When you choose to swap the 9 to 5 and go full freelance-mode, it might not occur to you that you’re actually starting a business.

That business is something you’ve been investing in for years: yourself.

Do freelancers need a business license?

Different locations will have different regulations, and individuals should consult with local business authorities. It is, however, better to be safe than sorry, as freelancers can be charged retroactively for failing to procure a business license.

As with many businesses, there are a lot of logistics to consider. You have to file your taxes differently, and procure your own health care (depending on the country you live in).

|

Tip: Afraid of doing your own taxes? Consider utilizing one of these tax services.

|

But have you ever considered that freelancers might need to have their own business license to even do their job?

Do freelancers need a business license?

The short answer here? It depends.

Business regulations vary depending on the state and country in which you live. The simplest solution is to check with your local authorities on the matter. Business licenses are often issued by your local chamber of commerce, city tax office, county clerk, or department of public works.

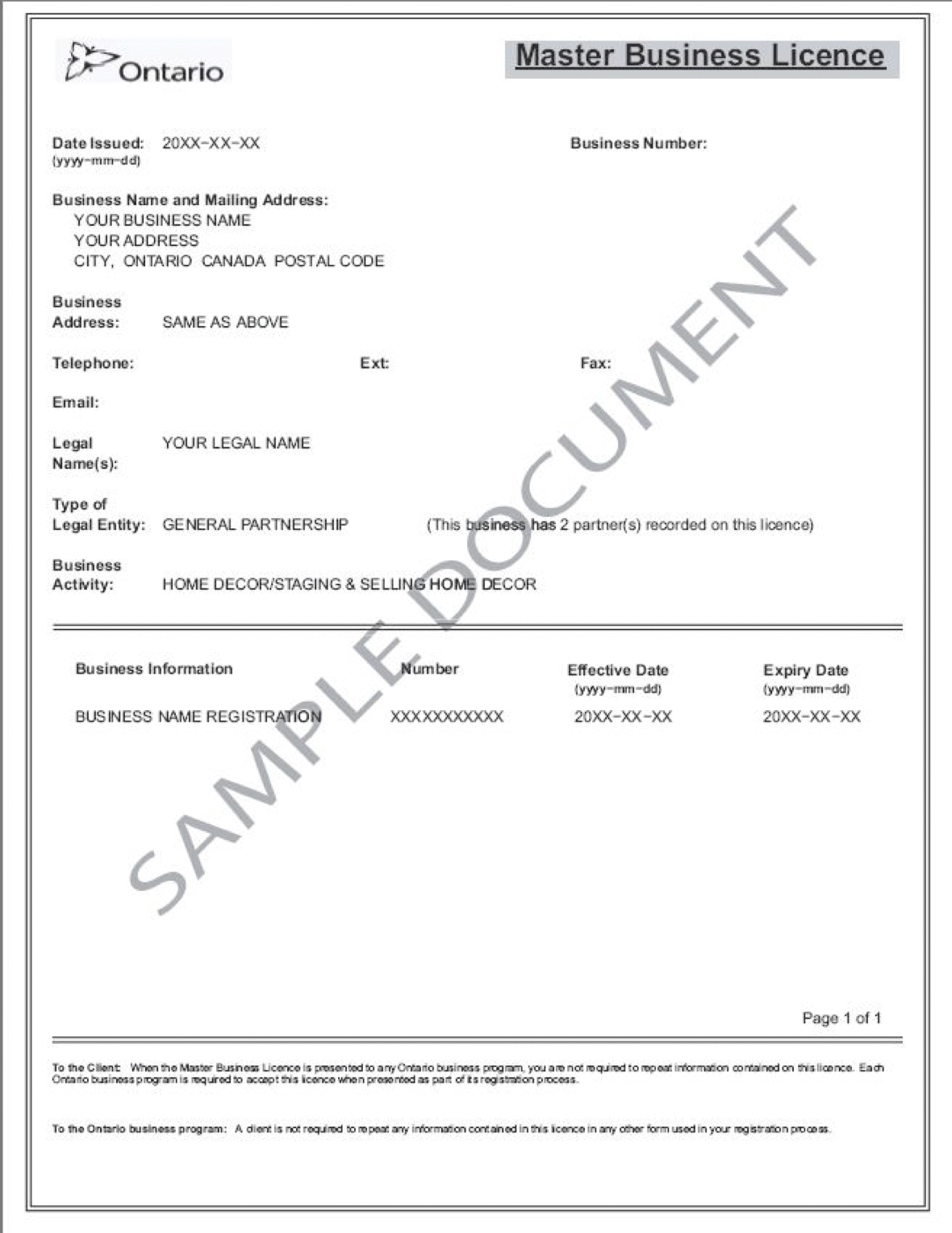

Sample license courtesy of Ontario Business Central

These offices should be able to tell you whether a business license is necessary for compliance with your city’s regulations.

What happens if you don’t get a business license?

Don’t wait to find out.

If you’re operating without a license in a state that requires one, you can be fined for your ignorance. You can even be fined retroactively, should your local business authorities catch wind of how long you’ve been dodging the licensure. Some places will even add interest onto the fines. Suffice it to say, the number can grow quickly.

Even a small fine can mean a lot to someone who is self-employed. The soundest choice is to be proactive about the process and file for this license early on. Most freelancers end up filing for a sole proprietorship, but your city can help you figure out the correct option.

The cost of obtaining a license typically ranges from $34 to $100. Some states will require this annually, while some locations only ask for this fee to be paid once.

Check out zoning regulations

In addition to a business license, you should ask local authorities what the rules are on running a business out of your home. Hair stylists and at-home daycare owners have to consider the same regulations.

Some towns won’t care about this so much, but others are run by authorities that prefer to operate incredibly by the book. If this is the case, you may have some trouble trying to work or profit out of your residence.

More knowledgeable freelance sources recommend individuals hire a tax preparer as to offload these questions and concerns onto a professional. A tax preparer can help you not only understand how to file your paperwork during tax season, but can also provide official advice as to how to run your business with minimal government interruptions.

Free to go about your business

Once you have secured a business license, you are free to carry on with what is truly important: the work! Whether you’re a freelance writer, accountant, or social media marketer., you don’t want to waste time and energy worrying if the feds are going to come find you.

Rather, prioritize this process at the beginning of your new career to ensure compliance, and ultimately, success in your endeavors.

To learn more about what it takes to be a freelancer, check out the differences between independent contractors vs. employees.

by Tricia Dempsey

by Tricia Dempsey

by Tricia Dempsey

by Tricia Dempsey

by Tricia Dempsey

by Tricia Dempsey