October 28, 2025

by Harshita Tewari / October 28, 2025

by Harshita Tewari / October 28, 2025

Navigating sales tax compliance isn’t getting any simpler.

Between shifting nexus laws, jurisdictional rate changes, and expanding cross-border rules, even seasoned finance teams can feel buried under filings and reconciliations. According to recent market data, the global sales tax software market is valued at USD 11.04 billion in 2025 and is projected to nearly double to USD 20.46 billion by 2034, a clear sign of how critical automation has become in keeping businesses compliant and audit-ready.

To understand what separates an average solution from a truly reliable one, I evaluated over 15 tools to find the best sales tax compliance software using G2 review data, focusing on automation depth, integration coverage, filing efficiency, and multi-jurisdiction accuracy. What stood out most were platforms that didn’t just calculate tax, but made reporting and remittance seamless across states and countries.

Here are the six that delivered the best balance of accuracy, usability, and peace of mind for growing revenue teams.

*These sales tax and VAT compliance software are top-rated in their category, according to G2’s Fall 2025 Grid Report. I’ve added their standout features to make comparisons easier for you. For pricing details, please contact the sales team directly via their official website.

Modern revenue teams aren’t struggling because they can’t calculate tax — they’re struggling because tax never stops changing. New jurisdictions pop up, product taxability shifts overnight, and manual filings can’t keep pace with the speed of digital business. One missed update can snowball into penalties, delayed remittance, or messy reconciliations that drain entire quarters.

That’s why sales tax compliance software has become a must-have in finance stacks. These platforms turn unpredictable tax rules into predictable workflows, handling calculations, filings, and exemptions automatically while keeping pace with regulatory change. Instead of reacting to errors, teams can audit confidently, plan proactively, and scale into new markets without tax becoming a bottleneck.

In short, the value isn’t just in automation; it’s in assurance. The right software gives finance and tax teams control, visibility, and accuracy at every stage of the compliance process.

I started with G2’s Grid Report, narrowing down to tools that consistently earned high satisfaction scores and strong adoption across finance and operations teams. That helped me identify a mix of established leaders as well as fast-rising challengers.

From there, I analyzed hundreds of verified G2 reviews using AI-assisted pattern recognition to understand what users actually value in daily use. The biggest positive themes centered on automation accuracy, multi-jurisdiction filing, integration reliability, and the ability to stay compliant as companies expand globally. At the same time, reviewers surfaced common friction points around implementation complexity, customization limits, and reporting detail.

To validate these insights, I connected with finance professionals who manage tax compliance across multiple systems. Their feedback helped me distinguish tools that perform well in demos from those that stand up to real-world filing cycles and audits.

Each platform in this list earned its place through a combination of G2 Data, verified customer sentiment, and hands-on evaluation.

All product screenshots featured in this article come from official vendor G2 pages and publicly available materials.

I considered the following factors when evaluating the sales tax compliance software and selecting the best software for VAT compliance, according to G2 reviews.

The list below contains genuine user reviews from the Sales Tax and VAT Compliance Software Category page. To be included in this category, a solution must:

*This data was pulled from G2 in 2025. Some reviews may have been edited for clarity.

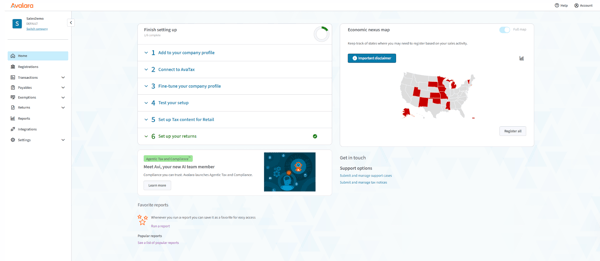

Avalara is one of the most established players in the sales tax compliance software market, known for its accuracy and depth across complex jurisdictions. According to G2 Data, 39% of its users are small businesses and 49% are mid-market teams, particularly in the retail, computer software, and accounting industries. Its wide adoption reflects how effectively it balances automation power with usability, helping companies manage tax calculation, filing, and exemption tracking from one connected platform.

