April 16, 2020

by Marta Michałowska / April 16, 2020

by Marta Michałowska / April 16, 2020

The banking industry has always seemed to be one of the most developed and willing to invest in new technologies.

It's no wonder that artificial intelligence has quickly become one of the technical pillars on which the entire modern financial market is built.

Not everyone is aware that AI is not only leading analytical solution, but also a way to change the way customers interact with services provided by the financial industry. Let's take a closer look at this extraordinary relationship, its impact on the way we use banks, and on issues such as fraud detection and compliance regulations.

Artificial Intelligence is used in many FinTech solutions. It’s a cure for the daily challenges faced by many businesses like customer experience personalization and loyalty building, to strictly technical financial features such as anomaly detection or fraud prevention.

The beginnings of AI in the industry, however, were not so simple. The first attempts to improve the operation of banks using computers were made in the 1950s. The story started with the simplest and most obvious solutions: accountants wanted to use computers to make calculations much faster and more accurately than real people could.

However, it turned out that their use might not be so easy since the machines themselves were not as powerful as they are now. Despite this fact, Bayesian statistics, which is used in machine learning even today, was implemented to expand algorithms enabling processing actions such as stock market predictions, loan repayments or calculation of probabilities regarding auditing.

In the early 90s, AI and machine learning appeared on Wall Street along with the first hedge funds - but there was still no significant breakthrough. It appeared only with the increased availability of data, generally with the spread of the internet. Since then, there has been an extremely rapid evolution of operating systems, taking advantage of the increasing capabilities of machines.

Nowadays AI basically affects every area of a bank's operations as well as the work of departments that we often forget about in the context of using technology in the financial sector, such as corporate core aspects, including even human resource team work.

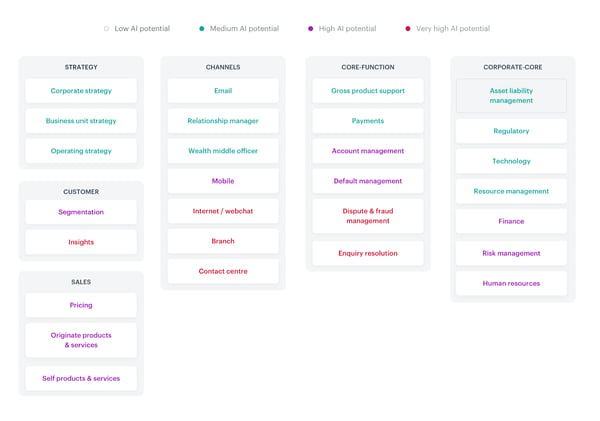

All the aspects in which AI is involved are perfectly summarized in the heat map below:

Considering the multitude of AI applications in the industry, you could basically write a book about each of them. Let's focus on the most common solutions that are already (or are about to be) popularly used in FinTech and which, as consumers, we should be well aware of.

According to Accenture, there are some key trends in the industry which should be followed:

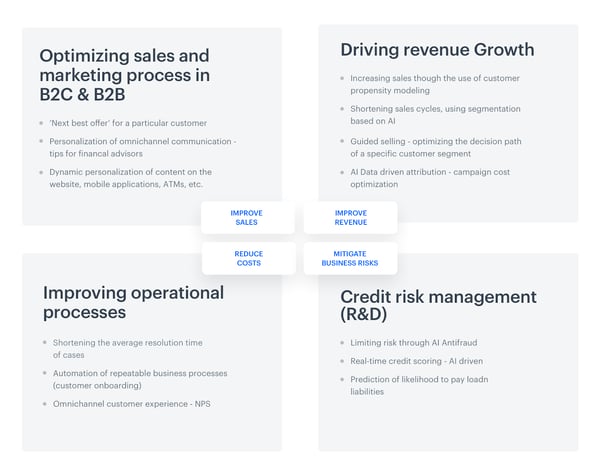

To simplify matters even more, the above-mentioned aspects can be divided into four groups: sales optimization, growth revenue driving, operational process improving, and credit risk management.

But it’s not only about the possibilities in the field of topics to cover. The scale of use of artificial intelligence across whole companies operating in the industry is enormous. The AI in Financial Services global study shows that 85% of all respondents currently use some form of AI. As a reason for implementing such solutions, respondents indicated the need to boost both speed and efficiency, and the demand for broader data-driven insights.

What's more, the declarative statistics contained in the report are even more optimistic: 77% of respondents said that AI will become the most important or one of the most important investment areas for their businesses by the end of 2020.

But what exactly do FinTech representatives want to invest in? Contrary to appearances, most of them (64%) primarily plan to invest in reaching mass users, thanks to the implementation of AI in aspects such as revenue generation, process automation, risk management, customer service, and client acquisition. This is an extremely significant increase. At present, only 16% of respondents declare the intention to invest in these areas.

