Do you have an interest in math and business? There’s an extremely lucrative career out there that could be perfect for you.

An actuarial analyst uses statistics, probability, and economic concepts to help a company leverage its financial risks and potential rewards. The actuarial science industry is incredibly competitive and the different job titles can become confusing at times.

What’s the difference between an actuarial analyst and an actuary?

An actuarial analyst is the most common entry-level position for someone in actuarial sciences. A person does not become an actuary until they have taken the right exams and become fully credentialed.

An actuarial analyst (sometimes called an actuarial associate) is a great starting position for someone who is interested in becoming an actuary, but still needs the experience and know-how that comes with a career path in the industry.

We’re going to explore exactly what an actuarial analyst does, but feel free to jump ahead to one of the following sections to get your questions answered:

What does an actuarial analyst do?

An actuarial analyst is responsible for analyzing and managing the financial risks of a business. Actuarial science is a deeply sought-after field that plays a high role in the success of a company. Actuarial analysts help accredited actuaries make strategic decisions and communicate solutions for deeply complex financial issues.

Many types of companies find value in hiring actuarial analysts. Some of the most common employers of actuarial analysts are insurance companies, consulting firms, government, hospitals, banks, and investment firms. There is typically a divide between those in life disciplines (life and health insurance) and those in non-life disciplines (auto, home, and property insurance).

The day-to-day role of an actuarial analyst involves quite a bit of mathematical work and analysis. It’s a fairly competitive field, meaning that commitment and strong collegiate performance can give you a leg up when searching for a job.

Actuarial analyst education

Becoming an actuarial analyst requires you to receive a Bachelor’s degree to start. Many institutions offer actuarial science programs, but you could also study curriculum in business, math, or economics.

Actuarial analyst certifications

There are also a number of required actuarial exams that cover important skills like mathematics, probability, economics, and business. Passing these exams can help promote you along the path to becoming a full-fledged actuary as well as help you make more money.

|

If you want to succeed at these tough exams, consider checking out study tools here on G2, reviewed and rated by verified users.

|

How much money do actuarial analysts make?

An actuarial analyst earns a significantly lower salary in comparison to a certified actuary. Starting out as an actuarial analyst as your first job out of college with few passed exams and little experience will put you at the lower end of the salary range. This can be increased quickly by passing more exams, often resulting in raises of a few thousand dollars each.

Compared to an actuary, who makes on average $102,000 yearly, an actuarial analyst makes about $74,000 on average.

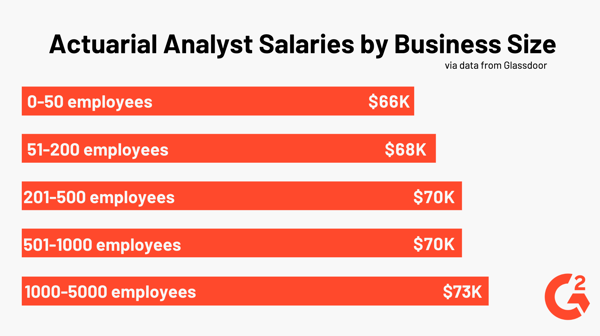

At G2, we highly value validated reviews and ratings. We looked at the popular job site, Glassdoor for data on actuarial analyst salaries and found that based on 2,316 reported salaries, the average base pay is around $74,000. Below, you can see how these averages may change based upon the size of the business an actuarial analyst works for.

Due to these high salary markers, many actuarial analysts can live comfortable lives with a high income and relatively low-stress work environments.

Skills an actuarial analyst needs

Not everyone is cut out for the life of an actuarial analyst; it takes a very special set of skills. Thankfully, many of these skills are not inherent and can be developed through determination and hard work. These necessary skills are:

- Specialized math knowledge in calculus, statistics, and probability

- Analytical, project management, and problem solving skills

- Finance, accounting, economics

- Interpersonal communication

- Computer skills such as simple coding, formulating spreadsheets, running statistical analysis programs, database manipulation, and programming languages

An actuarial analyst must be self-motivated, creative, both independent and collaborative at times, and have a strong sense of ambition. Having an understanding for the common industries that actuarial analysts are employed in such as insurance, banking, and government can also set you ahead as a candidate in the field.

On your way to the top

Becoming an actuarial analyst is often the first step for those beginning a career in actuarial science, but make sure you’re prepared for what you’re getting into.

Want to become more familiar with the role of an actuarial analyst? Check out these insurance analytics software commonly used in the position.

by Derek Doeing

by Derek Doeing

by Mary Clare Novak

by Mary Clare Novak

by Derek Doeing

by Derek Doeing