March 10, 2024

by Austin Talley / March 10, 2024

by Austin Talley / March 10, 2024

Imagine the thrill of buying that designer bag you've been eyeing, knowing you won't pay a dime extra.

No credit card checks, no hidden fees – just easy installments spread over a few weeks. This is the appeal of buy now, pay later (BNPL) services.

Far from being just another trend, BNPL is reshaping how consumers approach purchases, offering a compelling alternative to traditional credit and debit transactions.

But before you swipe, there's a crucial question: is this financing phenomenon just a fad or a game changer?

BNPL's meteoric rise gives us front-row seats to the reshaping of how we pay. As we delve deeper into the BNPL phenomenon, it's essential to understand that its success is not without challenges. Concerns about consumer debt, regulatory scrutiny, and the sustainability of the BNPL business model are critical issues that need addressing.

However, these challenges also present opportunities for innovation, regulation, and education that can strengthen the BNPL sector and solidify its role in the future of consumer finance.

Consumer Reports indicates that BNPL programs increased by 970% between 2019 and 2021. A “modest” $2 billion industry suddenly became a juggernaut, generating $24.2 billion.

of consumers surveyed used a BNPL service during the COVID-19 pandemic, seeking to break away from the traditional credit system.

This transition speaks volumes about the changing landscape of consumer preferences. There is growing disillusionment with conventional credit models and a strong desire for more adaptable and consumer-friendly financial products.

BNPL is a more straightforward method of borrowing than traditional alternatives since credit is extended with less information.

In contrast to traditional consumer credit, BNPL credit is typically not communicated to credit bureaus, meaning no adverse effect on the consumer’s credit score.

It differs from a layaway plan because the shopper receives the goods or services after paying the first installment. In contrast, layaway plan shoppers receive them only after paying the full amount.

Dividing a purchase into interest-free installments is a huge appeal, and consumers can manage their expenses while incurring small fees or none at all.

Source: Juniper Research

Juniper says the substantial growth of BNPL users will be driven by the anticipated economic downturn, which will increase the demand for low-cost credit solutions.

The growing popularity of BNPL services is driven by a combination of factors: the desire for interest-free installment plans, the avoidance of traditional credit interest rates, and the appeal of a more direct and manageable repayment structure.

The fact that BNPL has been widely embraced suggests it fulfills a common consumer want for financial flexibility, one persisting despite economic shifts.

Furthermore, the agility of BNPL providers in responding to consumer needs, evolving economic conditions, and regulatory landscapes has been pivotal in sustaining this growth.

Enthusiasts use BNPL (also known as point-of-sale installment loans) to juggle their budgets to purchase clothing, tech gadgets, and home furnishings. It is viewed by many as a lifesaver in a turbulent financial time. Others view it as a system that, when misused, is an invitation to add more debt.

The pros of BNPL are the ability to make payments in installments. Consumers routinely elect to pay 25% upfront and then 25% during two-, four-, and six-week periods to cover the remaining balance. This allows better money management and hopefully more control over spending habits.

This becomes especially important when purchasing big-ticket items, as the extended timeframe gives buyers ample time to replenish bank accounts before the next scheduled payment.

The extended payment plan is appealing, and some consumers may be inclined to eventually replace their credit card with the interest-free option offered by BNPL.

To harness the benefits of BNPL while mitigating financial strain risks, consumers and providers must adopt a conscientious approach.

Here are concrete recommendations for the responsible and sustainable use of BNPL services:

Consumers should assess their financial situation before using BNPL services. Establishing a budget that accounts for BNPL payments can prevent overspending.

It's crucial to consider not just the allure of immediate purchase but the commitment to future payments.

Before agreeing to a BNPL plan, it's vital to fully understand the terms and conditions. This includes any fees for late payments, the payment schedule, and the impact (if any) on credit scores.

Clear comprehension of these aspects can prevent unexpected financial burdens.

While BNPL can be tempting for all types of purchases, prioritizing essential or significant investments over impulsive buys can enhance financial wellness.