Automated tax calculation is the foundation of Avalara’s value. The system continuously updates its tax content database with new state, county, and city rates, ensuring real-time accuracy for every transaction. Users appreciated how the automation eliminates manual lookups and errors. Avalara also supports granular product taxability rules, which help teams correctly apply exemptions, bundles, or category-specific rates without constant oversight.

Its returns filing earned equally strong feedback. The platform prepares, files, and remits returns across thousands of jurisdictions. Users noted that being able to review filings before submission gives them confidence without adding manual workload. For finance teams handling multiple entities or frequent filing cycles, this feature significantly reduces time spent reconciling returns.

The tool’s nexus tracking capability stood out as a core advantage. It automatically monitors where a business is nearing or exceeding nexus thresholds and visualizes those triggers in an intuitive dashboard. This makes it easy for compliance teams to act proactively. Businesses expanding into new states or countries found this especially useful for maintaining continuous compliance.

Integrations are another area where Avalara shines. The platform connects seamlessly with NetSuite, Shopify, QuickBooks, Salesforce, and hundreds of other systems. These connections allow tax data to flow automatically between billing, ERP, and e-commerce environments, minimizing reconciliation work and manual imports. Reviewers frequently noted that this interoperability enhanced overall data accuracy and audit readiness.

Avalara’s exemption certificate management feature further simplifies compliance. It stores certificates in a centralized repository, automatically validates them, and links each one to its respective customer or transaction. This prevents missing or expired certificates from slipping through during audits.

The dashboard and user interface add to the tool’s usability. Despite its powerful automation, users described the interface as approachable, with clear navigation and guidance through each step. The main dashboard consolidates filing progress, remittance status, and nexus activity, giving teams an instant view of their compliance posture.

Avalara’s customer support offers detailed guidance and technical expertise, particularly for complex filings and multi-jurisdiction setups. Some users noted that during peak filing periods, response times can vary as support teams prioritize high-volume cases. For organizations that prefer immediate assistance, this may occasionally extend resolution timelines. This helps maintain service quality and efficiency when demand is at its highest.

The platform’s reporting tools and databases are robust, but some users find the web interface slower when processing large data sets or generating detailed reports. This delay reflects Avalara’s extensive tax engine, which manages thousands of live rate updates. For most teams, these delays are acceptable given the system's accuracy and completeness.

Overall, Avalara combines extensive jurisdiction coverage, powerful automation, and wide integration support, making it one of the most dependable options for businesses that need to manage complex tax compliance efficiently.

“I am a repeat Avalara customer, having installed the suite at five separate companies. We love the "one-stop shop" solution to unify our needs for sales and use tax, managed services, certificate management, 1099 filings, tax filings, and on and on. It is the gold standard in tax solutions. Additionally, I look for partners with a great team and an easy rapport, and Avalara delivers. Even when we have experienced any struggles, people have been at the ready to help.”

- Avalara review, Kelly S.

“The setup can be a bit boggy, but with the right support, it's navigable. And the support tickets can be a bit quick to close without a full explanation of what actually happened and whether or not it was resolved vs. closed.”

- Avalara review, Jennie A.

Related: Looking to simplify client invoicing and compliance for your legal team. Explore our guide to the best legal billing software for accurate, automated time and expense tracking.

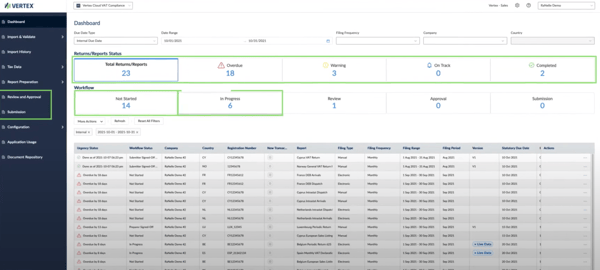

Vertex is trusted by enterprises for its precision and scalability. According to G2 Data, 55% of its users are enterprises and 28% are mid-market teams, primarily in the retail, accounting, and manufacturing industries. Vertex stands out for its robust tax automation engine, deep ERP integrations, and flexible deployment options.

