It’s nerve-racking to watch a store clerk swipe your debit card as you wait to see if you have sufficient funds for that ice cream cone, pair of shoes, or new stereo.

It’s a little different with credit cards. We have more freedom to spend and worry about actually paying for those splurges later on. However, it’s not a privilege to be messed with. Neglecting to pay attention to our billing cycle and not making timely payments can result in bad credit, which limits our future financial activities.

Our history of paying off our debts matters in business just as much as it does in our personal lives. A business’ credit determines the freedom it has to spend, borrow, and work with other organizations.

What is business credit?

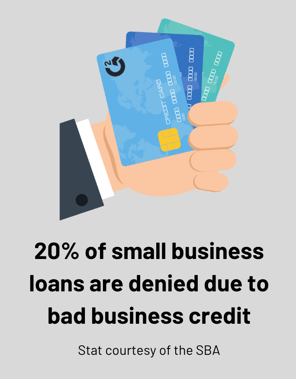

Business credit is a record of a business’ financial responsibility. Investors, financial organizations, and other companies look at credit scores to determine whether or not a business is a good option to work with.

Factors that can build or destroy your business credit include balances outstanding, your payment habits, and how often you are buying things using credit.

How to build business credit

A lot of business activities can affect your business score, but let’s look at the ones that help establish and build it, giving you a good reputation in the business world.

Establishing business credit

One of the most common reasons businesses are denied funding is because they have poor credit. And most businesses with poor credit simply don’t understand how to establish it. Let’s go over some things you can do to first form your business credit.

Establish the business itself

To create business credit, you first need to be established as a business.

Put yourself out there. Get a business bank account and phone number to use for any and all business activities. You should also obtain an Employer Identification Number (EIN), which will help you open a business bank account and conduct other contracted activities.

This will help build your credibility. Literally.

Create good credit relationships

Just like you value your friends and family in your personal life, you should care about your relationship status with people in your industry that can support you.

Build a solid line of credit with suppliers, vendors, and anyone else you work with to carry out business. Not only can this result in them extending payment dates, but certain vendors you work with will report your payment history to business credit reporting agencies. Having a good line of credit with them will boost your overall business credit history.

Get a business credit card

A good way to establish business credit is with a business credit card. Duh!

Open a business credit card and use it for all business-related expenses, while abiding by the tip above and paying off your bill on time. Like always, tread lightly. Be careful with the financial freedom associated with a credit card.

Separate business and pleasure

While there is nothing wrong with checking your business email while on vacation and taking a few phone calls from the beach, there is definitely a time when you need to draw a line between your personal and professional life.

Establishing business credit is one of these times.

If you haven’t already made your business a legally separate entity, you should consider doing that to build credit. Otherwise, your business and personal credit, debts, and liabilities will all be the same. Plus, separating the two will make both of them easier to manage.

| Curious to see which business structure is right for you? Check out our piece on the types of business ownership to see which separate entity will work best for your business. |

Building business credit

All of the business activities listed above will help you establish business credit. In the eyes of other organizations, you will be seen as someone that has used credit to do business, which is half the battle. However, for credit to work for your business, it needs to be good credit.

Let’s look at how to build good credit to make all that credit establishing worth it.

Pay on time

If I could put that in all capital letters without it looking bad, I would.

It is extremely important to pay on time when trying to establish credit. Heck, pay early if you can. This shows your financial responsibility and how well you manage debt as a business owner. Late payments on a credit card bill or a small business loan will lower your business credit score. Dun dun dun.

|

Avoid those late fees and the risk of lower credit by investing in some calendar software.

|

Monitor credit

Nobody is perfect. Even those that take care of tracking your credit.

Keep track of your own credit and point out any inaccuracies to your credit reporting agency. It will be worth it in the long run.

|

TIP: If your team all has their own business credit cards, it can be a lot to keep track of. Quickly and accurately manage your employee spend with G2 Track.

|

Have accounts report to business credit agencies

Not all vendors and lenders will report your good line of credit to agencies. Make sure at least one credit reporting agency has a hold of your credit reports. To avoid making the extra effort, try to only borrow from lenders that work with business credit bureaus.

To charge or not to charge

Charge it, but only if you can afford it. A lot of activities can affect your business credit score. However, if you actively work towards establishing and building good credit, you will build strong relationships and have more financial freedom.

If you are a new business trying to get a loan but have bad credit, check out our resource on small business financing options and everything you need to know about UCC filings.

by Mary Clare Novak

by Mary Clare Novak

by Mary Clare Novak

by Mary Clare Novak

by Piper Thomson

by Piper Thomson