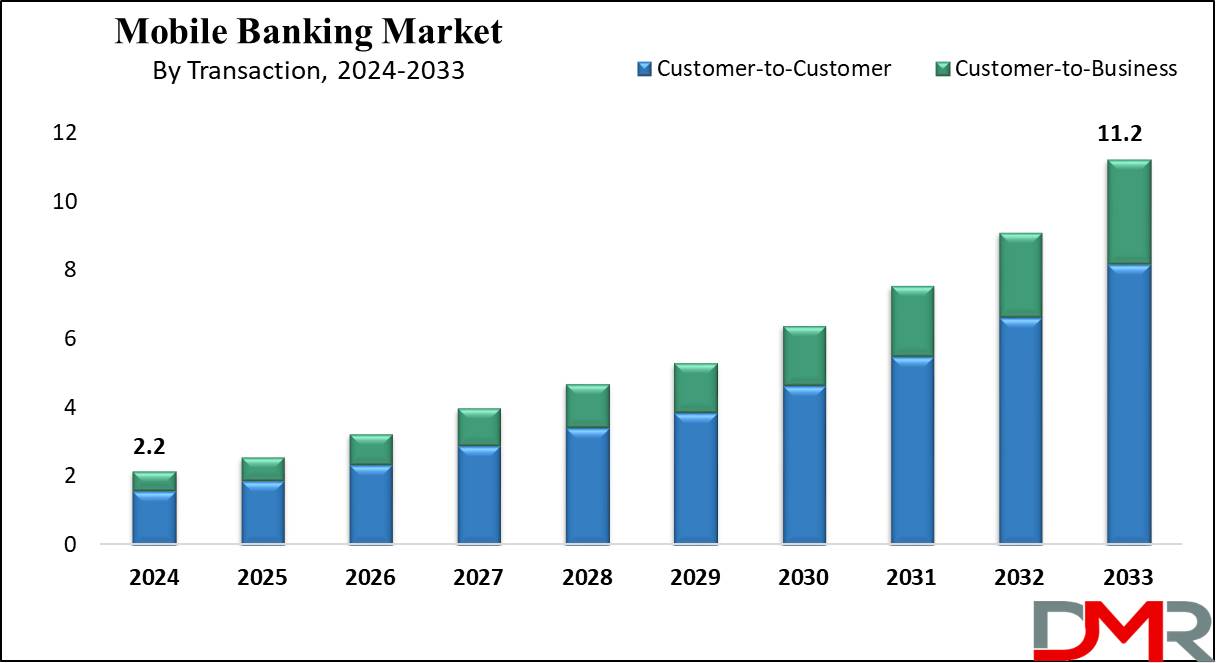

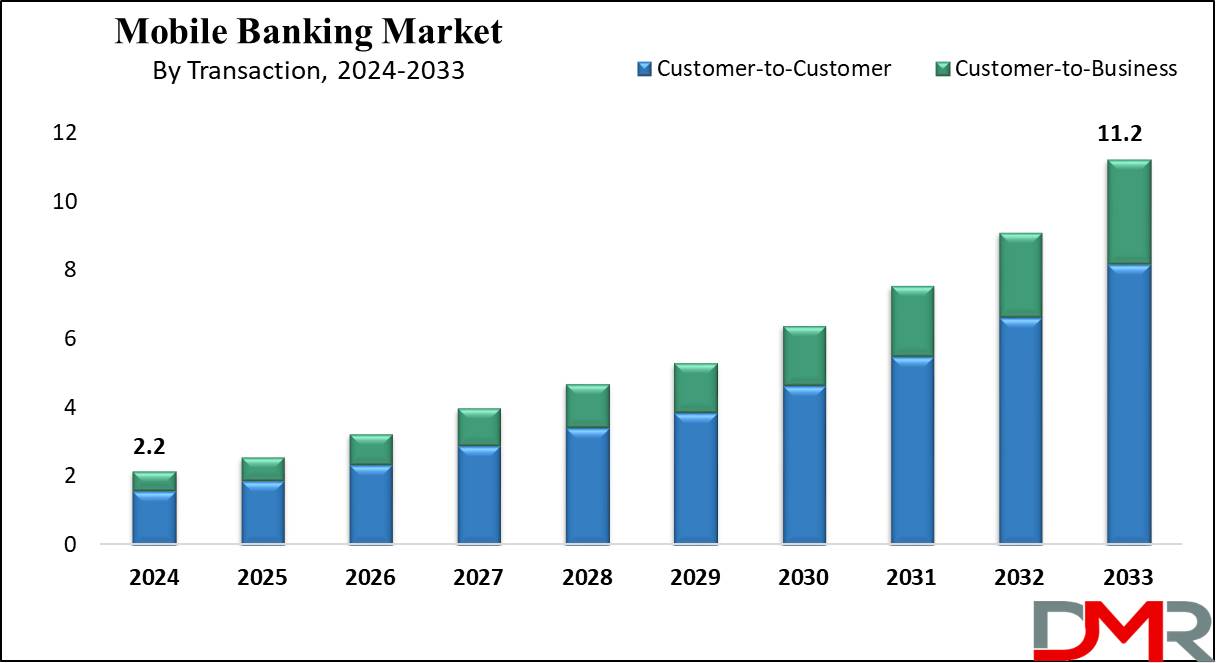

- The global mobile banking market is expected to grow to USD 11.2 billion by 2033, at a CAGR of 20.0%.

Source: Dimension Market Research

- 71% of consumers prefer to manage their bank accounts through a mobile app or computer.

- As of 2024, almost 59% of people used their mobile phones to manage their bank accounts.

- 25% of mobile banking users go beyond account management by signing up for financial products directly via mobile apps, highlighting the platform’s growing role in product discovery and decision-making.

- 53% of customers are frustrated when they can't reply to mobile messages, creating a key opportunity for financial institutions to improve customer experience with two-way digital conversations.

- Android as a platform is expected to get the largest revenue share in 2024 in the mobile banking market.

- North America is expected to contribute about 56.7% to the global mobile banking market in 2024, maintaining its leading position in the coming years.

- The global volume of mobile payment transactions is expected to surpass USD 13 trillion by 2025.

AI in banking statistics

Artificial intelligence is rapidly transforming the banking industry, bringing benefits in several key areas. AI is making banking faster, more efficient, and more secure for banks and their customers. As AI technology develops, we expect to see even more innovative applications emerge in the banking sector.

61%

increase is projected in the adoption rate of AI across financial institutions by 2025

Source: Agile Infoways

- AI has the potential to improve banking industry productivity by around 5% and reduce global spending by up to $300 billion.

- 79% of customers say digital innovations are making banking services more accessible.

- AI adoption in banking is expected to grow by 52% by 2025.

- AI can automate 20% of banking and financial activities.

- Banks using AI have witnessed a 34% increase in their revenues.

- AI has the potential to generate $140 billion in revenue for the banking sector by 2025.

- By 2030, AI could help banks reduce operational costs by 22%.

- AI-based fraud detection in banking is expected to reach $68.6 million by 2026.

- 17% of decision-makers are focusing on using AI for personalizing investments, 15% on credit scoring, and 13% on portfolio optimization.

- 85% of customer interactions in banking will be powered by AI by 2025.