This strategic approach ensures that BNPL serves as a tool for financial management rather than a source of avoidable debt.

Keeping track of all BNPL plans is essential to avoid overcommitting financially. Consumers should consider using financial management apps or tools that consolidate all BNPL obligations in one place, offering a clear view of upcoming payments and total indebtedness.

Whenever possible, consumers should aim to build an emergency savings fund that can be used for unexpected expenses rather than relying on BNPL.

This proactive financial habit can reduce the need for deferred payment services and contribute to overall financial stability.

Providers should offer transparent, user-friendly information about their services, including clear disclosures of fees and charges.

Providing educational resources on financial literacy and responsible spending, along with tools for budget management and payment tracking, can empower consumers to use BNPL wisely.

BNPL services that reward early repayment or offer flexible payment schedules encourage responsible use. Such options can help consumers manage their finances more effectively and avoid debt accumulation.

BNPL providers should adhere to regulatory standards and best practices, ensuring consumer protection is at the forefront of their operations.

This includes conducting affordability checks before offering services to reduce the risk of lending to consumers who may struggle to meet repayment obligations.

By following these guidelines, BNPL services can be utilized as a responsible financial tool that benefits consumers by providing flexibility and control over their spending while also ensuring that this innovative payment option remains sustainable and viable in the long term.

The BNPL business model began in Europe and Australia and gained momentum about a decade ago. Its appeal gained traction with the rise of e-commerce during the COVID-19 pandemic.

BNPL became a popular way to buy clothes and home furnishings with consumers homebound and flush with cash.

With soaring inflation, a higher cost of living, and skyrocketing interest rates on credit cards, many shoppers now turn to BNPL services to make everyday purchases.

These factors have a ripple effect on the following:

A leading advocacy and trade association, Electronic Transactions Association (ETA), reported a 30% BNPL penetration for Gen Z and millennials in 2021, which is expected to rise to 40% by 2025.

The association says that while only 6% of baby boomers chose BNPL, that number is projected to be as high as 15% by 2025. Gen Z and millennials are 55% more likely than other generations to use BNPL.

In the face of rising costs, consumer spending using BNPL services is estimated to increase 290% by 2027, which means $437 billion will be spent on goods worldwide.

According to Investopedia, Gen Z has the lowest credit scores of all generations due to owning fewer credit cards (an average of two). This data can be valuable for institutions with an established older member customer base.

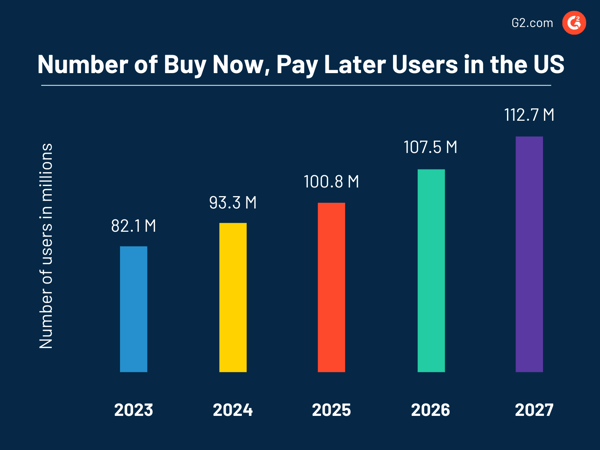

Source: Oberlo

Business owners who recognize the value of BNPL are quick to jump on board because they believe consumers will be enticed to spend more and complete the sale.

Currently, according to Exploding Topics, there are about 360 million BNPL users worldwide, and that market is worth more than $150 billion.

Other notable BNPL statistics:

Source: Exploding Topics

BNPL services present a compelling alternative to traditional credit mechanisms. Credit cards offer the flexibility of minimal monthly payments and benefits such as rewards points and cashback, features not commonly found in BNPL services.

However, the need for hard credit checks and the risk of high interest on balances may make credit cards less accessible for some.