Vertex’s automated tax determination engine is highly praised. It uses extensive jurisdictional content to apply the correct rates, exemptions, and rules across global transactions. G2 reviewers frequently mentioned its accuracy and reliability in handling complex tax scenarios involving multiple tax types and layered rules. For large organizations managing thousands of invoices daily, this level of precision directly translates into increased audit confidence.

The platform’s returns and remittance management feature simplifies high-volume filing. It consolidates multiple entities, jurisdictions, and filing frequencies into a single workflow. Users appreciated how they could manage return approvals, corrections, and submissions directly from within the system.

Vertex’s global compliance coverage also received consistent praise. Beyond U.S. sales tax, it supports VAT, GST, and other international tax regimes, making it particularly valuable for multinational manufacturers and distributors. The ability to manage multi-country tax data in one platform reduces the need for separate regional systems and ensures alignment between domestic and global compliance obligations.

Integration flexibility is another key strength. It integrates deeply with major ERP systems like SAP, Oracle, and Microsoft Dynamics, ensuring tax data flows automatically between invoicing, procurement, and reporting environments. Users liked that they could maintain one source of truth across systems, which helps prevent mismatched tax data and manual adjustments.

Vertex’s tax data management capabilities add another layer of value for enterprise finance teams. The platform consolidates all tax-relevant documentation, returns, notices, and exemption certificates into a single searchable digital repository. This makes audit preparation faster, since teams can retrieve archived records for any jurisdiction or time period within seconds. Users found that managing exemption certificates directly through the system reduces manual tracking and improves customer accuracy during tax-exempt sales.

The platform’s user experience and stability were also frequently highlighted. Despite the complexity of enterprise tax processes, users found Vertex reliable and smooth to navigate. Once configured, it runs in the background with minimal disruption to ongoing operations, making it a dependable choice for global finance teams.

Vertex’s customer support is known for its technical expertise, particularly for ERP integrations and large-scale tax implementations. Some users mentioned that the escalation process can take time, especially when multiple teams are involved. For enterprises managing sophisticated setups, this structured support ensures thorough investigation and resolution, though response times may occasionally feel slower than expected.

A few users also shared that the initial system setup and data mapping require detailed coordination with IT or implementation partners. This is largely due to Vertex’s depth and customization capabilities, which allow it to handle unique tax environments. While onboarding may take longer than simpler tools, the end result is a solution finely tuned to enterprise-level accuracy and compliance demands.

All-around Vertex is built for scale, delivering powerful automation, global tax coverage, and deep ERP integration.

“Vertex has been our mainstay for tax determination and calculation from SAP for several years. We like the ease of generating O-series reports for SUT and VAT reporting, and the tax area IDs in our SAP vendor and customer master automatically.”

- Vertex review, Sarah E.

“The process around submitting a service request. The documentation and process to prove our case are cumbersome and time-consuming. Research should be more proactive, in my opinion, and meet me halfway at least. I'm in the leasing industry, and it is unique. I feel that I constantly have to prove what I need, rather than researching and trying to understand. Cases are closed without resolution and understanding.”

- Vertex review, Monique M.

Related: For businesses focused on managing corporate filings efficiently, check out the best free corporate tax software options that streamline reporting without added costs.

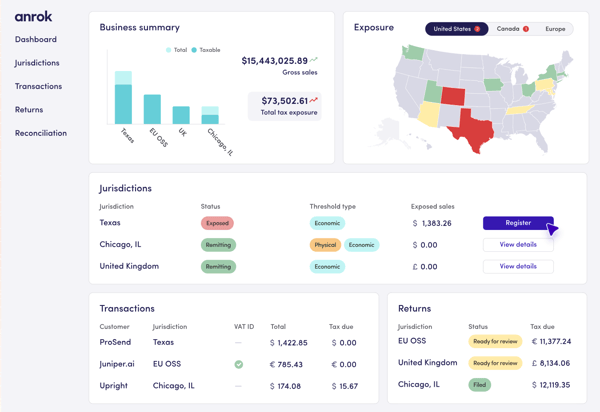

Anrok is purpose-built for subscription-based and digital-first businesses that deal with recurring revenue, variable usage, and cross-border customers. According to G2 Data, 48% of Anrok’s users are small businesses and 52% are mid-market teams, mainly in computer software, IT, and accounting.

