March 12, 2024

by Tom Kussmann / March 12, 2024

by Tom Kussmann / March 12, 2024

Consider a tech startup based in Silicon Valley.

Eyeing the burgeoning markets of Southeast Asia, seeking global expansion, an ambition fueled by the fact that the ASEAN internet economy is expected to triple by 2025, illustrating a growing trend among businesses to tap into global markets.

However, this journey to global expansion (and employment) brings its own set of challenges, particularly in recruiting and managing a workforce spread across diverse legal landscapes.

Employer of record (EOR) software emerges as a cornerstone of opportunity, offering a seamless avenue for international growth.

EOR simplifies the complexities associated with global employment, making it crucial to understand EOR costs for maximizing strategic insight.

Employer of record (EOR) services function as a linchpin for companies looking to expand their operations internationally without the cumbersome process of establishing a legal entity in each country.

An EOR takes on the legal responsibilities of employing staff overseas on behalf of a company, handling complex administrative tasks such as payroll, human resources, benefits administration, and ensuring compliance with local labor laws.

The range of services an EOR offers is designed to alleviate the administrative burden on companies. It can range from basic employment tasks to more comprehensive support, visa and immigration services, employee onboarding, and even termination procedures.

For instance, if a company aims to penetrate the Chinese market by hiring a team of sales professionals, the direct costs associated with leveraging an EOR service for this expansion would include the fees for the recruitment process, payroll management, and benefits administration for the newly hired team.

These fees are generally upfront and predictable, providing businesses with a clear understanding of their financial commitments.

However, the real value of EOR services shines through when considering the potential hidden costs and legal complexities of international employment.

In China, employment law is notably strict, with rigorous regulations around contracts, severance, and social benefits. Navigating this legal landscape can be fraught with challenges, leading to substantial compliance costs and the risk of financial penalties for non-compliance.

This is where EOR services prove to be invaluable.

An EOR proves instrumental in mitigating the risk of costly penalties and reducing the need for a dedicated legal team to manage employment matters in each country of operation.

Some EOR providers also offer integrated multi-country payroll software, allowing businesses with local entities to manage payroll, benefits, and compliance across multiple countries, all within a single platform.

Beyond compliance, businesses may encounter unexpected expenses related to cultural differences, such as differing benefits and work conditions expectations. Additionally, fluctuations in currency exchange rates can also impact the overall costs of employing staff in foreign countries. The strategic use of EOR software can lead to deeper cost savings in several areas.

An EOR's established presence and understanding of the local market can streamline the hiring process, reducing the time and resources required to find suitable candidates.

Additionally, by managing employee benefits, an EOR can often negotiate better rates than a foreign company could achieve on its own, further reducing employer burdens.

Even with the convenience and support offered by services, most EOR providers do not always communicate transparently about several expenses. Therefore, businesses should be mindful of hidden costs to ensure a cost-effective partnership.

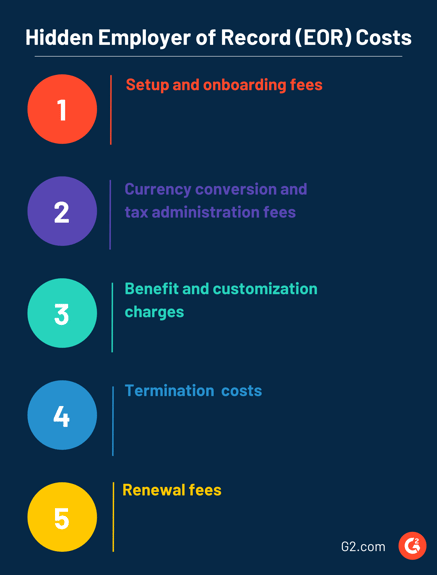

Fees commonly charged by EOR companies include:

Source: Horizons

Charges for initiating the partnership and adding new employees. The amount often equals one monthly service fee.

Costs related to foreign currency exchanges and complex tax compliance across jurisdictions.

These charges can differ widely. Ideally, the provider shall incorporate all costs related to the provision of the service in the monthly service fee to ensure full transparency for the client - without the need to add up the different fees.

Benefits and customization charges include the following:

Some providers charge offboarding fees (often equalling one monthly fee). Further, it is essential to note that employee terminations may result in additional severance pay or legal fees.

Annual charges may increase over time when continuing the EOR partnership.

For cost-effective global expansion, businesses using EOR services must strategically prioritize compliance, focusing on varying labor laws, regulatory changes, and local employment customs crucial to different regions.

In APAC, businesses should look for EOR providers with strong local partnerships to navigate diverse regulatory landscapes efficiently.

Using an EOR with an extensive network can reduce costs related to legal compliance and employee benefits management, which vary widely across countries like Singapore, India, and Japan.

The European market demands attention to detail regarding labor leasing laws and employee rights, like The AÜG in Germany and The Waadi Act in the Netherlands.

Opting for EORs specializing in European labor regulations can prevent costly compliance errors.

Additionally, seeking providers with multilingual support can streamline communication and HR processes, thus reducing administrative costs.

In the U.S. and Canada, where employment laws differ significantly by state and province, businesses benefit from EORs that offer scalable solutions.

This allows for cost-effective expansion or contraction based on business needs without the fixed costs of establishing local entities.

High volatility in regulatory and economic conditions in Latin American countries like Brazil and Mexico suggests the need for EORs with real-time compliance monitoring.

This can mitigate the risk of non-compliance fines and ensure cost-effective adaptation to local employment laws.

With its emerging markets, businesses should prioritize EORs with robust on-the-ground presence and knowledge of local labor markets. This can decrease costs related to hiring and onboarding, as well as ensure compliance with local employment practices.

Technology is dramatically transforming the cost structure of EOR services, enabling businesses to streamline global expansion efforts more efficiently and economically.

Here are three critical ways technology is making a difference:

Automation streamlines payroll, HR tasks, and tax filings, significantly reducing manual efforts and errors, while cloud-based platforms offer scalable solutions.

This combination ensures businesses can manage their global workforce more effectively, minimizing operational costs.

AI optimizes processes like payroll and benefits administration, enabling real-time regulatory change monitoring. This not only prevents compliance penalties but also tailors services to the specific needs of businesses, enhancing cost efficiency.

Advanced analytics provide strategic insights into labor costs and compliance risks, allowing for more informed decision-making.

Furthermore, seamless integration with existing HR systems eliminates redundancies and facilitates efficient global workforce management, cutting down on unnecessary expenses.

Don't let the complexities of international expansion hold you back. Explore EOR options today to unlock global opportunities with ease and financial savvy.

Start by evaluating EOR services with a keen eye on cost-effectiveness and compliance.

Here’s a quick checklist for assessing EOR costs:

By following this checklist, businesses can navigate the EOR landscape more effectively, ensuring a strategic approach to global expansion that balances ambition with financial prudence.

Learn everything you need to know about business operations for software companies and how to identify your specific business needs.

Edited by Jigmee Bhutia

Tom Kussmann is the Co-Founder and COO of Horizons – a premier Employer Of Record (EOR) provider operating in 180+ countries. His remote employment solutions platform enables seamless, compliant hiring globally, revolutionizing local payroll management.

Are you offering enough to keep your employees engaged?

by Lauren Pope

by Lauren Pope

A connected and thriving remote team is within your grasp.

by Margaux Morgante

by Margaux Morgante

The stats are in, so listen up.

by Rosie Greaves

by Rosie Greaves

Are you offering enough to keep your employees engaged?

by Lauren Pope

by Lauren Pope

A connected and thriving remote team is within your grasp.

by Margaux Morgante

by Margaux Morgante