Not all charitable giving is created equally: there is a way to give smarter

According to recent nonprofit statistics, the average American supports 4.5 charities. That’s a lot of money being spread around on an annual basis. If you’re one of those individuals who is finding it increasingly tricky to track all of your donations, you might benefit from learning a better way to give.

Charitable giving serves two main purposes: supporting charities and as a tax-planning strategy. With the right giving strategy, you can actually donate to your favorite cause and save money on your annual taxes.

While most people don’t partake in charitable giving for the sole purpose of saving on taxes, it is a benefit that many charitable individuals enjoy. This guide will provide you a high-level overview of the many ways you can use charitable giving in your philanthropic plan.

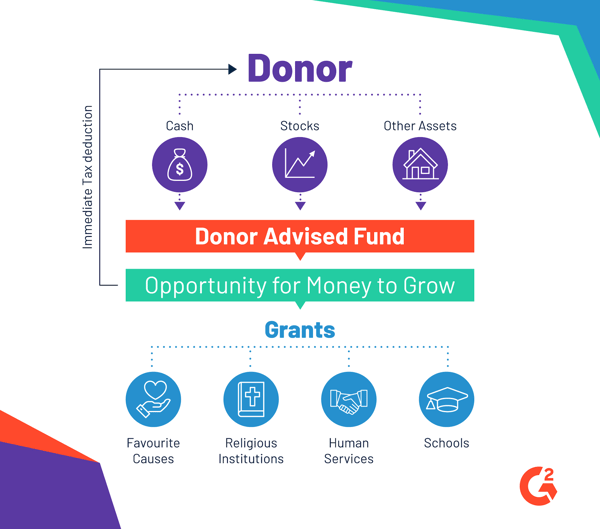

A donor advised fund is a charitable giving program administered by a public charity on behalf of an individual, family, or organization. After creating a donor advised fund, the funder will make donations to it and receive an immediate tax deduction. Because the money is being held in a fund managed by a public charity, the money is allowed to grow and accumulate interest tax-free.

The money in a donor advised fund must be used to bestow grants to qualifying 501(c)(3) organizations and cannot be taken out once it is given. The benefit of a donor advised fund is that oftentimes the charity holding the fund will take on the responsibility of administering the funds, mailing the checks, and managing funds on behalf of the funder.

Many donor advised funds can be managed through online portals that allow the donor to give money to their favorite 501(c)(3) with just a few clicks. Think of a donor advised fund like a specialty banking account designed specifically for charitable giving.

| Tip: Most donor advised funds are facilitated through community foundations. Find the community foundation closest to you with the help of this community foundation locator. |

A scholarship fund is similar to a donor advised fund in that donors create a specialty fund that is held by a charity. The key difference is that scholarship funds are created with the sole purpose of awarding educational scholarships to students.

Scholarship funds are popular because the funder can be as involved in the grant making process as they’d like. They’re also allowed to create the scholarship requirements for their specific fund.

If you’re particularly passionate about seeing more women in STEM, you could create a scholarship fund through a community foundation that grants multi-year scholarships to female students looking to pursue a STEM degree. You could also be part of reviewing, reading, and ultimately awarding funds to the winners.

Many donors find this process rewarding because they get to see the impact their money has on the recipient. In some cases, donors and students form lifelong bonds and friendships after the money has been awarded.

For many lifelong philanthropic givers, there’s a desire to leave a lasting legacy after they pass away. Legacy giving is one of the many ways to ensure that the giving spirit lives on after you do.

There are several ways to structure your legacy giving plan, and you would be wise to explore all of your options before deciding which legacy giving plan is right for you. Here’s a quick overview of the two most popular legacy giving options.

Creating a bequest is one of the most popular options for legacy giving. With the help of a lawyer, you can designate which charities or nonprofits are included in your will. This can be done a number of ways.

| Percent bequest – where a certain percent of your estate will/can be donated |

| Specific bequest – where a certain dollar amount is gifted |

| Residual bequest – where a gift is made from the balance of your estate. |

Bequests are ideal for donors who want to split their estate between family, friends, and their favorite charitable nonprofits. You can also designate that your bequest be spread out across several years, so the money isn’t spent all at once.

