Millennials are leading companies to look online for goods and services instead of traditional offline purchasing and procurement.

Marketplaces are their go-to channel. As millennials take over B2B purchasing, the broad category of B2B commerce is ripe (and ready!) for disruption into the 2020s.

In this post, we’ll explore the supply and demand side of B2B marketplaces, discuss some innovative B2B marketplaces along the way, and wrap up with a series of recommendations for B2B digital commerce for 2020 and beyond.

Marketplaces are uniquely positioned to aggregate demand by offering a wide selection of third-party SKUs and reduced friction in the buying process. This helps vendors sell more products and services than if they launched siloed e-commerce sites alone.

As we have seen with Amazon, the organization that controls the marketplace also owns all the data, which means potentially lucrative insights that can boost your organization’s revenue.

According to Adobe, “By 2023, organizations that have operated enterprise marketplaces for more than one year will see at least 10% increase in net digital revenue.“

The global B2B market has a lot going for it: massive purchasing power, long-term relationship-driven customers, and strong network effects (if you’re lucky). Yet the status quo of B2B purchasing suffers from many supply-and-demand-side problems:

Eighty percent of B2B buyers now expect a convenient purchasing experience similar to those offered by B2C websites.

Online B2C marketplaces like Amazon and Alibaba – which are also rapidly expanding into B2B – have conditioned us to expect personalization, autonomy, and speed when buying online. As a result of modern digital procurement, we settle for nothing less than millions of readily-searchable products, verified peer reviews, breezy checkout, and fulfillment within hours.

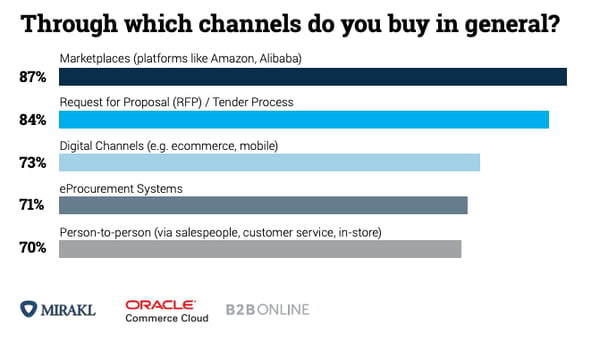

While marketplaces are the top channel for corporate purchasing, they currently rank low in terms of buyer preference.

A report from Oracle gives us this striking insight:

“Over one-quarter of B2B buyers (26%) identify marketplaces as their most preferred purchasing channel, and more respondents (87%) – including 97% of Millennials – buy [more] through marketplaces in general than in any other channel.”

Marketplaces are shaking up the expectations for the entire purchasing and procurement industry, with buyers demanding more transparency and information about vendor solutions.

“Nearly 60% of Millennials reported that they only engage sales in the middle of a purchase decision, actively avoiding sales until only after they’ve had a chance to do some research on their own,” according to a report by SnapApp and Heinz Marketing.

When millennials were asked about top resources for researching a purchasing decision, this is what was found in a report by DemandGen:

According to BigCommerce: “These [millennial B2B] buying behaviors mimic B2C buying behaviors in which brands must educate, build trust and build community before a purchasing decision is made – or even considered.”

Millennials are conducting a lot more online research, depending on direct search engine research as well as peer-to-peer review sites and discussion forums, and even posting questions within niche communities on social media.

But on the buyer side, overlong purchasing processes are chafing millennials who want to make decisions faster. Of course, not every B2B buyer is weighed down by a 12+ month purchasing and procurement cycle. But too many still are.

According to the previously-mentioned Demand Gen report, “(52%) of respondents noted that there are too many people part of the decision-making process at their company, while 49% said that their buying group is indecisive and misaligned.”

Brands know they need to get their product catalogs online as soon as possible, but this is easier said than done. With 62% of B2B brands reporting they could earn at least half of their revenue through online commerce by 2025, now is the time to step into the opportunities presented by digitized demand.

Fortunately, the technology is there. Technical API-driven architectures needed to “build real-time multi-vendor product catalogs with accurate SKU and pricing information” are finally accessible.

Dynamic pricing is opening up a lot of possibilities for vendor automation. Giving buyers a user login allows you to personalize products, units, and pricing for segmented customer groups such as wholesale vs. individual companies. This automation can also help modernize sellers who are used to traditional gated and custom pricing protocols.