Let's stop for a moment at the division placed at the end of the last paragraph and take a closer look at each of the areas mentioned:

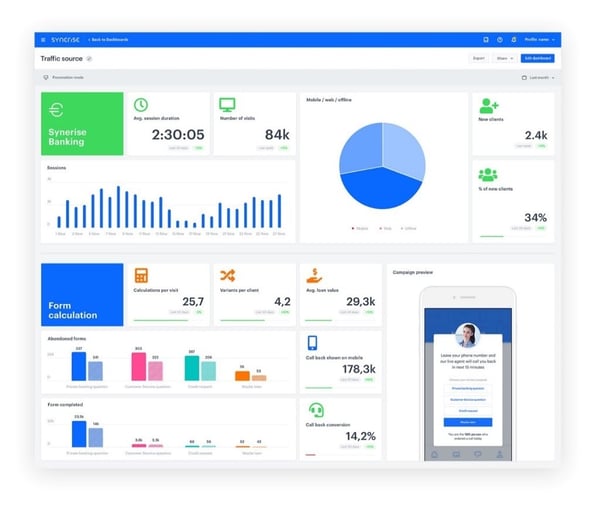

Benefits resulting from the use of AI in FinTech, Synerise

They benefit with advantages valued by managers responsible for financial institutions strategies – i.e. cost reduction, sales, and revenue improvement or business risk mitigation. However, it’s also worth mentioning that the AI options used by banks do not end there. The possibilities can go far behind typical expected features.

There’s a saying in the financial market that’s very timely: people don't really need banks, they need banking.

In the age of smartphones and simplified login methods, there’s a special way of entering a bank's mobile application: taking a selfie. This solution is relatively easy to deploy and implement. The identification procedure is speedy and does not require too many actions from the end user, which in itself is an encouraging way to drive adoption of the process.

The OCBC Bank from Singapore enabled clients to use such an AI-driven option; the only requirement needed to be logged in this way is to have an iPhone X.

Citing the bank's official statement, its users, thanks to facial recognition solution, can now: “dispense with passwords or even fingerprints when doing their everyday banking on mobile apps.”

But how does this technology actually work? As the name suggests, the success of the login process depends on the identifying or verifying the identity of a given bank user. AI captures, analyzes, and compares specific patterns that each of us has on our face.

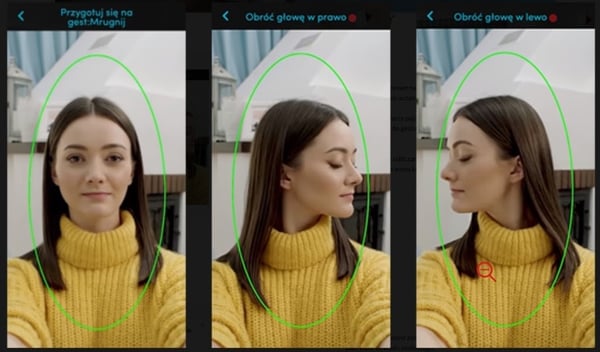

Let's look at the instructions prepared by another bank using this technology, Polish bank PEKAO:

Instructions on how to take a selfie are needed to set up an account: gesture ‘blink eyes,’ gesture ‘turn head left,’ gesture ‘turn head right’

As the bank's CEO, Michał Krupiński, said, the company is very pleased with the results of the introduction of face recognition technology, and about 25% of the account entries were made outside the bank's business hours.

He emphasized that:

"We believe in our banking, our advantage is the strength of the mobile application, we've been growing by 50-60 percent year on year here. We will invest even more in the mobile app.”

The results turned out to be so satisfying that selfie-verification functionality will probably also be adapted to the needs of micro-companies.

Maybe you associate virtual assistants with robots that look like people and will one day take over the world.

The accuracy about how reality looks, however, is completely different. It is true that chat assistants have come a long way from their humble beginnings, but in fact we are still developing machine learning and natural language processing, so assistants are just learning our human-like manner, and are really far from mastering the world.

One example is the twins created by Hang Seng Bank (China), Haro and Dori. They have extraordinary language skills; they communicate in Chinese, English, Cantonese, and a mixture of Chinese and English.

However, chat assistants shared their tasks. Haro focuses on general queries, such as products, services (with special emphasis on mortgage, personal loan, credit card and insurance services).

Dori, in turn, is a typical type of Facebook Messenger, using the opportunities offered by personalized recommendations based on customer preferences.

Of course, this is just one of many interesting examples. Another is Erica, a Bank of America employee and AI-driven chatbot who deals with card security updates and credit card debt reduction. In 2019, this virtual assistant processed over 50 million clients requests, regardless of their needs and age: 15% from Gen Z, 49% millennials, 20% Gen X and 16% percent from seniors, who are typically not the target group for such solutions.