Advantages of BNPL services over credit cards include:

However, some challenges and areas with room for improvement include:

Recognizing the value of consumer protection features inherent to credit cards, there's an ongoing effort to incorporate similar safeguards within BNPL services, ensuring a secure and beneficial user experience.

While acknowledging the strengths of traditional credit cards, the unique benefits of BNPL — including its accessibility, budget-friendly payment options, and lack of interest charges — position it as an essential tool in the financial toolkit of contemporary consumers.

Looking ahead, the focus will be on enhancing the BNPL model through increased transparency, educating customers about its benefits, and introducing additional advantages.

This will aim to achieve a harmonious balance between the innovative appeal of BNPL and the established benefits of credit cards.

As BNPL services expand, they face increasing scrutiny and challenges around interest rates, regulations, and consumer risks.

There are no interest rate charges and no hard credit checks in a typical BNPL platform. This increases e-commerce conversion and opens the opportunity for more repeat purchases. It's important to carefully weigh these benefits against potential downsides.

One downside is that consumers forfeit traditional credit card perks, such as rewards points and purchase protection (although the counterbalance is a zero interest rate and more control over cash flow).

However, the risk of overspending due to installment payments is a significant concern. Impulse buying is a real possibility, and those who don't pay on time may accumulate late fees, potentially damaging their credit scores.

Additionally, BNPL platforms often have limits on the amount that can be financed, which may not be suitable for larger purchases.

While BNPL can be an asset for individuals who need to manage their cash flow, it's not without potential problems. Although purchases typically don't directly affect a credit score, late or missed payments on BNPL may be reported to third-party bureaus and could raise concerns about one's ability to meet loan requirements.

In this scenario, a lender may require the customer to reduce, repay, or close their BNPL service. It's also important to note that some BNPL providers charge fees, potentially increasing the total purchase cost compared to traditional methods.

BNPL's success depends on adapting to market changes and regulations and prioritizing consumer well-being.

Navigating these challenges through financial literacy, responsible regulatory innovation, and consumer protection is key for BNPL providers to remain a valuable and sustainable financial tool for diverse consumers.

Cooley’s reports highlight the Office of the Comptroller of Currency's (OCC) guidance to banks on managing BNPL risk.

The guidelines warn of potential "credit, compliance, operational, strategic, and reputation risks" for consumers and banks, particularly for short-term, no-interest loans repayable in four installments or less.

Key risks for borrowers include overextension, extra fees, and difficulties with returns. Banks face challenges due to limited visibility into borrowers' full financial obligations and the potential for operational and compliance risks when relying on third-party BNPL providers.

The OCC emphasizes continued regulatory focus on BNPL, urging all parties to review policies and procedures for compliance and anticipate possible additional federal regulations.

In addition to regulatory scrutiny, rising interest rates pose another challenge for BNPL services. Higher borrowing costs could lead to more missed payments and defaults, especially among financially vulnerable consumers.

Some BNPL providers now offer longer-term loans with interest rates as high as 36%, exceeding many credit cards.

Consumer advocates recommend guardrails, such as checking for outstanding debt before approving BNPL and suspending the option for past-due customers. Retailers should also support legislation promoting responsible practices.

Monitoring the impact of rising rates on delinquencies, particularly for longer-term, higher-interest BNPL products, is crucial.

The evolving debates around BNPL regulation and rising interest rates underscore the need for vigilance and a balanced approach.

As consumer demand grows, BNPL providers, financial institutions, regulators, and retailers must collaborate to foster responsible innovation that prioritizes consumer protection and financial well-being.

Convenience prompts consumers to use BNPL.

Longer to pay, cheaper, simpler, and speed all fit into BNPL’s wheelhouse. But the economic pain of high interest rates and inflation as a driver for alternative credit solutions can’t be discounted. Younger consumers who span multiple income brackets embrace BNPL and use it for casual spending and to manage their money better.

The Federal Reserve Bank of Philadelphia says that the heaviest users of BNPL services in the U.S. are households with average incomes above $75,000.