Its dynamic tax engine is one of its strongest advantages. Rather than relying on static tables, it recalculates rates and taxability rules instantly as new transactions flow in. For SaaS companies processing thousands of subscription renewals or variable invoices, this ensures every charge reflects accurate jurisdiction rules. Reviewers noted that this level of responsiveness prevents errors that often occur when tax settings lag behind billing updates.

The platform’s automated nexus tracking makes monitoring compliance thresholds effortless. Instead of manually reviewing sales data, teams can visualize their exposure across U.S. states and international regions in real time. This proactive design helps finance teams identify when they’re nearing registration thresholds before liabilities appear, giving them time to prepare.

Anrok’s return management and filing automation also earned strong feedback. The system generates, reviews, and submits filings automatically while maintaining clear audit trails. Teams can still approve filings manually, which strikes the right balance between automation and accountability. G2 reviewers said this structure simplifies monthly and quarterly filings.

Its SaaS-native integrations are another standout. Anrok connects directly with platforms like Stripe, NetSuite, and Chargebee, syncing tax data seamlessly between billing, payments, and accounting systems. These real-time connections minimize reconciliation headaches and ensure that tax calculations stay aligned with financial records. Users described this as a major time-saver during close cycles.

The platform also supports global VAT and GST compliance, making it suitable for software businesses with international customer bases. It centralizes regional tax obligations and reporting, allowing finance teams to manage all jurisdictions through a single dashboard. This consolidation helps avoid fragmented workflows that often arise when companies expand into new markets.

Anrok’s reporting and visualization tools give teams a clear snapshot of their compliance health. The dashboards summarize nexus exposure, filing progress, and tax liability trends at a glance. Reviewers mentioned that having all this data centralized reduced their reliance on spreadsheets.

Anrok’s customer support team is known for its deep tax expertise and hands-on guidance. Some users mentioned that support response times may vary, particularly when dealing with complex international queries. For teams seeking faster resolutions, leveraging Anrok’s growing self-service library can often address routine setup questions quickly.

A few users mentioned that the platform’s interface could feel dense at first. The number of menus and settings reflects the system’s depth rather than complexity, and most users said the layout becomes intuitive once configured. The guided workflows and in-platform tips make onboarding smoother over time. For many teams, the learning curve is a worthwhile trade-off for the visibility and control Anrok provides.

Overall, Anrok delivers the automation and agility that modern SaaS companies need to stay ahead of evolving tax rules. It’s a platform designed not just to calculate tax but to make compliance seamless for recurring-revenue businesses.

“Anrok has allowed us to file tax returns seamlessly and in compliance with limited effort from the team. Easy and convenient. The Anrok team is very prompt and willing to help, as they can, with any questions or support tickets. Including program assistance and outside integration troubleshooting. Anytime there has been a potential issue, we have been escalated to the right department and team member swiftly.”

- Anrok review, Bailey V.

“My main issue is that once we are subject to an applicable tax, the platform does not keep track or differentiate between the types of taxes that we are subject to. For example, sales tax should be broken out separately from excise tax or gross receipts tax, or the like."

- Anrok review, Mike O.

