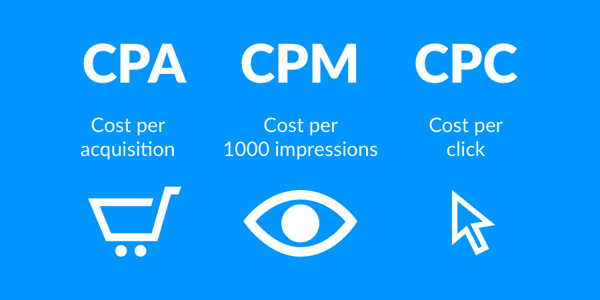

Cost per acquisition is one of the most important marketing metrics you have to take into account when it comes to deciding the general success of your marketing campaigns.

It measures the overall cost to acquire a paying customer on the campaign or channel level. Not to be confused with the cost of acquiring a customer (CAC), which is another marketing metric just as important that will be briefly discussed later on.

The cost per acquisition (CPA) is also known in the world of business as the cost per action. Both of these terms can and will be used interchangeably throughout the article. The cost per acquisition’s final goal is to measure the cost per conversion during the whole product or service marketing and advertising campaign.

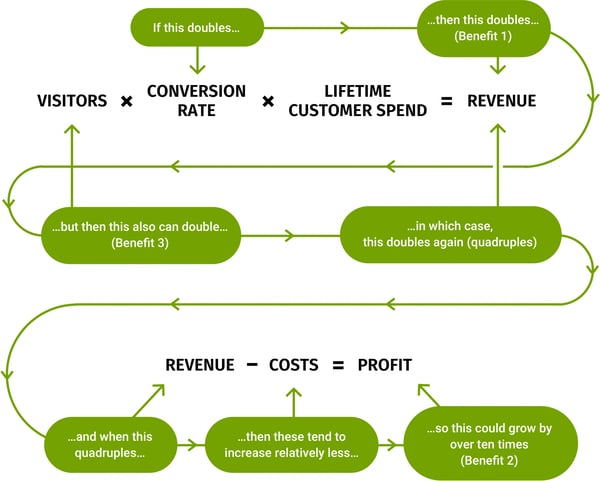

To be more precise, the cost per acquisition reveals how much advertising would cost, overall, if your advertising is successful in converting a visitor. There are plenty of benefits to be immediately gained when you get in control of your cost per acquisition. In business, advertising plays a crucial role when it comes to reaching the target market.

Generally, advertising can be seen as a way to compensate for your more or less recent investments. The success of your business almost always depends on the way you are advertising your products and services.

Without having an understanding of your cost per acquisition, you are operating your business with a constant risk of overpaying for your customer acquisition – each and every business holds its customer in high regard, but sometimes you can find yourself paying more than necessary to acquire a customer.

It’s different for every business, which makes calculating an effective CPA even more important, maybe even central. In the long run, this helps to create solid customer acquisition strategies that are critical to the long-term success of your business.

To consider your advertising campaign efficient, your CPA should be reduced to its lowest possible rate, without undercutting your overall marketing budget, as in, the lowest possible investment for getting to keep a high conversion rate, visitors becoming clients. Knowing your current cost per acquisition makes paid advertising the best choice since you will only need to adapt your investments to your company’s budget.

Understanding that the CPA is the most efficient metric to take into account when it comes to the efficiency of your conversion rate is vital. Subjecting your advertising campaigns to the practices of SEO makes knowing your CPA even more relevant.

The way it works is that if you are advertising, using affiliate marketing software with an optimized CPA proves to be more cost-efficient because it essentially means that you will pay only when your desired outcome (let’s say, the X number of conversions) is achieved. The software could use a form that asks visitors, aka potential clients, to fill out their names and/or email addresses, helping you to get an estimate of your CPA.

Furthermore, to make sure that your cost per acquisition is efficient, you should develop advertisements that catch the eye of your visitors, thus making them click and making you able to add them to your click conversions calculus for the moment (the CPC, or cost per click).

Regardless of any initial strategies you use to start tackling your cost per acquisition/cost per action, you need to track your performance so that you can determine any return on investment. If a campaign doesn’t seem to be working out for you, you may have to consider increasing your advertising budget.

