Pierce Brosnan. Daniel Craig. Sean Connery. What do these people have in common besides being caucasian male actors? They all played James Bond in the popular franchise film series.

While their portrayals of the character had slight differences and they each held the role for differing amounts of time, they all effectively conveyed Agent 007’s most memorable idiosyncrasies. In the age of streaming services, you have options of which to watch.

Companies looking to gain some capital have options as well. They could sell company stock or take out a bank loan. Or they could issue bonds. Corporate bonds.

What are corporate bonds?

Corporate bonds are bonds (lending agreements) issued by corporations and purchased by investors. They differ from other types of bonds because the issuer is a company rather than the government or a municipality. Companies typically pay a fixed interest rate to investors over a set period of time until the bond’s maturity date, at which the original investment is reimbursed. Selling bonds is a way for companies to gain debt capital, which they use to fund expansion. From the perspective of the investor, corporate bonds are generally riskier investments than other bonds. However, they also have a higher return rate.

Corporate bond definition

noun

A corporate bond is an agreement between a company and an investor in which the investor loans money and the company pays it back with interest over a period of time.

What are the different types of corporate bonds?

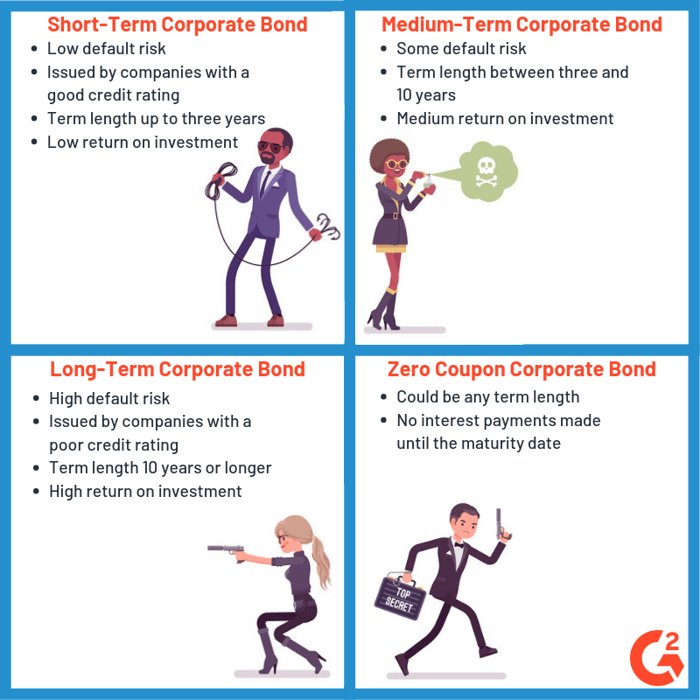

Corporate bonds are categorized by the length of their terms. Companies may issue short, medium, or long-term bonds for a variety of reasons, and in turn there are a variety of benefits and consequences for investors who purchase these different types of bonds. Let’s break them down:

Short-term corporate bonds

Of the three types of corporate bonds, short-term bonds have the lowest risk and lowest return. Their terms are three years or less. When you think about bonds in regards to time, if the bond’s term is shorter, there is less time for the company to go bankrupt (thus, less default risk). There is also less time for the company to decide to call the bond, or buy it back from the investor, or for federal interests rates to change unfavorably. On the flip side, there is also less time for short term bonds to gain interest, giving them a lower return rate than other types of bonds.

Medium-term corporate bonds

Medium-term bonds are just that: bonds with terms in between long and short-term bonds. The length of these terms is four to 10 years. Consequently, they are a middle ground, offering medium risk and medium return on investment.

Long-term corporate bonds

Long-term bonds are a high risk investment, but they also have the highest return. Their terms are 10 years or more. There’s more time within the term for things to go wrong for the lender: the company may not make enough money over time to pay off the debt (causing higher default risk), federal interest rates may rise above the bond’s interest rate, or the bond may be called. They are also sometimes called high-yield corporate bonds because, if all goes well, they can make the most money for investors.

Coupon rate and other factors

While it is a simple way to categorize them, term length isn’t the only thing investors and companies must consider when purchasing and issuing corporate bonds. Additional variables that affect a bond and its risk factor are its coupon rate, whether or not it includes a call provision, credit quality of the issuer, and more.

What is the coupon rate?

The coupon rate is probably the most important thing to consider in a corporate bond. Most bonds have a coupon payment structure, typically meaning that each year, a set amount of interest is paid back to the investor until the bond’s maturity date, at which the company reimburses the lender’s original investment. There are exceptions to this standard coupon structure—-zero coupon bonds gain interest just like regular bonds, however the investor does not receive any interest payments until the full principal plus interest is paid back on the maturity date.

Is there a sinking fund or call provision?

Sinking fund provisions can lower riskiness of a bond because they add assurance that the issuer will repay the par value of the bond through periodic payments. However, sinking fund provisions usually include call provisions, or call features. Callable bonds give the company the option to buy the bond back from investors and cease to pay them interest. Call features must be factored in when projecting the yield of a bond over time, because once the bond is called it will not gain any more interest.

What is the company’s credit quality?

While a company’s credit quality will often determine what type of bond it chooses to issue, investors would be remiss not to check it out for themselves before purchasing. The lower the company’s credit quality, the higher the default risk, but they also may issue bonds with a higher interest rate to get more investors’ attention.

Diversify your bonds

So, you know about the various features, risks, and benefits that come along with different types of corporate bonds, but you can’t decide which one to purchase. Would you rather have a high-yield corporate bond, or junk bond, issued by a company with a low credit rating? A short-term bond with a low return rate, just to be safe? Maybe you are considering not purchasing a corporate bond at all, opting for a government bond instead? Or do you want to forgo bonds all together and instead invest in equity?

What if you didn’t have to choose? The best way to invest in bonds is to diversify your portfolio. A healthy portfolio has bonds of various types, issued by corporations in various industries, expiring on various dates short, long, and medium-term.

Mission accomplished

Corporate bonds are a great way for companies to raise money for expansion, and for buyers to invest their savings, but only if both parties know the ropes. So long as they do, investors in corporate bonds need not do more than sit back, watch the interest flow in, and enjoy a martini. Shaken, not stirred.

|

TIP: Over 1,600 companies are managing software spend, usage, contracts, compliance, and more through G2 Track. Fight the SaaS sprawl and get deeper financial insights today.

|

Still unsure of how to issue or invest in corporate bonds? Financial services software is here to help.

by Maddie Rehayem

by Maddie Rehayem

by Maddie Rehayem

by Maddie Rehayem

by Maddie Rehayem

by Maddie Rehayem