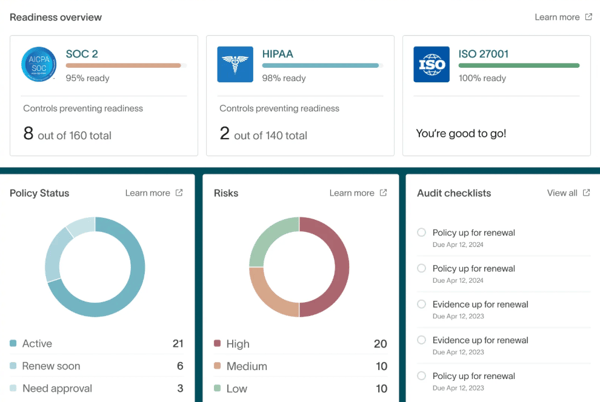

Related: Strengthen your compliance and risk posture with the best GRC software

trusted by enterprises for governance, risk assessment, and policy management.

DualEntry platform bridges compliance automation with financial precision, giving teams both control and clarity over every recorded transaction. According to G2 Data, 34% of its users are small businesses and 57% are mid-market teams, primarily in accounting, finance, and manufacturing.

Its transaction-level accuracy is one of its defining strengths. Instead of processing taxes at the invoice level, it validates each line item independently, ensuring every rate and exemption is applied correctly. This granular approach makes reconciliations faster and more reliable. Users valued how discrepancies can be traced directly to the source transaction, reducing time spent on month-end cleanup.

The platform’s filing coordination system is built to handle high-volume reporting without losing oversight. DualEntry organizes filings across multiple states and entities within a single interface, making it easy to track return status and remittance schedules. Teams can approve filings individually or in bulk, maintaining the perfect balance between automation and human review.

DualEntry also offers granular access controls for large teams managing multiple departments or subsidiaries. Permissions can be set by user, role, or region, so only authorized team members can modify filings or reports. G2 reviewers stated that this fine-tuned control structure enhances internal compliance while facilitating collaboration among finance, accounting, and tax operations.

The tool’s audit automation is also highly praised. It tracks every system interaction with full audit trails, edit histories, and IP logs for each change made. Real-time alerts flag irregularities instantly, while automated approval routing and time-stamped sign-offs streamline review cycles. The AI-powered audit assistant also helps summarize findings and identify key action items.

Integration flexibility is another core strength. DualEntry connects seamlessly with NetSuite, QuickBooks, and Xero, ensuring tax data stays consistent from calculation to ledger. Users noted that this automatic synchronization prevents journal entry errors and makes monthly closings more efficient. For finance teams prioritizing data integrity, this level of alignment provides real peace of mind.

Despite its depth, it remains easy to navigate. The interface organizes workflows logically, with clear menus for returns, reconciliations, and exemption management. Users found that after a short onboarding period, even complex filings became simple to manage. The balance between detail and simplicity makes the tool approachable without compromising functionality.

DualEntry’s structured workflows promote consistent, audit-ready processes, though customization options could be broader. Some users mentioned wanting more control over dashboard layouts or report formats to match internal templates. The platform’s standardized design ensures data consistency across entities, which many teams prefer for compliance reliability. For those who prioritize uniformity and traceability, this trade-off helps maintain long-term accuracy.

A few reviewers also mentioned that mobile functionality is still evolving. While the web interface functions reliably across desktop browsers, users noted that navigation on smaller screens can feel limited. This focused design ensures optimal performance and usability on full desktop displays. For teams that primarily manage filings from their workstations, this has minimal impact on day-to-day operations. As DualEntry continues to enhance mobile support, it remains a strong solution for on-the-go visibility without compromising security.

All in all, DualEntry blends precision, audit readiness, and usability into a single tax compliance environment. It’s best suited for teams that value control and transparency as much as automation.

“What I like best about DualEntry is its ability to process a huge amount of data at the same time without glitching or overloading. It was also impressive how smooth the platform integrations were that it felt like they were already part of the software itself, like BambooHR, for example, which our company uses primarily for our business needs.”

- DualEntry review, Xaviera Faye B.

“The UI, though clean, could benefit from a few more customization options to suit different team workflows. That said, the support team has been very responsive, and once everything is set up, the system runs smoothly.”

- DualEntry review, Ariana D.

