September 14, 2023

by Washija Kazim / September 14, 2023

by Washija Kazim / September 14, 2023

Imagine a world where your financial data moves between banks without compromising security, where you have full control over your choices, and where innovation speeds past any limits or boundaries. Thanks to the concept of open banking, this is the reality we now live in.

The open banking ecosystem allows customers to explore the potential of an interconnected financial future. It promotes collaboration and consumer empowerment while strongly focusing on security and data privacy.

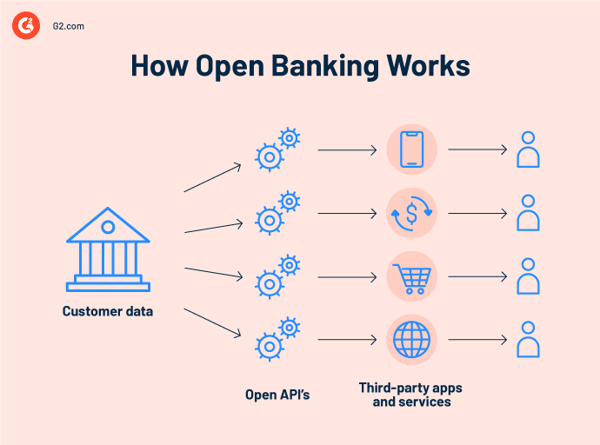

Open banking, also known as open bank data, is a practice that enables secure interoperability in the banking industry. It gives third-party service providers access to customer banking data and transactions via APIs, allowing them to offer personalized services and expand their range of financial products.

Through open banking, digital banking platforms gain the ability to securely access and share customer financial data across institutions, offering a holistic view of accounts, transaction data, and financial health. As a result, banks are no longer the isolated institutions of information they used to be.

Open banking has allowed financial service providers to unlock their vaults and share data responsibly. Banking as a service (BaaS) solutions make this happen by integrating financial products into non-financial service businesses using application programming interfaces (APIs).

Open banking’s primary goal is to increase competition, innovation, and consumer choice in the financial services industry. It enables different industries to offer a variety of banking products and services in an interconnected, efficient manner.

Open banking uses financial data APIs provided by banks and other financial institutions to grant secure access to customer data. For example, a bank's API integrated into a ride-sharing platform lets users pay for their rides from their bank accounts.

This cross-industry collaboration demonstrates the way open banking has the potential to reshape our interactions with the various services we use in our daily lives.

The following are the steps to an ideal open banking process.

Open banking was first introduced in 2015 with the launch of the payment services directive 2.0 (PSD2) in Europe. The concept facilitated a shift in the mindset of banks from acting as data stewards to looking at their customers’ data as useful assets.

Although financial services firms are now more likely to offer up their data sets, the rules set by PSD2 explicitly give the consumers the power to share – or to not share. There are informed consent stipulations in PSD2 that require banks to tell their customers exactly which data they’re granting the bank permission to share.

Open application programming interfaces are publicly available APIs that developers use to access backend data. They typically rely on the insights in that data to structure product development strategies to address the needs revealed.

The term “open APIs” when it comes to usage in the financial services industry is a bit of a misnomer, as these APIs aren’t truly open. The rules and regulations in PSD2 require that each developer using an “open” API is vetted and monitored, guaranteeing that data is used correctly.

These principles collectively define the foundation of open banking and guide its implementation to ensure customer trust, data security, competition, and improved financial services.

Open banking has given rise to a wide range of use cases that make use of the shared data between financial institutions and third-party providers. Read on for a few examples.

* These are the leading digital banking platforms on G2 as of August 2023.

Open banking transforms the financial landscape by promoting competition, innovation, and customer-centric services. It gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole.

Some of the key benefits include:

While open banking offers various benefits, it also comes with risks and limitations. These need to be addressed to ensure that open banking remains secure, transparent, and beneficial for all stakeholders.

One of the potential concerns for customers is privacy with regard to data sharing. The more places your data is held, the more vulnerable. Consumers are more aware of security risks than ever before and have become more hesitant to hand over access to their data.

The fact that consumers have to explicitly accept all data-sharing requests should alleviate some of their issues about open banking. In addition, there’s a frequently updated list of regulated open banking third-party providers that must enroll with an open banking regulatory body to ensure that only regulated providers access consumer information. Uneasy consumers can consult the list to confirm whether the banking provider or fintech application they use is there.

Transaction data shared through open banking APIs is anonymized, meaning no personal information is attached to the data. Open banking’s use of APIs in lieu of screen scraping is another notch in the data safety belt.

Screen scraping involves the use of actual customer login details to gain access to their accounts. This increases the possibility of fraudulent activity, as login information can be hacked and used maliciously. Open banking, once again, does not engage in this practice which should set the consumers’ minds at ease.

The three most common types of financial data shared using open banking are:

Banks and fintech developers can use the information to create useful applications for consumers based on their personal data, such as their salary or spending habits. Consumers use the applications created as a result of their data – applications limited only by the creativity and ingenuity of the developers working on solutions for those consumers.

An example of open banking is HSBC’s Connect Money application, which allows customers to see all of their accounts from different banks within a single application. The app is a harbinger of things to come. Banks will soon be able to roll out applications in the same vein, and fintech can engineer applications that take advantage of the data on offer.

Despite the risks and challenges associated with open banking, financial institutions and third-party providers can establish a secure, compliant, and user-friendly open banking environment that benefits all stakeholders involved. Applying best practices means open banking procedures always have:

Several companies have tapped into the open banking market and already provide valuable services. Let's take a look at some of these innovators.

The future of open banking is poised for dynamic growth, with several key trends on the horizon. As open banking continues to spread globally, a focus on standardization and interoperability will keep integration seamless across institutions. The expansion of services beyond payments and account information will create a holistic financial experience, while data-driven personalization through AI will elevate customer engagement.

Regulatory frameworks will evolve to address privacy concerns and technological shifts, and innovation between traditional banks, fintech firms, and other industries will give rise to integrated, user-centric solutions. Strengthened cybersecurity and fraud prevention measures will safeguard data integrity, while cross-border open banking initiatives and enhanced consumer education will shape a more inclusive and informed financial landscape.

Three things need to happen for open banking to become an unequivocal success:

Open banking stands as a pivotal transformation in the financial landscape, ready to usher in a new era of connectivity, innovation, and empowerment. As traditional barriers crumble, customers are no longer confined by the limitations of traditional banking models. Instead, they’re granted unprecedented control over their financial data, unlocking personalized services and seamless experiences tailored to their unique needs.

This evolution, driven by the harmonious collaboration between established institutions and agile fintech disruptors, has the potential to reshape how we perceive, access, and manage our money.

Learn more about the rise of digital transformation in banking and how it has truly benefited the secure way financial services operate today.

Washija Kazim leads the SEO/AEO content strategy at G2, helping the brand stay visible across search and AI-driven discovery. Her expertise lies in turning buyer demand, SERP shifts, and performance data into content roadmaps and scalable workflows. Outside of work, she can be found buried nose-deep in a book, lost in her favorite cinematic world, or planning her next trip to the mountains.

Is highstreet banking dead?

by Tim Keary

by Tim Keary

As technology evolves, so do customer expectations, creating a dynamic interplay that drives...

by Sagar Joshi

by Sagar Joshi

Far from the dramatized portrayals in popular media, investment banking operates at the core...

by Holly Landis

by Holly Landis

Is highstreet banking dead?

by Tim Keary

by Tim Keary

As technology evolves, so do customer expectations, creating a dynamic interplay that drives...

by Sagar Joshi

by Sagar Joshi