Any business owner knows that to make money, you have to spend money.

And as a business grows both in number of employees and cash spent on different operating costs, client meetings, and business travel, it’s natural to seek out an easy way to manage and track expenses.

Enter the corporate credit card, a way that businesses can track their spending and easily keep tabs on purchases. With signing up for a corporate card, there are many grey areas that can be difficult to manage. Because of this, it’s imperative that any company using a corporate credit card has a clear policy.

Corporate credit card: how to obtain and best practices for companies and employees

Ultimately, your company’s corporate credit card policies are customizable to fit interests and ways you intend to use it. We’ll go over some best practices for setting this policy from the business side and adhering to it from the employee side.

Obtaining a corporate card

Before you can go about setting up a corporate card policy, you must first be approved to use a corporate credit card.

For a business to obtain a credit card, it will need to submit its Tax ID number, from which the credit card issuer will be able to perform a background check of the company’s financials and business credit score. Once these checks are passed, the company can be issued a corporate credit card account and begin to use it. Most large banks, such as American Express, Citi, Bank of America, and Chase, issue corporate credit cards just as they issue consumer credit cards.

Just as regular consumer credit cards do, corporate credit cards can provide rebates and rewards. However, these rewards are credited back to the main company account instead of the accounts of individual card users.

Another unique aspect of corporate credit cards is that they contain analytics tools to allow executives, accountants, and managers within a company to track where employees are spending company money. Obtaining and setting up a corporate credit card puts a lot of money into the hands of potentially a large number of employees, and it’s important to note the tracking features that come with a corporate card right off the bat.

Best practices for companies

Here are a few best practices we’ve compiled for companies using a corporate credit card account:

Use analytics tools

As mentioned, the analytics tools that accompany a corporate credit card provide an advantage to businesses looking to track when, where, and why employees are spending company money. Businesses can typically sort through their corporate card spend by vendor, department, and employee. Sorting ensures that even if a corporate account is used by a large number of employees, companies can still track and monitor the ins and outs of exact spending practices.

|

TIP: Track your monthly corporate card spend free with G2 Track. Activate your free account to get monthly spend reports, fraudulent charge alerts, and more.

|

Set clear cardholder responsibilities

Just as a company should provide clear and understandable guidelines when establishing an expense reimbursement policy, it’s necessary that businesses lay out strict rules for employee use of corporate cards. Most imperatively, that corporate cards cannot be used for personal expenses. Another essential element of cardholder responsibilities is that only the person whose name is on the card is eligible to use it.

Establish limits on spending

Generally, with greater responsibility and status within a company comes more freedom for decision-making. This principle is typically reflected in corporate credit card policies. Spending limits are set for every employee and typically determined by an employee’s status and need for spending. If a high-level executive travels a lot, they will have a much larger spending limit than a lower-ranking employee who has an occasional coffee with a client.

It’s also important to deploy multiple types of spending limits as outlined in a corporate credit card policy. For example, you can have a spending limit for each meal as well as a cumulative limit per week or month. This ensures that employees are spending company money within reason on individual items in addition to on a cumulative basis.

Require approval when necessary

Depending on the level of employee spending on certain items, it can be helpful to require approval for larger costs, such as long-distance flights or expensive client dinners. Not only does this ensure that the company is aware of when and why employees are taking on certain larger expenses with company money, but it also establishes an expectation with employees that large expenses must be valid and justified as necessary business expenses.

Make expense reporting as easy as possible

To have a full picture of where company money is going, a corporate card policy should also include bylaws for employees to provide as much information regarding their corporate card expenses as possible, including their date of purchase, vendor, and business purpose. A credit card policy should outline the timeliness required for expense report submission as well. Feel free to enlist the help of expense management software here.

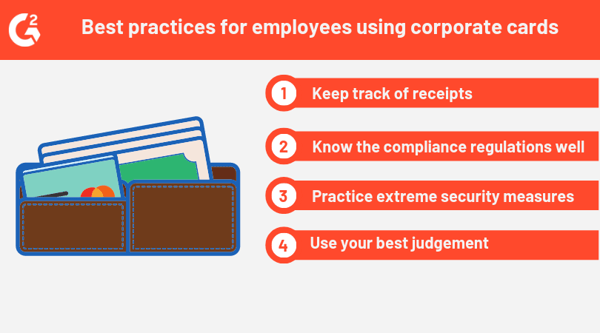

Best practices for employees

For employees, spending company money on a corporate credit card can involve difficulty discerning when it is necessary to use the card, how often to use it, and how to make sure that you’re keeping track of all the information a business could request regarding any purchase made with the card. Here are a few best practices from the employee side:

Keep track of receipts

Any time you spend with a corporate credit card, be prepared to explain all of the details surrounding your purchase. Knowing the when, why, and where of your corporate credit card spend as an employee makes life easier for you and your employer. Keeping track of your receipts helps accomplish this with ease, and you’ll have concrete details to justify your business expenses if your employer requests them.

Know the compliance regulations well

Most companies that use corporate credit cards have robust compliance policies with many rules and regulations to which you must comply as an employee. Knowing these regulations in advance of using your card makes it easier to spend within your company’s guidelines and know what expenses do and don’t need special approval.

G2's free software management tool, G2 Track, integrates with credit cards and bank accounts, and offers peace-of-mind that you're protecting your budget and your data with the custom compliance hub.

Practice extreme security measures

A corporate credit card contains access to more than just a personal amount of money, so make sure to be in the know on how to report a theft or loss as soon as possible if anything does happen to your card. Look after the card just as you would a personal credit card.

Use your best judgment

Even if you’re in compliance with your company’s corporate credit card regulations, it’s important to think proactively about your spending behavior with a corporate card. Knowing what constitutes worthwhile spending of company money will streamline your corporate card spending and earn the trust of your employer in the process.

Summing up

A corporate credit card enables companies to easily and efficiently track and manage the money they spend on business operations. It also allows employees to spend company money on necessary business expenses separate from their personal bank accounts. Following these best practices will lead you to a well-run corporate card account and smooth sailing in how you spend company funds.

Learn more about virtual credit cards and how to choose the best one for your business!

by Nahla Davies

by Nahla Davies

by Tanushree Verma

by Tanushree Verma

by Grace Pinegar

by Grace Pinegar