Some charities offer the option of creating a charitable gift annuity. When you create a charitable gift annuity, you give an organization a gift that can provide you with a secure source of fixed payments for the remainder of your life.

|

Here’s how a charitable gift annuity works: 1. You transfer cash or property to a participating charitable organization 2. In exchange, you receive fixed payments for the remainder of your life 3. You receive a charitable income tax deduction for the gift portion of the annuity 4. Your gift will continue to help the mission after your passing |

An example of a charitable gift annuity could look something like this. You gift your beach house or accumulated stock to a qualifying charitable organization before your passing and, in return, you receive fixed payments from your gift. The organization claims full ownership of the gift and can sell it in order to fund the mission.

There are countless other legacy giving plans, and depending on the organization you partner with, they can tell you more about your options. Always do your research to find the best philanthropic giving plan for you.

Unlike the first two options we’ve gone over, family giving isn’t a program so much as it is a practice. Harnessing the power of your family to enhance your charitable giving is one popular way to both increase your impact and pass on the legacy of philanthropy in your family.

|

Here are a few ways you can encourage family giving:

|

The impact of your charitable giving can be measured by more than just money. Cultivating a sense of philanthropy in the next generation can have a bigger pay-off than any check you write. Get creative with how you and your family give.

Being flush with cash isn’t the only thing you need to be charitable. Many donors like to explore their options and make contributions through non-cash donations. A non-cash gift is any non-liquid asset that has monetary value. This can include things like stock, property, credit card rewards, and more.

These gifts do not come in the form of a check but many of them can be donated in exchange for a tax write-off. Different charities will accept different non-cash gifts, so it’s always wise to check with the nonprofit you’re hoping to donate to and ensure they can accept your non-cash gift.

If you’re looking for a way to both donate your time and your money, giving circles might be the best route. A giving circle is a collection of charitable individuals who pool their time and resources to give to a single cause.

Oftentimes, these groups will participate in volunteer days or host fundraising activities on behalf of their chosen charity. The members of a giving circle vote on which organization to support and use the power of their combined resources to make a big impact.

The great thing about giving circles is that you can join an existing one or start one of your own. A giving circle isn’t a nonprofit, it’s a social club where individuals can come together to support nonprofits with other philanthropists.

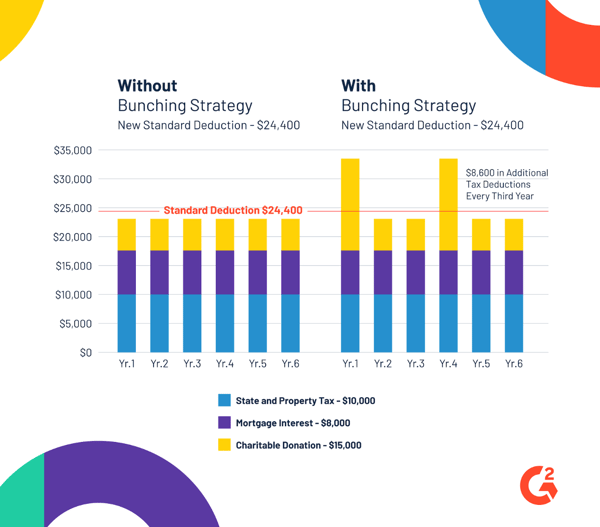

A few years ago there was a change in the tax codes that changed the amount individuals could claim on their standard charitable deductions. What was first assumed to be a disaster for individual donations has actually sparked a new giving strategy called charitable bundling.

The practice of charitable bundling is actually pretty simple. Instead of donating money every year and consistently missing the cut-off for their standard deduction, donors are saving their donation money and donating one large gift every three years.

|

Here’s what charitable bundling looks like in practice:

|

In 2019 standard deduction amounts will increase to $12,200 for individuals, $18,350 for heads of household, and $24,400 for married couples filing jointly. During the first year, a philanthropic individual makes donations large enough to hit the standard deduction and they save their funds for the second and third year.

This method allows donors to continue to support their favorite charities while giving the same amount of money, and maximizing the tax benefit of their charitable contributions. It’s a more strategic way to give money to their favorite organizations.