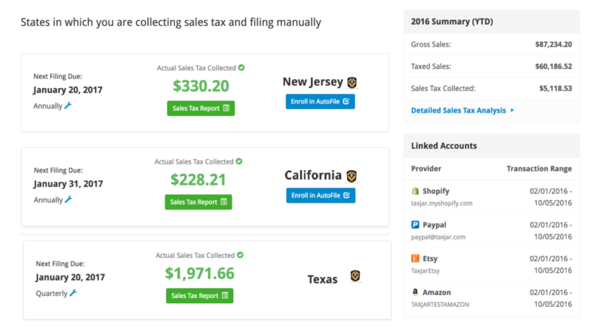

Managing sales tax across multiple states can be overwhelming for small online retailers. That’s where TaxJar comes in. Built for e-commerce sellers and small business owners, it automates rate calculations, filing, and remittance across U.S. jurisdictions. According to G2 Data, 88% of TaxJar users are small businesses, primarily in the retail, consumer goods, and apparel and fashion industries. The platform’s simple setup, strong marketplace integrations, and filing automation make it a reliable compliance partner for sellers managing growth without a full finance team.

TaxJar’s automated tax calculation engine is at the core of its value. It applies state and local sales tax rates in real-time, ensuring every checkout reflects the correct total. G2 reviewers highlighted the dependability of the automation, particularly for sellers who use multiple e-commerce channels. The system eliminates the need to manually upload rate tables or track tax changes, which saves hours of repetitive work each month.

The platform’s AutoFile feature is another highlight. It automatically files state sales tax returns accurately and on time, using transaction data directly from e-commerce or ERP systems. This end-to-end process manages remittance, report preparation, and deadline tracking automatically. Users said that AutoFile removes the manual burden of researching forms or state-specific formats, reducing filing mistakes and maintaining smooth compliance as businesses grow.

TaxJar’s nexus tracking tools help businesses stay compliant as they expand into new states. The platform monitors sales thresholds and alerts users when they’re approaching registration requirements. G2 reviewers said this feature gives them peace of mind, especially during high-volume seasons when monitoring compliance manually would be impossible.

Integrations are one of TaxJar’s biggest strengths. The platform connects directly with Shopify, Amazon, WooCommerce, BigCommerce, and QuickBooks, automatically syncing transaction data. These integrations reduce discrepancies and ensure that tax is calculated consistently across every storefront. Reviewers noted that setup is straightforward, with minimal technical steps required to get started.

The tool’s reporting and reconciliation features were frequently mentioned for their clarity. TaxJar breaks down transactions by state and filing frequency, making it easy to double-check tax liabilities before submission. Users said the reports are clean, readable, and useful for both filings and internal audits, even without extensive accounting expertise.

Ease of use is another area where TaxJar stands out. G2 reviewers consistently praised its simple and intuitive interface, which makes onboarding fast, even for teams without dedicated finance staff. Everything from connecting stores to reviewing filings can be managed from a single dashboard, making it one of the most user-friendly options for small businesses.

The platform is widely praised for its automation, accuracy, and reliability, particularly among small business users. However, there aren’t many recent reviews to form a clear consensus on ongoing challenges. From individual feedback, I gathered that while most users see strong value, a few mentioned that pricing can scale with filing requirements and that coverage for certain local jurisdictions, such as Colorado, may be limited. Still, these notes appeared as isolated experiences rather than widespread concerns.

Overall, TaxJar remains a trusted choice for e-commerce businesses that need dependable automation without complexity.

“TaxJar saves me literally 20 or more hours per month, and takes away all the headaches and hassles associated with tracking sales tax in multiple states (we have nexus in 27 states).”

- TaxJar review, Asher J.

"I don't like the fact that it's not easy to get customer support. I have to email my questions and get email responses.”

- TaxJar review, Laura M.

