May 28, 2023

by Dimitri Raziev / May 28, 2023

by Dimitri Raziev / May 28, 2023

Every day, strategic decisions must be made to monitor, assess, protect, and optimize your business’ cash flow.

However, the burden of fragmented data and outdated, cumbersome processes can hinder your ability to manage your business’ working capital effectively.

With rising interest rates, high market volatility, and economic uncertainty top of mind for many, it is now essential to implement actions to protect balance sheets, anticipate cash needs, and streamline operations to achieve greater control and visibility.

Working capital management is a pressing matter. Business leaders and finance teams should leverage available accounting and finance technological power to maximize efficiency and enhance operations.

Working capital is a trustworthy key performance indicator (KPI) to which chief financial officers (CFOs) should pay attention. This ratio, which is your current assets/current liabilities, is a faithful witness to your company's short-term financial health.

By considering short-term assets and liabilities, you can determine your net working capital to assess the money readily available to meet your current expenses. It gives you a critical insight into your finances, money cycle, and assets to make the right decision and upgrade your overall strategy.

In the current economic climate, managing your working capital with an iron fist is essential to operate effectively and stay competitive. After all, cash flow is the ultimate value driver, and the risk of overlooking effective working capital management is a tough one to pay.

Especially in an economic downturn, with increasing insolvencies and rising interest rates, liquidities must be flowing and accessible in anticipation of unexpected expenses and needs. Unsurprisingly, CFOs are trying to factor their receivables or sell their accounts receivable to optimize their cash flow.

According to Johannes Wehrmann, managing director for corporate sales at Demica, a supply chain finance platform provider, more companies are now looking for working capital financing facilities.

Managing cash more efficiently and paying off higher debt by selling receivables is the best move - and effective working capital management is the best ally to implement this strategy.

Now more than ever, business leaders should foster resilience and agility within their organizations to help mitigate current or future potential risks.

Keeping track of your finances, managing your order-to-cash cycle, reducing days sales outstanding (DSO), and knowing where your money is, is essential but time-consuming.

Leveraging technology to smoothen these processes is a game-changer.

With the right software, you can automate accounting operations, provide financial analysis and decision-making tools, and improve communication and collaboration. It can save you precious time and money by reducing the need for manual data entry while improving accuracy. It also makes financial forecasting and budgeting easier and tackles the burden of fragmented data to make sure everyone is on the same page regarding financial matters.

The following are some gains from using technology to augment your working capital management.

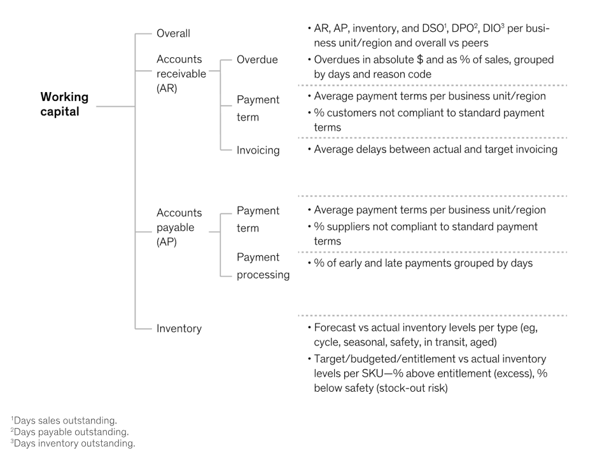

Companies that leverage technology and data to manage their working capital can add back to their bottom lines. According to McKinsey, focus should be placed on three key areas to improve your working capital management.

The image below details the essential KPIs that must be on a CFO's radar.

Source: McKinsey

Optimizing working capital management comes hand in hand with keeping on top of your customers and managing your accounts receivables, as it is the primary source of cash bleeding. It involves the time-consuming task of segmenting your customer portfolio by identifying and prioritizing high-risk customers and serial (or not yet) late payers.