- 83% of banking executives believe AI and digital banking make banks more vulnerable to cyber threats.

Digital banking security statistics

Digital banking is prone to cyber threats. In 2023, the Reserve Bank of India (RBI) reported bank frauds amounting to over 302.5 billion Indian Rupees.

With massive digital transactions, traditional fraud or scam monitoring services need to catch up to the modern cybersecurity challenges banking institutions face.

- Merchant losses from fraud in online payments are projected to exceed $362 billion globally between 2023 and 2028.

- In 2028, merchant losses from online payment fraud are expected to reach $91 billion.

57%

of Americans trust financial institutions to protect their personal data

Source: PYMNTS

- 30% of customers without online bank accounts are worried about security issues.

- In 2022, individuals reported nearly $8.8 billion in financial fraud losses, marking a staggering 30% increase from 2021.

- 62% of all new accounts created by criminals in 2022 were financial accounts, making new accounts 9.5 times riskier than mature accounts

- 67% of victims of Account Takeover (ATO) attacks found that their exposed data was used for unauthorized purchases

- 87% of consumers prioritize convenience over security when it comes to financial services

- In 2023, the possibility to detect breaches in one's Social Security number was perceived as the most valuable mobile banking feature by users in the United States.

Moving toward a digitally charged future

Online banking offers several benefits compared to traditional banking, such as easier access, more convenience, and increased flexibility. Customers can handle a variety of banking tasks, like transferring funds or checking account balances, at their convenience, without the need to visit a branch. Digital platforms also offer personalized services, with insights and recommendations based on individual financial activities.

That said, the rise of online banking also highlights the importance of enhancing security measures to address concerns such as fraud, identity theft, and data breaches. Despite these challenges, digital banking platforms continue to adapt to meet the needs of today's technology-driven consumers.

Learn more about the rise of digital transformation in banking.

This article was originally published in 2023. It has been updated with new information.

Edited by Monishka Agrawal

by Sagar Joshi / December 18, 2024

by Sagar Joshi / December 18, 2024

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi

by Sagar Joshi