Voice search is becoming more and more popular. In a recent report on this subject, Microsoft emphasizes that 69% of respondents by 2020 will regularly use voice assistants. Of course, such trends have not escaped the notice of banks, like Lloyds Bank, the Bank of Scotland, or Halifax UK.

These financial institutions have decided to simplify the lives of their customers by using "voice biometrics," i.e. confirmation of identity through AI-driven advanced analysis of the user's voice characteristics.

Of course it's hard to disagree that using an account through voice commands is easier and faster than traditional logging methods – but is it completely safe? Some industry analysts point out that if there are recordings on the web that contain our voice (e.g. in the form of podcasts) - they can be used to log into our account by unauthorized persons.

Such solutions will likely blossom in the near future, although they already exist in limited forms in the industry. Current versions, especially in European and American markets, are somewhat more mundane and familiar solutions, focusing on mobile banking, fraud detection, and regulatory compliance.

Mobile is our future: it is predicted that by 2023 this device will be used over 7.33 billion people worldwide. By the same year, the mobile app market will generate revenue of 935.2 billion dollars, which of course also includes mobile banking applications. What makes us so willing to invest in them?

First off, mobile banking means improved security, which is often at a higher level than typical online counterparts. What's more, applications are eagerly used by banks for more prosaic reasons since they allow banks to cut operational costs. Thanks to mobile, expenditures on typical offline banking operations and human resources can be reduced and they are also cheaper than ATMs. What's more, they actually save not only money, but also time and paper commonly used to supplement "necessary" paperwork.

Also, mobile apps are always available. It’s easy to analyze the data collected through this channel. Plus, mobile facilitates communication with the client thanks to the option of sending push notifications.

But what does AI have to do with this? At first glance, biometrics in mobile banking available thanks to the artificial intelligence solutions may look a bit like a part of a science fiction movie, especially aspects such as fingerprint scanning, facial recognition, iris scanning, and voice biometrics.

Let’s stop for a minute and wonder if our smartphones are at all able to support such advanced technology. According to Juniper Research data, the availability of dedicated hardware will not be an obstacle to be used for these biometric purposes. The company predicts that by 2024, about 90% of phones will cope with these modern solutions.

The real question we should ask ourselves in this context is a bit different. Will people in the era of contactless cards really want to use this kind of mobile feature to be used to authenticate contactless payments? The forecasts mentioned above are not very promising - only 30% of respondents declared that they would gladly use this option.

The first seeds of AI fraud detection were implemented over 10 years ago, based on anomaly detection, a technique for identifying deviations from a norm, covering issues related to cybersecurity and anti-money laundering processes.

Nowadays, common fraud types in the financial sector include identity theft and extortion of loans using stolen documents or login details. As this McAfee report indicates, (which also includes data concerning financial fraud), cybercrime costs FinTech globally around $600 billion, equal to 0.8% of global GDP.

These events not only cause real financial losses, but also add to the problem of debt collection – which in many legal systems is an extremely long-term process, but unfortunately not in all cases one hundred percent effective. Financial institutions are also harmed and as a consequence, they can lose their reputation in the market. This kind of damage can be fatal in financial markets.

Fortunately, AI, and solutions that automatically prevent financial fraud, also known as fraud detection/prevention systems (FDS), can help.

Detection and prevention systems differ primarily in the way they are implemented. Prevention is slightly more complicated and requires the bank to be authorized to intervene in the banking platform and transaction system; meanwhile, detection only requires access to data, without the need for direct intervention into the platform.

Regardless of which FDS system you choose, it should be able to detect and monitor all actions taken by the user, regardless of the channel he uses to complete the transaction. This means not only investments in caring for the web channel, but also protection of ATMs, some call center services, "offline" operations at the bank's branch or mobile payment orders.

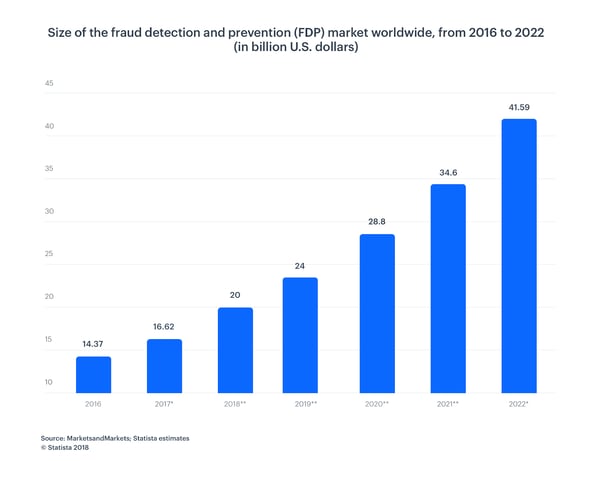

According to the chart below, the size of the fraud prevention and detection market is constantly increasing. By 2022, it will be worth $41.50 billion, compared to $14.37 billion in 2016 – a massive increase.