Of course, you can ask your employees to perform this tedious task or take it upon yourself, as many business owners do. However, you also have the option to invest in advanced classification algorithms to seamlessly categorize your customers according to their risk to limit your exposure to the riskier profiles.

How?

By using working capital management software. The relevant customers will be contacted right after invoice emission to ensure you collect your fees quicker and keep your accounts receivables under control.

The best working capital management solutions include software and services that help mitigate risk and optimize your company's cash flow. It leverages accounts payable and accounts receivable solutions, loan management, and invoicing management and optimization.

Relying on ERP and CRM technology alone isn't sustainable. It only gathers more dispersed, disaggregated data to process. Besides, sticking to manual processes can negatively impact your team morale and costs by accumulating too many error-prone processes. With accounts receivable software, you can:

Accounts payable automation software enables buying organizations to receive invoices, manage approvals, and process payments seamlessly. With this software, you can:

Working capital management improves once the accounting function is automated. It is an optimal strategy to collect more cash and reduce your DSO while increasing your teams' productivity and focusing on added-value operations.

Accounts payable and receivable automation software can simplify invoice processing and follow-up. It helps reduce payment errors, and detects duplicate or fraudulent payments. Automated solutions are easy to integrate into your existing financial systems, so you don't have to worry about data flow and communication.

Manual collection processes are lengthy and time-consuming in B2C or B2B contexts, which hurts productivity.

Manual collection involves:

For B2B companies, the process is even more strenuous, especially in the absence of a dedicated credit controller team, as is the case for SMEs.

On top of their existing responsibilities and duties, employees must:

Automation removes such manual processes and gives back time to employees to focus on more value-add tasks.

Accounts payable automation can also cut the cost of invoice processing by reducing the amount of data entry involved in the process and eliminating document storage, postage, and invoice production costs. Accounts receivable automation has the same positive impact on your finances.

Accounts payable automation can increase your business transparency as it integrates all compliance rules within the system. It helps mitigate risks and prevent fraud by immediately detecting duplicate invoices, additional charges, and fraudulent activity.

Automating your accounting function helps improve customer relationships through better communication. Paying is made easier for the customer, as well as being reminded to pay, and therefore, you can unlock your outstanding revenues while maintaining good relationships with your customers.

Accounts receivable automated solutions segment your customers by sorting out loyal customers with a good history of payment behavior from late serial payers. It also uses a different tone of voice for each of them, whether a gentle nudge or a stricter approach.

Artificial intelligence can set up creative follow-up strategies by assessing the ideal frequency of payment reminders and relying on omnichannel communication. For instance, it can even tailor the message to its recipient according to age or mimic its style.

It is clear now that working capital management should be at the top of CFOs' agenda, yet it is far from the case.

In a recent Deloitte webcast, participants poorly evaluated their organization's ability to drive working capital performance, admitting they were "somewhat or very concerned."

Any business trying to fuel growth by freeing cash should address the working capital management challenge by harnessing the power of technology and automation.

Understand the key components of accounting automation. See how technology can optimize your company’s finance management processes.

Dimitri Raziev is the co-founder and CEO of Kolleno, a global, cloud-based accounts receivable management and collections platform. A member of the Forbes Technology Council, Dimitri spent several years working at Goldman Sachs and Credit Suisse prior to founding Kolleno.

Imagine a growing business constantly extending free credit to customers but lacking the...

by Sergio Tzianos

by Sergio Tzianos

Regardless of a company's size, the accounts payable (AP) department fulfills an essential...

by Kayla Matthews

by Kayla Matthews

With the recession looming, most companies are looking for ways to stay afloat.

by Nahla Davies

by Nahla Davies

Imagine a growing business constantly extending free credit to customers but lacking the...

by Sergio Tzianos

by Sergio Tzianos

Regardless of a company's size, the accounts payable (AP) department fulfills an essential...

by Kayla Matthews

by Kayla Matthews