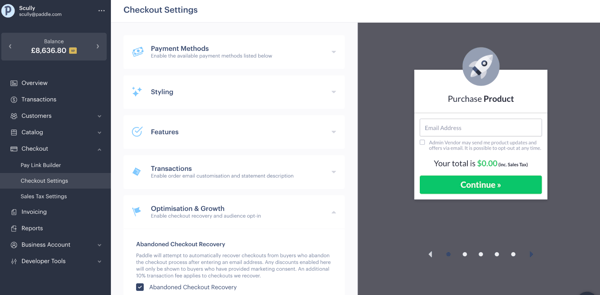

Paddle is an all-in-one revenue delivery platform for SaaS businesses that handles billing, payments, subscriptions, and tax obligations across multiple regions. According to G2 Data, 92% of Paddle’s users are small businesses, primarily in the software, IT, and marketing and advertising industries. The platform’s ability to combine payment processing with built-in tax compliance makes it a strong choice for startups that sell across borders without dedicated finance teams.

One of Paddle’s biggest advantages is its built-in global tax compliance. Rather than asking sellers to register in each country, Paddle handles the tax calculation, collection, and remittance process on their behalf. Reviewers noted the value of this for small teams without in-house tax expertise. The system automatically stays current with international tax rules, minimizing the risk of penalties or missed filings.

The platform also shines in subscription and recurring billing management. Paddle automates renewals, upgrades, cancellations, and refunds while ensuring each transaction includes the right regional taxes. G2 users said these automated processes reduce errors and improve billing transparency for both teams and customers. This makes it particularly useful for SaaS businesses with tiered pricing or usage-based models.

Paddle’s payment infrastructure simplifies global selling by supporting multiple payment methods and currencies. Reviewers appreciated how it localizes checkout experiences for buyers automatically, helping to boost conversions in new markets. Teams also liked not needing separate payment gateways or merchant accounts, as Paddle consolidates everything into one platform.

The platform’s integrations make it even easier to manage the entire revenue lifecycle. Paddle connects with tools like HubSpot, Databox, and Stripe, allowing teams to sync payment, subscription, and customer data with their existing workflows. Reviewers noted that these integrations cut down on manual exports and give finance and operations teams a more unified view of revenue and compliance data.

Another feature that stood out was Paddle’s developer readiness. The platform provides straightforward API documentation and flexible plug-ins, making integrations easier than most enterprise payment systems. Users reported that the setup required minimal engineering time, which allowed them to focus on product growth rather than infrastructure.

Customer support received strong recognition across reviews. Many users praised Paddle’s onboarding support, mentioning the team's responsiveness and expertise during the initial setup and international expansion. For growing SaaS companies, this proactive help made compliance seem much more manageable.

While the support team is recognized for their knowledge, that same thoroughness, for some G2 users, means response times can vary once users begin requesting deeper technical or API-level guidance. Teams managing highly technical configurations may simply need to plan for slightly longer resolution cycles.

Paddle’s documentation is structured for clarity and accessibility, making it easy for most users to complete standard integrations independently. For developers working on advanced or highly customized setups, however, the materials can feel fragmented or lack complex examples. This keeps the learning curve manageable for non-technical teams, while those seeking deeper implementation detail may prefer to supplement with direct support or community guidance.

Lastly, it’s worth noting that recent G2 review volume for Paddle is limited, making it harder to gauge newer user experiences in 2025. In general, Paddle delivers what most small software businesses need: dependable automation, peace of mind regarding compliance, and a billing system that scales as quickly as their growth.

“What I like most about Paddle is how easy the platform is to use — the interface is intuitive and straightforward, which makes managing payments a breeze. The support team is fully capable and always ready to help or answer any questions promptly, which gives a lot of confidence. I also appreciate the option to accept payments in multiple currencies, which makes it easier to sell globally. Another great feature is the ability to pass on payment taxes and fees to the customer, which helps keep costs transparent and manageable for the seller.”

- Paddle review, Mateus N.

“When going live, we faced some issues, and in the beginning, the level of support was not sufficient. But to be fair, Paddle has taken our complaints seriously and improved the quality of their support drastically. It took some time, but now we are at a level where we are happy with the support, and I'm sure Paddle has learned from this experience.”