As such, keeping track of your cost per acquisition is a really good way to enhance your income. Knowing how to reduce the cost per acquisition is an even greater way. The best CPA reduction strategies will be discussed later on.

To sum up, the cost per acquisition gives you an idea of exactly how much your business should have to spend to gain new customers. Keeping your CPA at a low rate directly shows that:

There is no set in stone solution for having an optimal CPA, the rule is that numbers always vary per industry. Some businesses employ keywords that can have a higher CPC (cost per click), which in turn nets you a higher CPA. The market always dictates the price.

For example, the last couple of years have shown that Google ads benchmarks report the current average search CPA at around 48$. B2B’s search sector is evaluated at 116$. The only relevant way to know your real CPA involves, as usual, real-world testing. Of course, this doesn’t happen with just one test, it can even take plenty of months to find your optimal spot.

Different channels and different goals should always be tested, as CPA can also vary in accordance with them. With the data collected from testing real traffic, you are getting closer to employing good cost per acquisition optimization strategies. But first, just to clear things up for an even smoother understanding of the CPA metric, we have to draw a clear dividing line between the cost per acquisition and the customer acquisition cost.

Both CPA and CAC are important metrics when it comes to making the most beneficial decisions regarding your business’ growth. A common misconception is that these can be used interchangeably. They cannot.

The customer acquisition cost is not the cost per acquisition. What CPA does is already specified, what remains to understand is that CAC specifically measures your cost when you want to acquire a new customer. A customer is a paying user. CPA tackles the point where you are trying to get possible paying users, potential conversions. As such, on the metric relevancy hierarchy, the CAC stands higher and contains the CPA in itself, along with other aspects.

In a manner, we could say that the CPA rather refers to the cost of acquiring a non-customer, or a potential conversion, while the CAC refers to the cost of acquiring a real customer. Despite these two metrics being different, with regards to the metric hierarchy, the CPA measures the cost of important indicators for your overall CAC.

We will refer to the actual B2C and B2B business models to further clarify the difference between CPA and CAC, while always taking into account that, in opposition to a B2B model, B2C models don’t usually require sale cycles since the conversion time is faster.

Cost per paying user in a basic plan or a pro plan

With the difference between CPA and CAC out of our way, it's time to focus on how to calculate your cost per acquisition and eventually, how to employ efficient strategies that reduce your cost per acquisition. Of course, it ultimately depends, as stated before, on what your business model is and what customer definition you employ.

Much in the way that CPA is a component of the CAC, CPA subordinates other sets of metrics which are needed when wanting to correctly determine your real cost per acquisition, such as:

CR: conversion rate

AOV: average order value

CPV: cost per visit

REVENUE

In the simplest terms, the conversion rate (CR) is the percentage of persons that not only visit your website or landing page but convert and become clients/customers. What a client/customer means directly depends on your business model and on what products or services you deliver.

A conversion doesn’t always mean a direct purchase, they can just be an indication that a visitor is about to become a customer. It’s an important part of the cost per acquisition because it indicates if your marketing campaigns are successful.

The average order value (AOV) keeps tabs on the average amount spent every time a customer places an order. It is usually calculated monthly and can also be referred to as the average monthly value.

CPV is one of the newer metrics that started to increase in usefulness in the last years, as it indicates advertisers the new store visits, usually driven by media (video ads which you have to watch for at least X seconds, for example).

The customer lifetime value is also fundamental for getting an idea of your real CPA since it reveals how valuable a customer is to a business for an unlimited period, as in taking possible future multiple purchases into account, not just their first one. In other words, it can be described as the total net profit that can be made from a customer between their initial purchase and a possible churn.

After all of the above have been taken into account for the long term health of your business, in comparison, the standard cost per acquisition formula is pretty simple and easy to use.

CPA = Total cost of a campaign (marketing+sales) / total number of conversions (customers)

Of course the cost has another definition for every business out there. One thing is for sure, calculating your CPA will allow you to eventually lower the total cost of your campaigns. Some companies consider that the cost of a campaign is just the cost of a campaign. Others include their total expenses which can include their employee salaries or even overheads.

As seen throughout the article, there is no clear, one-size-fits-all answer when it comes to defining what is a good cost per acquisition. I will say it again: it depends on what you define as your costs and on how you define your customers. Regardless, calculating your cost per acquisition enables you to pay for more direct results and also to compare channel performance more easily.