Regulations play a key role in the banking sector and this is another field where AI can help, facilitating (and accelerating) complex analyzes in the modern data-centric world. Let’s take a look how it simplifies the whole process and makes it much more effective.

Let's start with the fact that AI can automate repetitive manual tasks. Regulatory compliance processes are based on collecting data from various source systems. Before these data can be forwarded for further decisions, they must be organized and carefully checked.

Without AI, all the work is labor-intensive and requires several manual interventions. Moreover, the whole procedure is time-consuming and prone to mistakes. Such a solution can also be called robotic process automation (RPA). It can be done via automation, with webhooks, or APO integrations.

Natural language processing (NLP) enables computer programs to understand human language as it is spoken and written. NLP increases the capacity and efficiency of artificial intelligence. RPA software with NLP can create more efficient analysis for banking professionals dealing with large amounts of data. Robotic process automation with machine learning is useful for processes that require human behavior imitation.

Thanks to the ability to process quickly and accurately, AI is definitely a better decision-maker. Algorithms will analyze all risks, including those related to financial crimes, money laundering and potential fraud (AML, MiFID II, FinCEN).

AI implemented in banking undoubtedly affects the optimization of sales and the operations of B2B and B2C sales. This is due to, among other things, improved customer service.

Artificial intelligence allows you to accurately reach the selected target group and personalize the message. Segmentation significantly shortens the entire purchasing process, and well-used knowledge of customer preferences affects the number of users of financial products.

AI is also able to carry out a detailed analysis of client decisions, and offer only those products that a given person really needs. It is worth emphasizing that recommendation models created for banks are much more complicated than those used in typical e-commerce.

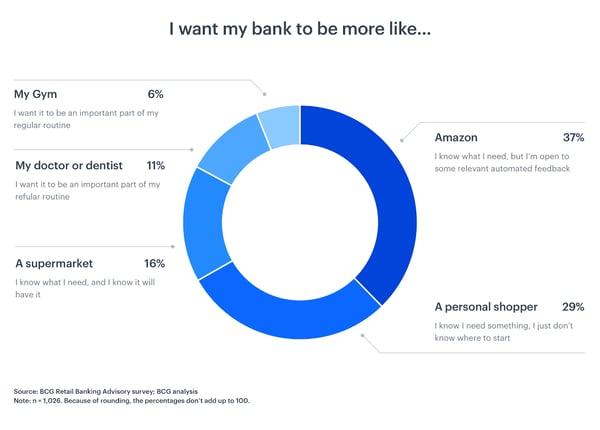

Perhaps the extraordinary power of personalization provided by AI in the context of the above mentioned biometric examples seems quite "ordinary" - so let me show you specific numbers.

The Boston Consulting Group has estimated that only by personalizing customer interactions, a bank can garner up to $300 million in revenue growth for every $100 billion it has in assets.

Why is this happening? Consumers expect that, by definition, complex banking systems will be as accessible and easy to use as other services they use on a daily basis:

We are entering a completely new digitized era in which the possibilities of AI in FinTech are still developing. We don't know with what kind of new features artificial intelligence will surprise us in time but one thing is certain: brands need to take advantage of the power that it offers.

As you can see, banks are in possession of so many types data:

Some of them come in the real time, yet some are really scarce.

Let’s take an advantage of AI and machine learning advancements in order to combine the information coming from these multiple possibilities into the lowest possible dimension.

Many of the functionalities are related to the most desired applications enabling revenue generation, such as recommending actions and offers based on true 360 degree customer profile or enhancing currently used statistical models by adding features allowing brands to evaluate and compare neighborhood of any entity banks are working with (debtors, creditors, merchants, individuals, enterprises).

AI will allow us not only to save time and money, but also to better protect savings and more easily access our money. What more could we want?

Learn more about all things AI by checking out G2's artificial intelligence hub.

Marta Michałowska is the Digital Marketing Manager at Synerise. In the industry for four years, Marta knows how to create creative content, what a perfect landing page is, and how to prepare a valuable, aesthetic business presentation. After hours, she is a PhD student and academic lecturer at the University of Warsaw.

As technology evolves, so do customer expectations, creating a dynamic interplay that drives...

by Sagar Joshi

by Sagar Joshi

Is highstreet banking dead?

by Tim Keary

by Tim Keary

From creative fields to e-commerce and software engineering, there’s no limit in sight for how...

by Sandra Nikolov

by Sandra Nikolov

As technology evolves, so do customer expectations, creating a dynamic interplay that drives...

by Sagar Joshi

by Sagar Joshi

Is highstreet banking dead?

by Tim Keary

by Tim Keary