- Paddle review, Sven L.

Whether you came here wondering which VAT compliance software is highly rated or what’s the most recommended sales tax software for startups, I hope you found your answers. If you have more questions, we have some FAQs for you.

The leading sales tax compliance solutions in the U.S. include Avalara, Vertex, and TaxJar. Avalara is widely recognized for its automated rate updates and multi-jurisdiction filing capabilities. Vertex stands out for enterprise-grade accuracy and ERP integrations, while TaxJar simplifies sales tax compliance for small and mid-sized e-commerce businesses.

For small businesses, TaxJar, Anrok, and Paddle are strong contenders. TaxJar automates U.S. filings for online sellers and integrates directly with Shopify, Amazon, and WooCommerce. Anrok caters to SaaS companies with subscription-based billing, while Paddle helps small digital businesses manage both payments and global VAT obligations.

Tech and SaaS companies often prefer Anrok and Paddle. Anrok automates tax calculations for recurring and usage-based billing, while Paddle handles VAT, GST, and sales tax globally under a merchant-of-record model. DualEntry is another option for finance teams that want real-time, transaction-level accuracy and audit-ready reporting.

If your business operates globally, Avalara and Vertex offer the most comprehensive sales tax and VAT compliance features. Avalara provides automation for both U.S. and international jurisdictions, while Vertex supports multi-country filings, exemptions, and advanced reporting.

Based on G2 Data, the top-rated tax compliance software includes Avalara, Vertex, and Anrok. Each tool ranks highly in terms of automation, accuracy, and ease of integration.

For e-commerce and online sellers, TaxJar is one of the best options. It automates U.S. sales tax filings, tracks nexus thresholds, and integrates seamlessly with major platforms like Shopify, Amazon, and QuickBooks. G2 reviewers praised it for saving time and ensuring filing accuracy for small and mid-market online stores.

Global enterprises often rely on Vertex or Avalara for VAT management. Vertex provides extensive international tax coverage with configurable workflows, while Avalara simplifies multi-region compliance through automation and standardized reporting.

Tax compliance might never be simple, but with the right software, it doesn’t have to be stressful. The six tools I evaluated stand out because they don’t just calculate rates; they automate the entire compliance process, from nexus tracking and filing to audit preparation.

For large enterprises, Vertex and Avalara deliver unmatched precision and scalability. SaaS and subscription-based businesses will find Anrok and Paddle ideal for automating complex recurring revenue taxes. Meanwhile, DualEntry brings clarity to transaction-level accuracy, and TaxJar remains a go-to solution for small retailers seeking reliable automation without the complexity of enterprise systems.

Each of these platforms earned its place on this list because real G2 users confirmed their reliability, automation depth, and impact on day-to-day tax management. Whether you’re selling digital products, managing cross-border transactions, or filing in multiple states, these tools make compliance less about chasing deadlines and more about running your business with confidence.

If you’re managing global teams or looking to simplify cross-border payments, explore our guide on the best multi-country payroll software to complete your global compliance stack.

Harshita is a Content Marketing Specialist at G2. She holds a Master’s degree in Biotechnology and has worked in the sales and marketing sector for food tech and travel startups. Currently, she specializes in writing content for the ERP persona, covering topics like energy management, IP management, process ERP, and vendor management. In her free time, she can be found snuggled up with her pets, writing poetry, or in the middle of a Netflix binge.

Financial clarity is one of the strongest advantages a company can have.

by Harshita Tewari

by Harshita Tewari

Let's face it; payroll isn't the most glamorous part of running a business.

.png) by Shreya Mattoo

by Shreya Mattoo

I believe getting paid should be a simple, straight-forward process, not a stressful one.

.png) by Tanuja Bahirat

by Tanuja Bahirat

Financial clarity is one of the strongest advantages a company can have.

by Harshita Tewari

by Harshita Tewari

Let's face it; payroll isn't the most glamorous part of running a business.

.png) by Shreya Mattoo

by Shreya Mattoo