As Amazon spearheaded many marketplace innovations through the use of advanced tracking and data analytics, other players have been watching and learning. Brands can even use platform-as-a-service (PaaS) B2B marketplace solutions like Uppler, mCart, or Mirakl to launch their own multi-seller marketplaces.

Mirakl, for instance, provides marketplace platform capabilities to companies like Walmart, Best Buy, and Siemens who now sell their own products alongside third-party B2B sellers.

B2B marketplaces come in many shapes and sizes. While legacy e-procurement vendors (pre-2010) were largely horizontal, says Bessemer Venture Partners, they lacked significant adoption because they simply couldn’t keep up with nuanced buyer needs. These older marketplaces also lacked integrated payments and did little to facilitate trust within the marketplace.

Due largely to the factors above, B2B marketplaces targeting fragmented verticals or specific regions are now expected to see massive growth into the 2020s. Next, let’s explore three different vertical B2B marketplace innovators.

Here are three different snapshots of innovative B2B marketplaces operating online today:

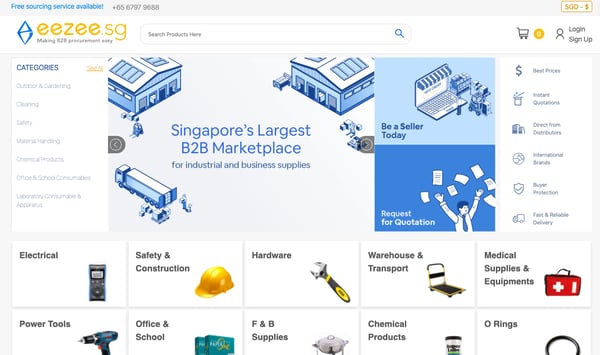

Eezee, Singapore’s largest B2B marketplace for industrial and business supplies, was born out of frustration with the difficult procurement process. In his 20s, Logan Tan started a role in purchasing for a construction company, he got a firsthand look at the challenges of eProcurement for a large company.

“A typical civil engineering project will have procurement requirements of more than 300 products. Imagine emailing and calling up three vendors for every product, how much time will that take?” he told Vulcan Post.

Again, inspired by the Amazon buying experience, Tan and his co-founders got to work, launching the marketplace in 2017. A pivotal part of the ecosystem are its integrations with all major ERPs and eProcurement solutions like SAP, Coupa, Workday, Oracle Procurement Cloud, and more. Today, their accounts include names like Shell, Singapore Police Force, and Rolls-Royce.

Meet Tajir, a startup and recent graduate of Y Combinator’s W20 cohort. Tajir is an app that makes it easy for mom and pop markets in Pakistan to quickly source FMCG products at transparent prices with next-day delivery via Tajir Express. The app also offers a third-party marketplace for buyers and sellers who handle their own fulfillment.

As the first YC graduate focused on Pakistan, Tajir is bringing simplified ordering to a traditional industry that had very little flexibility and buyer options.

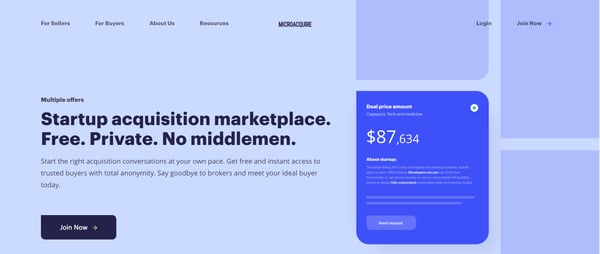

Microacquire was built by entrepreneur Andrew Gazdecki as a startup acquisition marketplace that seeks to cut the red tape and expense of buying and selling small startups. This marketplace verifies and connects anonymous buyers and sellers, with a focus on the sale and purchase of companies that make less than $500K ARR.

Gazdecki explains on their website:

“Having sold two businesses, I understand the expense and effort that goes into being acquired. The months of due diligence, reams of paperwork, and endless meetings with brokers and investment bankers, it’s a thankless job with no guarantee of success. Yet thousands of founders embark on these laborious acquisitions every year.”

Microacquire does not currently take a cut of the proceeds. In fact, in early 2020 Gazdecki said that he put the marketplace up for sale on the platform itself.

With all this B2B marketplace hype, you might be fired up to start your digital empire immediately. But there are some significant hurdles to fostering a healthy B2B marketplace, which is why there is a sizable graveyard of failed B2B marketplace ventures.