Philanthropy is fast becoming a growing trend in corporate America. Organizations around the world are adopting corporate social responsibility programs that encourage philanthropy. If you work for a company that is embracing corporate giving or are in a position to create the program yourself, you should!

Organizations of every size have resources and funds that can be used to give back to the community. Whether that comes through a corporate giving program, a scholarship program, or even corporate sponsorship, it’s becoming more common for big companies to give back.

| Tip: Reach out to your HR department and see if your organization has a corporate giving program that you can be a part of. And if they don’t, take the action steps to show them why corporate giving is good for everyone involved. |

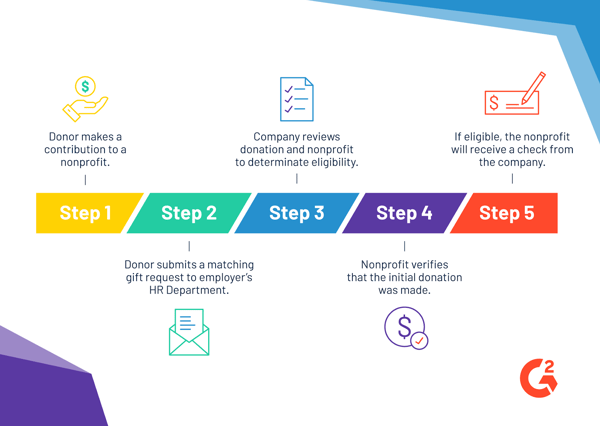

Gift matching programs have seen a spike in popularity over the last few years. Often incorporated with corporate giving initiatives, a gift matching program is designed to double your donation.

Here’s how it works: the donor makes a contribution and submits a form requesting their gift be matched by any participating organization. The organization reviews the request and if the nonprofit qualifies for the program, they verify with the charity that a donation was made. If everything looks right, the nonprofit receives a matched donation in the form of a check.

Let’s say you donate $50 to the ACLU and you’d like your gift matched. You provide the required paperwork for your gift-matching organization and once everything is approved, the ACLU receives another check for $50.

Gift matching is common with corporate giving programs, but large businesses can also get involved. In 2018, Facebook and PayPal announced they’d be matching up to $7 million in donations made through online Giving Tuesday donations. Anyone who made an online donation to a qualifying 501(c)(3) within that first $7 million had their donation matched.

Gift matching is a smart way to make your gift count for more.

As we’ve mentioned before, money isn’t the only way to make an impact. Donating your time and your skills are both creative ways to pay it forward. You can do this on your own time, in partnership with a giving circle, or even through a volunteer time off (VTO) program.

While the trend of individual giving overall is slowing down, volunteering has never been more popular. According to NCCS, over 25% of Americans volunteered in 2017 with the number of people volunteering continuing to trend upwards.

|

Where are the best places to find volunteer opportunities:

|

Volunteering is a great way to expand your philanthropic friendships and stay close to the organizations you feel a connection with. It’s also a smart way to give when your assets are limited.

You don’t need millions of dollars in order to make an impact with your charitable giving. In fact, with the right giving strategy, anyone can create a personalized philanthropy plan. The key is knowing what your philanthropic goals are and then finding the best way to achieve them.

|

Did you know G2 has a corporate giving program? Write a review for a software you use at work and unlock a $10 donation, courtesy of G2 Gives. |

Lauren Pope is a former content marketer at G2. You can find her work featured on CNBC, Yahoo! Finance, the G2 Learning Hub, and other sites. In her free time, Lauren enjoys watching true crime shows and singing karaoke. (she/her/hers)

Nonprofits? Charities? What’s the difference?

by Lauren Pope

by Lauren Pope

Life is a boomerang. What you give, you get.

by Lauren Pope

by Lauren Pope

Does trying to get to know your donors feel like stumbling around in the dark?

by Patrick Bryden

by Patrick Bryden

Nonprofits? Charities? What’s the difference?

by Lauren Pope

by Lauren Pope

Life is a boomerang. What you give, you get.

by Lauren Pope

by Lauren Pope