The general rule is that the more you scale (you observe an increase in your volume of conversions), the higher your CPA will start being. The CPA will rise exponentially at a point, so controlling it (reducing it) becomes more important than ever. You want more conversions, but the increase in conversions becomes more expensive than you’d like.

The number of conversions available for your current CPA is finite. Let’s say you currently generate 500 users per month at an average $50 cost per acquisition and this is NOT your maximum CPA, so there could be room for more users. Unfortunately, only a limited number of people search for what you are offering.

These potential customers could be interested in your offer, but their mindset isn’t currently placed in the purchase stage of the sales funnel. Let’s say they are just browsing for solutions and happen to find yours, but they don’t convert, they keep looking for more.

Attracting such users via various methods (usually less relevant search words) will perhaps get you 200 more users, but in this case, your CPA could end up towards double the initial amount.

To know what your good cost per acquisition is you have to know your CPA’s tipping point, the one where additional volume brings no upside to the business. Au contraire. It’s a fundamental marketing principle.

Reducing your cost per acquisition involves a series of strategies that may have more or less relevancy, depending on if you employ a B2B or a B2C business model, but are generally agreed upon nevertheless:

Your main focus is reducing your cost per acquisition to a comfortable point where it should cost you less to acquire a new customer than you already generate from your existing customers, on average. You can do this by:

One direct way to achieve this goal is to be more specific when it comes to your marketing campaigns. Advertising your products or services on a channel or on a platform that prior research has shown that your target audience tends to use will reduce your CPA since you're reaching towards a more relevant audience that is more likely to convert.

Another safe way to decrease your CPA is to make sure that your offer is good. Really good. A more focused selling. It may seem like a simple idea, but simplicity tends to be often overlooked. Walk that extra mile when it comes to the nature and spread of your message about your actual product or service. This will decrease your CPA.

Raise awareness of your offers through well-timed emails. If the recommendations are based on purchases your customers already made, bonus points for your business! You can already deduct that this means that your customer lifetime value also increased. If not, at least recommend products that other customers have frequently bought together. This strategy is called cross-selling and it’s very cost-efficient.

Cross-selling is a good friend of upselling. With cross-selling, you can also access upselling, which means recommending products to customers that satisfy the same needs, being targeted around what they are already searching for, but are simply better or have a generally higher quality. The chances for customers to pay a little extra for the added quality are pretty high, they just need some incentive. This will help you increase your average order value, which directly reduces your CPA.

Cross-selling and upselling naturally lead to the importance of thinking in advance. There are times when a customer doesn’t exactly know that they need a product until the very moment they see it. Knowing how to take advantage of this will give your business a firm upper hand.

The cost per acquisition/action is proven to be one of the most important marketing metrics. It has the potential to measure your costs when acquiring a customer, on the campaign level at least, before being used in the overall CAC.

Being in control of your CPA gives you a good idea about the return on your investment. The cost per is vital for any kind of business, as it gives you insight on the do’s and don'ts of your current channels and campaigns.

Reducing your CPA affects your revenue positively, as it pushes you to employ strategies that increase the return of each purchase made by one of your customers, which is key for any successful business.

Along with these marketing metrics, make sure you know the marketing KPIs you should be keeping on top of with everything else you learned here.

A serial entrepreneur with 20 years of experience in building B2B and B2C companies, Valentin leads Omniconvert, a tech company with 7 years in data-driven growth for e-commerce companies. He is also an international speaker, co-author of educational materials, and the host of the Growth Interviews podcast.

By the time you finish reading this, thousands of digital marketing campaigns will have been...

by Ninisha Pradhan

by Ninisha Pradhan

You’re about to learn what the rest of the B2B industry doesn’t want you to know.

by Gaetano DiNardi

by Gaetano DiNardi

Long-lasting customer relationships are vital to growing any business.

by Nupura Ughade

by Nupura Ughade

By the time you finish reading this, thousands of digital marketing campaigns will have been...

by Ninisha Pradhan

by Ninisha Pradhan

You’re about to learn what the rest of the B2B industry doesn’t want you to know.

by Gaetano DiNardi

by Gaetano DiNardi

Never miss a post.

Subscribe to keep your fingers on the tech pulse.