Bill Gurley of Benchmark Capital said it best: “Great marketplaces do not simply aggregate a market; they enhance it.”

Simply setting up a B2B marketplace will not guarantee success: you have to make sure you have the right market opportunity and revenue model. To succeed, Gurley argues, your team must improve upon the status quo when it comes to UX and economic advantage for both sides as well as a whole host of other factors.

Payments in the B2B space is a major pain point. And of course, there’s always the ”chicken and egg” problem of how to get a two-sided marketplace off the ground in the first place. Then once you get there, you need to put structures in place to monetize, promote trust, ensure speedy fulfillment—all while you maintain a good reputation among suppliers and purchasers.

The B2B purchasing and procurement revolution is upon us. If you are looking to launch a B2B marketplace, here are five recommendations you should keep in mind:

B2B purchasing has been very difficult for a long time. To differentiate yourself, marketplaces must ensure an easy and delightful buying experience. Eighty-eight percent of millennial buyers reported that an excellent digital buying experience is very important or even extremely important in vendor selection. Amazon has set the standard, and B2B marketplaces must make buying easy, cost-effective, fast, and secure for buyers.

If you want to be successful, you need to show how your marketplace and/or products specifically meet buyers’ needs. To support buyer groups, vendors need to give buyers the content, case studies, and resources needed to help buyers build consensus and demonstrate ROI.

As Demand Gen puts it:

“More than half (52%) said vendors should provide a better mix of content to help Millennials through each stage of their research and decision-making process. Close to two-thirds (63%) said vendors should demonstrate a stronger knowledge of the Millennial buyer’s industry.”

If you’re in B2B purchasing and procurement, you may be waiting for the right marketplace to come to your vertical’s rescue. But in the meantime, how can you innovate internally to prepare your team for the move to e-commerce marketplace purchasing? (Hint: it probably involves having fewer stakeholders rather than more.)

The upside of owning the B2B marketplace is, of course, owning the data. But you need to make sure you’re tracking the right numbers, particularly for smaller, vertical B2B marketplaces: “From the acquisition side in e-commerce, I think the first step to unlocking growth is making sure you're tracking the right numbers,” says Nick Christensen, AppSumo’s Head of User Acquisition.

He goes on to say:

“We look at customer lifetime value by monthly cohort segments for both channel and customer type as well as the Customer Acquisition Cost (CAC) to Lifetime Value Ratio (LVR) for each of those segments. You need to know: How much did it cost you to get that customer and how much are they really worth to you?”

Modern digital ecosystems give vendors the ability to segment customer groups to automate much of the pricing customization that used to occur through drawn-out RFP or procurement processes. Once you can set this automation in motion, don’t forget that you’ll still need to provide expert customer support, particularly at the bottom of the funnel.

B2B purchasing is set to change drastically in the coming years. Global marketplaces bring exciting, new, user-friendly functionality to legacy industries like container logistics.

G2’s software marketplace gives buyers the ability to compare complex products and read in-depth user reviews focused on the business problems solved by each tool. The depth of product comparison and usability presented by these marketplaces is the new standard for B2B procurement today.

Overall, businesses have a big purchasing itch to scratch, and marketplaces are filling in the gap to make B2B purchasing easier and more human than ever before.

Go more in depth and discover the breadth of B2B platforms out in the wild. See all available solutions on G2.

Sarabeth Lewis is a freelance SaaS copywriter and UX writer based in Austin, Texas. She regularly writes for AppSumo, a software deals marketplace for entrepreneurs, small business owners, and freelancers.

B2B buying behaviors are constantly evolving, with review sites – like G2 – playing a more...

by Palmer Houchins

by Palmer Houchins

You’re about to learn what the rest of the B2B industry doesn’t want you to know.

by Gaetano DiNardi

by Gaetano DiNardi

Modern consumers have unprecedented power to influence purchase decisions and shape a brand's...

by Sara Rossio

by Sara Rossio

B2B buying behaviors are constantly evolving, with review sites – like G2 – playing a more...

by Palmer Houchins

by Palmer Houchins

You’re about to learn what the rest of the B2B industry doesn’t want you to know.

by Gaetano DiNardi

by Gaetano DiNardi

Never miss a post.

Subscribe to keep your fingers on the tech pulse.