July 30, 2019

by Grace Pinegar / July 30, 2019

by Grace Pinegar / July 30, 2019

Let me start by saying that I am not an insurance professional.

I am, however, an aspiring artist coming of age in a country whose healthcare system is a mystery, if not a complete crapshoot.

Needless to say, I’ve done plenty of research into how self-employed individuals and freelancers make healthcare work for them.

If you’re a freelancer, or you simply work in an industry that does not provide health insurance to its hard-working employees (here’s looking at you, retail and food service), continue reading this article to find out how you can get yourself covered.

You don’t need me to harp on about the importance of having a health insurance plan. We’ve all either heard, or experienced firsthand, the horror of needing emergency medical care without coverage.

You either wind up with doctors who refuse to treat you or bills that could slide you into bankruptcy. Our goal here is avoiding all of that by understanding your options as a self-employed individual.

Let’s start off by clarifying that a self-employed person is someone who works for themselves, without any employees under their payroll. If you have employees, you may have to look into small business insurance plans. (See: HR services, Finding HR solutions for small businesses)

The following are some of the best healthcare options for self-employed persons, whether they’re looking for individual or family plans.

Note: With politicians changing the healthcare landscape every couple of years, it’s important you remain up-to-date on what the latest policies are. Government sites can help you stay in-the-know when policies change.

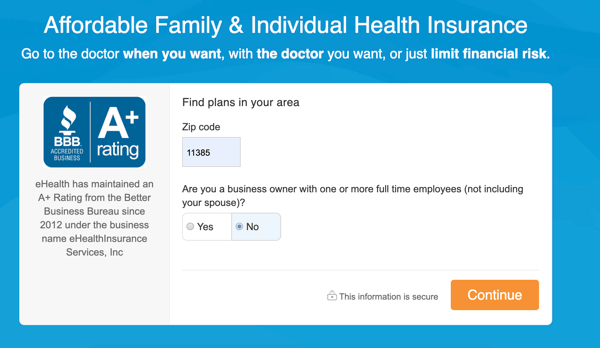

eHealth Insurance is a great site that helps individuals, families, and small businesses alike find the best insurance plan for their needs. In the image below, you can see it has you fill out a few pages worth of information to discover what it can offer you.

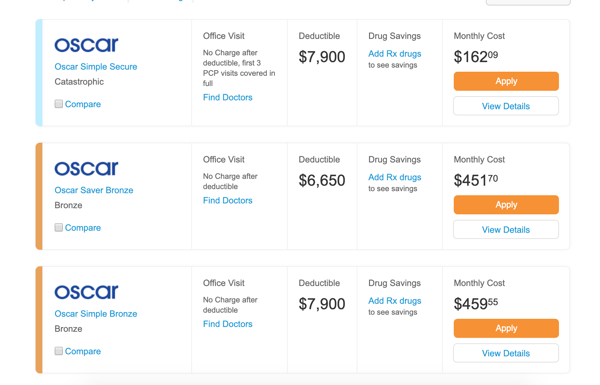

Once you’ve filled out that information (the next page asks for more sensitive information, such as annual income, birthday, and whether you’re pregnant or have children), it’ll give you some options for plans. You get to decide which one fits your needs and apply accordingly.

A health savings account, also known as an HSA, is an account that you own and contribute to every month, and which can only be utilized for medical care.

From their website: “Unlike a flexible spending account (FSA), health savings accounts do not have deadlines and funds roll over from year to year making them great supplementary savings accounts for the future. For 2019, you can contribute up to $3,500 to an HSA if you participate in your health plan on an individual level, and up to $7,000 for family health plan coverage.”

In order to have an HSA, you must also hold a high-deductible health plan, which is an insurance plan that has a higher deductible than a traditional health insurance plan. When combined with your HSA, you’re able to pay for medical costs with untaxed earnings.

As 2019 is halfway over, I’ll include this information for the upcoming year: “For 2020, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,400 for an individual or $2,800 for a family. An HDHP’s total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) can’t be more than $6,900 for an individual or $13,800 for a family. (This limit doesn't apply to out-of-network services.)”

Next on the list is telemedicine services, which provide individuals with the option of calling certified healthcare professionals, explaining symptoms or problems, and getting diagnoses and prescriptions over the phone.

This option is helpful for those times when you know something is wrong, but it doesn’t feel like an emergency. Examples of this are a scratchy throat, or if you’re running a low fever with aches and pains.

Telemedicine services are typically much cheaper than the cost of going to an emergency room or an urgent care clinic. If further medical care is necessary, these “teledoctors” can refer you to a primary doctor, or other appropriate physicians.