Those with an income of less than $40,000 are less likely to use the service. The purchase of clothes is the top product financed, followed by electronics, shoes, home décor, and accessories.

The industry most impacted is e-commerce, which grew during the pandemic. Rising interest, inflation, and other factors have stalled its growth. According to similarweb.com, retailers face a very competitive playing field and should look to trends, tech, and innovation to make up for the shortfall.

According to their report, the electronics industry hit hard last year, with visits and conversions down across the board. Yet, in its survey, 26.7% of consumers used BNPL to buy electronics they would not have otherwise been able to purchase without using BNPL.

Retailers can embrace several strategies to revive BNPL usage and expand its applications:

Implementing AI to personalize shopping experiences and BNPL offers can enhance consumer engagement.

By analyzing consumer behavior, retailers can tailor their BNPL offerings to match individual preferences and financial capabilities, making purchases more appealing and manageable.

Integrating educational tools within the BNPL process can help consumers make informed decisions.

Providing insights on budget management, interest rates, and the long-term implications of BNPL can foster a more responsible and informed consumer base.

Enhancing the BNPL experience across all retail channels can address the e-commerce growth stall.

By offering BNPL both online and in-store, retailers can create a seamless omnichannel shopping experience that encourages more frequent use of BNPL services.

Broadening the scope of BNPL beyond traditional retail to include services such as healthcare, education, and travel could open new markets. This expansion can drive growth by making BNPL a ubiquitous part of larger financial decisions, not just retail purchases.

Forming strategic partnerships between BNPL providers and financial institutions could introduce new products that combine the benefits of credit cards (e.g., rewards programs) with the flexibility of BNPL.

Such collaborations could also enhance consumer protection and trust in BNPL services.

As consumers become more aware of their environmental impact, BNPL services need to incorporate sustainability and ethical considerations in their offerings. This can help differentiate their services from others in the market.

By incentivizing customers to purchase environmentally friendly products or from socially responsible companies, BNPL providers can align themselves with the broader consumer values.

BNPL is not just a passing craze but a game changer for the future of finance.

This conviction is rooted in observing BNPL's rapid adoption rates and its ability to address the immediate needs of a diverse consumer base. By offering more flexibility than traditional credit systems, BNPL services are democratizing access to financial tools for a broad spectrum of consumers.

There are now conversations about diversification in payment options within BNPL services and a redefinition of BNPL shopping standards.

Advances in financial technology are leading to the integration of functionalities such as the ability to make payments by text message. Convenience is often the key to successful sales, and BNPL options offer just that to customers.

We are now in a contactless business environment.

Consumers enjoy the benefits of BNPL and can spread out their purchases over time while paying swiftly by text as an option. BNPL is yet another tech advancement that is safe and fast and puts power in a consumer’s hand.

BNPL is evolving, and its future looks very bright.

Learn how you can reach the next generation of Gen Z consumers and shape the future of your brand.

Edited by Shanti S Nair

Austin (Larry) Talley, Founder and CEO of Everyware, is passionate about connecting with people and providing excellent customer satisfaction through innovative payment and communications solutions. Launched in 2015, his company provides services to more than 9,000 merchants across multiple verticals, including healthcare, travel, utilities, not-for-profit, and automotive. The platform offers a simple, fast, and secure way to move money while enhancing the ability for merchants to communicate with their customers in real time with text messaging.

Buy now pay later (BNPL) lets customers purchase products immediately and defer payments over...

by Sagar Joshi

by Sagar Joshi

The global economy is undergoing significant shifts with high interest rates, increased...

by Evie Parker

by Evie Parker

When it first came on the scene in the 1990s, software-as-a-service (SaaS) was a means to...

by Arijit Bose

by Arijit Bose

Buy now pay later (BNPL) lets customers purchase products immediately and defer payments over...

by Sagar Joshi

by Sagar Joshi

The global economy is undergoing significant shifts with high interest rates, increased...

by Evie Parker

by Evie Parker