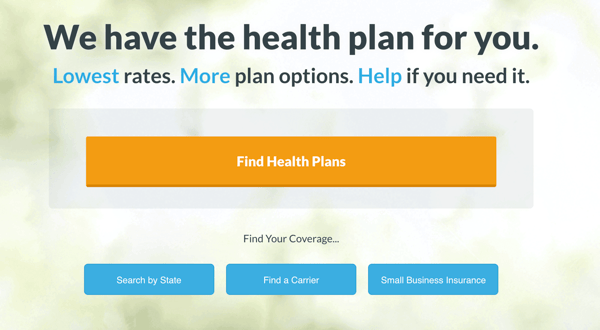

eHealth Insurance is great, but it’s always nice to have a comparable second opinion. GoHealth is the same idea as eHealth Insurance in that it’s a website intended to help you find the best plan for you.

GoHealth is a health insurance matchfinder, with more than 10,000 licensed insurance agents ready and willing to help you choose your plan.

Unfortunately, upon entering my own information into GoHealth, it wanted me to call to retrieve my options — so it’s not as simple as eHealth. But it could be a good choice if you want personalization along with a human to walk you through the process,.

This option is similar to telemedicine in that you speak to a doctor online, and ask them any health-related questions for a predetermined price.

It’s kind of like how you call the poison control hotline to determine if something you ingested could be fatal. But in this scenario, all health questions are fair game.

With a website such as HealthTap, you’re quickly connected to a doctor who helps you come up with a plan of action.

They even have a free search feature that allows people to search their concerns before committing to a consultation. It’s possible a doctor has already answered your question online, and offered their expertise freely.

The search should not be used in an emergency situation. If you’re truly in dire straights well, get yourself on the phone, or to a clinic.

Contrary to how it sounds, you do not have to be religious in order to be a part of a healthcare sharing ministry. This healthcare strategy is free of government constraints and restrictions.

Rather, it is run by individuals (oftentimes individuals associated with the same belief system) who wish to pool their healthcare funds for the greater good of the group.

What the heck does that mean? It means all members pay annual and monthly fees that can be used by other members when needed. Contributing to a sharing ministry can often cost less per month than it would to have a government-sanctioned plan.

If this is important to you, you also have the peace of mind knowing your healthcare payments could actively be contributing to someone else’s immediate needs.

Examples of popular healthcare sharing ministries are:

I’ve given you plenty of options to mull over. But what factors are truly important when it comes to deciding on what will work for you?

Let’s touch on how you should go about making such an important decision.

First of all, be sure to choose a plan that covers the people who need coverage. Options are: you, your spouse, and your kids.

Secondly, consider what all comes with this plan’s coverage. How big is the physician network? How extensive is their physician drug coverage? A plan is worthless if everything is out of network.

What additional benefits does your plan offer? For example, many plans will enable you to join fitness centers at a reduced cost. Become familiar with the perks of certain plans and choose the one that benefits you and your family.

One of the many tricky facts about healthcare coverage is that open enrollment only happens during one specific period every year. During open enrollment, individuals can opt into or change their healthcare plans.

Try and time your health insurance journey around open enrollment season. This will change annually, but typically falls between the November and December months.

If you’re unable to time your needs around this season, you could consider pursuing a short-term health insurance plan. You could also talk to insurance providers about special enrollment.

| Tip: Whatever decision you make, you are going to need a notary to witness signatures on documents. Don't worry, you can find yourself a remote notary to make it as painless as possible. |

Life is funny, and we really can’t predict how things will change from one day to the next. If you have an unexpected event such as the birth of a child, a divorce, a move, a marriage, or the loss of your job, you could qualify for the special enrollment period.

No matter where, how, or when you get your insurance, just be sure that you do. I know the prospect of paying another bill every month — especially one that can range from $200-$500, depending on your needs — is daunting.

But it’s so much better than being hit with a $10,000 bill for the emergency surgery you needed after tripping over your dog and falling down the stairs. If you really want to save money, you unfortunately will have to spend some of it up front.

Want to learn more about what life is like as a freelancer? Check out the benefits of freelancing.

Grace Pinegar is a lifelong storyteller with an extensive background in various forms such as acting, journalism, improv, research, and content marketing. She was raised in Texas, educated in Missouri, worked in Chicago, and is now a proud New Yorker. (she/her/hers)

If you work full-time for an organization, it’s possible you’ve been told not to unionize....

by Grace Pinegar

by Grace Pinegar

Are you offering enough to keep your employees engaged?

by Lauren Pope

by Lauren Pope

Day in and day out, HR managers are inundated with requests.

by Mara Calvello

by Mara Calvello

If you work full-time for an organization, it’s possible you’ve been told not to unionize....

by Grace Pinegar

by Grace Pinegar

Are you offering enough to keep your employees engaged?

by Lauren Pope

by Lauren Pope